18 Nov 2011

The most frequent question I get from eBay’s institutional investors and start ups is about PayPal’s opportunity to win at the POS. I met with 3 top Retailers who have been pitched PayPal’s new service. Quite frankly they were laughing.. it goes something like this

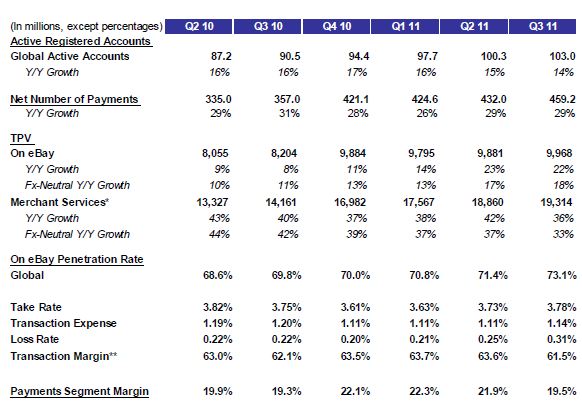

“we [Retailers] just won Durbin and are in the midst of planning how we incent customers to use their debit card … and we get presentation from PayPal with a rate of 150-200 bps.. am I going to loose any customers because I don’t have paypal payment? Will Paypal bring me new customers that would not have shopped here in the first place? Is there going to be a 100% conversion of credit card customers to paypal? Why on earth would I want to do this?”

PayPal of course is also pitching a gaggle of new mobile tools that let people scan in aisle and shop online to pick up in store.. but does a retailer really want to outsource this? PayPal’s core value was built around commerce, specifically the new form of commerce that eBay marketplaces brought. Buyers and sellers flocked to a tool that met their needs. No one came to eBay because of PayPal. Payments are just the last phase of a successful commerce interaction. PayPal still has tremendous global opportunity, but their opportunity is an evolutionary one driven from their COMMERCE core. Their business model (and cost of funds) does not adapt well to the physical world.

PayPal has no tools in its shed to deliver incremental value within a PHYSICAL commerce orchestration role. They simply do not touch consumers or influence them prior to purchase. Facebook, Apple, Google, MSFT all have a much better chance of orchestrating commerce.. This is why Google’s Wallet will win against ISIS… the business opportunity is commerce orchestration…NOT about mobile payments. Never before has a customer had the ability to interact real time in store with products and offers. Who will win? Which company above has a sales force of over 2000 globally selling to retailers today? Driving business growth? There will be no contest here.

How can PayPal use its tremendous consumer network to deliver value off of eBay? The answer revolves around what they “could” orchestrate.. perhaps in a junior capacity. What problems can they solve? If PayPal’s biggest asset is Consumers.. and objective is physical commerce… why not create a “reverse auction” for goods? Let consumers describe what they are in the market for and have sellers bid for the privilege to sell (and service) it. Give consumers option to buy it now in store down the street. This would relegate physical retailers to competing on price alone.. and certainly would not make them many new merchant friends…but they could start off doing this for excess inventory or mark downs. This could be a very stupid idea.. but PayPal’s efforts to go head to head with Visa and MA in an area where they add no value at a high cost is not much better.

One corollary here is that Payments will become dumb pipes. Banks had a traditional role as the intermediary in commerce. They have fouled the well.. and continue to cry against the harm done to them by Durbin instead of engaging in an honest assessment of the future of their business. Banks believe they have a lock on payments.. and similarly to ISIS engage in a strategy of control instead of value delivery. This dynamic will push “Commerce orchestrators” to find the path of least resistance (least cost routing) for payment. Not all payments are the same, for example Credit card payments are much different.. because they extend financing to benefit merchant consumer and bank. However there is no reason to force everything through this CREDIT card channel, which is precisely what the banks are trying to do with NFC (for example there is no debit NFC product.. it is not a technical issue but a business one).

Even if payments are dumb pipes they must have a reservoir to pull from, either in a DDA, stored value account or credit line. During my meeting with the Kansas City Fed last week, I discussed the McKinsey report describing how the bottom 4 deciles of retail banking customers are unprofitable. In other words the big 5 banks are trying to find a way to sponsor “switch your bank day” for 40% of their customers. Many will leave the banking system all together, and this reservoir of funds will translate to cash, pre-paid or some other non-bank product. Banks loss of control over DDA is a slippery slope. If every American has a PayPal account, an iTunes account, an Amazon account, a Google Wallet and a pre-paid card they could find their control strategies are no longer effective.

I apologize in advance for the brevity of this note, and I certainly appreciate comments.. but this is how I see it.

Tom as always right to meat of it. Yes, I have been wondering about the actual cost of paypal at the POS. I am still waiting for someone to get merchants rates down to 1% of the transaction. New rails are needed. Interesting side note, working with QSR (Fast Food) vendors, they are really hurt by the Durbin due to the nature of smaller (<$10 txns) transactions that make up the bulk of their business. File that under un-intended consequences of well meaning (for merchants anyways) legislation.

I have been anti-square for some time, but I can't deny their success at this point.

Pingback: Visa aims at developing countries with new international prepaid mobile payment service | | Tech news

Tom,

I recently tried to sell my mobile banking business plan to four of the major banks in the USA: It seems that no one gets it. My business plan primary focuses on the study of human payment behavior patterns around the world. When money becomes a variable liquid throughout the world, the current banking regulations that strangles the true meaning of mobile banking will simply collapse. Try to strangle a cat at a dark corner and it kills you instead. Ubiquitous mobile payments will eventually overflow the regulations_dam and finally we will be able to see the word harmonic and money in one sentence.

What I don’t understand is why PayPal are pitching at the 150-200 BPS mark, if they focused on an ACH/BACS – rather than card, either credit or debit – then surely they would be able to go down to the 50-75 BPS level which might be of more interest to the retailers.

Pingback: PayPal and Home Depot « FinVentures

Pingback: PayPal vs Google (at POS) « FinVentures

Pingback: Battle of the Cloud – Part 2 « FinVentures

Pingback: PayPal at POS – Take 4 « FinVentures

Pingback: Business Implications of Payment Tokens | FinVentures

Pingback: Payment News for May.. What a Month! | FinVentures