Banks Need A Change in Perspective

Short bullet point blog (My issuer friends just put me on the 10 most wanted.. but I’m really trying to help).

Having just completed a merchant survey, Retail CMOs were quite clear with their top 3 companies they would spend time with to improve eCommerce (payment focus):

Continue readingShort Blog

Continue readingUS Payment Infrastructure is in the midst of completing a major renovation.

Let me preempt the #1 question most of you are about to ask “are card volumes at risk”? Nope, why on earth would banks want to walk away from the most profitable retail banking product in the history of man (see Future of Retail Banking)!?

© Starpoint LLP, 2025. No part of this site, blog.starpointllp.com, may be reproduced or retransmitted, in whole or in part, in any manner without the permission of the copyright owner. Also, see our Legal/Disclaimer (this is a highly opinionated and partially informed blog).

My estimates for how US eCom market share will shift in next 3 yrs are at the end of this blog.

eCommerce is not a single monolithic market. There are many “segments” to optimize that vary by geography, retailer type, consumer device, customer type (guest vs loyal), transaction type (recurring vs new), ad type, payment type,…etc. A great source of this information is Monetate (highly recommend). For example, let’s look at conversion rates by industry, device and region.

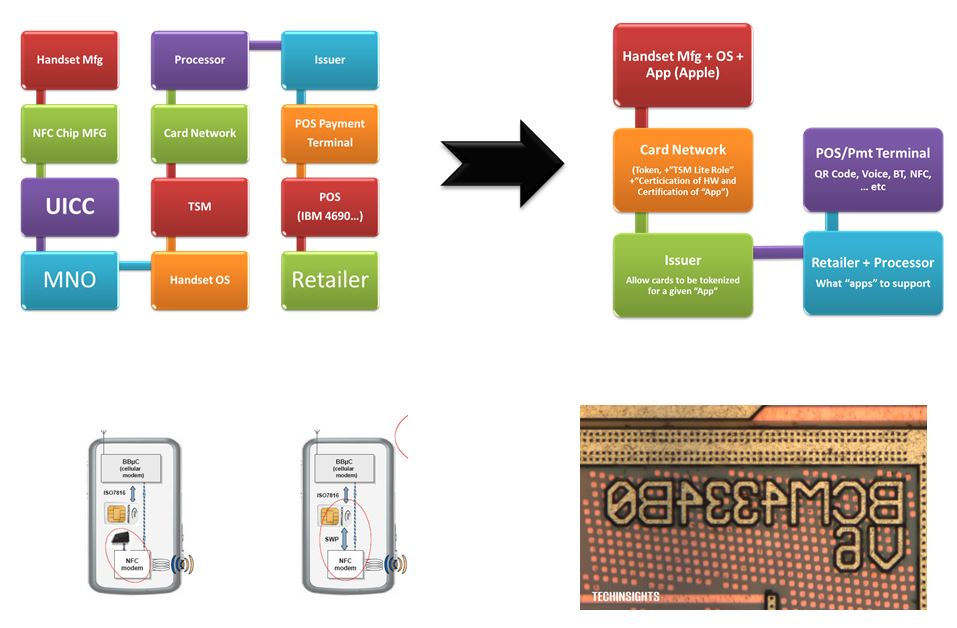

Continue readingLet’s talk about tokens. When discussing tokens and payments, it’s important to clarify which category of tokens you’re talking about. Today, I’m not discussing NFTs; instead, I’m discussing card network tokens. It’s hard to believe I’ve been writing on this subject for almost 15 years. For a historical refresh, here are a few of my old blogs

Continue readingWhat are the core functions of a digital wallet and what will the future bring now that Apple has opened up their Secure Element (see blog)?

I’ve been writing about wallets for over 12 yrs. Let me recap some history

I’ve been confused on Fastlane? Was it branded? Nope. Is it tied to Braintree? A little.. So what is it and why are Adyen and FISV partners? Why would Adyen and FISV pay PayPal a 6-7bps revenue share for using Fastlane?

Continue reading18 months of Revolutionary Change in How we Buy Online

Short Blog

Follow up to my June 2024 blogs – eCom Politics and Scenarios and Fastlane + FIDO Enabled Checkout. Today, we focus on the changes, what merchants are asking for, and what consumers will adopt (and when).

Read First – Blog on SPA from Checkout.com

Background Reading – June blog eCom politics and Scenarios, and Identity, Authentication and Risk

What’s the big news here? SPA allows Google to stand at par with ApplePay in providing the best-authenticated checkout experience. Google looks to have taken TWO MASSIVE pieces out of the authentication process: 1) 3DS handshake (putitting in Cryptogram and 2) A step up from the Issuer (possibly – a significant portion of this blog). This is a generational improvement and massive simplificaiton of the current 3DS flow.

The mobile platform is key to authentication and Google is the preferred partner of every bank, merchant and network. Their challenge in SPA? Doesn’t seem Checkout.com coordinated with the networks on SPA (ie liability shift OR step up). I think it will get worked out as the quality of this innovation is just fantastic.

As I wrote in June, ApplePay 2.0 plans to cross the chasm from mobile only to desktop (as announced at WWDC). Google is proving that they have the same capability, as Chrome makes up about 10-12% of eCom and over 30% of guest checkout at most retailers; they are positioned well (particularly in Android markets).

Continue readingNotifications