Previous Posts

- Mercury NewCo – Aug10

- Mobile Marketing – Jun10

- Googlization of Financial Services

- AT&T Discover Pre-paid – Mar10

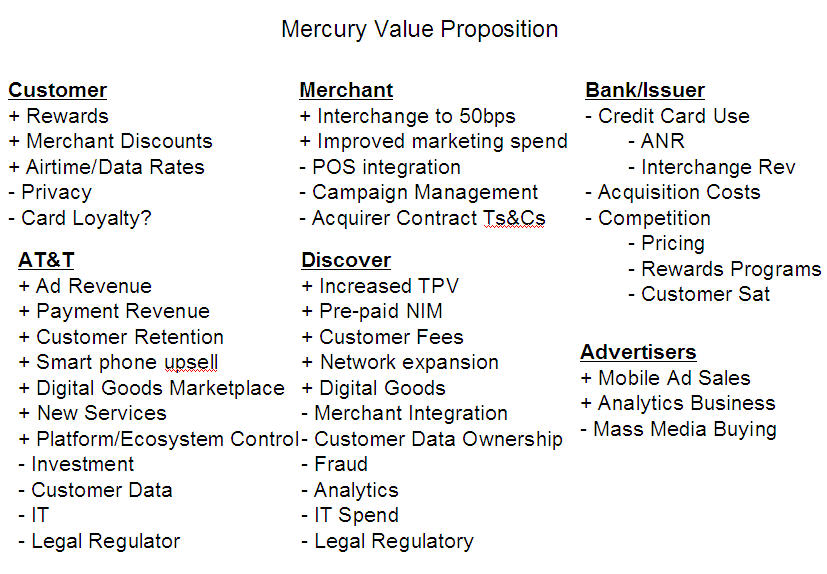

Last week I found myself in NYC and was fortunate to meet with several payment leaders. Change is not something we see often in payments as it is historically known for its galacial pace. The most interesting topics centered around new investment and consolidation, with the rumored $500M capital commitment for ATT/Discover Mercury NewCo at the top of the list. I greatly appreciated the dialog, and this blog is a follow up to a few of the discussions. My view is that Mercury will be present a completely new payments value proposition that existing networks will have trouble competing against, with the revenue driver of mobile advertising. As stated in previous blog, mobile advertising may well exceed Google’s precedent set with online…. perhaps a completely different dynamic with established fortune 50 organizations leading the way in collaboration with old line Madison Ave Ad Agencies. The MNO payment strategy seems to be driven by a recognition that mobile advertising is key to future revenue growth, and payments is an outgrowth of this larger strategic plan (see previous blogs above). Why do I like Mercury’s prospects given the dim history of “change” in payments?

- Enhances an existing value chain (mobile operators) that is well established with sufficient investment capital and patience (deep pockets)

- Addresses a new market opportunity in a way that can deliver disruptive value to multiple stakeholders

- Existing payment providers can not adapt. The great thing about networks are their resiliance. The negative is that they are also resiliant to change.. even when necessary

- There is significant short term merchant pain in the card payments. Merchants have been in effective in influencing Interchange rates.

- Consumer behavior is changing, and the pace at which adoption of new tools and technologies are “mainstream” are also accelerating.

- Payments is an “infrastructure service” to every business and every country. Traditional banking is becoming decoupled from the business of payments in both mature and emerging markets.

- …etc

Its hard to genericize the antagonist view of Mercury.. but the following are key points I frequently hear:

- Consumers have tremendous card loyalty and will not use a different payment instrument just because it is available.

- Discover is a failed network with over $2B invested in infrastructure

- Existing cards can compete on rates. There is nothing that Discover (or Mercury NewCo) can offer which existing issuers can not compete with

- Changing consumer behavior is unpredictable and takes tremendous marketing investment

- Investment in POS infrastructure is expensive and time consuming

- Merchants are happy with the existing payment networks, and will not spend additional money on marketing or interchange

All are excellent points (with exception of merchant attitudes toward V/MA). Below I have laid out a scenario for NewCo success (some of which is based upon industry intelligence…). Following the scenario, there is an outline of the value propositions for the parties involved.

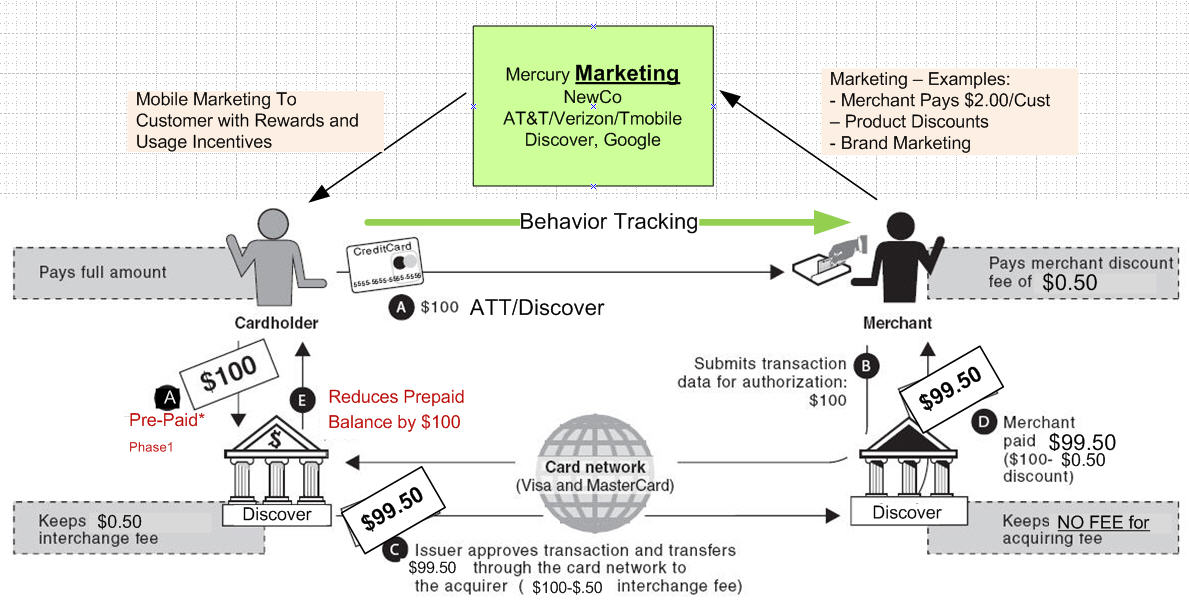

New Scenario 1 – Pre-Paid Card/Mobile Marketing (AT&T Example)

- All AT&T customers are issued a pre-paid Discover card with $10 pre loaded

- AT&T establishes incentives for use and incentives for user acceptance of mobile marketing agreement whereby personal data can be used to market you 10 times per month.

- Customers accepting agreement also receive NFC MicroSD cards

- Mercury commits to $200M in advertising spend to kick off program

- Mercury establishes mobile advertising group in collaboration with major Madison Ave firms, goal of directing $2B in marketing spend by Year 2. Get back at Google (Own Mobile).. is motivation for Madison Ave firms.

- Mercury establishes Merchant division in collaboration w/ Discover. Mercury will over all transactions at 50bps with minimum marketing spend and/or POS updates. Mercury will also provide marketing incentives/discounts for early adopters. Customer and campaign analytics will be key selling point. Mercury will also seek item detail in transactions.

- Google makes investment in Mercury to serve as ad serving engine and direct existing spend. Agreement ensures that google does not have exclusive rights so that Madison Ave firms can work directly with large corporates.

- Mercury/Discover develop common shared wallets and common marketing processes/standards that are used across MNOs (analogous to Apple iAD). Mercury retains directory of customers that have accepted disclosure and campaign engines bid for ad placement based upon demographics, analytics, and location.

- Customer receives advertising via mobile. 4-8 Categories

- Brand level marketing

- Store discounts

- Product discounts

- Coupons

- Free Trials

- Cross sell/Upsell…

- Incentives for card use drive merchant and consumer behavior. Durbin allows merchants to “direct” consumers to preferred payment methods. Discover is used for small purchases, and also acts as “decoupled debit” once history is established. Customers begin to think of Mercury card as new debit with benefits.

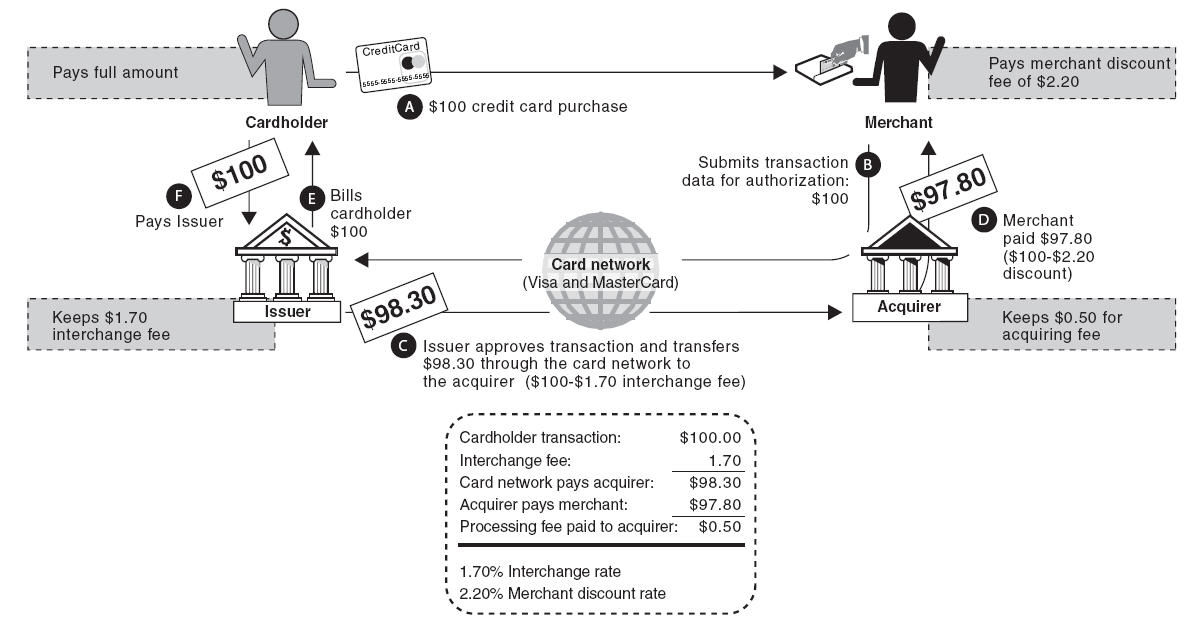

Process Flows – From GAO

NewCo Revenue Model – Year 1 (in Previous Post)

- 85M subscribers (7M iPhone)

- Year one penetration of 10% (8.5M or 60% of iPhone base),

- Average purchase amount $40

- Interchange 50bps

Revenue

- Annual TPV = 50%(85M*10%*$40*5*12) = $10B (note: 50% ramp up)

- Transaction Revenue $50M

- Digital Goods/Usage $50M

- Retention $50M

- Ad Revenue $300M

- Total Revenue $350M

Expense

- Processing expense (30% of Rev, 100% ACH funding) – $15M

- IT Build (one time) – $200M

- Marketing spend – $200M

- G&A – $80M

- Total Expense – $495M

Value Proposition

Thoughts appreciated

– Tom

Pingback: Debit Card in Peril? « FinVentures

Pingback: Decoupled Debit « FinVentures

Pingback: ISIS: Moving payments from Rail to Air « FinVentures

Pingback: ISIS: Antonym of Nimble? « FinVentures