25 July 2010 (Updated 20 Aug)

![]()

- Netbanker on Chase iPhone App

- Previous post on USAA’s Deposit@mobile

- American Banker

- ApStore – Chase iPhone App

- Chase QuickPay

- Mitek Systems Product Page

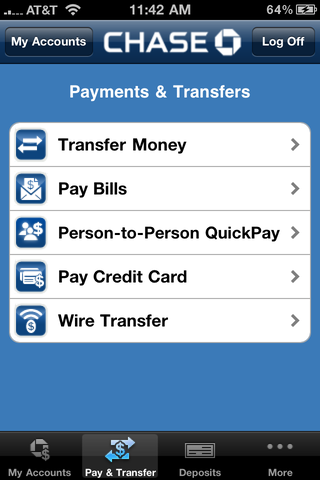

Chase has a stellar eCommerce and mobile team in both their retail and cards organization, and they are poised to deliver tremendous payment innovation across both of these business units. This innovation has been “in the works” over the last few years, and Jack Stephenson (PayPal’s former head of strategy) is fortunate to have joined at a time where both the payment platform and team is gaining traction. This month the JPM retail team has delivered new capability in its iPhone versions of QuickPay and Quick Deposit products.

QuickPay Overview:

QuickPay is a JPM’s money movement “pay anyone” service that provides  registration for both Chase and non Chase customers. Chase was very late to the money movement game, rolling out its first QuickPay service in 2008 (whereas Bank of America and Citi have been providing this since 2002 through CashEdge). From a strategy and organizational perspective, JPM is well known for their “preference” to develop applications internally. It may have taken some time for JPM to complete the QuickPay internal build, but in the current release it has surpassed the domestic capability (and usability) of all other banks. JPM is now the leader in retail online payments.

registration for both Chase and non Chase customers. Chase was very late to the money movement game, rolling out its first QuickPay service in 2008 (whereas Bank of America and Citi have been providing this since 2002 through CashEdge). From a strategy and organizational perspective, JPM is well known for their “preference” to develop applications internally. It may have taken some time for JPM to complete the QuickPay internal build, but in the current release it has surpassed the domestic capability (and usability) of all other banks. JPM is now the leader in retail online payments.

Non-Chase customers can register for QuickPay before or after receiving funds. For non customers, registration for QuickPay is similar to PayPal (or CashEdge’s PopMoney), with the QuickPay wallet currently constrained to single linked checking account. Chase customers have a streamlined enrollment process and the QuickPay functionality is integrated into their existing online experience (demo above). This differs substantially from BAC, where the same capability to transfer funds exists but the usability is very poor. BAC is missing a substantial opportunity to capture beneficiary phone/e-mail information, an unnecessary miss since the capability exists (BAC is Cashedge’s largest US customer but has not yet signed on with CashEdge’s mobile POP money service). Beneficiary information is critical to maintaining an accurate directory.. the key element in any payment system. Chase’s QuickPay maintains e-mail, phone and other information which gives it a head start in the directory battle (subject of future blog). Given Chase Paymentech’s role in acquisition (for card, paypal, …) you can see potential for further directory synergies internally.

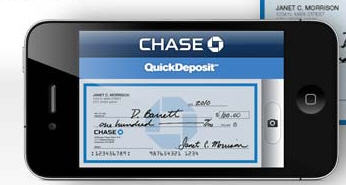

The articles above provide a great overview of the new iPhone App, with Chase following in the footsteps of USAA’s Deposit@Mobile. Application is from Mitek Systems and it is just super, and for small merchants this may become the payment method of choice (when compared to card):

Merchant benefits:

- No transaction costs (savings of 150-350bps)

- Usability and simplified enrollment

- Same day availability of funds

- Fits existing consumer behavior pattern (checks)

- Legal protections/enforceability (paper checks vs. electronic signature)

- Instant verification, risk and fraud management

- Leverages bank imaging systems and processes (regulatory and consumer receipt)

- Notification/receipt to consumers

JPM Business Case

- Check imaging (op expense)

- Small business acquisition (Customer Net Revenue for SME = $3-$5k)

- NRFF for non-customers (NIM on settlement funds held)

- Future “directory” business case, cards growth

- Prevention of DDA Account Number Breach

The JPM Quick Deposit application was reportedly built in-house, other Vendors such as EasCorp’s Depozip provide similar functionality. As for the success of this application, NetBanker reported USAA’s recent numbers for Deposit@Mobile. (update 20 Aug, my friends at BAC tell me that they have been trialing the Mitek application for almost 3 years now, fine tuning the app and the support process and are set for launch any day) .

Given that the audience for this blog (investors, start ups and innovators), you might ask why it takes 2 years for a bank to roll out this type of innovation. An excellent question! The iPhone app itself is the easy part, perhaps consisting of less then 20% of the overall budget. The “hard work” is in integrating it into existing systems and risk controls. For example, the primary value proposition, for QuickDeposit, is improving check acceptance and funds availability. At the teller line, banks have tools like DepositChek which allows the bank to determine if information on the check is correct and the account is in good standing (stopping check fraud before the check image gets into the system). These same tools must be integrated into the online and mobile process to reduce risk. I’ve picked this particular example because it is a tool unique to bank entities (not available to non-banks). In addition to the technical integration costs, banks have become very prudent in testing, and accessing impact of new functionality to call center support costs. Given the wide availability of both of these applications, it is essential that they are intuitive to JPM customers.

These applications are a great retail success. I understand that the JPM cards team is also poised for a major release in mobile soon (with multiple alliance partners). Well done JPM!

Enroll for QuickPay – www.chase.com/QuickPay

Overview of Quick Deposit – www.chase.com/quickdeposit

Thoughts appreciated