Great Interview w/ CEO of Tempo on how Durbin killed margins in Debit.. and killed Tempo

http://pymnts.com/Tempo-CEO-Opens-Up-about-Decision-to-Shut-Down-after-Durbin/

Just as I wrote in March (Sepa and EU payment innovation), when governments intervene to set prices.. “innovation” can be impacted. John says Tempo is the “poster child” of government regs gone awry. On the flip side.. third party payor processes are also disconnected from market forces (payments, health care, education, pension, …). Bank of America’s response ($5 debit card fee) is the right response for america’s banks to take toward Durbin, customers that directly incur the costs for services they use can make more informed decisions (and change behavior) to optimize their own value equation.

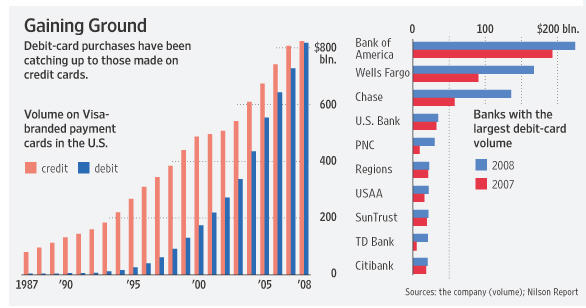

In the US, bank debit cards will be evolving to what we see in Canada and Australia. It remains to be seen if we will see fall off in Debit transaction growth in favor of “free” credit card transactions.

Banks and Visa/MA certainly see things like mobile payments driving convenience of using credit.. while the “pain” of using debit increases…

Banks and Visa/MA certainly see things like mobile payments driving convenience of using credit.. while the “pain” of using debit increases…