Tag Archives: prepaid

MA buys Travelex Prepaid for $458M

9Dec 10

Great move by both MasterCard and Travelex. This gives MA a global platform for prepaid, by which their exisiting bank customers can launch branded, multi currency, prepaid cards. Few banks today are able to compete with Citi’s pre-paid (http://www.citiprepaid.com/), a group that is seeing tremendous growth. Citi’s recent success here has certainly drawn attention. On the product front, Citi prepaid had its genesis in the 3/2007 acquisition of eCount. On the business side, Citi is hitting the ball out of the park with both governement and commercial disbursement, supporting new payment flows with existing customers and a high margin product.

The opportunities for MA growth are:

- Commercial – White Lable Processor for corporate disbursement (ie Citi Prepaid )

- Foreign currency card (Travelex Cash Passport). Important to note here that it is not just for travel, but also for cross border online transactions.

- G2P Payments

- Cross Border Remittance (Base of the pyramid).

- …etc

With respect to a consumer “travel card”, the challenge that MA faces is that bank processors (TSYS ,FIS Prepaid) currently have much broader PRODUCT capability in this area already. Fortunately (for MA) these processors are dependent on multiple issuers for branding and marketing. Travelex has excelled in the branding and marketing of its products. Consumers (and businesses) all over the world associate the Travelex name with global travel, currency and FX. Can MA extend its brand here as well? They certainly have the A+ team to do it with.. but it will require some of the major banks to also jump on board. As an issuer, you have multiple choices for this today.. from the large processors (TYS/FIS), and Citi, to small global program managers like hyperWALLET.

From the press release

According to a 2010 Boston Consulting Group study commissioned by MasterCard, prepaid is expected to reach more than $840 billion in global volume by 2017, a compound annual growth rate (CAGR) of 22 percent. This same study estimates that the prepaid open-loop market in the travel sector is expected to grow at a CAGR of 31 percent over the same period.

MasterCard expects the transaction to be $0.04 dilutive to its 2011 earnings per share due to amortization and one time transaction and integration costs. For 2012, MasterCard expects the transaction to be neutral and accretive beginning in 2013.

SWAGG

19March 2010

Previous Posts

- http://tomnoyes.wordpress.com/2010/03/15/att-visa-prepaid/

- http://tomnoyes.wordpress.com/2010/03/02/obopay-and-firethorne/

What is this? In a nutshell it seems to be a software app that provides for consolidation and creation of pre-paid gift cards. Allowing gift card bar code to be displayed on a cell phone screen so it can be scanned by merchants.

From the SWAGG website we see:

GIVE

Plastic is lame. You’re not.

SWAGG lets you create a personal digital gift and send it to your friend’s mobile device.GET

Get hooked up. Way up.

SWAGG stays on tops of your favorite brands so you’ll always be the first to know what’s fresh.GO

Your wallet is full. Of crap.

SWAGG files all your membership and loyalty points neatly under one button.

QCOM CEO, Paul Jacobs comments at CES “”It lets us conduct all sort of transactions on the go…So we can purchase and personalize gift cards, share them with our friends, exchange them with stores we like better. We can use them to buy stuff wherever we are. We can receive personalized offers, We can get loyalty points, manage our rewards programs.”

[youtube=http://www.youtube.com/watch?v=Zgfn-_lXo0U]

SWAG stands for “stuff we all get.” … sounds much more interesting than Firethorn’s initial mobile balance checking application. I’m a little disappointed this isn’t more NFC focused given QCOM’s tremendous IP portfolio. In this “bar code” model, I can’t help but wonder about conflict w/ Apple’s broad payment patent here

http://www.forbes.com/2007/12/26/apple-patents-iphone-tech-wire-bc_1227appatent.html

Obopay and Firethorn

2 March 2010

Related posts

Spoke to most of the top 5 US banks this week. Interesting to note that Firethorn is out of all of them.. even in the model where Firethorn paid one of the majors $1M to take the application and integrate it. As of the latest QCOM 10-Q we can now see that total Firethorn revenue was $3M for the 2009 YEAR! Wow.. no wonder Len lost his head for buying this thing and making it a separate division.

QCOM and Firethorn have a new product planned: SWAGG (www.swagg.com). Good luck trying to figure out what this thing is.. could this be associated with Visa/ATT? (Youtube here). There seems to be a pre-paid debit card associated with it (from Dr. Jacobs CES presentation). Hey QCOM is one of my favorite companies… the people there are absolutely brilliant. But the Firethorn team is adopted.. and therefore the genes do not extend here. They need a top exec to drive this thing.

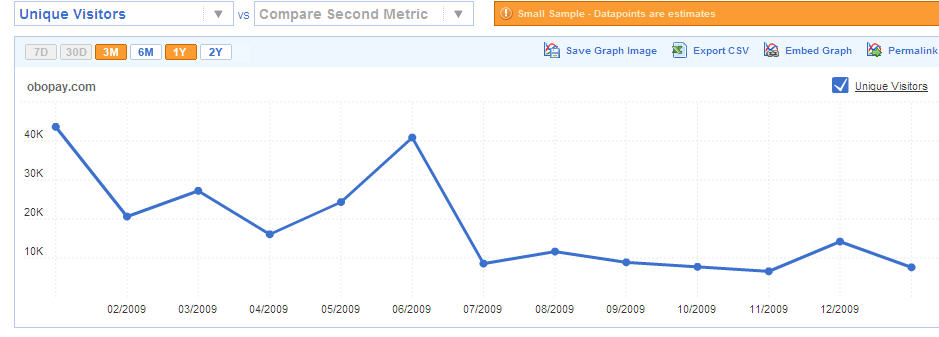

On another note, Obopay showed up to at least one of the top 3 banks last month (BankX) touting its mobile payment solution. Undoubtedly with “millions” of subscribers (actual estimated at less then 20k). Always interesting to see spin here, they also reportedly told BankX that Citi’s departure was only temporary. Other banks should ask them to get specific.. very specific.. (probably not the US and there is no commitment on use).

From compete.com (Hard to spin facts..8,000 unique visits last month .. estimate only 20% use the service)

The “big secret” in mobile payments is that there aren’t any… (with very few exceptions). Those exceptions usually deliver “payments” as part of an existing value proposition (see MNOs will rule in Emerging Markets). Banks know that changing consumer behavior is a 20 year effort. Card based payment schemes have particularly high hurdles in emerging markets due to interchange rates and rules that are ill suited for low value payments by unbanked. Toward this end countries such as India are contemplating the development of new domestic payment networks.

Thought for the day

NFC Break Out – VISA/FirstData/AT&T

23 December 2009

Previous post http://tomnoyes.wordpress.com/2009/11/25/visamobpay/

Get set for a major announcement in next 4 weeks from Visa, AT&T and FirstData that will combine an AT&T pre-paid card account, managed by FirstData, and with services from several Visa led start up companies (both mobile advertising, couponing and NFC). Consumers will be issued NFC stickers for existing phones and can fund the account with existing card and deposit accounts. AT&T will also have an integrated reward system to reward payment activity with coupons, airtime and special offers with participating merchants. In addition to the NFC sticker, Visa will also be trialing other “other form factors” including: plastic, handset integrated NFC (new phones) and 3rd party hardware for OTA provisioning. FirstData will begin a new role as both the processor and Trusted Service Manager (TSM).

As stated previously, the US market is ripe for a break from the 6 party political “fur ball” that is hampering mobile innovation (Card Issuers, Acquirers, Network, Merchant, MNOs, Handset Mfg). Mobile Network Operators (MNOs) are better positioned to execute in mobile payment in all markets. AT&T is no stranger to credit cards, even today the ATT Universal card is the largest affinity card within Citi’s portfolio. The implications for card issuers are unclear, given the uncertainty of “mobile payment” consumers behavior and payment patterns. There is a storng possibility that this initiative will be a “tipping point” in both mobile commerce, unleashing a new wave of innovation for all consumers (not just iPhone any longer). It will be very interesting to see if Apple is a part of this initiative.

More to come..

From Previous Post

For those outside the US, US MNOs have substantial control over handset features and applications, they have been leveraging this “node control” to “influence” direction of payments. The central US MNO argument being “it is our customer, our handset, our network we should get a cut of the transaction rev”. Unfortunately existing inter-bank mobile transfers/ payments are settled through existing payment networks that provide limited flexibility in accommodating another party (beyond issuer/acquirer), with much room for improvement in authorization, authentication and consumer “control”.

Outside the US, the situation is much different, as consumers have great flexibility in switching MNOs, have ownership of their handsets, and are largely on pre-paid plans. The MNO challenge for payments in this environment is largely regulatory. Many countries (EU, HK, Korea, Japan, SG) have open well defined rules for MNOs role in payments (example: ECB ELMI framework within the EU), while other countries are highly restrictive and are in the midst of developing their legal and regulatory framework. Even in the countries where MNOs participation is defined, they have largely benefited from the complimentary role that the service plays with pre-paid plans (not in interchange at POS).

Globally, MNOs are looking for a payment platform where they can benefit from interaction between consumer and merchant, with flexibility to deal with a heterogeneous regulatory environment. The competitive pressures on Visa/MC are much different then they were 5 years ago (when both were bank owned). The network fee structures and rules were written with banks and mature markets in mind. Emerging markets present a much different set of opportunities, as MNOs lead banks in brand and consumer penetration within every geography.

All of this leads to the case for a new “Mobile Payments Settlement” network, a network which will alienate many banks. I expect to see Visa roll out the initial stages of this network in the next 2 months with an emphasis on NFC. Quite possibly the best kept secret I have ever seen from a public company. I’m sure many Silicon Valley CEOs are crossing their fingers (with me) on this, as a “new wave” of innovation is certainly close at hand that will drive growth (and valuations).

For those not keeping up with the 50 or so product announcements a day on NFC, handset manufacturers committed to have NFC enabled phones to consumers in mid 2009 in the GSMA 2008 congress. NFC capabilities are numerous (Vodafone YouTube Overview), and may represent a true disruptive innovation surrounding payments. There have been many very recent product announcements that will enable existing phones to use NFC, and P2P Capability. All of which will blossom in a more “fertile” mobile settlement environment.

Side note: This is not all bad news for Banks, as the structure will certainly provide for existing cards (debit/credit) and may deliver substantial revenue through cash replacement (small < $50) transactions. More details on structure of MNO in settlement 2 weeks….

Select Product/Alliances Below:

- http://www.corporate.visa.com/media-center/press-releases/press921.jsp

- http://www.neustar.biz/pressroom/files/announcements/VISAFINAL.pdf

- http://www.neustar.biz/

- http://www.nearfieldcommunicationsworld.com/2009/11/04/32152/zenius-adds nfc-to-standard-mobile-phones-with-bladox-waver/

- http://www.paymentssource.com/asset/article/2703061/att-certifies-charge-anywhere-mobile-payment.html?pg=

- http://www.morerfid.com/details.php?subdetail=Report&action=details&report_id=6376&display=RFID

- http://www.nfcnews.com/2009/11/18/attachment-turns-iphone-into-rfid-nfc-reader

- http://www.bladox.com/

- Neustar http://www.americanbanker.com/issues/174_125/-383355-1.html

Cash Replacement – Part 2

December 15, 2009 (PDF VERSION HERE)

Part 2 – Cash Replacement (V1)

In my previous Blog (see Investors Guide to Mobile Money) I outlined a simplified categorization of payment schemes for “first world” economies. The common win-win for both mature economies and underdeveloped appears to be Cash Replacement. Cash Replacement has been the subject of thousands of reports originating from: economists, bankers, academics, non-governmental organizations and consulting groups (a few of which are listed in references below). The objective of this blog is to provide a market basis for investors and small companies attempting to “quantify” the opportunity in cash replacement, specifically e-Money and non-card based schemes.

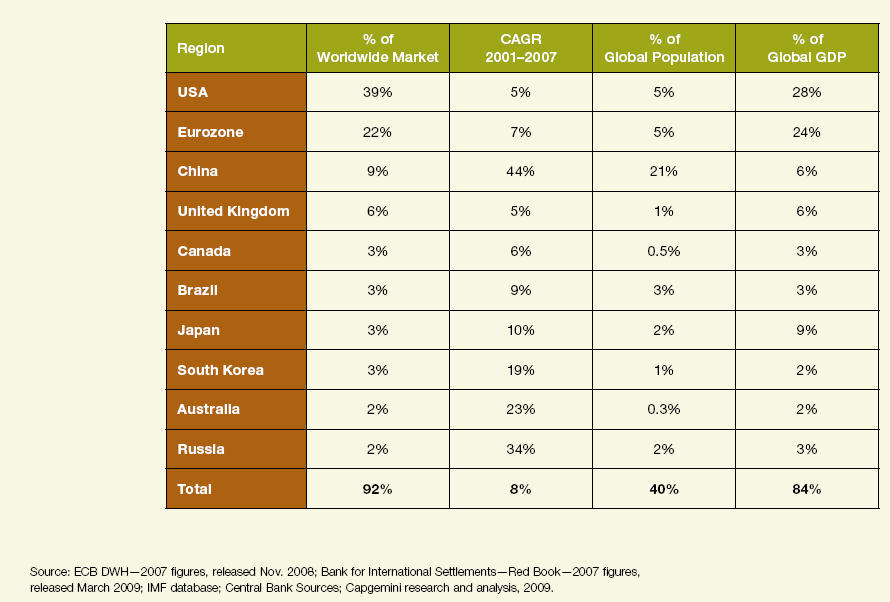

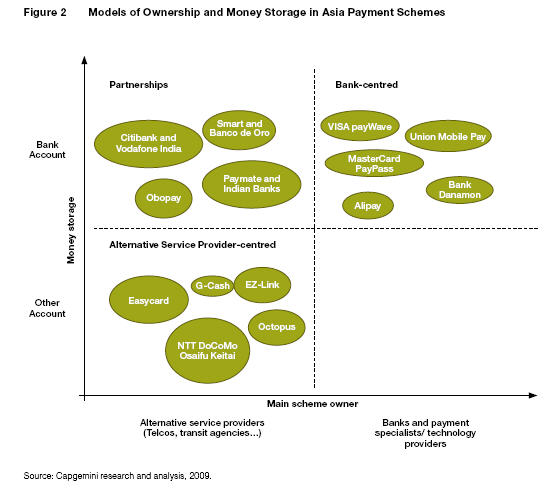

Global debit and pre-paid card growth have been the key instruments leading in cash replacement use within top global economies. The card infrastructure (ie “card rails”) that  provided for this success was “built” on the credit card value chain over the last 35+ years Cap Gemini’s 2009 World Payment Report provides an excellent overview of key trends. Key excerpts below:

provided for this success was “built” on the credit card value chain over the last 35+ years Cap Gemini’s 2009 World Payment Report provides an excellent overview of key trends. Key excerpts below:

- The worldwide volume of payments made using non-cash instruments (direct debits, credit transfers, cards and cheques) grew 8.6% to 250 billion transactions in 2007. The use of cards continues to be the single strongest driver of volume growth. Global card transactions (credit and debit) grew 14.5% in 2007.

- The ten largest markets accounted for 92% of all non-cash payments transactions in 2007 (when they represented 84% of global GDP).

- Unlike in the US, where cash in circulation has decreased by 7.4% in 2007, cash is still increasing in Europe, albeit at a slower rate of 7.8%.

Background

A historical review of products attempting to gain traction in cash replacement reveals a battlefield littered with the “corpses” of plastic and digital products. (Ref 1)

- Mondex, now owned 51% by MasterCard and national franchises owned by big banks, is after years of testing still confined to trials, often internal to banks.

- VisaCash. See history here http://www.mondex.org/main_page.html.

- DigiCash eCash, licensed by several big banks worldwide

- CyberCash never rolled out a stored value system at all; after announcing a trial in September 1996 the CyberCoin system was never rolled out except on a limited scale at Barclays in the UK.

- eGold. http://lawvibe.com/e-gold-founder-admits-e-gold-used-for-money-laundering/

- Geldkarte in Germany

- Paybytouch

- Obopay

These “failures” were less to do with technology, and more to with competing against an existing payment network(s). Payment networks are inherently “sticky” with investments required by consumers, merchants, and banks for effective functioning. Payment networks also have substantial government involvement to support Commerce and Treasury functions that ensure stability, resilience and protection of parties. Innovation in payments is challenged by this network dynamic. As most small companies know, getting a bank to make a decision is tough… but nothing compared to getting 4-6 groups (issuers, acquirers, merchants, MNOs, Regulators, networks, ..) to collaborate in making coordinated change. A level of difficulty that is only superseded by the challenge new entrants face in competing directly against these existing networks.

Why read further? Although I’ve painted a very negative picture of past payment failures and the challenges of competing against the traditional networks, the payments business is undergoing tumultuous change and where there is change, there is opportunity. To understand the forces and competitive dynamics of cash replacement, it is important to understand both the local and global forces driving this change (see pdf above).

Emerging Market Regulation

As this blog is largely focused on emerging markets, it is worth noting several “unique” regulatory challenges within emerging markets as regulations surrounding MFIs and Money Transfer Services have been evolving at an astounding rate. This regulation evolution is not taking place in a vacuum, as regulators always work with the entities they regulate. Teams  capable of local engagement and partnerships are therefore much better suited to operate in this dynamic regulatory environment. As an example, Vodafone has developed enormous competency in the payments space, extending not only its “product” success in MPESA, but developing talent which can be leveraged to seed other local teams (in the 40+ markets it serves).

capable of local engagement and partnerships are therefore much better suited to operate in this dynamic regulatory environment. As an example, Vodafone has developed enormous competency in the payments space, extending not only its “product” success in MPESA, but developing talent which can be leveraged to seed other local teams (in the 40+ markets it serves).

As a generalization, there are 4 bodies of legislation that impact mobile money:

- Bank Regulation (particularly role of non bank agents, and payment networks)

- Micro Finance Institution

- Electronic Transaction Legislation (Consumer protection, admissibility of electronic records, prosecution of electronic crimes, …)

- Telecommunication Regulation

MNOs success to date has not been in isolation, given that in every instance (above) the MNO partnered with either an MFI or Bank. 2009 Mobile Money Summit in Barcelona provided several excellent presentations covering the global regulatory environment, an environment that is both complex and evolving. It is imperative that your team understand the local regulatory environment. Regulatory changes have significantly impacted many investments made to date, with the key example of Reserve Bank of India’s Aug 2009 regulation preventing non-banks from domestic money transfer (destroying Obopay’s P2P plans).

Network Effects – Stating the Obvious

For payments to flourish, a coordinated system of instructions which can be read by trusted participants is necessary. Providers of payment services must consider what network participants are providing in order to collaborate in risk management and settlement; the greater the number of consumers and businesses that participate, the greater the collaboration and interdependency. As more people adopt the payment system, its value increases, since it provides access to more people; this encourages larger networks. Not only do the benefits increase as the network expands, but the per unit cost of service falls. This behavior is the basis for what economists refer to as a “network effect”.

Once a payment system reaches a “critical mass”, economic value will be created at the ends of networks. At the core- the point most distant from users-generic, scale-intensive functions will consolidate. At the periphery-the end closest to users-highly customized connections with customers will be made. This trend pertains not only to technological networks but to networks of banks as well as small merchants and even to consumers who engage in shared tasks9. From a payment network perspective, this means that the “routing” of payments will provide much less revenue opportunity than managing the end points (e.g. the customer interaction or the products which are sold on the network).

Transportation has proven to key opportunity for electronic money: Oyster in the UK, Octopus in HK, CashCard in SG, …etc. Success in these transportation initiatives has been “relative” because they have been challenged to generated consumer adoption beyond transportation “core”, and they have note generated an attractive margin to the network (for the economic reasons that Georgios lays out above).

The European Central Bank (ECB) has provided a new regulatory framework for electronic payments (see ECB ELMI overview by M. Krueger, and World Bank). The ELMI framework, as well as Singapore’s Electronic Legal Tender (SELT) concept, demonstrate a tremendous collaborative multi year effort between central banks, governments, financial institutions and business to provide rules, law, consumer protections and an environment which would support alternatives to cash. However, it also highlights the scale of effort needed to move a consumer behavior that has existed for millennia.

Financial Case

In general, economists and bankers agree that there is a strong macro economic case for cash replacement when accounting for the “shoe leather” costs (Ref 5). However, it remains to be seen “who” will pay for this convenience. Ref 1. Electronic Money and the Possibility of a Cashless Society by Georgios Papadopoulos provides and excellent analysis:

“…the high social cost of cash is all too general. The costs and the benefits for cash as well as for electronic money are not distributed evenly. The cost of issuing cash is paid by the state and financed by taxation. Most of the infrastructure for e-money is paid by the issuer, which in turn is charging the user for this payment instrument, even though the distribution of the costs between the consumers and the merchants is uneven. Consumers may pay a fee for the card (either directly or as a part of their checking account), while merchants have to pay a fee to the issuing bank(s) either pro transaction or as a percentage of the total value of the transactions and in addition carry the cost for the infrastructure“… from Georgios Papadopoulos

This “free nature” of cash, combined with its unique qualities (i.e. anonymity, history, physicality …etc.) further challenge new payment models and the barriers they face from existing card and bank networks. Payment networks are resilient, this is both a strength and a weakness. In 2000, the average transaction cost for credit card transactions was around US$0.70 (ref 1) and thus did not serve as a viable option for cash replacement. At the time, VISA cost studies showed that card transactions of amounts of less than about US$10 are in fact unprofitable for the Issuer bank and amounts of less than US$38 are unprofitable for the Acquirer bank. Any product attempting to take the place of cash must make low value transactions efficient and profitable to the parties providing the service.

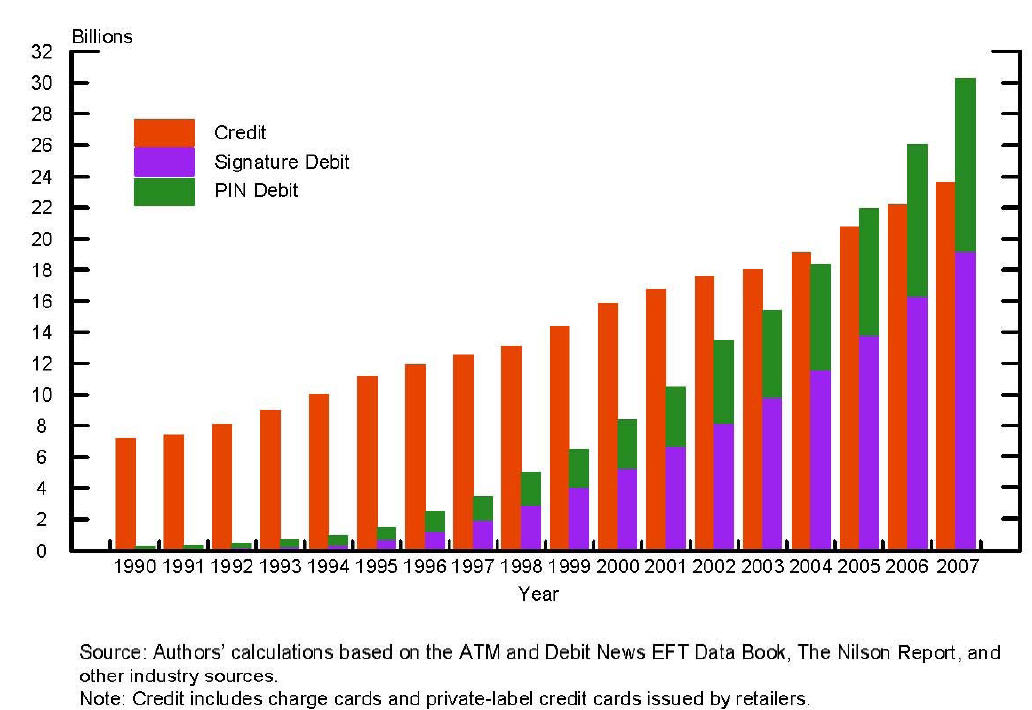

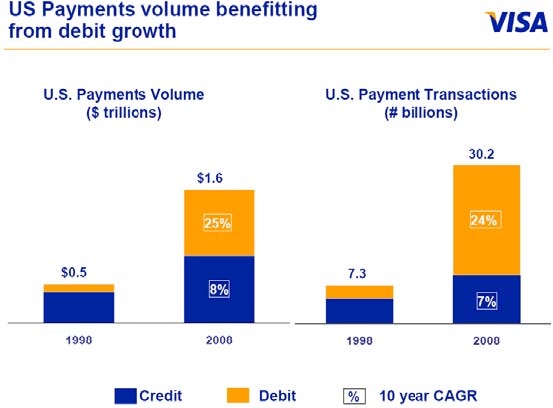

The “debit revolution” for the card networks began with pricing and risk. For the non-bankers reading, issuing debit cards was (and still is) a  highly contentious fight within banks. Large issuers did not want to forsake the high margins of credit cards (350bps + interest on ANR) for the paltry returns of linking a current account to a card (150-250 bps and no interest income). This fight was exacerbated by the fact that banks typically run the “card business” separate from the deposit “retail” business. Banks began supporting debit when they realized that Debit DID NOT displace credit cards, but rather supplemented it, providing net incremental (non-interest) revenue to the bank. After this realization, banks then began to take issue with PIN Debit vs Signature (another story).

highly contentious fight within banks. Large issuers did not want to forsake the high margins of credit cards (350bps + interest on ANR) for the paltry returns of linking a current account to a card (150-250 bps and no interest income). This fight was exacerbated by the fact that banks typically run the “card business” separate from the deposit “retail” business. Banks began supporting debit when they realized that Debit DID NOT displace credit cards, but rather supplemented it, providing net incremental (non-interest) revenue to the bank. After this realization, banks then began to take issue with PIN Debit vs Signature (another story).

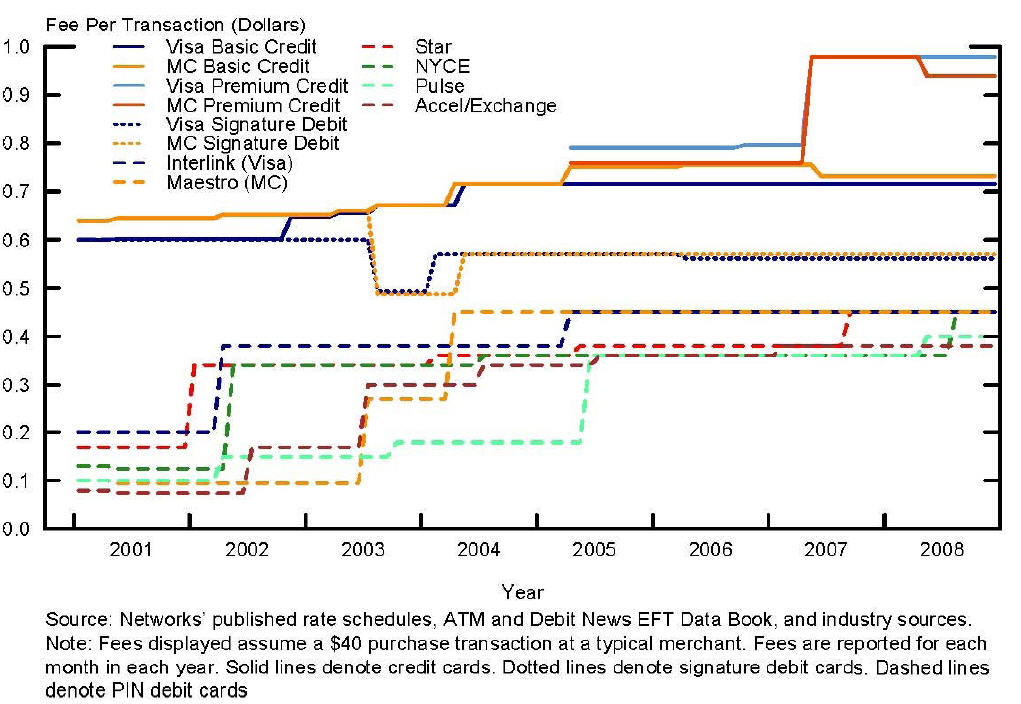

The story of interchange rates, and how they are negotiated is complex and full of intrigue. For those of you interested, read the US Federal Reserve’s “History of Interchange”. As you can see from the table above the trend (across all products) seems to point “north east”, a trend not lost on merchants and consumers. It is important not to assume that these rates will remain static. Banks (issuers and acquirers) can respond to competition, a state which does not seem to be of an immediate threat.

The debit success led the way for pre-paid cards. Pre-paid may present the best “global” opportunity to reach unbanked customers and further impact cash (See US Federal Reserve Study on Prepaid). Pre-paid is a category with both open and closed loop models. Open loop prepaid has benefited from Visa and MasterCard’s recent independence from their bank ownership model (in 2008 and 2006 respectively). In the US Pre-paid has seen substantial participation from non-banks such as Wal*Mart (11/2009 American Banker) whose business strategy aligns well with reaching the unbanked and delivering disruptive value in bank like services.

US Federal Reserve – Interchange Fees (Cross border excluded)

In the US, Gross dollar volume (GDV) for all prepaid cards is expected to grow at a compound annual growth rate (CAGR) of 21%, approaching $250 billion by 2012. Open loop prepaid cards are likely to produce a 36% GDV CAGR and closed loop gift cards a 5% GDV CAGR between 2008 and 2012 (First Annapolis). The EU provides a much larger opportunity in pre-paid market. Research indicates that the EU prepaid market is likely to generate a turnover of €132 billion across the predicted 418 million cardholder base, with transaction volumes of 4.4 billion by 2015. Within Asia and Africa, it remains to be seen whether prepaid cards will gain traction outside of Japan, Korea, SG, HK, and AU. New payment innovations present opportunities for non banks to create local (non card) networks (ex: MPesa, ZAP, GCash, …etc. )

The network motivation for pre-paid is quite simple, just as it is with credit and debit, there is very little incremental costs to adding transactions to the network. For merchants the incentive is to decrease costs. Unfortunately merchants are limited, within their existing card agreements, in their ability to pass on these costs directly to consumers ( surcharge on payment type). This limits merchant ability to incent consumer behavior toward the lowest cost payment channel. An excellent paper covering network effects economics and interchange is covered in Ref 7 (highly recommend).

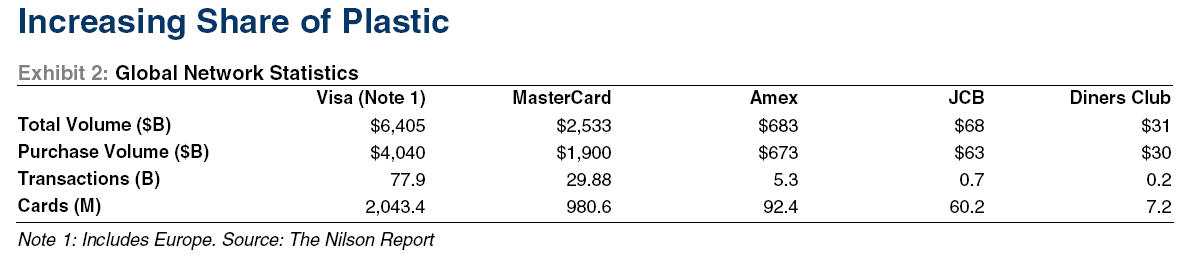

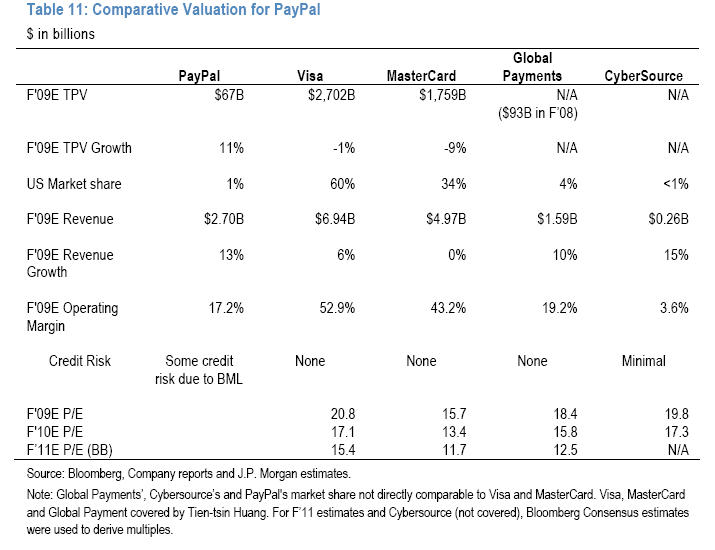

Global Network Volume – 2009

Card products (particularly debit) are filling most of the convenience gap, as PIN Debit competes quite well with Cash at most merchants (see The Move Toward a Cashless Society: Calculating the Costs and Benefits) Debit card volume growth has exploded globally, many would argue that it is the closest competitor to cash. Consumers have shown a tremendous reluctance to bear the “direct” cost payment. In other words: would I like to wave my phone at Starbucks to pay for my next cup of joe? yep… would I pay $0.10 for it? nope… I will use cash.

The payment heads at the major banks echo this view, as consumer data and spending patterns don’t reveal significant gaps where consumers report that they are not served by current payment products. Within Europe, cash replacement in areas such as ticketing and public parking shows significant price sensitivity on part of consumer (assumption of convenience cost). SMS payment providers are heavily subsidized and largely unprofitable.

Payment Costs

The benefits of electronic payments are not without costs. Most analysis estimate the cost of payments to be 1.10% – 1.60% of GDP (EU Reference, US Federal Reserve, Journal of Network Economics, Africa, ). Most analysis point to a significant “social” savings potential in moving from cash to electronic payments. However, this data is highly skewed toward developed countries (as significant differences in infrastructure are not accounted for).

Many emerging economies which did not “ride the wave” of consumer credit access have limited consumer and merchant payment infrastructure (ie. POS terminals, credit bureaus, consumer laws, …etc). In addition to infrastructure issues “Cash is King” in many of these emerging markets because no financial company has developed business model to profitably serve the rural poor.

Banks typically have challenges pricing “down market” as concern over cannibalization prohibit price led competition of channel focused products which compete with an existing product. CGAP research (also see IAMTN) shows that MNO pricing of money transfer services is substantially lower than services available from either money transfer services or banks.

Most interviewees in Kibera say they chose M-PESA because of cost. For example, sending 1,000 Ksh (US$13.06) through M-PESA cost US$0.39, which is 27 percent cheaper than the post office’s PostaPay (US$0.52), and 68 percent cheaper than sending it via a bus company (US$1.16).

Within emerging markets, the primary distribution channel is local agents (An excellent cost analysis for agents has been done by CGAP.) Agent incentives are a very important aspect to any emerging market business case.

Just as banks have used payments as a “loss leader” to generate revenue from other products (current accounts, cards, …) MNOs and their agents have created a model where payments enhance the value proposition of their core product (communication).

e-Money

The ECB definition of e-Money is

… any amount of monetary value represented by a claim issued on a prepaid basis, stored in an electronic medium (for example, a card or computer) and accepted as a means of payment by undertakings other than the issuer, predominantly for small-value transactions (for example, the settlement of modest transactions over the Internet and of parking or telephone charges and payment for public transport services)9. In common with banknotes and coins, e-money is ‘fiduciary money’, deriving its value not from its intrinsic worth but, instead, from the bearer’s expectation that it can be exchanged for its underlying value.

Successful eMoney initiatives, in both developed and emerging markets, have typically been tied to an existing value chain. A few examples: Paypal-eBay, Oyster – UK Transit, Octopus – HK Transit, Payforit – UK MNOs, MPesa – Vodafone Kenya, GCash – Global/BPI. In almost every case, these initiatives began as a closed system and evolved to connect to other payment networks. Once value is stored in a network, every business will seek to connect, at an investment rate proportional to the network’s size, value stored and alignment to current customer demographic.

Paypal and Vodafone have shown that there are significant revenue opportunities in e-money. As the major card networks seek payment volume, they will likely develop new rate structures to incent MNO led payment initiatives to “ride on their rails” (ex. Pre paid card).

Network Profitability – 2008 US Volume

Mobile Money – Emerging Markets

The emerging market environment is a fantastic crucible for innovation as the network effects associated with the convergence of: finance, telecommunications, consumer access and business fuel economies within emerging markets. For those outside of the mobile payments industry, there are 3 principle emerging market success stories in mobile payments: M Pesa (Vodafone/Safaricom), ZAP (Zain Group), and GCash (Globe/BPI). Understand that my list is contentious given that all three are MNO led (I’m open to feedback, but it must be quantified by data). A more detailed list can be found here

M-Pesa certainly seems to win the “award” based upon Consumer Metrics and most talked about. Prior to getting started here, I encourage readers to review 2 fantastic briefs M-Pesa: M Pesa by Tonny Omwansa , CGAP brief. My stated bias toward MNOs in emerging markets (See MNOs Will Rule) is driven by the following facts:

- There are 3 success stories as proof points

- MNOs have developed a business model to profitably sell and service unbanked customers SEPARATE from banking (phone)

- Payments enhance the MNO business model in emerging markets

- MNOs have the resources to invest

The research on mobile money for the unbanked is tremendous and I can do no justice by trying to summarize. Imagine that you run a local shop in Kenya which sells dry goods and mobile phones, you must come up with 5 reasons why one of your unbanked customers would want to give up cash and pay a fee to load her money on cell phone. A few questions come to mind:

- Value Proposition? Cost? Convenience? Will it make my life easier?

- Use. What can I do with it? (something I can’t do with cash today)

- Trust. Who has my money? Do my friends use it? Brand? Government?

- Risk. Is it safe? (consumer protections, contract, access to legal system)

- Support. Who can I see if there is a problem?

Previously I have stated a radical hypothesis: the successes above were driven by the mobile proposition (communication), and payment supported the existing MNO value proposition. The path of evolution for MPesa and its competitors are unclear and will be heavily influence by regulation. Today, MPesa operates out of a single commercial account with the central bank. That account has a balance of almost 10% of the GDP, a fact that highlights the potential to serve the needs of the unbanked.

The emerging market evolution is not so unlike that experienced with credit cards, although the “value chain” which drove the adoption is different. US, Japan, and EU access to consumer credit drove the development of the card networks; Consumer’s did not want a “card” as much as they wanted convenient access to a revolving credit line. In emerging markets it is the demand for communication that is driving the development of the network.

Investment (Greater detail in my previous post – Investor’s guide to mobile money)

As we look a cash replacement we will find that initiatives are frequent and success is not. It remains to be seen HOW the highly regulated world will evolve. In the long term, Capital is attracted to success and growth. What we see today is a period of enormous flux and experimentation with established players making multiple “bets” (in the form of investment capital and revenue guarantees). Investments from established companies are in the form both in-house and partner led initiatives (examples: Citi Obopay, Obopay India, Nokia Obopay).

The Silicon Valley model, where a bet is made and a (US) team is built to “figure it out”, faces many hurdles; it is particularly challenged for creating products and services targeted to emerging markets (where paradigms are different and local knowledge is key). Valuations today are driven by either: revenue, customers or board members. MNOs will lead investment in emerging markets, small companies must find a way to either collaborate with them (or their agents). ISVs should look 2 years down the evolutionary path where value begins to exit the “closed network”. Outside of the top 10 card payment countries listed above, 80% of the world’s population lives… a population that only shops locally with cash. You will have a hard time tackling this opportunity in Silicon Valley.

http://technology.cgap.org/2009/11/11/new-business-models-in-mobile-banking/

http://technology.cgap.org/2009/11/11/new-business-models-in-mobile-banking/

References

1 Why do stored value systems fail? Andreas Furche and Graham Wrightson NETNOMICS. Volume 2, Number 1 / January, 2000

2 Electronic money institutions – current trends, regulatory issues and future prospects, by Phoebus Athanassiou and Natalia Mas-Guix, July 2008. http://www.ecb.int/pub/pdf/scplps/ecblwp7.pdf

3 ECB 2008 Annual Report http://www.ecb.int/pub/pdf/annrep/ar2008en.pdf

4 Survey of developments in electronic money and internet and mobile payments, Sept 2004. Committee on Payment and Settlement Systems. http://www.bis.org/publ/cpss62.htm

5 The Move Toward a Cashless Society: Calculating the Costs and Benefits/. DANIEL D. GARCIA-SWARTZ, ROBERT W. HAHN *, ANNE LAYNE-FARRAR. American Enterprise Institute-Brookings Joint Center for Regulatory Studies

http://ideas.repec.org/a/rne/rneart/v5y2006i2p199-228.html

6 Optimal pricing of payment services when cash is an alternative/. Cyril Monnet, William Roberds. US Federal Reserve. Oct 2007. http://www.philadelphiafed.org/research-and-data/publications/working-papers//2007/wp07-26.pdf

7 Interchange Fees and Payment Card Networks: Economics, Industry Developments, and Policy Issues. Robin A. Prager, Mark D. Manuszak, Elizabeth K. Kiser, and Ron Borzekowski. 2009. Finance and Economics Discussion Series Divisions of Research & Statistics and Monetary Affairs Federal Reserve Board, Washington, D.C. http://www.federalreserve.gov/Pubs/feds/2009/200923/200923pap.pdf

8 Electronic money and the possibility of a cashless society 18.02.2007. Georgios Papadopoulos http://papers.ssrn.com/sol3/papers.cfm?abstract_id=982781

9 ECB’s note on regulatory framework surrounding ELMI http://www.ecb.int/pub/pdf/scplps/ecblwp7.pdf

10 Where Value Lives in a Networked World, Harvard Business Review, Jan 2001, Mohanbir Sawhney and Deval Parikh).

11 NTT DoCoMo’s Osaifu-Keitai (http://en.wikipedia.org/wiki/Osaifu-Keitai),

12 “E-Money And Payment System Risks,” JAMES J. McANDREWS, 1999.Contemporary Economic Policy, Western Economic Association International, vol. 17(3), pages 348-357, 07.

13 The Economics of Interchange Fees and Their Regulation: An Overview David S. Evans and Richard Schmalensee

14 Why do stored value systems fail? Andreas Furche1 and Graham Wrightson.

15 Prepaid Card Markets & Regulation* Mark Furletti. US Federal Reserve. February 2004. http://www.phil.frb.org/payment-cards-center/publications/discussion-papers/2004/Prepaid_022004.pdf