I was quite surprised to see the front page of my Saturday WSJ emblazoned with “Google Is Scrapping Its Plan to Offer Bank Accounts to Users”. As the former guy responsible for Citi’s online banks globally, and also a guy working in creation of the original Google Pay (as consultant), I thought I would provide some much needed clarity here (consistent w/ blog Google’s Bank Plans and the 20 others I’ve written on Google Pay over the last decade).

Category Archives: mobile banking

MNOs giving away Billions to Banks.

Monitise/Visa Announcement – P2P transfers?

http://corporate.visa.com/media-center/press-releases/press1176.jsp

From PR:

… [The Visa] mobile services that allow financial institutions in the US to offer their account holders the ability to monitor account history and balances, transfer funds between accounts

Oh the joys of allowing Visa to push credit transactions on the debit network… if only banks would allow it. As I outlined in previous blogs below, Visa has no traction with the OCT transaction set in the US. Internationally, the opposite is true as emerging market banks have taken on to OCT (receiving funds via Visa debit network), but will not SEND. . Visa’s VMT service is thus stuck.. it can’t serve as a remittance service because sending country banks (US/EU) do not participate. Note from this week’s MA earnings call that Mastercard has partnered with Western Union to address this issue.. a much better approach for cash in.

- http://tomnoyes.wordpress.com/2010/11/23/visa-money-transfer/

- http://tomnoyes.wordpress.com/2011/03/11/apples-p2p-visa-money-transfer/

If you ask Visa for a VMT test account, you are likely to get Bank of the West or some other small bank, with Visa’s promise “it is mandatory and all banks will comply”. It won’t happen.. there are problems with this mandate.. it is after all a debit network (see VMT blog).

What is this announcement.. really?? Visa has put a notification event service on their DPS switch where registered issuers and consumers can receive alerts.. nice of Visa to throw Monitise a bone after they completely messed up their corporate strategy by promising them to make them the “go to market” solution for mobile payments. Monitise is now the “go to” solution for issuers looking for a 3rd party service to check your balance.. or get an alert.

Also… if there were 2 banks that supported VMT I’m sure I could transfer funds with the service as well. Visa… please give us the list of banks that support it.. a demo.. we are all dying to see your progress.

Green Dot Bank: Finally Wal-Mart gets to Play

16 Jan 2012

http://www.reuters.com/finance/stocks/GDOT.N/key-developments/article/2447460

GDOT Bank – Federal Reserve Authorization

GDOT bought Bonneville Bancorp for $15.7M + $14M Capital Infusion on 8 Dec 2011. Bonneville was a Utah licensed state bank and a Fed member (regulated by Fed). This is a very significant deal for several reasons:

- Sets a new regulatory guidepost in the creation of “national” bank with a pre-paid focus. See Bank Talk article on how GDOT was able to get Fed Approval, specifically around CRA responsibilities.

- Is essentially WMT’s retail bank for consumer services (WMT owns ~15% of GDOT)

- Model for future deals in State Chartered banks (particularly for retailers)

- Highlights need for reassessment of “pure play” banks in pre-paid space (ex. Meta)

- NEW PRODUCT potential in interest bearing pre-paid accounts targeted to the lower mass market

This is a brilliant move by the Fed, and by GDOT. The Fed is rightly concerned about the fact that the bottom 4 deciles of customers are no longer profitable for the big banks.. and there is an exodus. How does the US financial system retain customers in the lower mass? GDOT and WMT believe it is not through the typical branch model. Just as with Tesco in the UK, Retailers are proving to be excellent distributors of banking services. Retailers do not need to make their margins on bank services alone, in fact banking services improves the overall retail value proposition, brand and loyalty. The same holds for mobile operators internationally. Why should I pay for all of those branches and sales people if all I need are basic payment services?

I joined Citi in 2006 with the mandate to grow the retail business without growing the number of branches. Creating the ING direct competitors.. the HOOK was high yield savings. GDOT bank could be catalyst for a new retail banking model, with a HOOK associated with “payment”, retail convenience, loyalty and data use.

What are the core product innovations? Here is my list:

- Combining a GPR card with retailer brand and distribution (WMT). Banks normally have to seek charters that enable them to operate nationally (ex. Fed, the now defunct Thrift, …) when doing business in multiple states. Virtual GPR cards don’t have this problem as consumers are buying a banking product in another state.

- Stand alone consumer value proposition. GPR card that can earn interest on funds held on balance. GDOT/WMT also have a established a rate structure that is one of the best in the business.

- WMT’s integrated value proposition. International transfers ( WalMart owns part of MGI they are 30% of MGI’s TPV), International Banking (Mexico, Canada, GDOT, …), StraightTalk prepaid mobile, … they have all the components to deliver value. Can they bring it all together?

Banking is a network business.. the GDOT opportunity is to build the network quickly through key retailers (as physical distribution). What other innovations can they bring to market? At the top of my list would be instant credit (Paypal BillMeLater does this through a WebBank a Utah ILC). Or real time transfers to any bank (using $0.58 Fed wire…).

Today, MSBs are restricted in both offering interest on accounts and the length of time they can hold a balance (escheatment). There will be some regulatory scrutiny by the State Regulators on how cash in/out is performed at the physical retail outlet, and what constitutes a “bank”. From the Retailer’s perspective, the GDOT card is a product which can be bought (buy $100 GDOT reload), with cash out from ATM or through a Mastercard purchase. GDOT is a licensed MSB in 39 States (according to their 10-k) with a network of 50,000 cash in/out locations. Previously GE Money was the US bank for the WMT MoneyCard. A single state licensed bank owned by an MSB network may face some state regulatory scrutiny. GDOT can probably address by keeping as separate legal entity with its own BOD and capital.

If I were thinking of starting the next PayPal… I would skip getting MSB licenses in 47 states and start looking for a Utah bank I could buy.

What to look for:

- Retailers following this model (including ISIS, Amazon, …). Particularly retailers serving lower mass market

- Salary d0miciliation (direct deposit) onto a card

- Future of GE Money. GE has been looking to sell Mark Begor’s business for some time. It is subscale, and WalMart is its largest US customer. My guess is that WMT had to develop fall back plans in case GE did sell the business. I would not be surprised to see GDOT bank be the primary bank behind the MoneyCard.. but it hasn’t happened yet.

- Pre-paid processors and platforms looking to create their own brands.. or change their relationships to retail branded banks

- MSBs moving toward a state bank license. Issue is cash in/out. MSBs that require their own branded physical distribution will keep MSB license… those that are virtual will move to GDOT model.

- Consumers making switch to a “new” banking model centered around payments.

- Semi closed payment networks with integrated loyalty and incentives.

- New Payment Banks which make money on marketing and data (not interchange). See Googlization

For those interested in a Utah Bank.. please call my favorite Utah Banker.. Crawford Cragun..

Your thoughts are appreciated. As always sorry for the typos and the brevity.

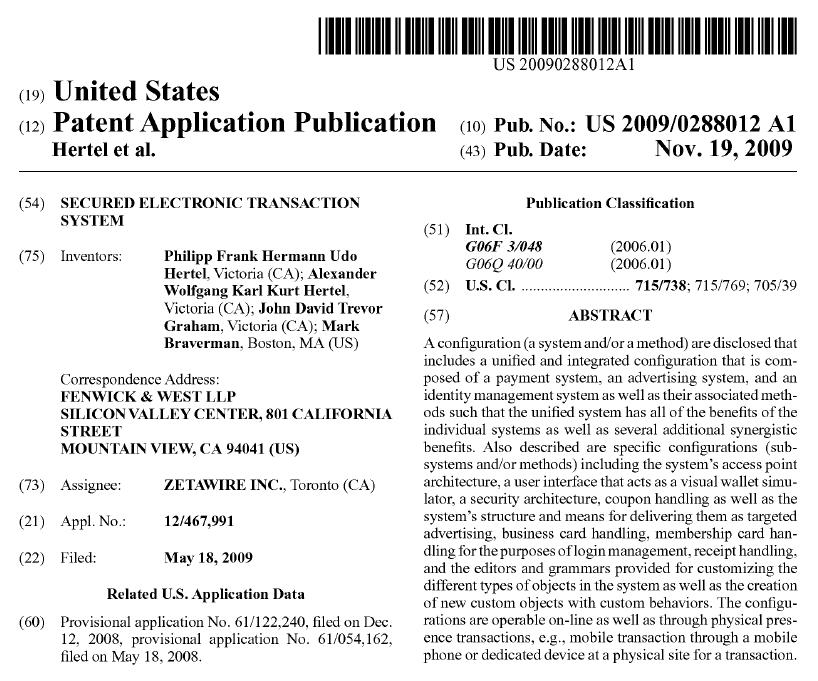

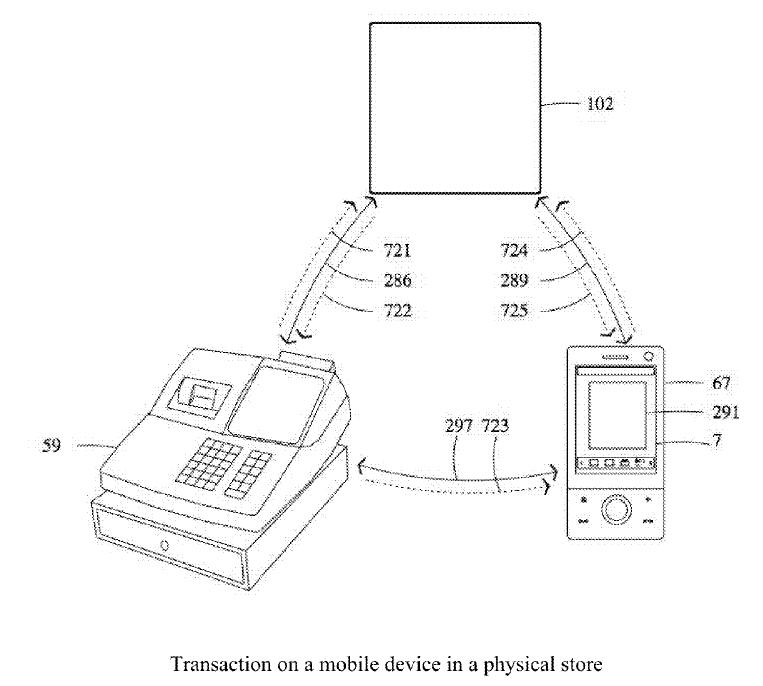

Google/ZetaWire

![]()

22 Dec 2010

TechCrunch – Google Acquires ZetaWire

Why did Google acquire a 3-4 person Canadian company with no customers? The answer seems to lie in its patent application

… quite an interesting read. A ubiquitous wallet, online and mobile that provides for direct communication (bluetooth, Wi-Fi, NFC, …) to other wallets and POS terminals. Interesting vision.. google as center of the mobile universe…. who would have ever imagined.

From a payment perspective, I thought paragraph 271 was rather interesting

[0271] Because the coupon and advertising system is integrated with the payment system, it is able to target and deliver advertising on an individual basis rather than on a demographic basis. The payment system has a complete record of all the purchases ever made by a user, and because the payment system is also integrated with a social network, it can also know the purchases made by all of the user’s friends. In addition, it has access to many other streams of data providing information about a user such as the user explicitly entered preferences and wish lists, which coupons the user’s friends have shared, which coupons the user currently has, etc. The system is therefore able to build a much more accurate user profile than standard advertising techniques, and this user profile can in turn be used to deliver advertising which is customized on an individual basis.

This seems to indicate a significant gap in the understanding of the applicants surrounding financial transactions (and data). Merchants hold on to item detail information, the payment network receives merchant level data.. but does not get item information. ZetaWire attempts to address this gap by inventing a “coupon authority” entity in Paragraph 264.

All information related to coupons and their definitions is managed by a coupon authority, which can be an integrated subsystem of the transaction authority 102. All instances based on the coupon definitions are minted by the coupon authority. Whether coupons have been applied to transactions is recorded by the coupon authority, as are coupons’ chains of custody from the time they are minted to the time they are spent, including all data related to how and when they were share

For those of you unaware, merchants are rather stingy with their store data. The Visa’s team best effort here is with Monitise and the new iPhone application “Visa Offers” (link is my related blog). It results in a coupon with a bar code and you show your iPhone to the cashier. How does google intend to integrate to merchants and receive store level data? I can’t imagine Amazon being excited about this.. or Wal-Mart in that matter.

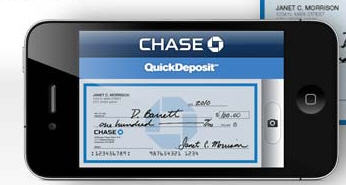

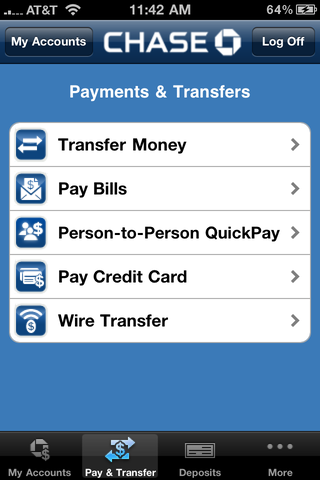

Chase QuickPay and Quick Deposit

25 July 2010 (Updated 20 Aug)

![]()

- Netbanker on Chase iPhone App

- Previous post on USAA’s Deposit@mobile

- American Banker

- ApStore – Chase iPhone App

- Chase QuickPay

- Mitek Systems Product Page

Chase has a stellar eCommerce and mobile team in both their retail and cards organization, and they are poised to deliver tremendous payment innovation across both of these business units. This innovation has been “in the works” over the last few years, and Jack Stephenson (PayPal’s former head of strategy) is fortunate to have joined at a time where both the payment platform and team is gaining traction. This month the JPM retail team has delivered new capability in its iPhone versions of QuickPay and Quick Deposit products.

QuickPay Overview:

QuickPay is a JPM’s money movement “pay anyone” service that provides  registration for both Chase and non Chase customers. Chase was very late to the money movement game, rolling out its first QuickPay service in 2008 (whereas Bank of America and Citi have been providing this since 2002 through CashEdge). From a strategy and organizational perspective, JPM is well known for their “preference” to develop applications internally. It may have taken some time for JPM to complete the QuickPay internal build, but in the current release it has surpassed the domestic capability (and usability) of all other banks. JPM is now the leader in retail online payments.

registration for both Chase and non Chase customers. Chase was very late to the money movement game, rolling out its first QuickPay service in 2008 (whereas Bank of America and Citi have been providing this since 2002 through CashEdge). From a strategy and organizational perspective, JPM is well known for their “preference” to develop applications internally. It may have taken some time for JPM to complete the QuickPay internal build, but in the current release it has surpassed the domestic capability (and usability) of all other banks. JPM is now the leader in retail online payments.

Non-Chase customers can register for QuickPay before or after receiving funds. For non customers, registration for QuickPay is similar to PayPal (or CashEdge’s PopMoney), with the QuickPay wallet currently constrained to single linked checking account. Chase customers have a streamlined enrollment process and the QuickPay functionality is integrated into their existing online experience (demo above). This differs substantially from BAC, where the same capability to transfer funds exists but the usability is very poor. BAC is missing a substantial opportunity to capture beneficiary phone/e-mail information, an unnecessary miss since the capability exists (BAC is Cashedge’s largest US customer but has not yet signed on with CashEdge’s mobile POP money service). Beneficiary information is critical to maintaining an accurate directory.. the key element in any payment system. Chase’s QuickPay maintains e-mail, phone and other information which gives it a head start in the directory battle (subject of future blog). Given Chase Paymentech’s role in acquisition (for card, paypal, …) you can see potential for further directory synergies internally.

The articles above provide a great overview of the new iPhone App, with Chase following in the footsteps of USAA’s Deposit@Mobile. Application is from Mitek Systems and it is just super, and for small merchants this may become the payment method of choice (when compared to card):

Merchant benefits:

- No transaction costs (savings of 150-350bps)

- Usability and simplified enrollment

- Same day availability of funds

- Fits existing consumer behavior pattern (checks)

- Legal protections/enforceability (paper checks vs. electronic signature)

- Instant verification, risk and fraud management

- Leverages bank imaging systems and processes (regulatory and consumer receipt)

- Notification/receipt to consumers

JPM Business Case

- Check imaging (op expense)

- Small business acquisition (Customer Net Revenue for SME = $3-$5k)

- NRFF for non-customers (NIM on settlement funds held)

- Future “directory” business case, cards growth

- Prevention of DDA Account Number Breach

The JPM Quick Deposit application was reportedly built in-house, other Vendors such as EasCorp’s Depozip provide similar functionality. As for the success of this application, NetBanker reported USAA’s recent numbers for Deposit@Mobile. (update 20 Aug, my friends at BAC tell me that they have been trialing the Mitek application for almost 3 years now, fine tuning the app and the support process and are set for launch any day) .

Given that the audience for this blog (investors, start ups and innovators), you might ask why it takes 2 years for a bank to roll out this type of innovation. An excellent question! The iPhone app itself is the easy part, perhaps consisting of less then 20% of the overall budget. The “hard work” is in integrating it into existing systems and risk controls. For example, the primary value proposition, for QuickDeposit, is improving check acceptance and funds availability. At the teller line, banks have tools like DepositChek which allows the bank to determine if information on the check is correct and the account is in good standing (stopping check fraud before the check image gets into the system). These same tools must be integrated into the online and mobile process to reduce risk. I’ve picked this particular example because it is a tool unique to bank entities (not available to non-banks). In addition to the technical integration costs, banks have become very prudent in testing, and accessing impact of new functionality to call center support costs. Given the wide availability of both of these applications, it is essential that they are intuitive to JPM customers.

These applications are a great retail success. I understand that the JPM cards team is also poised for a major release in mobile soon (with multiple alliance partners). Well done JPM!

Enroll for QuickPay – www.chase.com/QuickPay

Overview of Quick Deposit – www.chase.com/quickdeposit

Thoughts appreciated

Firethorn is dead

October 2009

Ok not yet.. but this is the obituary precursor.

Firethorn Quick View

- Acquired by Qualcomm for $210 in Nov 2007.

- Estimated Revenue of $4-8M through MNO fees and bank licenses ($500k-$1M). Qualcomm does not seperate revenue from this unit, nor is it mentioned in filings (http://www.qualcomm.com/investor/index.html). (Mar 2010 update. QCOM did separate earnings, see related post here)

- Current customers: Wachovia, Regions, SunTrust, Citi Card and now US Bank

- Wachovia is pulling out of $1M arrangement

- JPMC is pulling out

When I was at Gartner Group, I sat down with an “anonymous” analyst and he said let’s think of some catchy titles for a new analyst brief. I asked “what is the subject”? He said “let’s decide that after we define the title that everyone wants to read”. It was then that I decided to leave Gartner, realizing it kept more to its journalism roots (as a prior division of McGraw Hill) then I cared to be associated with.

But alas I regress, growing ever more frustrated by MNO and bank attempts to “mobilize” financial services. Firethorn was a mess from the start. Having been at Wachovia (but never party to Firethorn selection) I can tell you that Firethorn’s banks “wanted to do something in mobile”, without much of a business plan behind it. The lack of a business plan is something that not only challenges the Twitters of the world, it also challenges big organizations. In either case a business plan must be addressed or the initiative will atrophy.. such are the vagaries of life… with perhaps the exception of centralized state planning (thank God for capitalism). The cards were stacked against Firethorn:

- Firethorn Banks had no “mobile” business plan.. when there is no plan, there is no executive support (because there is no revenue)

- Active customers are less then 10k per bank, Firethorn’s $1M price tag was hard for Wachovia to justify. Firethorn is actually paying other (card) banks to use the service..

- Fat clients on mobile phones are a failure (more below).

- Telecos stopped blocking access to http traffic (bank mobile sites)

- Consumers don’t perceive value (browser based access is faster).

BAC, JPM and WFC have solid strategies for mobile in support of their business. Distribution is a key facit of any business and it is never acceptable to create a new channel for sales/service without understanding of how it impacts products, customers and costs to serve. From a Bank CEO perspective, business leadership is required in distribution… don’t let the techies or “internet teams” make distribution decisions absent of business involvement. Firethorn’s current bank customers should have been more thoughtful in their decisions. Giving an MNO “control” over your content is not acceptable. Banks must push strategies that support their ownership of data, control over consumer (including authentication), brand and service experience/cost (quality).

My sources tell me that Wachovia has stopped new enrollments and is sunsetting the app immediately. Existing clients will be notified in next few months. The application never took off w/ Citi Card customers. (Poor US Bank.. they just went live with Firethorn last month).

Firethorn was acquired by Qualcomm for $210 in Nov 2007. Current customers: Wachovia, Regions, SunTrust and now US Bank (blind following the blind). I project Firethorn revenue as $8M from both direct sales to banks and MNO service fees. Revenue growth is challenged by issues above. Expect to see Qualcomm refocus Firethorn in NFC payments space, and align with companies like Vivotech. This is consistent w/ 3Q09 guidance in QCOM investor call

http://www.redherring.com/Home/23154

(side note) Globally mobile banking fat client apps have been a resounding failure. In my previous life at Citi 6 of 6 fat client initiatives have failed. Take a look at the Citi iPhone app.. guess how many people use it? What do I recommend? Low cost…. with no change in consumer “behavior” or support requirements. In the USA.. Create a slimmed down style sheet(s) that fit the mobile browsers. BAC, Wachovia, and Wells to a terrific job here. Most other markets SMS is the way to go. Simplicity is the key to mobile…. My favorite “mobile banking” vendor outside of US is Monitise .. just reuse your ATM transactions and tie to a service (Overview here)

iPhone at POS? PaybySquirrel – updated

Twitter founder Jack Dorsey. Card swipe on iPhone.

- http://www.finextra.com/fullstory.asp?id=20618

- http://www.engadget.com/2009/10/17/twitter-founder-jack-dorseys-squirrel-project-revealed-as-th/

Roberto Garavaglia was nice enough to share this finextra story on linkedin. Is this a consumer play.. or a “merchant play”? Will I see my local ticket scalpers taking credit cards on their iPhone? This start up was certainly “in the black”. Data we know:

- Squirrel has a “signature” line in the app

- Have hardware on the phone

- Alpha test in NYC

- Receipt in engadget pic above shows consumer payment (you paid)

- Mind behind it is Dorsey

- Top VCs know about it, and seem to think it is a merchant play.

- Very US centric.. no EMV (Chip and Pin)

There are certainly some conflicting data points. If a consumer play.. this signature will not be valid… and transaction will be treated as a CNP (so why the signature?). If this is a merchant play who would possibly want to act as acquirer (fraud loss)? The merchant use would make most fraud heads loose a little sleep, for they would have a whole new threat vector. Can you imagine the buyers of the merchant use?.. The bank and I will have to worry about every kid in a fast food window and every waitress holding my card swiping on their iPhone (in addition to paying for my dinner). My guess is that squirrel has the technology working.. but haven’t figured out the “banking side”.

Fraud attacks the “weakest link” in payments quickly. Would love to hear from others on the community, but my view is:

- Interesting as a merchant play…. but acquirers will shy away from originating transaction in either network without solid fraud controls. The merchant owns the loss here by rules of network in a “CNP transaction”. Signature capability will be debated…

- Squirrel biz model.. questionable as anything but a hardware business. The fraud numbers of leading merchant selling digital goods is astounding. All top merchants have had to develop their own internal specialist teams to handle. If Apple and PayPal have trouble with teams of 300+ (after 10 years) this will be a challenge for any new “merchant”. As a payment method, squirrel will have to take this on. Having access to the physical card may allow them to try something disruptive like MagTek which reads the randomness (noise) in the card stripe to establish a “unique” card… which has the downside of card registration. Something like this would push squirrel further into a “US centric” model as it appears that they do not support EMV (aka Chip and PIN).

- “No go” as a consumer play. Why not just keep my card at the Apple app store? or at PayPal? What is the incremental value that this provides me? Why not just key in my card data.. why add a reader to my sexy iPhone .. .in its sexy case.

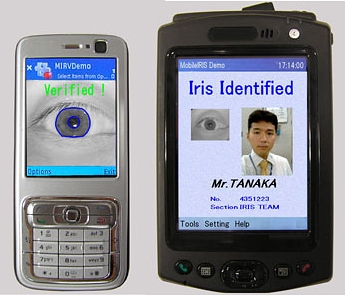

Innovation in payments is tough… if I were going to add something the Steve Job’s product plan for the iPhone what would it be?

- Global

- Ubiquitous

- Unique to every person

- Globally Accepted for use in Payment and Authentication, by merchants, banks, networks, regulators

- Low error rate

- Impossible to clone

- Difficult to crack

The answer is… ( ). OK so nothing fits my criteria, but any appendage on my iPhone must certainly seek to optimize the goals above. Only item I’ve seen that comes close it IRIS scanning.. now being miniaturized to fit on a chip the size of your thumbnail (below). Just for fun.. I bought “paybyiris.com” domain as I finished this article (today).

http://www.nydailynews.com/archives/news/2002/01/07/2002-01-07_credit_card_cloners___1b_sca.html

http://4g-wirelessevolution.tmcnet.com/news/2009/08/19/4331395.htm

BlingNation Review – Updated 11/2