10 Jan 2012

Historically I’ve been a big PayPal fan, and still am. I have a PayPal Debit card that I used this morning… and use PP every chance I get online. The online checkout process is just fantastic. In the good old days I earned more money from my PayPal money market then I did from my bank (savings and DDA), so my preference was always to keep a balance with them. Sadly this is no longer the case.

In my last post on PayPal (PayPal at the POS – Nov 18, 2011) I described PayPal’s challenges at the physical POS:

PayPal has no tools in its shed to deliver incremental value within a PHYSICAL commerce orchestration role.

There are few “payment problems” at the POS. For example, how often do you go to Home Depot and forget your wallet? Or go home empty handed because Home Depot wouldn’t accept your form of payment? Payment in and of itself is only the last phase of a long: product, marketing, retailing, pricing, selection, distribution and delivery buying process. Most retailers strongly believe that the cost of this last “payment” process has been disproportionately high relative to the value it brings. This is the key strategic battle being fought today in “mobile payments”. Banks and the card networks are trying their best to make “mobile payment” a premium service tied to 300bps+ cards… while retailers and manufactures are looking for solutions that will enable them to create new buying experiences. PayPal’s solution may bridge this transaction cost gap (blended rate), but does very little to address the physical buying process.

In the virtual world eBay is the lead orchestrator in this process (on its marketplace), as is Amazon. Key to Amazon’s and eBay’s ability to serve, as virtual world orchestrators, are their ability to control the buying process (end-end) AND the data.

However in the physical world, the buying process is highly fragmented. The value that PayPal brings to Home Depot today is based upon their current product capabilities (payment + ?) and customer base (100M+ globally). If you were running store operations at Home Depot, what are you trying to accomplish with PayPal?

- Decrease transaction cost? Perhaps Home Depot has a high credit transaction mix and PayPal’s 200bps (my guess) cost is a net savings

- Increase basket size? Can Paypal incent customers to buy more

- Increase total annual sales? Get existing customers to buy more over the year

- Increase gross margin? Example set prices higher on shelf, as PayPal customers will get unique custom pricing

- Increase marketing effectiveness? Drive sales of targeted merchandise?

- Increase Loyalty? Decrease trips to competitors, increase share of wallet, …etc

I’m fortunate to have led teams at Oracle and 41st Parameter (a KP start up) that worked with some of the World’s largest Retailers (online and physical)….. It is based on this perspective that I see the following business issues with PayPal-Home Depot approach:

1. Incentive to use payment instrument. As a consumer why would I want to pay with my phone number? I know if I use my Amex card I get points.. what do I get here?

2. Home Depot value. What are the metrics around the pilot and what is success? I can’t imagine how this will drive sales or margin. eBay does not market, and if they did will consumers see the price for item on eBay? eBay is a competitor to most physical retailers.. a hyper efficient marketplace. eBay has few tools to market and influence a customer during the buying process.. I’m sure PayPal has develop some very cool instore tools.. but hey Home Depot could do that themselves.

3. Consumer protections. The reason I use a credit card at Home Depot are my Reg Z consumer protections. What happens if I have a dispute? Or want to return merchandise?

4. No need for PayPal. This is actually my number one reason.. Home Depot will eventually wake up and realize that they can keep the phone number based checkout.. but use it to ask the customer if they would like to pay with the same payment instrument they used last time. There is no need for PayPal anywhere in this process. This is what happens for me at my local grocery store today (Food Lion).

Make no mistake, I do like the idea of customers giving their phone number at the POS… but it is the retailers that should use this data to make an informed decision on payment instrument choice AND loyalty incentive (example Target’s decoupled debit 5% back, or Payfone/Verizon with VZ incentives).

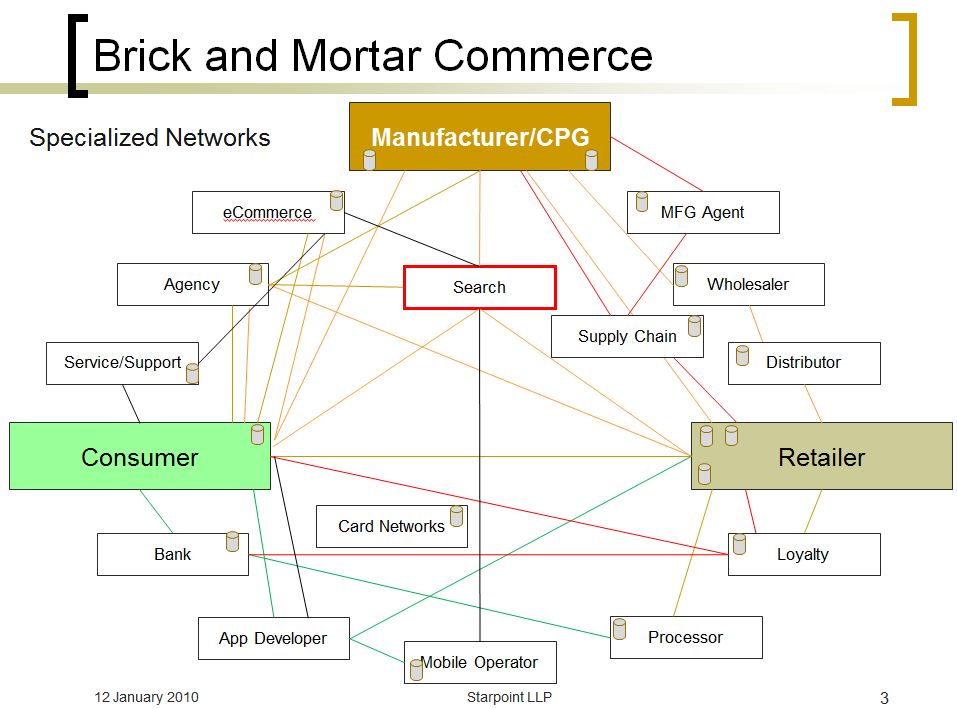

As a side note, Patrick’s comments on my Galaxy Nexus blog led me to update my disclosure, and restate the obvious: my views are biased (no secret to my Obopay and Square friends). Today’s blog is consistent with what I have been telling eBay’s institutional investors.. there is plenty of runway for PayPal globally.. but physical POS is a distraction and they don’t have the physical retail team to tackle it. There are no payment problems at the POS.. per yesterday’s blog, the REAL opportunity is in rewiring commerce in ways which enable manufactures, consumers and retailers to interact. eBay’s virtual marketplace is a negative to most physical retailers.. as is Amazon’s. Retailers are looking for solutions which will increase sales and decrease transaction cost. A platform which begins with a new marketing paradigm (ex. Google) is much more likely to draw participation, particularly in a pay for performance model. If this hypothesis holds, what companies are best positioned to influence a customer before they buy?

Also see Googlization of Financial Services..

Tom – fascinating post, thanks. I agree with you that just providing mobile payments at POS is not enough. What I am surprised about is that to date – as I understand it – Paypal have not made more use of the ACH/BACS direct transfer to free up margin to either undercut the card schemes by offering interchange <200 bps or supporting promotions/cashback using some of that margin. My own view is that for retailers with sufficient repeat business from their customers the 'branded app' will offer a very intersting alternative to NFC-based mobile payments: with or without PayPal.

Thanks for thoughtful comment. I agree as well.. Durbin has changed the dynamics.. hard to compete with $0.21 flat fee for debit. Much debate on PayPal’s blended cost of funds.. set against their 360bps take rate. PP certainly wants to maximize ACH mix to drive down their cost of funds (globally, their cost of funds is around 150bps.. US perhaps is much better at 80-90.. but still not in competition with debit.)

Interesting also to see if OBeP solutions a) take off outside select markets and b) can be made to translate into the mobile arena in a way that is user friendly.

Tom as usual a quality view on today’s mobile payments business (lack of). I like PayPal as well but not at physical merchants for your reasons sited. I would say one thing that is worthy of a new effort is to attack CASH. Yes, the small transactions can’t afford the VISA/MC tax like a big box retailer can. Fast Food, transit, newsstands (assuming they exist) and such.

If you look at your daily under $15 cash transactions, they are primed for a new way to pay with increased convenience and a decrease in TXN cost. The $0.21 debit fee is GREAT if your TXN is over $30 but under $5.00 it becomes a bit much.

I would say PP’s efforts are mis-guided at a big box merchant and should focus on smaller TXNs and more frequent, ala Starbucks, or transit or ??

Agreed.. Would be interesting to see if they could compete on a new “instant credit” product like billmelater.. allowing customers access to credit on a specific transaction (ie riding lawn mower) at a rate better than their card. Perhaps quote a rate based upon the type of purchase, and customer…

Pingback: FinVentures

An outstanding share! I have just forwarded this onto a co-worker who has been conducting a little research on this. And he actually bought me lunch due to the fact that I found it for him… lol. So let me reword this…. Thank YOU for the meal!! But yeah, thanks for spending some time to talk about this issue here on your internet site.

I posted in a tweet this week that an eBay analyst was called by a home depot exec. Analyst was told by HD that PayPal paid HD $3M and gave them payments at 0bps for a year!! Hard to make money if that is the acquisition cost.

Pingback: PayPal vs Google (at POS) « FinVentures

I love reading an article that will make men and women think. Also, thank you for allowing for me to comment!

http://blog.starpointllp.com/?p=1640 is good site. I’m here to read on PayPal and Home Depot – Starpoint Blog – Finventures. I sorry not speak good English.Undeniably believe that which you said. Your favorite justification seemed to be on the internet the easiest thing to be aware of. I say to you, I definitely get annoyed while people think about worries that they plainly do not know about. You managed to hit the nail upon the top as well as defined out the whole thing without having side-effects , people could take a signal. Will probably be back to get more. Thanks

It’s truly very complicated in this active life to listen news on Television, so I only use world wide web for that purpose, and obtain the hottest information.|