Update 8 November – Original post is below the image.. I had doubted Visa’s support here. But clearly this is a real product.

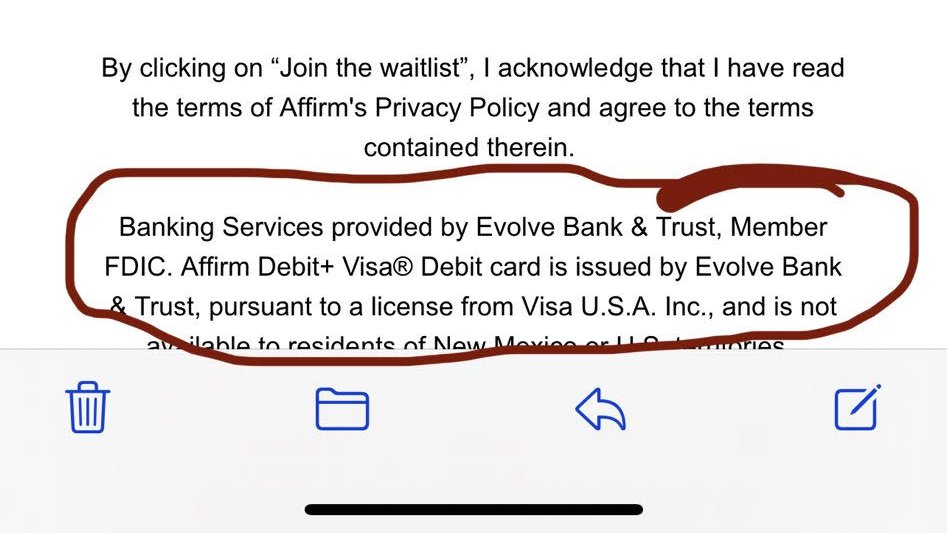

Affirm Debit+ is a decoupled debit on the Visa network with Evolve Bank as ODFI/Issuer. I doubt if Visa fully vetted this product.. it MUST have “slipped through”. For more info see Affirm’s investor day presentation.

Per my blog last week, my hypothesis is that the new Affirm Debit+ will be revolutionary.. which is why it is currently causing a massive firestorm amongst Banks. Today I want to drill into what I believe the value proposition will be (my hypothesis) and why Visa had to support this.

Today Affirm is “limited” in growth to the merchants it can directly integrate to. How can they solve this problem? Create a consumer “pay anyone” product that lets the consumer pick and choose what items they want to finance after they purchase them. Connect any of your bank accounts or all of them.. Finance anything you buy on improved terms. Affirm will also work with Stripe and others to create an improved checkout process, which will improve both conversion AND consumers ability to purchase (ie underwriting). The first mover advantage will be tremendous and step on much of the Neo Banks (already slim value prop).

10 thoughts on “Affirm Debit+ is Revolutionary”