9 July 2012

WSJ Article Today: Price of Plastic Going Up?

Merchants may soon begin to impose a surcharge each time a customer pays with credit card, a practice Visa Inc. and MasterCard Inc. currently prohibit…. [But provision will likely go away as part of impending settlement].

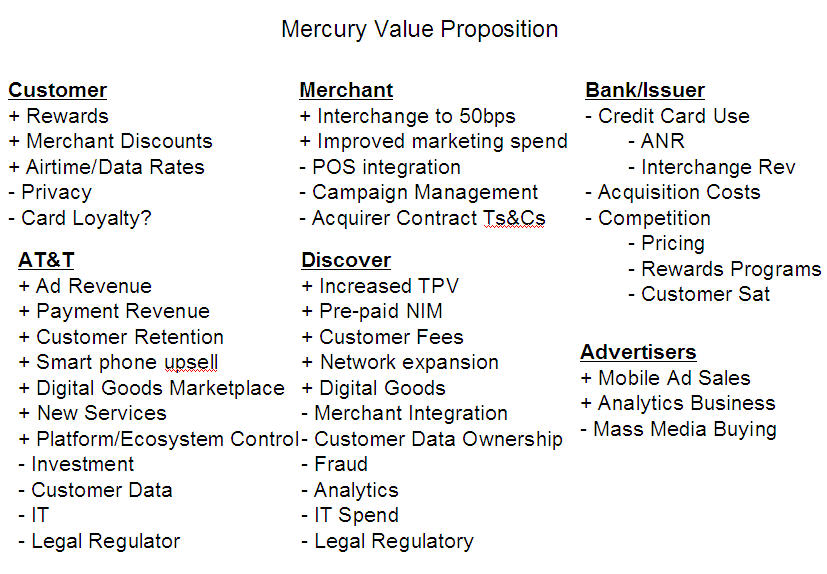

The “accept all cards” rule is likely to undergo a huge change, with implications for Visa/MA earnings, new retailer led payment networks, mobile wallets, issuer loyalty programs, EMV reissue, and “new products” (ex. Instant credit, pre-paid, decoupled debit, …).

Take a look at this excellent GAO Report to gain detailed insight into the battle being fought.

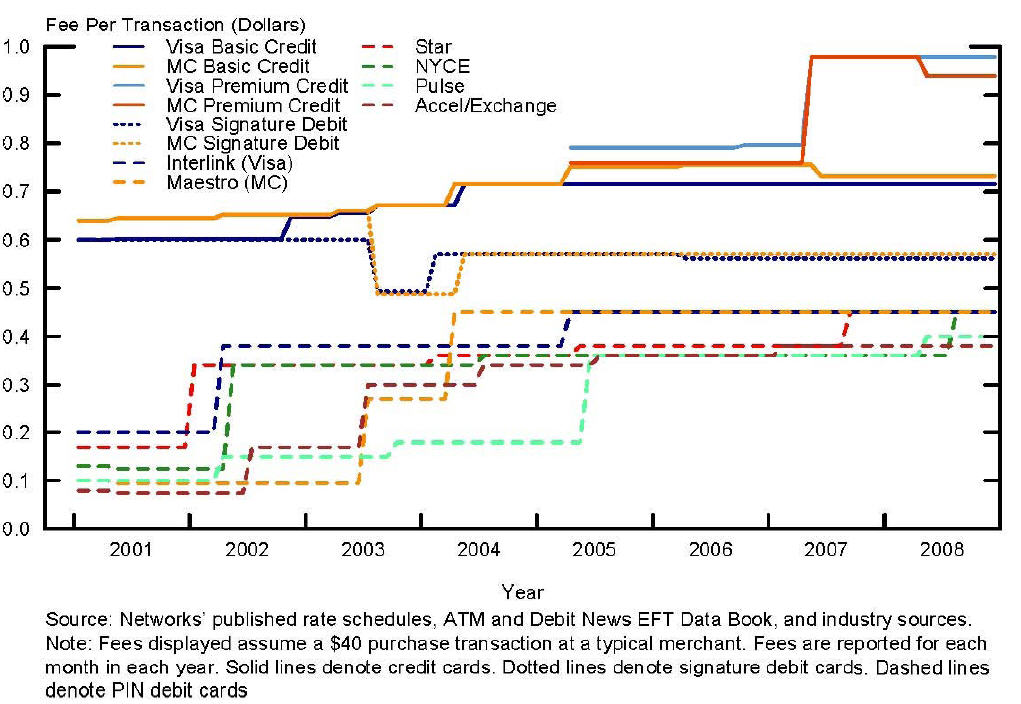

Several of the large merchants that we interviewed attributed their rising card acceptance costs to customers’ increased use of rewards cards. Staff from these merchants all expressed concerns that the increasing use of rewards cards was increasing merchants’ costs without providing commensurate benefits. For example, one large merchant provided us with data on its overall sales and its card acceptance costs. Our analysis of these data indicated that from 2005 to June 2009, this merchant’s sales had increased 23 percent, but its card acceptance costs rose 31 percent. Rewards cards were presented as payment for less than 1 percent of its total sales volume in 2005 but accounted for almost 28 percent of its sales volume by June 2009.

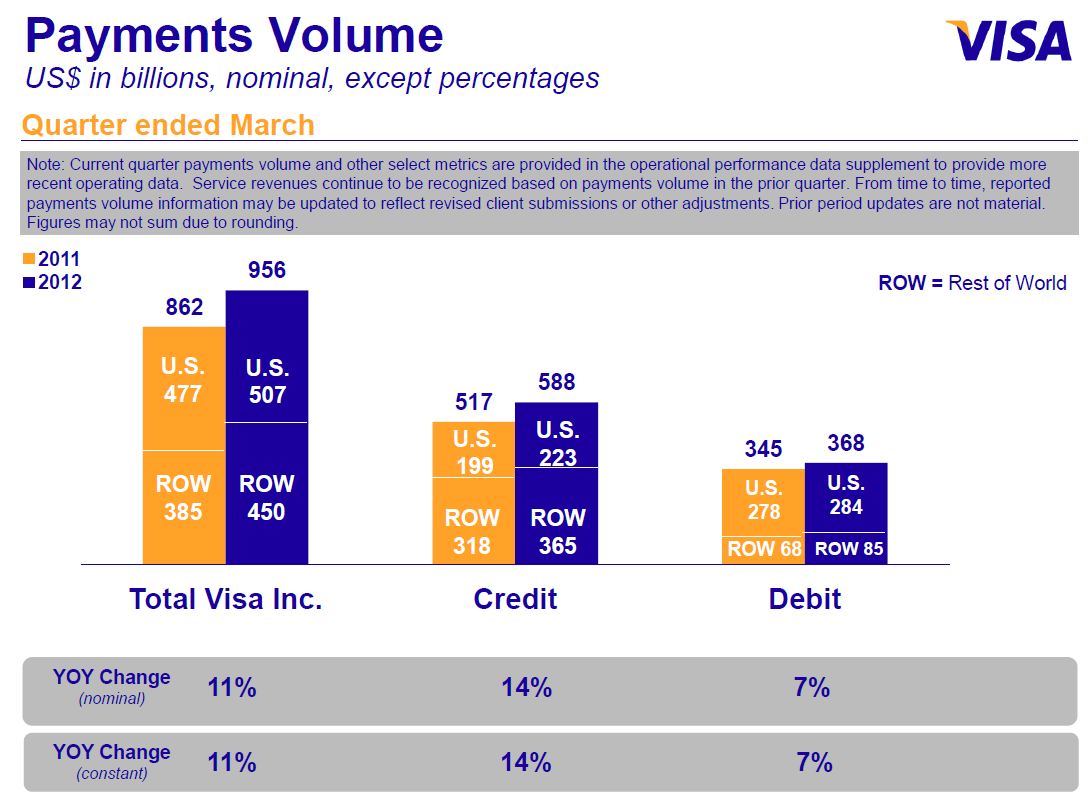

This will have an impact on Visa’s volumes if card issuers don’t start immediately renegotiating the rates with the top retailers. This taken together with Durbin (see previous blog), retailer driven payment networks (ex See Target RedCard), Retailers acting as banks (see GDot/WMT), Google/PayPal at POS (as MSBs), Pre-paid cards, …etc. We have a VERY exciting time in payments that the banks will be challenged in responding to.

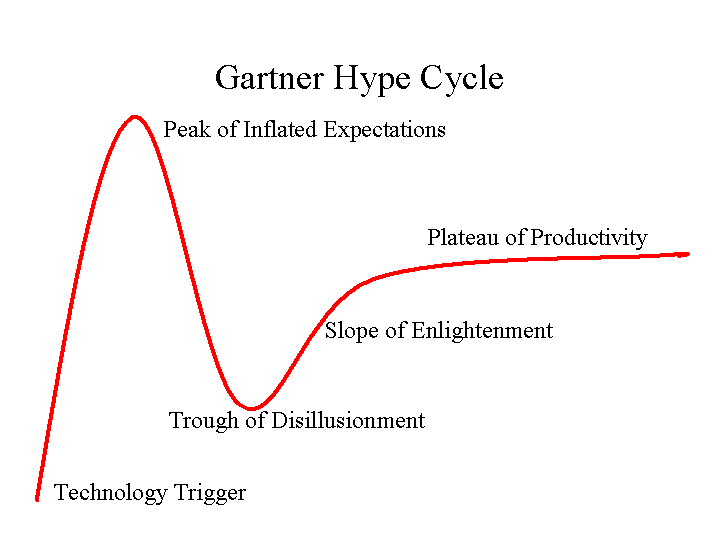

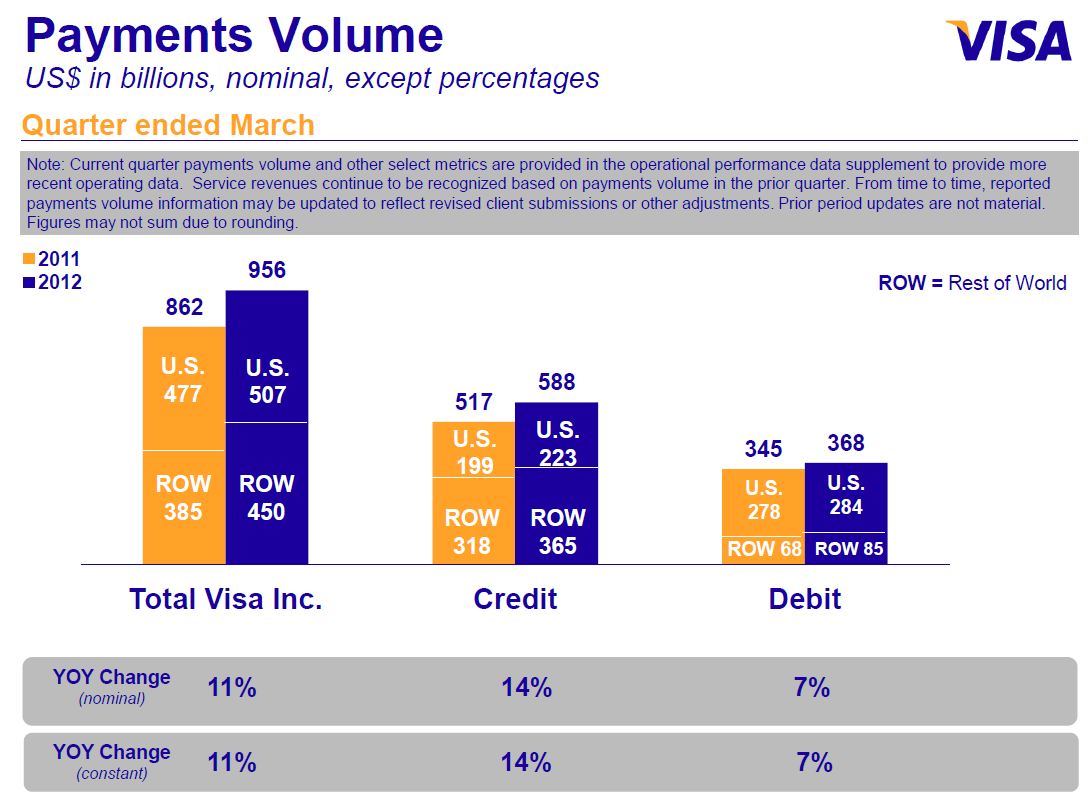

Why will this impact Visa’s US volumes? Well if signature debit it dead, consumers will use PIN debit (just like Canada and Australia). In the Post Durbin world, Retailers don’t have to route PIN debit transactions through Visa at all. If retailers aggressively reprice credit card transactions (adding fee of 1-2%) we will have consumers shift spend back to debit.. a PIN debit… This also is happening at a time when consumers aren’t exactly fond of banks and fees. If the top 20 US retailers add fee to credit card use, this could impact Visa’s growth buy 2-6% in 2 years. The main dependencies here are Issuer’s ability to lower interchange for these retailers and survival of Signature debit (over bank controlled PIN Debit).

Certain merchants obviously benefit from access to ubiquitous consumer credit facilities, and these merchants are unlikely to add on any fee. But retailers in non-discretionary and low margin segments will likely move aggressively to stem the growth of loyalty driven credit card use. I would also expect retailers to add lower cost payment options, instant credit (ex paypal’s BillMeLater) and new products which may replace some of the “lost” loyalty benefits (ex Target RedCard).

I maintain that Banks have the facilities to win in payments (see blog).. but winning is more than leveraging your user base and ubiquity to extract tolls from merchants.. and more about delivering value. Unfortunately Banks are working to restrict growth of new payment mechanisms by enhancing control points (ie ACH) .. they have seen this coming and are looking to lock any door they can. If you lock the door.. someone will just jump through the window.

BIG winners if there is a settlement on passing credit card costs:

- Payment service providers not dependent on credit, or offering alternative PayPal, Google, Square,

- Instant Credit

- Retailer Led payment networks

- Pre-paid,

- PIN Debit

Loosers:

- Anyone dependent on a credit card (NFC, issuers, loyalty, …).

For my mobile friends.. this may give you additional context on why many merchants don’t accept NFC?