Tag Archives: NACHA

“New” ACH System in US

Need for Bank Payment Councils

10 Dec 2010

Bank Innovation

Much of this post is derived from my original Feb Post “Wanted: Payments Leaders”. The original was directed to small companies operating in this payment space, this article is for banks.

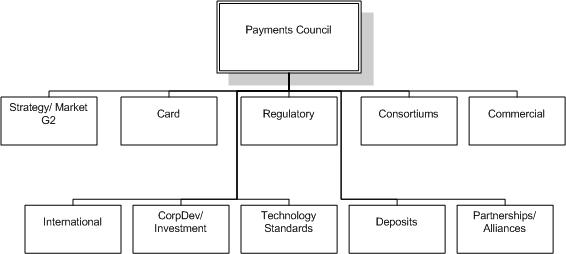

As an investor and banker attempting to connect capital to innovation I see $50B in investment capital focused in payments over the next 3 years. Most banks do not treat “payments” as a line of business outside of cards, this is a mistake. Banks typically allocate resources by product lines: Assets, Liabilities, Card, Investments with some pricing provided by segment. Payments are managed as a common service across these product lines (if managed at all). Banks like Wachovia managed this quite well, with the CEO and all LOB heads attending a quarterly “payments council” to discuss payment strategy, investment, and initiatives (led by a super exec: Lou Anne Alexander). From an inter bank perspective, much “payment strategy” is discussed within the bank consortiums:

- The Clearing House (TCH) Jamie Dimon Chairman

- Early Warning

- BITS

- NACHA

However “discussion” is usually focused on existing business and processes. Also note that the inter-bank POS discussions which your CEO had with Visa/MA (during the days where you owned them) are now gone. If I asked your CEO what your top 3 payment initiatives were would they know? My guess is that all 3 would be card related, as it is the only LOB (and defined P&L) focused on payments.

Banks must reconstitute their payments councils, to drive incremental revenue and cement their role as gate keepers of customer information and payment settlement. The primary threat to them is pre-paid, decoupled debit and MNO led schemes at POS. In order to coordinate collectively, they must first organize internally. The business threat is beyond interchange, as revenue from new payment models will come from advertising and behavior based incentives. There is a coming convergence of the digital and real world.. and you must create teams that span your organization to execute against it. Today the bank model that you should follow? Citibank’s new organization under Paul Gallant.

Within the next 3 years, we may see the birth of 1 or more new bank led payment networks (yes leaving Visa/MA) as well as a bank led acquisition of Discover, or Merger of Amex and a major bank (Amex attempted merger w/ Wachovia back in 2003). Additionally we will see $2-5B investment by groups like ISIS.

The amount of activity is tremendous, but banks have a clear advantage in resources they can dedicate in coordinating a response. There is no shortage of innovative people within your banks today, but there is a need for structure through which their excellent ideas make it to market.

Key Skills

- Define and evolve a core value proposition

- Ability to define regulatory risks and operational approaches to address

- Attract and retain start talent

- Ability to manage a P&L

- GLOBAL Payment Operations experience (the regulators are shutting us down)

- Sales skills (direct to consumer and/or business sales)

- Network within the Industry (what is everyone else doing)

- Manage a BOD

- Ability to listen to the customer and adapt

- Historical knowledge of payment initiatives

- Ability to drive complex technical initiatives

- Understanding of competing networks and value propositions

- Comfortable in the details and the strategy

- Can coach a people and build a team

Other related blog