Having just completed a merchant survey, Retail CMOs were quite clear with their top 3 companies they would spend time with to improve eCommerce (payment focus):

Continue readingTag Archives: google

eReciepts – The Politics and Economics of SKU Data

An update to my Data Games – 2021

© Starpoint LLP, 2025. No part of this site, blog.starpointllp.com, may be reproduced or retransmitted in whole or in part in any manner without the permission of the copyright owner.

Electronic receipts (eReceipts) COULD transform the retail landscape by offering numerous benefits to consumers and businesses. With the potential to enhance digital wallets, improve customer experiences, empower AI agents, and increase advertising effectiveness. However, the widespread adoption and sharing SKU-level data face several challenges, most of which are NOT technical. Today, I’m providing an overview of key business and economic challenges of unlocking SKU data.

Scenario – Agentic Wallets and Federated Data

Keeping up with the latest in agentic commerce, artificial intelligence (AI), payments, and data privacy is an ongoing challenge. Data and LLM are the key ingredients fueling the rapid advancements in AI and machine learning innovations. As a privacy advocate, I remain deeply concerned about the centralization of data. Once AI models are built to understand “you,” they no longer need continuous access to your data—just ongoing observation (see blogs on Data Centralization and Payments and the Observer Effect).

Do I think wallets will become “Agents”? No, but they will be the most important interface to all Agents, as they broker identity, authentication, authorization, permissions and highly secure data in the handset. My view is that Wallets enable many agents. This view of the the world is called the Agentic Mesh where specialized agents work together to achieve a result.

Wallets and Privacy

I’m on a brief vacation celebrating my 28th anniversary and deep in thought (pic below). What am I thinking of here on the beach? Wallets, Networks, Trust and Privacy.

The Case for Separating Wallets from Identity Providers

As digital identities continue to evolve, one of the most important debates centers around who controls and operates the wallet that holds these identities. Specifically, should wallets be separated from authorities that legally issue “identity”—commonly known as Identity Providers (IdPs)? This issue is particularly relevant in countries like India and Europe, where digital identity initiatives have made significant strides, yet their approaches raise important questions about privacy and control.

Continue readingWallets and Networks: The Backbone of Digital Transactions

Stimulating community discussion is the #1 reason I write this blog. The intersection of payments, banking, and technology is evolving rapidly, and I’m fortunate to engage with great minds like Dave Birch and new friends like Simon Taylor. Dave’s recent post on crypto predictions got me thinking about a topic I keep coming back to—wallets and networks.

As a former banker, I’m naturally more skeptical about FinTechs disrupting the core of banking. Consumer behavior is incredibly difficult to change, and financial services are among the most competitive industries in the world. If there’s one concept where my perspective diverges from many thought leaders, it’s the power of bank networks (read more). These networks are the foundation of financial transactions, and they continue to define the way money moves.

eCommerce 2025 – Wallets, Share Shift, Conversion Rates and Key Segments

© Starpoint LLP, 2025. No part of this site, blog.starpointllp.com, may be reproduced or retransmitted, in whole or in part, in any manner without the permission of the copyright owner. Also, see our Legal/Disclaimer (this is a highly opinionated and partially informed blog).

My estimates for how US eCom market share will shift in next 3 yrs are at the end of this blog.

eCommerce is not a single monolithic market. There are many “segments” to optimize that vary by geography, retailer type, consumer device, customer type (guest vs loyal), transaction type (recurring vs new), ad type, payment type,…etc. A great source of this information is Monetate (highly recommend). For example, let’s look at conversion rates by industry, device and region.

Continue readingWrapping up 2024 – Key Areas I’m Tracking

As we wrap up 2024, I thought I’d outline a few key areas I’m tracking and things to look for in 2025.

Continue readingDigital Wallets – Core Functions and Competitive Strategies

What are the core functions of a digital wallet and what will the future bring now that Apple has opened up their Secure Element (see blog)?

I’ve been writing about wallets for over 12 yrs. Let me recap some history

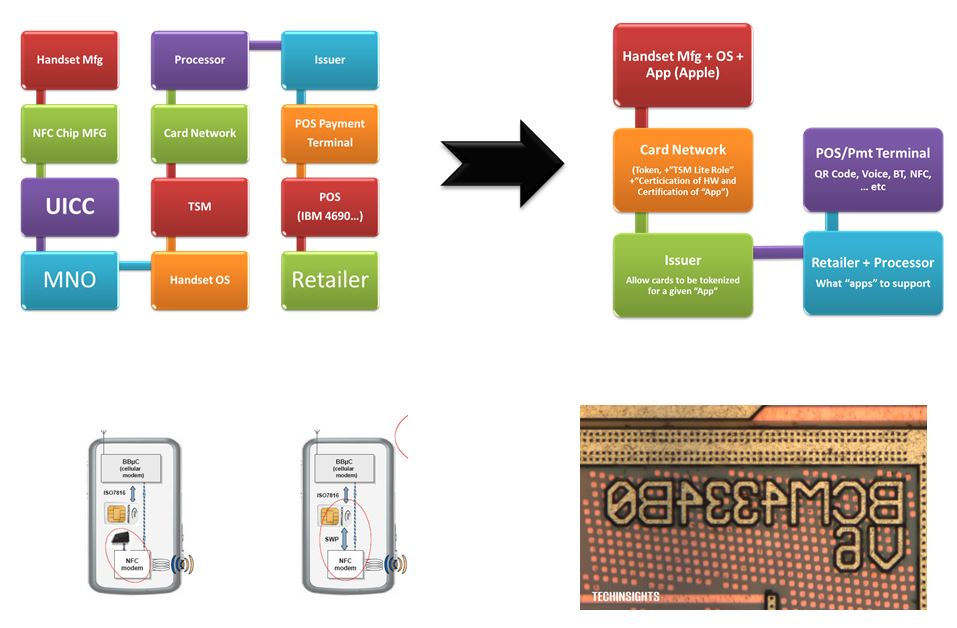

- In 2006, mobile operators had control of what “apps” could operate on a phone. In the US Qualcom bought Firethorne in an effort to create a single bank application, where banks had to pay $1 for every balance request. I’m not joking.. Open app stores destroyed this model quickly, but so the MNOs pivoted to the SE and SIM card.

- In 2010, Mobile Network Operators (MNOs) had control of the encryption keys for secure elements. Their pitch to Google was, “Give us a billion dollars, and we’ll give you the keys”. The absurdity here was only surpassed by Doug Bergeron (CEO of Verifone) marching into Google the next year and asking for a “Billion dollars” for Verifone to support contactless (I was just outside the meeting room). Of course there was no economic model for Google to make a single penny off of payments back then. Even worse, there were 12 parties in the NFC ecosystem, all looking for economics, yet there wasn’t a dime to share between all of them (blog). Now wrap all this silliness into a MNO consortium with the name ISIS.. yep.. What a great brand!

- From 2008-2014 the GSMA had a global vision for managing the phone’s secure storage (see blog) and monetizing it for the MNOs. MNOs could control either the secure storage within the SIM card with Single Wire Protocol (SWP) or within the secure element.

- ApplePay’s 2014 launch did several things that changed the game. 1) Ripped away control of the SE from MNOs and OEMs, 2) integrated payments and security into the OS (Card in SE, biometrics in Secure Enclave), 3) required a card to activate a new phone, 4) Created economics with the networks for payment (see blog).

- From 2007-2014, US Issuers wanted to only enable credit cards for contactless (a premium experience). 27 Issuers (led by Citi’s Paul Galant) were working on their own wallet, to “own” mobile payments (see Civil War). In 2014 launch of ApplePay, Apple forced the Issuers to enable debit at parity to Credit, and also gave Issuers a take it or leave it revenue share (15bps in US, 7bps in EU and ROW). Charlie Sharff (then CEO of Visa) also established a fundamental network rule in “no wrapping”. You can’t wrap a Visa card with another number and let it operate. A rule that was ahead of its time and also more formerly established with Durbin regulations.

- The 27 bank project thus floundered for 16 yrs until last year when saw the light of day in PAZE. Paze is Gen 5 of this effort, and really a white label version of SRC. A wallet that abandons the POS and focuses on eCom with Visa given the reigns as the lead architect only last year (see eCom Politics and Scenarios)

- Today, Issuers classify Apple as “enemy number 1” because of the 15bps fee that the Issuers voluntarily signed up for. Their renewed complaint is that merchant discounts (ie 45 bps and Costco, Walmart and Target) puts them upside down on transaction economics. Apple’s position (anecdotally) is “you knew what my fee was when you gave the discounts.. You voluntarily signed the agreement.. And now its successful you want a discount”? (see 2022 US Payments Environment)

- Visa and Mastercard have become the identity infrastructure for the internet because of the binding of identity to payment. India’s UIDAI and UPI have shown the power of separating identity from payment. Europe is working to build a new digital identity infrastructure (and wallet) in eIDAS. Commerccially, Fast Identity Online (FIDO) is at the heart of new eCommerce experiences that will massively disrupt investments in risk and fraud infrastructure. These services are in Card Networks Payment Passkeys, PayPal’s Fastlane and others. These first generation identity services will be surpassed by 2nd generation identity solutions with hardware bound credentials. Google’s Seccure Payment Authentication (SPA) is the best in class authentication solution globally. (also see Adios 3DS hello FIDO2).

- While the tech changing eCom is amazing, there are only 3 options for organizing it into a successful platform: 1) Government Led, 2) Standards Led, 3) Commercial (payment) Network. Of the 3 only V/MA have established an economic model where participants can invest (see Identity Models and my new blog this week on topic)

- Wallets have grown substantially from “payments” to the consumer interaction point for “everything” between the virtual and physical world. Door keys, concert tickets, boarding passes, DLs, loyalty cards, student IDs (see Apple’s list of UC’s it will support).

Apple Opens NFC

Apple Opens NFC. Just off the phone with Apple. They were nice enough to treat me as a journalist and I was able to ask a few questions.

Google Secure Payment Authentication (SPA)

Read First – Blog on SPA from Checkout.com

Background Reading – June blog eCom politics and Scenarios, and Identity, Authentication and Risk

What’s the big news here? SPA allows Google to stand at par with ApplePay in providing the best-authenticated checkout experience. Google looks to have taken TWO MASSIVE pieces out of the authentication process: 1) 3DS handshake (putitting in Cryptogram and 2) A step up from the Issuer (possibly – a significant portion of this blog). This is a generational improvement and massive simplificaiton of the current 3DS flow.

The mobile platform is key to authentication and Google is the preferred partner of every bank, merchant and network. Their challenge in SPA? Doesn’t seem Checkout.com coordinated with the networks on SPA (ie liability shift OR step up). I think it will get worked out as the quality of this innovation is just fantastic.

As I wrote in June, ApplePay 2.0 plans to cross the chasm from mobile only to desktop (as announced at WWDC). Google is proving that they have the same capability, as Chrome makes up about 10-12% of eCom and over 30% of guest checkout at most retailers; they are positioned well (particularly in Android markets).

Continue reading