Tag Archives: POS

Apple and Physical Commerce (not Payments) – Part 4

POS Integration: Build it and they will xxxxx?

PayPal under attack.. Not just Facebook…

Payment News for May.. What a Month!

PayPal at POS again?

JPM/V Scenarios… Which one is it?

Controlling Wallets – Battle of the Cloud Part 3

Business Implications of Payment Tokens

EMV Battle Impacts Mobile Payments

20 September

Most of everyone knows of the EMV efforts in the US, with Visa implementing a liability shift on October 1, 2015. In this model, any merchant that is presented with a chip and pin card, but is not capable of processing it (as an EMV), will bear fraud loss. There have been very BIG swings in strategy over the last 6-8 months. The big issuers were all dead set against EMV.. saying they could not afford the cost to re-issue. Now all are on board… why? This is what I’m thinking about  today….

today….

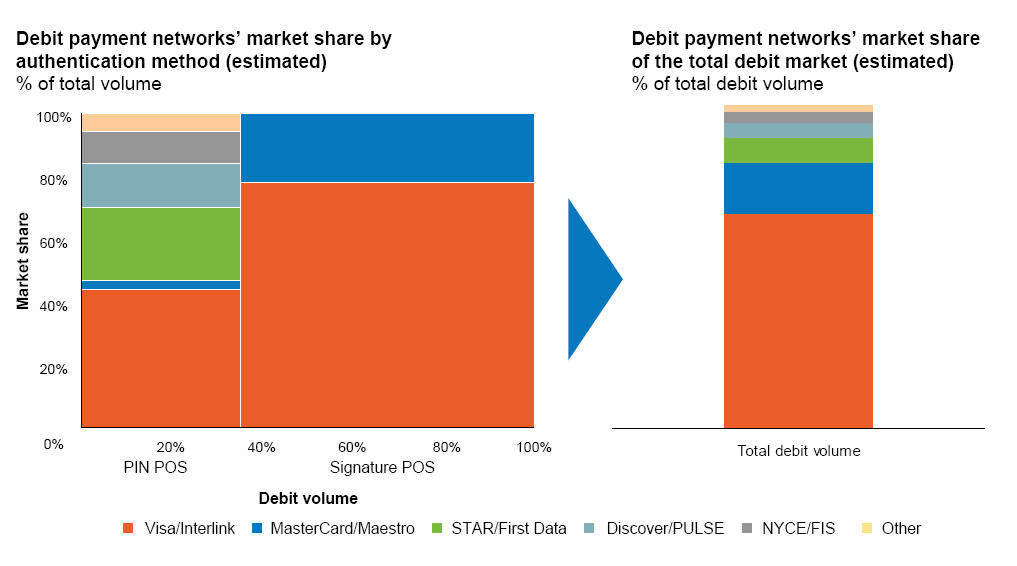

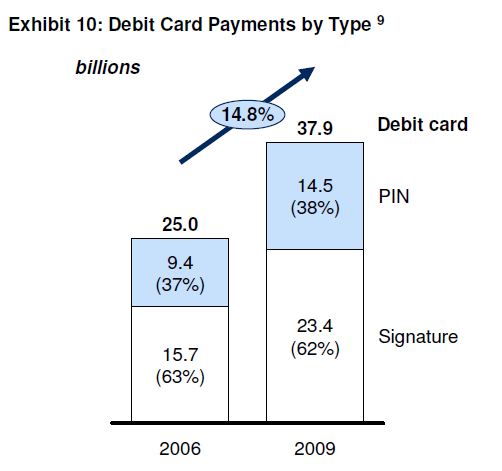

Merchants have always loved PIN Debit (see blog). PIN was the cheapest transaction type prior to Durbin, and post Durbin PIN still has the unique advantage of allowing the merchant to route without going to Visa at all. Remember PIN Debit leniage was from ATM networks. Merchants also like the fact that 96% of PIN Debit fraud losses are assumed by issuers..

Visa/MA hate PIN Debit.. the countries where it has taken off like Canada-Interac, Australia EFTPOS, China Union Pay… have domestic clearing networks. This means that transactions are no longer routed through Visa/MA. In the US we have 8 debit networks (see blog). It makes little sense to continue all of these separate PIN debit networks if merchants can route directly to banks… The banks were thus looking at consolidation similar to what was done in countires above. In other words, banks were planning to take Debit back from Visa/MA in a bank owned network. After all, Bank margin improves in the PIN model (post Durbin) when payments are routed directly to them (they don’t pay a network fee ~10 bps).

Visa read the tea leaves… So how can Visa/MA stop the bank and merchant love affair w/ PIN? Force EMV…

The Merchant Stick? How will Visa “force” merchant’s to accept contactless? (See Visa Document)

Domestic and cross-border counterfeit liability shift. Merchants that cannot accept an EMV or contactless card when presented one by a customer will bear the liability of a fraudulent transaction instead of the issuer after October 1, 2015.

The Merchant “Carrot”? Visa TIP program

TIP program allows merchants to be excused from validating their PCI DSS compliance for any year that at least 75 percent of their Visa transactions come from chip-enabled point-of-sale terminals. There are also subsidies for terminal upgrades … To qualify, terminals must be enabled to support both EMV contact and contactless chip acceptance, including mobile contactless payments based on NFC technology. Contact chip-only or contactless-only terminals will not qualify for the U.S. program

Visa’s effort to include contactless in the TIP program is very strategic. To gain the benefits of TIP, merchants must reterminalize with both contact and contactless EMV capability. Why? Well for one reason there are no contactless debit cards out there… yes everything is a credit card. These of course carry much higher fees… The other advantage of TIP is that the PCI-DSS wavier is like a “get out of jail free” card. Merchants can’t get the card without contactless… If this weren’t enough… not only does VISA want contactless.. they also want signature.

Visa says PIN not necessary – Green Sheet

“There’s a lot of confusion around the myth that EMV means ‘chip-and-PIN,'” Stephanie Ericksen, Visa Head of Authentication Product Integration, said in a blog published Jan. 13, 2012. “It doesn’t in many countries, including the U.S. That’s because, in the U.S., we can rely on online processing where transactions are transmitted in real time to the issuer for approval. With that in place, there’s no need for the offline authentication that was the genesis of chip-and-PIN.

From Chip and PIN to Chip and Choose? Visa wants encourage signature as these transactions must be routed through them.. my position (and that of most non network people) is that AUTHORIZATION and AUTHENTICATION are completely different problem sets. The availability of real time approval means nothing if you don’t know WHO you are approving for WHICH CARD. PIN answers the “who” question and the chip is the account number or “how” you are going to pay. I just can’t believe that Visa has come up with this story.. but they must in order to support “contactless”. Most consumers don’t know that today contactless transactions have limits. These limits are set by the issuer, in Europe they are typically around $25. However the issuer can choose to increase the limit (no PIN required), or require a PIN with a contactless payment. All of this is a little absurd for Visa as PIN is always viewed as key to authentication, AND Visa just waved the signature requirement for mobile payments. So no signature required for Square.. but Visa wants it optional at the merchant POS so it can retain the volume?…. Expect some Regulatory involvement here.

Large Merchants are very, very aware of this strategy to improve the credit transaction mix and make mobile/contactless payments a “premium” service. The top 20 retailers have put their foot down and said “no way” will we be putting contactless readers in our store (MCX members particularly). The terminals that they are ordering DO NOT have contactless capabilities.. only EMV chip and PIN. Most retailers agree that signature is a worthless authentication mechanism. Visa clings to signature in order to ensure transactions are routed through them. Expect MCX to look toward a PIN model..

So this EMV “battle” has many sides to it.. it impacts mobile payment adoption, EMV rollout, plastic re-issuer, consumer behavior, consolidation of national PIN debit networks, …

Comments appreciated.