Citigroup, Microsoft Said to Plan Challenge to Intuit, Mint.com http://www.bloomberg.com/apps/news?pid=20601103&sid=ajESsHMx7eYU

Hmmm… I believe Brian found me from my Mint/Intuit note below. Hope I don’t come off as a radical. Citi must be successful.. US taxpayers are shareholders. Jeff is a great guy, and one of the most talented people I have ever worked with. I have no idea how Citi keeps hold of him. Perhaps it’s like joining the Army.

Citi/MSFT will obviously look to provide services to non customers and industry sources tell me that the account aggregation will be provided by Yodlee. There is some amount of irony here, as Citi’s customer’s had access to Yodlee’s services until September 2005. During my time at Wachovia customers loved the Yodlee service, but we had to end it due to cost and risk issues.

For Citi/MSFT a central challenge will be moving customers away from their bank to engage in activities such as budgeting and paying bills… and then transacting. (Remember Transpoint from MSFT…. it was close to the date when Gates said Banks were dinosaurs in 1994…) In the US, MSFT, Mint.com and INTU had trouble getting customers engaged seperate from their Banks. In the US, Mint had the fastest growth rate with a total of just over 400,000 customers. A figure not likely to strike fear in the heart of many banks, this combined with the Mint demographic seems to indicate that the customer base of “spenders” vs “savers” (hence the need for budgeting). This would seem to indicate a card focus for Citi.

Assuming a card focus, a short term need to generate revenue, offering customers a way to transact with Yodlee as a service provider.. I would see card based bill payment as a key service to be offered in this new Citi/MSFT venture. During my time at Wachovia we piloted the Yodlee biller direct service. The UI was fantastic… and that was 4 years ago. This service leveraged cards as the vehicle for bill payment through aggregation of the billers online payment interface. BAC also evaluated this service as a way to generate interchange revenue off of bill payment.

Hence, I would assume that Citi’s business case for NewCo is based upon the following:

- Transacting. Both leveraging credit cards for a bill payment, and purchases. (interchange)

- Market customers based upon transactional data (marketing)

- Cross sell Citi products

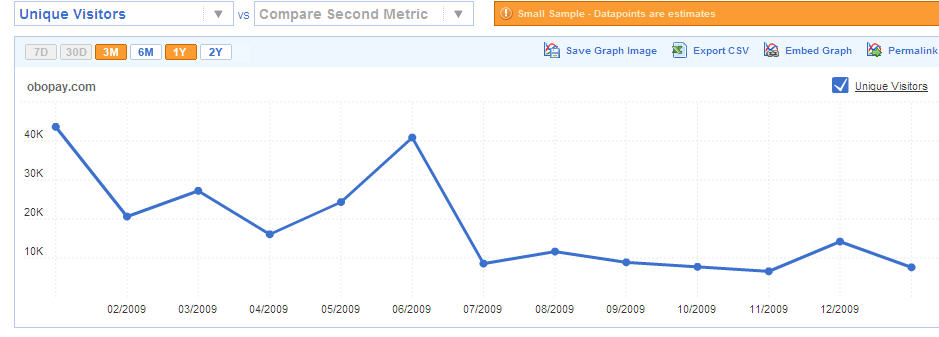

There are several organizational, brand issues and customer support isssues with Citi’s approach. Citi’s customer may get confused, is this a Citi service? How can Citi’s current card customers leverage it? How do they leverage it? For example, it is hard for me to remember the 3 separate log ins that I have today with Citi today: Card, banking, Obopay… now I need a forth? Who do I call when I have a problem?

Globally, the only success model for aggregation and comparison that I am aware of is Egg.com, which Citi acquired May 2007 for just over $1B. If you sit down with Paul Gratton, Egg’s first CEO he will tell you that their success was driven by a complete focus on delivering value to the customer, both in product and online services. It is the coupling of product and service value that creates challenges for large companies to replicate, particularly with respect to cannibalization of existing products.

In the UK, customers select their bank savings account through leading comparison sites like www.moneysupermarket.com. In the US, customers select their bank based upon the proximity to their house. The business premise with Mint.com, Intuit and its competitors is that customers will start with budgeting, and then move to select financial products (no retention play as these are not necessarily Citi Customers) or transact. Egg was successful because is first started with the most competitive product, establishing trust, and then moved to deliver the best services to surround it.

Fortunately for banks, customers prefer to go to their bank directly to perform financial services. This “Trust Pattern” is something banks should want to reinforce. WFC exemplifies the alternate approach within its online banking services, with integrated budgeting tools, which is a great service and provides solid customer retention. Banks hold enormous control over the success of any aggregator’s site. Yodlee possesses no contractual right to the data, and the collection of customer information by any third party can be managed. If Mint, lowermybills.com or Microsoft/Citi start to gain traction with mainstream profitable customers.. expect banks to start charging Yodlee for access to their customer data, or eliminate it outright.

http://tomnoyes.wordpress.com/2009/09/15/intuit-mint/