Tag Archives: WFC

Clearxchange – Bank Strategy Perspective

28 May 2011

As I related in last week’s Post, Clearxchange (let’s call it CX) evolved out of the online/mobile payment groups at Wells and BAC. I also described how bank’s will “Win in Payments” along with a high level view on internal bank dynamics which drive Debit/ACH vs. Credit payments strategy, as well as the fragmentation that is occurring in “unprofitable” payments like ACH, carrier billing and P2P… etc.

Consortiums are not the most nimble of creatures. Banks also have the tendency to follow the lead of the big 3 (BAC, WFC, JPM) in all things retail. BAC/WFC are well positioned to execute in CX, and certainly have a sufficient customer base to make CX work. Their addition of JPM (and associated QuickPay) and the creation of a separate entity also aligns well with getting something done quickly. Developing CX within an existing bank consortitum could have taken much longer than 2 years to get a common bank service built… This “build it and they will come” approach is how many of today’s bank services get their start (visa, interlink/debit/ , clearing house, …).

Unfortunately, CX does not have a sustainable “stand alone” business case. Because it was completed within the channel organizations, business strategy (with the LOBs) was not well coordinated with the other LOBs (exception is JPM, the top bank in payments strategy). I’ve actually made 5 CX payments on launch day already. In BAC, just go to internal transfers and fill out the form on the left (did you receive a transfer). I clicked yes as it did not require an accurate answer in the Ts&Cs..

The service is very solid, but I do wonder what the retail wires group must think. Most bank services today allow for transfers to and from accounts I own at other FSIs (we call this A2A). Now I can transfer money to anyone via mobile with no fee (p2p). What about P2B and impact on Debit? For example, eBay purchase? Or how about at a store? If I can send money to a person with no fee.. what prevents cannibalization of Debit? Because of Durbin making Debit “almost free” is there an incentive to create a new payment network?

My sources tell me that there has been very little planning around CX (outside of JPM) to answer these questions. Not only were people with the big 3 banks scrambling to explain the service internally, their CEOs were getting called by peer banks about why their bank had not been asked to join? While banks are not free from anti-trust concerns.. payments is a network business that requires broad participation. The CX announcement comes at a rather sensitive time for them, as Jamie Dimon chairs The Clearing House meetings, there is little doubt that TCH has also served a forum for coordination on all retail payment “industry matters” like Durbin. Can you imagine working with JPM, BAC and WFC in TCH meeting on retail debit strategy.. then hearing they have a new service rolled out without your knowledge? Not the most polite thing to do.

It certainly was not Jamie’s fault (my favorite bank CEO by far.. fellow Citi alum).. but rather the poor “payments” coordination within banks. In my previous blog Bank’s Need Payment Councils, I laid out how these bank teams had worked historically. CX is a fantastic idea.. and it could even evolve into a profitable service if banks can improve the way the coordinate internally. This is a CEO level decision.. no one wants to tell the CEO that he needs to create a cross LOB council to coordinate payment strategy.. The Citi approach is much more “get a guy to own it”.. like Wayne at Citi, Vin at Chase, or Steve at WFC. But decisions that impact multiple LOBs are very challenging to coordinate across the organization.. CX is the manifestation of just such a dynamic (better to get something done.. then work in a bank committee that never makes a decision).

I’ve been getting called this week on “what is the CX strategy”? The answer depends on who you talk to. BAC has a number of debit/retail payment initiatives.. and there are certainly overlaps..

– New Visa Debit with BAMS/First Data

– Visa Money Transfers (directly competes with CX)

– CX

– Internal Payment Warehouse (3 yrs in making)

– Cashedge (A2A money transfers)

– Pariter (On we w/ WFC)

– NFC Credit w/ Visa and Device Fidelity

– …

If banks have trouble coordinating internally.. the situation certainly does not improv

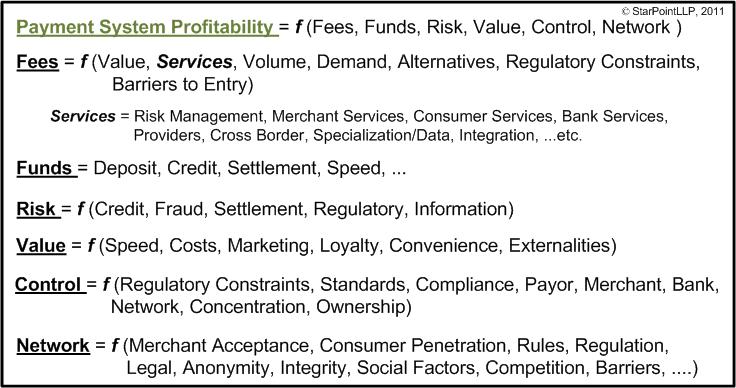

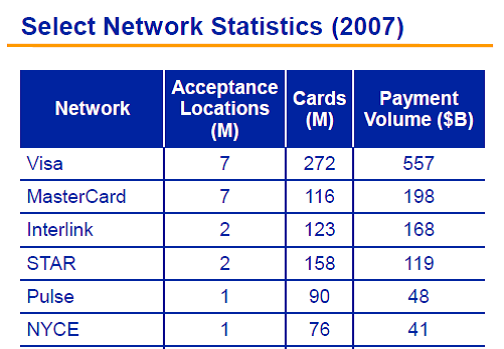

e when 20+ of them get together to set a strategy. Of course this “least common denominator” is why today’s existing payment network is both rigid and resilient. What the banks really need is a firm “platform” vision for payments that they own. For example, what if I broke payments into 3 broad categories: pay before, pay now, pay later? Having multiple products that compete in these categories is a sign of a good healthy market.. having multiple networks process the payment is NOT (only some of which are bank owned). As a side note, there is little reason to doubt that there will be SUBSTANTIAL consolidation surrounding the 6 major debit networks (Visa, Pulse, Star, NYCE…)

My top idea for CX to drive a little incremental revenue? 2 years ago, Metavante (now FIS) negotiated a PayPal deal that would provide for revenue sharing for eBay merchant payment.. PayPal collects 3%+fees and would share 30-50% with FIS. Why would the banks not want to do this? The original plan had more to do with this happening over bill pay.. but a transfer probably makes more sense. Either way, the banks should jump on this kind of opportunity. My #2 idea.. well I’m only telling my customer this one.. (my poor attempt at a tickler).

Happy Memorial Day

– Tom

Clearxchange

25 May (updated)

Banks take back mobile momentum!! Everyone else.. stay away from P2P because this team will own it.

BAC, JPM and WFC launch Clearxchange .. a mobile pay anyone service. This is a very solid idea by the 3 top US retail banks… after all why should PayPal route funds between banks? Banks have always had the capacity to make this work, but have lacked the structure (and business case) to pull this together. Their real risk was banks loosing the “directory battle” (referred to in my previous blog on Chase QuickPay). The last Bank driven initiative of this scale was Spectrum in 1999 where banks decided that acting together in electronic bill payment was the right thing to do..

A short history on this initiative. WFC and BAC got together and created Pariter Solutions a few years ago for “on we” clearing of ACH and images. Pariter initially received the charter to also move toward developing “on we” clearing for mobile/online P2P transactions, but this was pulled late last year as Pariter was having challenges executing against its core mission. Subsequently BAC and WFC got together and created Clearxchange to develop a common “directory” and online/mobile application infrastructure for P2P routing (ACH processing is TBD, but likely to be handled by host organization with clearxchange as a 3rd party sender).

Chase was an early leader here.. QuickPay delivers all of the functionality of Clearxchange… plus some. At one level, I view clearxchange as building what Chase (and Cashedge) already have. Chase has agreed to participate in directory sharing, so that Chase customers can send/receive to Clearxchange customers.

I’m a very big supporter of ClearxChange’s bank led P2P model, banks must own this for this service to take off. Remember, retail payments are a money looser for banks, the WSJ article did an excellent job describing the dynamics. By taking the lead, I would hope other banks also participate directly with ClearXchange or through Cashedge’s PoPMoney service (described here in blog).

Moving money via ACH is technically simple, the real challenge is in risk/fraud management. On this level, there are only 2 organizations with substantial fraud management skills in cross bank P2P: Cashedge and PayPal. Both have 10+ years of ACH history. In the last few years banks have collaborated in developing shared fraud models (can’t really discuss specifics for obvious reasons) that now allow them to substantially reduce risk without prior transaction history. The long term objectives of CX are rather vague (bank control of ACH rails, and balance retention in DDA). Their short term plan is to move consumers to a “push” model, where funds are sent from a bank authenticated log in. Banks want to be the starting point of a transfer. This positions them as the trusted intermediary, with benefits in fraud and cementing consumer behavior. This is a significant announcement with over 3 years of planning behind it.. but scope is narrow.

The push (ACH Credit) P2P model, where customer initiates transfer from their bank, has a poor history (search on “Paybox success”). The historical issues here have nothing to do with technology, but rather business model: simple and free funds transfer is not a great business. I’m very curious to see what CX’s revenue model looks like.. At one level I do laugh.. just 5 years ago, the only top 5 Bank to allow online transfers out of the bank was BAC. I ran online and payment services at Wachovia (now part of WFC) which included all the online payment operations. The other bank retail heads were very reluctant to launch online transfers because of the risk of deposit run off.. or rate hopping. … wow have things changed.

Every year the banks delayed this service was another year that PayPal could develop a directory of mobile phone numbers, e-mail addresses and ACH information… this is the real battle… retail payments are a terrible business when viewed as a stand alone product.. but are essential to retail banking. (See Banks will win in Payments).

The only “cons” I have for ClearXchange are:

- It involves a technology build.. and clearly Chase and Cashedge have already built these functions. The banks should have gotten together and bought Cashedge.. particularly since BAC is Cashedge’s biggest customer.. they could have been running with this for 2 years

- The structure. Why not put this in The Clearing House? or Early Warning Services? another bank owned consortium does not make sense given their charter unless they plan on involving non-banks

- BAC, JPM, WFC.. will you please walk away from Visa Money Transfer.. they are attempting to walk all over what you are building here. My guess is that your Visa relationship managers are not talking to your P2P teams..