3 Aug 2012

Paypal COULD do everything that Google wallet does today.. so why won’t they? (Note I’m talking about the Physical POS… not online)

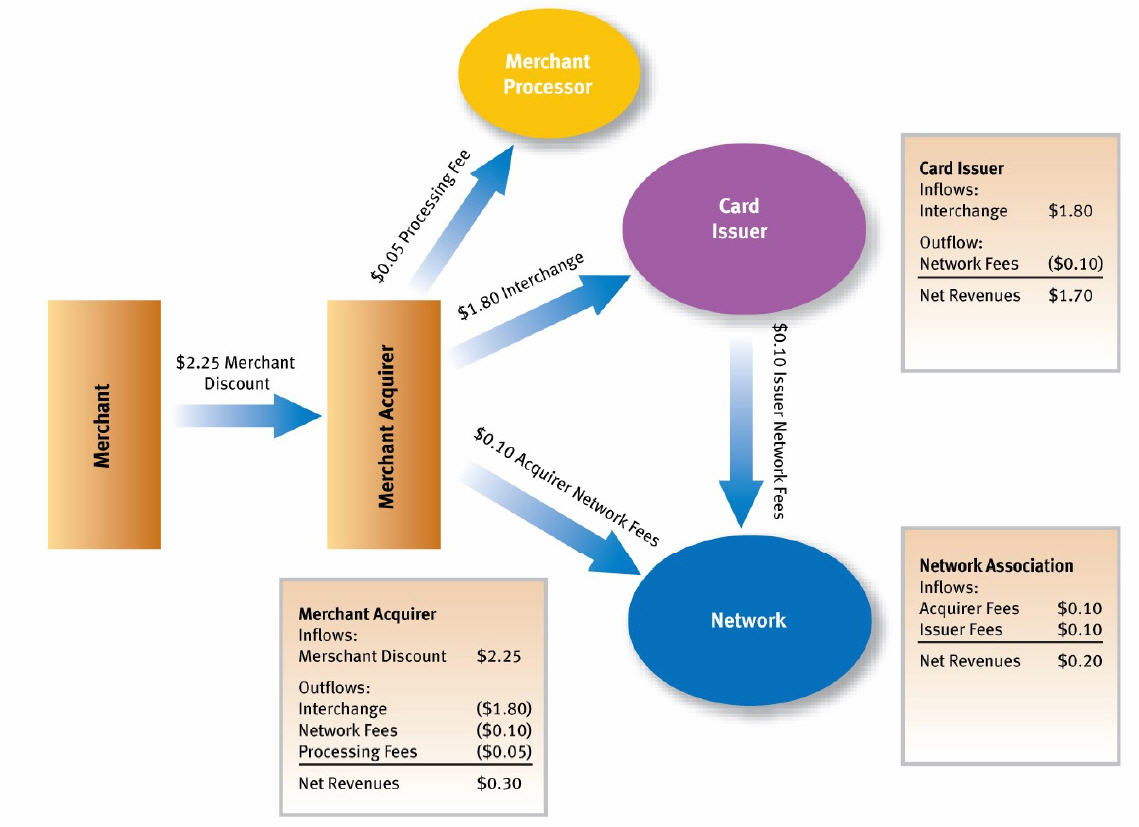

I’ve had a PayPal debit MasterCard for 6 yrs, when I use it at any merchant PayPal deducts from any stored balance I have, and then hits one of my stored payment instruments. I use this card exclusively on international trips because they have always offered the best cross border fees (.. and just 3 years ago paid an interest rate higher than any of my banks). I looked on the back of my new PayPal debit card and see that JP Morgan Chase is the issuing bank. Given that Chase has over $10B in assets, this card costs the merchant $0.21 + 5bps in the US. This is a great deal for retailers. A REALLY great deal.

Why is PayPal pushing out its own Plastic? Unbranded? Obviously they really don’t like the standard debit interchange (above) and want a bigger cut (than $0.21 flat fee) from the retailer. (see PayPal at POS)

Why won’t PayPal expand its online wallet to allow me to select any card for any given purchase? In this I mean creating an app that works like Google wallet, prompting the customer “what card do you want to use”? The answer is that they want to drive the underlying account selection decision to ensure the instrument with the lowest cost is selected.

Take a look at your payment instruments in PayPal today, they let you define a DDA account as “primary” but NOT a card. In other words PayPal incents you to link DDA in order to get money out.. then PayPal looks to leverage this account whenever possible (sometimes taking take settlement risk). The most costly customer for PayPal would be an Amex customer with no linked DDA and a PayPal debit card (for ATM withdrawals). See my related blog on PayPal’s funding mix (estimate 150bps)

PayPal is a payments business.. not an advertising business. Their goal is to maximize revenue. This is not a bad thing… But their recent moves are a “replay” of what happened to the bank payment networks as they pushed to ramp up merchant fees and grow interchange revenue at the expense of retailers. Why on earth would any merchant agree to take on Paypal’s new plastic? If it is above $0.21 it makes no sense at all… UNLESS Paypal is driving incremental sales.

PayPal today could create a Virtual “wallet” tied to either a Sticker or a Card that would work across Android, iOS, Blackberry, … and do everything that Google has done.. Why won’t they? Because the instrument must operate as a debit card, and the interchange “arbitrage” could kill them. In other words they will bear the cost of 350bps for a CNP Amex transaction and only charge the merchant $0.21 flat fee. If they rolled this out, I’m sure they would have MASSIVE success.. but if customers unlink DDAs and delete debit cards they would risk a funding mix that is “unsustainable” because they have no other revenue channel.

The true “payment innovation” from Google has little to do with payment and much to do about risk management and monetization of data. Google drives business to retailers today.. google helps consumers find the right product… they also “know you” from your history. They can use this information drive value to consumers AND to retailers.. they are also willing to take a very big risk that the benefits of Google will out weigh the COSTS of WALLET. Google Wallet will likely loose money on every single transaction. If you never accept an offer, incentive or coupon.. never search.. never use maps to find a business, never use Zagat to find a restaurant, never watch you tube commercials… they will likely loose money on you. However Merchants will ALWAYS win.. no matter what, they will have the lowest cost payment when accepting a Google payment.

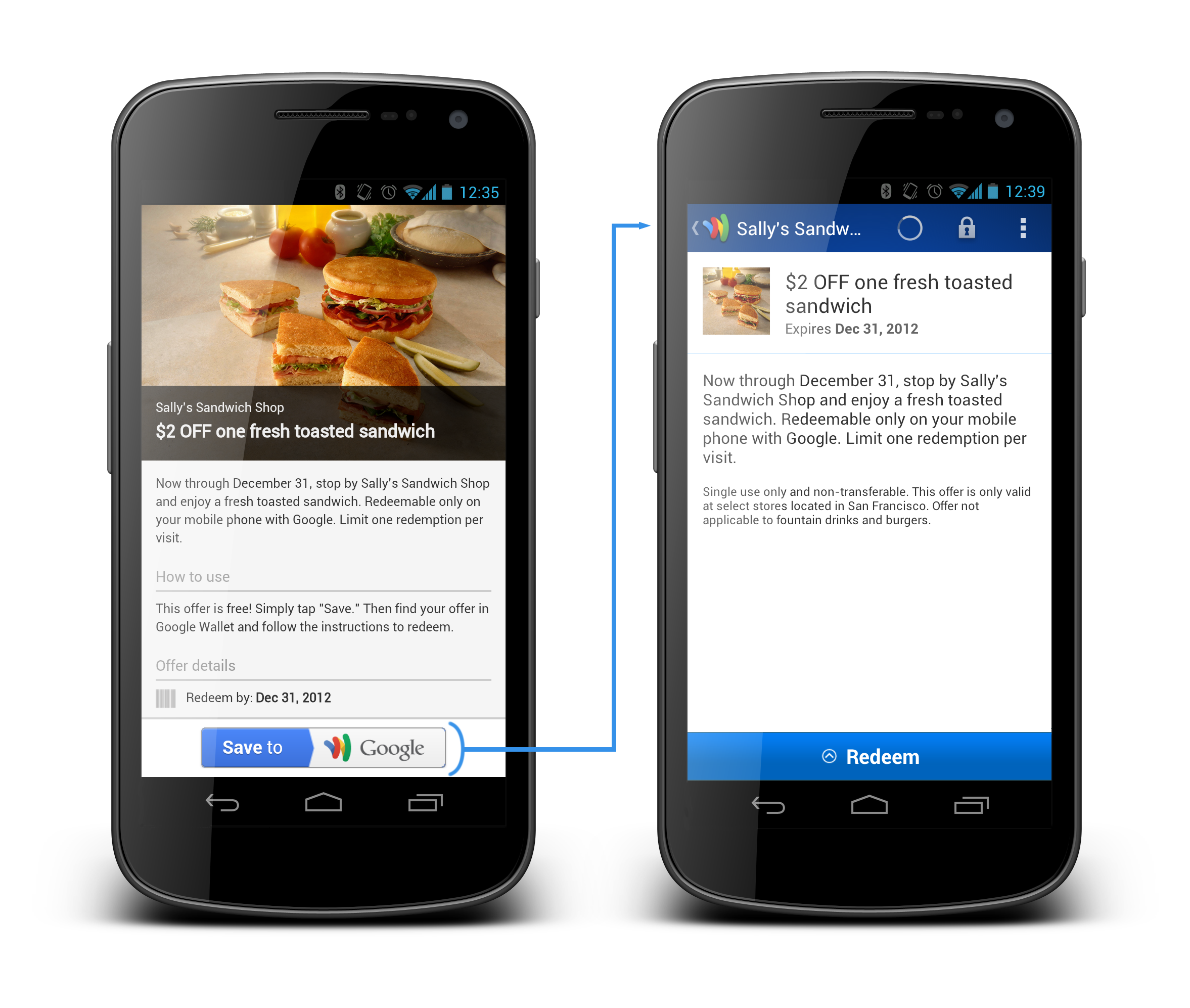

This is either INNOVATION OR INSANITY. From my perspective, what Osama and team have done is fundamentally game changing.. ! Bearing costs, giving consumers and retailers complete control.. in the hope that they can deliver value in other services. Payment is now just a small part of an overall Commerce Process. For example, a “new” feature of Google Wallet that has not received enough attention is the “saveto” API release at Google I/O . Google allows merchants to store 3rd party offers and payment types in the wallet. These offers don’t have to be created by Google.. it is a true “wallet” function.

As I stated yesterday, Visa, Mastercard, Amex, all of the banks are REALLY worried about data. Google will be in a position to deliver value to consumers independent (or dependent) on the card you use. Few other companies can do this… Consumers will always have a choice.. no one will be forcing them to use their Google wallet. But why not? Why didn’t the banks use their information to help me earlier? Why did the banks and payment networks stop retailers from passing their real costs along, of delivering incentives that they could control?

This “aggregate” model is something ANY company could do in short order.. Square is doing it, Revolution Money, LevelUp, … but no one else can make it profitable.

PayPal’s new POS “hope” is to re-engineer the customer experience at the POS, allow merchants to throw away their custom POS terminals.. As most of you know I believe Square Register was by far the best POS experience I have ever seen. From PayPal’s June Video it looks like they agree and have replicated the Square Register “voice” experience. While the customer experience is FANTASTIC.. it did not bring the customer into the store.. nor is payment cost competitive with Google.

[youtube=http://www.youtube.com/watch?feature=player_profilepage&v=CMByV-k9Oc4]

Investment take

PayPal has enormous runway left for them globally. I don’t see Google wallet denting current growth for 2 years. However this is VERY disruptive. IF google is successful in getting all Android users to register with a payment instrument (like Apple does in the App Store), and Google pushes Wallet out beyond NFC phones, it could result in a Tsunami wave which Paypal could not overcome in mCommerce.. This is a scenario where there are 3 primary mCommerce payments options: Apple Passbook, Google Wallet and Amazon. For physical commerce.. nothing will impact this world in next 5 yrs if it does not entail a physical plastic card. NFC phones and payment terminals just aren’t materializing fast enough. IF google creates physical plastic.. watch out… In this scenario Google should be pursuing an unbranded card.. “let the consumer decide”.. .”let the retailer influence” these are themes not heard in the payment world and would seem to resonate.

Tom, you may want to review your points on why Paypal cannot create virtual wallets.. I sifted through the Durbin final amendment and this is what it says on Page 90 .. (check out http://www.federalreserve.gov/aboutthefed/boardmeetings/20110629_REG_II_FR_NOTICE.FINAL_DRAFT.06_22_2011.pdf)

” …The second category of hybrid cards includes those cards, or other payment codes or devices, that may be used to access multiple accounts (including both credit and other accounts) (often referred to as ―virtual wallets‖ or ―mobile wallets‖). Cards used to initiate transactions that access and post to credit accounts are not considered debit cards for purposes of this rule because such cards are not used to debit an account, as the term is defined in § 235.2(a)…. ”

If Paypal (or for that matter GW) doesn’t charge a blended rate, it can charge cc processing rates for credit-funded transactions and Durbin rate only for asset-funded transactions. In fact, they are not bound by Durbin rates for DDA-funded money if they use only ACH to settle!

I do agree that Paypal cannot leverage any other revenue-source to subsidize the payment transactions and that is a HUGE disadvantage!

Good discussion, thanks for sharing. I did not know about the hybrid card rule. To summarize Durbin “restricts” covered FIs debit to debit interchange of $0.21+5bps. Your point is that hybrid cards allow for a “mixed” rate depending on how they are funded, with a very key point that PayPal can charge whatever it wants on an ACH funded transaction where they hold settlement risk.

What is the “book rate” interchange rate on the current PayPal debit card? A must read article from Paypal to the Fed http://www.c.federalreserve.gov/SECRS/2011/March/20110331/R-1404/R-1404_022211_67491_559260029595_1.pdf

Also, take a look at market leader TSYS in their hybrid card. http://www.tsys.com/ngenuity-journal/archives/winter-2012/winter2012_new-card-economics-bolster-case-for-hybrid-approach.cfm

As Durbin 235.2f part 5 (Debit Card) outlines for “virtual wallets”

The Board has added comment 2(f)-4.i to clarify that hybrid cards that permit some transactions to be posted directly to an account as defined in § 235.2(a), rather than posting first to a credit account, are considered debit cards for purposes of this part. Only those transactions that post directly to the account, however, will be considered electronic debit transactions.

And Part 6

If at least one virtual card within the virtual wallet may be used to debit an account under § 235.2(a), then that virtual card is a debit card for purposes of this part, notwithstanding the fact that other cards in the virtual wallet may not be debit cards for purposes of this part. The entire virtual wallet is not considered to be the card, or other payment code or device.

The last part is a gift to Paypal.. for NON POS PAYMENTS. Payment with Wallet only (a three party network transaction using cards stored in the wallet for settlement) is not covered by durbin. However POS Wallet payments are Debit transactions when one card is debit.

In the market, we see 2 different solutions. Fifth third taking PIN for debit or swipe for credit so that their hybrid allows the merchant to route at POS.. and complies with Durbin debit routing rules. (see http://pymnts.com/regulations/debit-checking/who-gets-to-choose-durbin-s-provision-on-multi-homing-and-the-prohibition-on-network-routing-exclusivity/)

#2 TSYS hybrid. Particularly the quote

It does not look at if Durbin supports a Tsys hybrid. Would love more comments here

What is Google’s interchange in a debit wallet transaction? is it credit? is it debit? prepaid? They are not required to make it lower 1.05% plus a $0.15.. but they certainly could. Could they price Google wallet higher than a debit? I don’t see how they could.

Interchange is a construct of a 4 party network… In this I completely agree. This is where Discover, Amex and Paypal have tremendous advantage. Hence 3 Party networks are where future Wallets accounts should be migrating (hence Amex’s revolution money).

Regarding TSYS Hybrid card, I, as a consumer will never use it. I would rather use separate cards to choose either credit/debit..

Also, check out Page 91 of the Durbin. They have explicitly mentioned that case (txns posted to a credit account and then immediately paid by ACH from an asset account). Such transactions will be considered as DEBIT. The issuer cannot get cc interchange rates for this!

Here is the excerpt from that section …

“…For example, a card may be used to initiate transactions that access and post to credit accounts, but the issuer enables the cardholder to preselect transactions for immediate repayment (or repayment prior to the monthly billing cycle) from the cardholder‘s asset account. The issuer, then, may initiate a preauthorized ACH debit to the cardholder‘s account in the amount of the preselected transactions. Such products, due to their classification as credit cards, may not condition the extension of credit on a consumer‘s repayment by means of preauthorized electronic fund transfers.67 An issuer may permit a cardholder to opt in to preauthorization of some or all transactions made using the credit or charge card. The Board, however, recognizes the potential for issuers to restructure existing debit cards like these hybrid cards in order to circumvent and evade this rule. Therefore, such cards will be considered debit cards for purposes of this part if the issuer conditions a cardholder‘s ability to preselect transactions for early repayment on the cardholder maintaining an asset account at the issuer (see comment 2(g)-4.ii)….”

Regarding Google Wallet interchange rates, I think they can charge whatever they like for credit transactions and Durbin rates for Debit transactions.

Page 91-92

“…For example, a mobile phone may store credentials (the payment codes) for accessing four different accounts or lines of credit, which the cardholder can view on the phone‘s screen. At the point of sale, the cardholder selects which virtual card to use (e.g., by selecting the icon for the issuer whose card the cardholder wishes to use). If at least one virtual card within the virtual wallet may be used to debit an account under § 235.2(a), then that virtual card is a debit card for purposes of this part, notwithstanding the fact that other cards in the virtual wallet may not be debit cards for purposes of this part. The entire virtual wallet is not considered to be the card, or other payment code or device…”

Note the last sentence. The entire wallet may not be considered as a debit/prepaid or a credit wallet. So, if Google charges a blended tx rate, they can charge anything.. If they do not charge a blended rate, they have to charge Durbin rate for debit cards and any rate for credit cards.

Google has a fantastic opportunity in the pricing here if they are blending.. If they charge, say a flat 1% for all txns, that will be a killer proposition! Of course, they need to bet on the transaction mix, but they have the ability to subsidize these transactions anyway.

Thanks so much for taking the time to respond.

Pingback: Battle of the Cloud – Part 2 « FinVentures

Online Payment Services – Are They a Good Fit for Your Small Business? Credit cards are a common online payment alternative for small organizations, but what about other providers like PayPal, Bill Me Later and Google Wallet? These now ubiquitous tools make it easier than ever before for anyone – maybe not just e-tailers – to purchase and sell goods online and via mobile phones.

When I initially left a comment I appear to have

clicked the -Notify me when new comments are added- checkbox and now each time a comment is added I get 4

emails with the same comment. Is there an easy method you can remove me from that

service? Many thanks!

Pingback: Controlling Wallets – Battle of the Cloud Part 3 | FinVentures