Visa is an independent for profit company… they are on a tear with adjusted earnings up over 19% and the stock up over 40% for the year. Who are Visa’s customers? They are a network, created by banks.. but they only set rules.. historically they don’t have direct relationships with merchants or consumers; the issuing bank owns the consumer, and the acquiring bank owns the merchant. Their primary customer is therefore banks (issuing and acquiring).

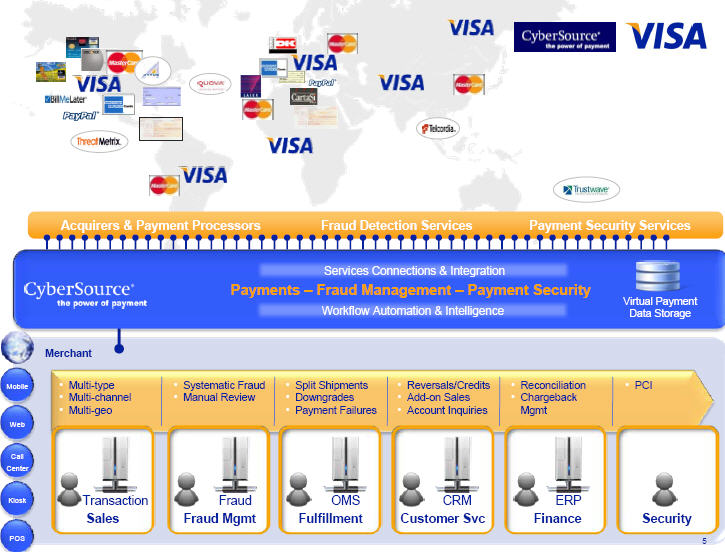

With the CYBS purchase, Visa gained direct merchant relationships. CYBS at one time handled over 25% of eCommerce transactions. The “big 3” in online merchant services are now eBay (Paypal+GSI), Visa (CYBS) and Amazon. Visa is looking for ways to expand its network, services and revenue base. The expansion is very hard to do if you are dependent on your member banks, hence Visa is looking to establish a direct consumer touchpoint in line with Cybersource’s merchant capability.

In my very first blog (2009 Googlization of Financial Services), I outlined both the alert service that Clairmail built for Visa, and the advertising/offer engine they had put in place. Neither the alert service nor the ad service had taken off as issuers were not exactly thrilled with expanding Visa’s services or opening the door to Visa’s efforts to communicate directly to consumers. Clairmail has since been acquired by Monitise ($173M in March 2012). Monitise is the entity that build “Visa Offers” and initially was “the mobile horse” which Visa intended to ride … until they upgraded to Fundamo. Now Monitise seems to be focused on the offers product… (See Visa Mobile Strategy). Visa wants to get into the card linked offers business (Visa Offers, FreeMonee, Monitise,…), and has had the technology working for sometime, they also want to get into the wallet business. (see Battle of the Cloud)

Neither of these services are to the best interest of issuers, which is why we see a hodgepodge of small banks without the resources to properly digest the strategic impact, or build the technology themselves in this recent V.me “50 bank pilot”. Let me be crystal clear on what I believe Visa’s strategy is:

- establish direct consumer service

- start with eCommerce (autofill) functionality to speed checkout and improve conversion

- add alerts to give consumers knowledge of card transactions

- add incentives/offers in 18 months (they already have built the service)

This is why Visa hates the Google service.. it steps all over their plans online.. as well as at POS (not in scope for this blog).

Take a look at V.me terms and conditions. They have done a great job in obfuscating their strategy in this document, as it clearly states that issuers have control

These Terms do not amend or otherwise modify the cardholder agreement or any other terms and conditions of your Issuer. In the event of any inconsistency between these Terms and your cardholder agreement with your Issuer, these Terms govern as to the relationship between you and Visa solely with respect to V.me and your cardholder agreement with your Issuer governs as to the relationship between you and your Issuer. You are responsible for ensuring that your use of the Services complies with your cardholder agreement with your Issuer.

Visa Alerts is the service where banks should start to become concerned. For the first time, visa is creating a list of consumer names, emails (above) and mobile phone numbers. Alerts will start with card usage, and then they will morph into incentives and offers based on spending patterns. These incentives will be offered completely separate from the issuers. In the V.me privacy policy “We share some information, but not your full card number, with merchants you pay with V.me” and “We may contact you about your V.me account, service updates, and new V.me features”.

I’ve got news for the V.me participating banks.. why don’t you just give Visa your customer list and give them permission to use it as they want? You have just given Visa much more.. They can now act on transactions they see on the switch.

I see Visa quickly expanding the service beyond eCommerce to physical commerce primarily around offers and alerts. You will be able to redeem offers across any card stored in your V.me wallet. This means that V.me will work without eCommerce merchant adoption… and could be a stand alone offers platform. Of course they don’t want to lead with this… but it is indeed where Visa sees the best margin.

Banks.. get serious about this. Why would you want to let Visa step all over your brand and start delivering services to consumers directly? This is the start of a major tipping point for Visa… the Top issuers are fuming… but Visa may be able to build consumer adoption ahead of banks pulling the plug on it.

There is certainly no reason to worry.. take a look at the participating merchants https://www.v.me/shopping/ not exactly a whose who of online merchants. Why is this? well my merchant friends are also aware of Visa’s efforts to do the incentive business and the last thing they want is another entity switching consumers to the lowest cost provider. V.me on an eCommerce perspective is fine.. but what Visa doesn’t realize is that Google, Paypal an Amazon all have this today. (ex Google has autofill in Chome browser and Android…). If Visa has trouble signing up its own CYBS merchants.. what issues do you think they will have in signing up with those on GSI?

Great post, Tom. Very insightful – every bank should indeed ignore the message at their peril.

That explained why GW partnered with MC (and why they are not best friends with Visa). BTW, where is MC in that picture? I believe they are planning to expand capabilities of their m-wallet platform next year (think of Google Wallet function…), but it that enough to compete with V.me? Also, that platform is aimed at non-issuers, which – like with V.me – does not improve the relationship with the banks…

Alerts: what’s missing is an MNO-related entity – post factum alerts are not as useful as live 2FA…

“offers platform […] is indeed where Visa sees the best margin” – don’t consumers have “offers fatigue” yet? What can Visa offer that Google (or offers-focused startups) cannot?

Would appreciate your comments.

Pingback: Tokens: Merchant Options | FinVentures

Pingback: CEO View – Battle of the Cloud Part 5 | FinVentures