Assessing the Environment and Setting the Focus (part 2 – Power of Bank Networks)

© Starpoint LLP, 2022. No part of this site, blog.starpointllp.com, may be reproduced in whole or in part in any manner without the permission of the copyright owner. Please do not share unless you hold an enterprise license.

Must read FT article “How JPMC’s plan to kill credit cards split the bank”. The article discusses Jamie Dimon’s internal mandate to drive a new payment network. I was shocked with the level of internal org quotes here. In my view, Jamie is the best bank CEOs in history (based on performance and talent coming out of JPMC). As a former banker, I know how hard it is to move the ship. However, FT is wrong. Chase’s efforts ARE NOT about killing credit cards, but rather creating something much bigger.

This is a long blog..

The payment initiative which has Jamie’s commitment is something both payment geeks and investors should track. It’s not often that 20+ bank CEOs all agree to move in unison. Jamie and the partner TCH Banks are prudent in planning the future of payments. However, mobile has completely changed banking, commerce, and social interaction. Given the investments by FinTech/BigTech, the ubiquity AND efficacy of V/MA, is creating a “new” payment network the right focus? I’m going to lay out my thoughts on this question in a 5 part series.

-

- Payments Landscape and Drivers of Change

- How Transaction Costs Shape Bank Organizations and Networks

- Last Mile: Embedding Financial Services, Dumb Pipes and Wallets

- Innovating in Existing Networks: The Efficacy of V/MA

- Future of Retail/Commercial Banking … What Will Define Bank Success?

You may want to start with the last section of Today’s blog where I lay out my best guess at what TCH is building.

Changing Payments

Something big is going on with JPMC, The Clearing House and 20+ other banks. For Jamie to say “get on board or your fired” to his team (even in jest) clearly indicates that TCH efforts are more than an eCom wallet or new RTP/debit product.

Over the last 50 yrs, payments have evolved. New payment products don’t necessarily replace prior products, rather the entire inventory of every payment product lives forever. Thus Banks have a spaghetti portfolio of payment systems and relationships. Payment complexity hampers the ability to adapt and respond across bank business lines.

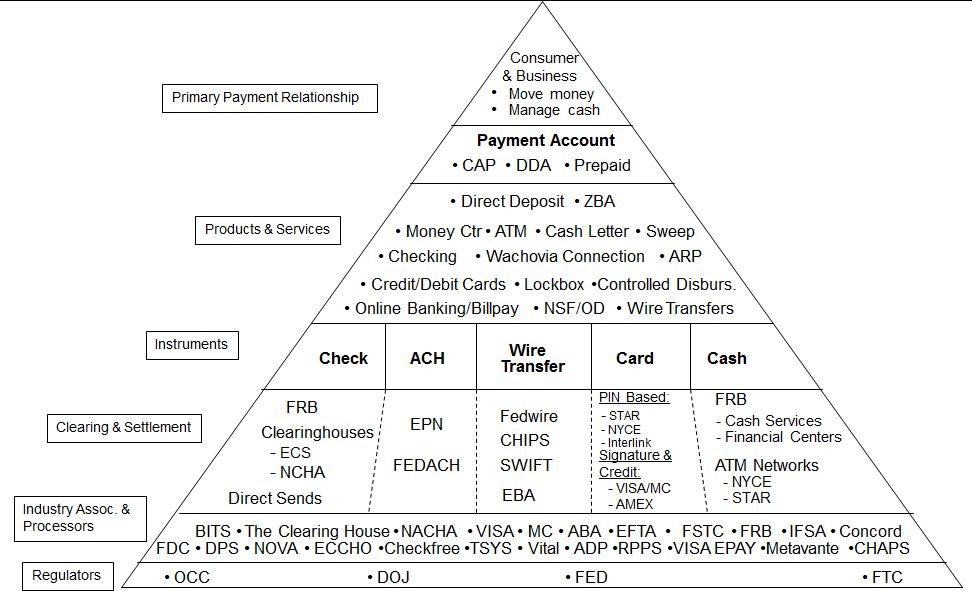

Fixing this mess is hard because payments are not managed separately (except for credit cards), but rather as a supporting service across all business lines; the connection point to customers and the products they use. The complexity is both external (ex network agreements, customer agreements, fraud ops, settlement) and internal (see Inventory of Payment Decisions – 2015).

This payment pyramid is a simplified product view of Wachovia’s payment efforts. For each of the names above there are associated banking products, systems, customer agreements, customer support processes, and P&Ls. External complexity revolves from how these products are used by customers and how they connect to other banks and service providers. Enterprise Payments thus become a bottleneck that limits new products and overall bank responsiveness. Investment flows to where new ideas can deliver, and today that is Visa and Mastercard.

To accomplish internal system-wide changes in payments, CEOs leadership is required to “change the arteries”. This is the only way for the entire organization to seek relief from impact and collectively invest to accomplish change.

Side note – Back in 2011 when I interviewed with JPMC for the CEO of Digital and Payments role, I told Gordon and Todd that changing payments was like upgrading the space shuttle from copper to fiber optic while it was operating. The shuttle had over 200 MILES of copper wire weighing 2.5 TONS. The change to fiber optic has impact on everything (see about Tom – Former NASA GN&C).

Internal-only payment change has little value, as neither customers or other banks are touched and efficiencies are not fully realized. Yet external payment change represents an even LARGER challenge (politically). As the intermediaries of commercial transactions, banks require networks (ie a single bank can’t connect to every consumer and every business).

Side Note: Remember that just 150 yrs ago, banks issued their own notes, and thus a network of trust and correspondent banks were required (see Trust Networks). What bank notes do you trust? Which bank notes does your bank trust? These same questions are asked in the tokenized environment.

Changing the connective system that SPANS Banks requires a uniting purpose. Other countries have approached this as a regulatory mandate (ex ECB/SEPA, UK Faster Payments), an effort to eliminate cash and improve government disbursements (ex India NPCI/UPI) or service led by central banks (ex Brazil/PIX, FedNow,…etc). While many of these have seen focused success, few have impacted the internal plumbing of financial institutions (ex PIX accounts do not interact with DDA accounts).

FinTech and Revenue at Risk

What pain point is most important? what are banks missing out on? Matt Harris and the Bain crew just published a fantastic – article Embedded Finance (highly recommended read). Bain’s investor perspective informs where VCs are focused with a proposed categorization framework. A great investor perspective, but what impact are today’s FinTech’s having on banking?

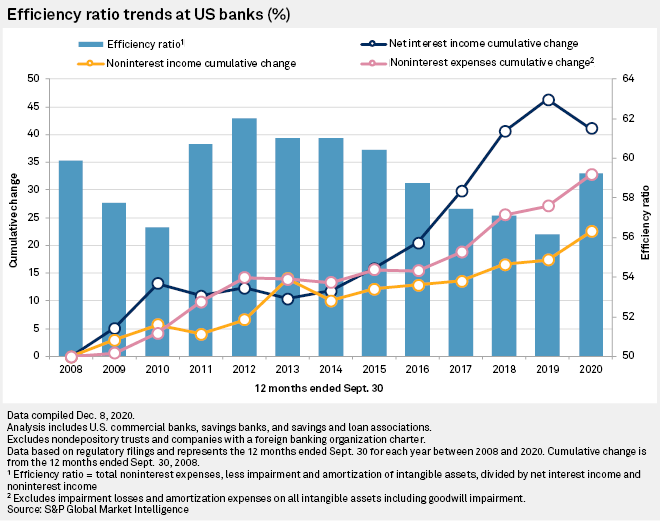

In 1994, Bill Gates quipped that “banks are dinosaurs”, 28 yrs later and banking is pretty much the same. Sure consumers have migrated to mobile, and checks are gone with cards taking their place. But banking hasn’t really changed much. The leading banks are larger, and more profitable with improving efficiency ratios.

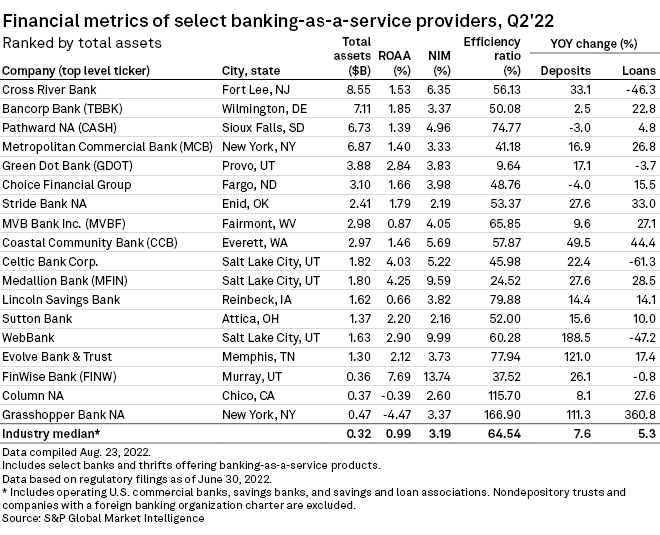

In summary, FinTech has NOT BEEN a Chicxulub meteor (ie killed the Dinosaurs). While global FinTech investments smashed all records at $210B last year, Fintech is NOT disrupting core financial services growth or profitability. In fact FinTech is almost always DEPENDENT on a sponsoring bank (see Bloomberg Article and S&P BaaS). In the US GDOT, TBBK, Meta and Cross River are leading FinTech banks. If you review their financials you see a normalized ROA of about 1.7%, NIM of just over 3%, and an efficiency ratio of 50%.

“FinTech Banks” clearly show no sign of threat to the top US banks (2022 S&P Global). The Combined assets of the 18 US FinTech enablers ($55.3B) is less than 1.4% of Chase’s total Assets.

Given that FinTech sponsoring banks provide no case for revenue at risk, are FinTech’s generating significant revenue that could be captured by Banks? Well that is a loaded question. Yes Fintech’s are generating significant revenue, but no this revenue is not likely to be captured. Stripe (~$12B), Block ($18B) are the best examples.

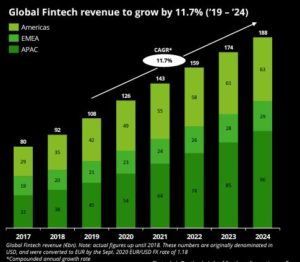

Deloitte’s 2020 market analysis shows that total Fintech revenue should reach $188B in 2025 at 11.8% CAGR. It is interesting to note that FinTech revenue growth is significantly less than Visa Direct’s 40%+ CAGR over the last 2 yrs.

Note: My view is that this Deloitte estimate is deeply flawed, particularly the definition of FinTech as it includes V, MA, Adyen, Stripe, PYPL as “FinTechs”. Note that $188B is greater than the quarterly NIM of all US banks ($166B). Excluding all publicly listed companies from FinTech, would yield a 2025 revenue of ~$20B.

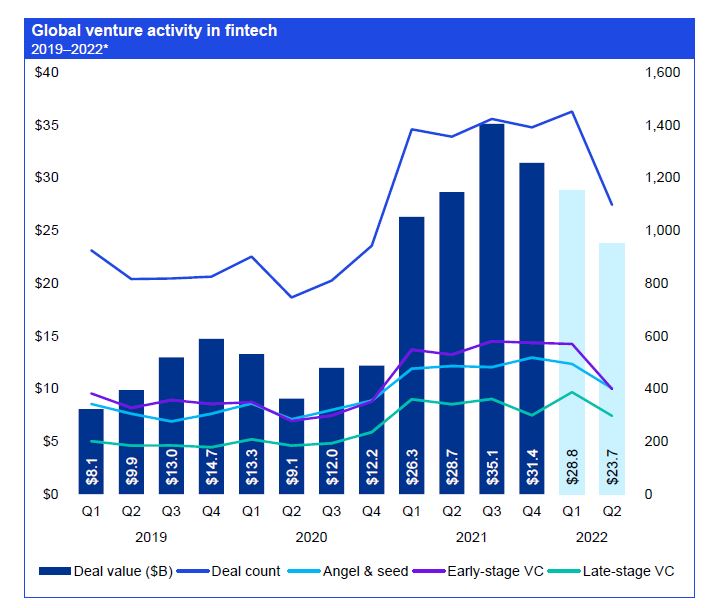

While Venture Capital was aggressively moving in the space through 2019, it fell off in 2020 with valuations crashing in 2022 (half trillion dollar loss in public fintech companies). KPMG and Bain’s numbers show investment still flowing (at reduced valuations).

and Bain’s numbers show investment still flowing (at reduced valuations).

What was tried before and what happened?

Given this RTP initiative has been on-going for 12 yrs, it is useful to look at history to see what has been tried before. As I related in 2015, and the 2017 ChaseNet Blog,

(2014 as told to me by Amazon). Chase shows up to present their new secret creation: ChasePay. The Amazon guys didn’t know before hand what JPM wanted to talk about…. On hearing the opening of the JPM pitch Amazon thinks it’s some kind of joke (…. listening for the punch line). But Chase was serious. The Amazon team puts the phone on mute and is rolling in laughter/pity. As opposed to telling them how silly the idea is (Amazon has a little One Click button with 400M+ consumers registered) they ask how this is different than the initiative that Chase Payment Tech is leading to enroll merchants in Amazon Pay (CPT as the acquirer). The Chase Senior Exec (consumer side) is silent.. “I’m not aware of that”. Can you believe that the largest bank, shows up at the largest online merchant to pitch an idea for a wallet to the company that invented it!?

Just before abandoning ChasePay, JPMC pursued MCX which included Walmart and Target. It was fortunate for Walmart that JPMC didn’t know that MCX was about to be shut down in favor of Walmart Pay. To get ChasePay into the MCX wallet, JPMC gave up all their card pricing (rumor ~50bps) for all cards. After the deal was signed and announced at Money2020.. MCX closes down. See WalMart Pay blog.

In 2015 Tokens and the Trojan Horse I outlined how upset the banks were ApplePay’s terms (and 15bps revenue share). They were also quite upset with the network’s token services. These services stepped on what they were working to build in TCH. TCH banks refused to let Google have access to the same tokenization services that were made available to Apple and pushed Google to a non-existing TCH token service (now in place today). Google ended up building its own bespoke token service with each and every acquirer.

Tokenization of payments is the focus of TCH activities today, and the bank’s new payment CEO is the #1 global expert in the field. Thus I have a great deal of confidence that TCH and the new payment network will lead with tokenization as the heart of a new real-time service. But what problem is it solving?

WHY Change the Plumbing?

This is the million-dollar question. Banks are healthy and growing. FinTech is moving fast, dependent on sponsoring banks, and creating value, but not disrupting any of the major banks. What is it that is uniting banks in collective payment investment?

Before I invest in anything I want to understand what problem it is solving. The second hurdle is dependencies for success. Payments today work very well. After all none of us leave a merchant because they didn’t take our form of payment. We can also transfer funds “instantly” to our own accounts and to our friends. While merchants don’t like the cost of accepting a credit card, and international payments/FX are out of line, there are very few other areas of friction.

This lack of “problem” is problematic. New schemes require “a first success” to gain momentum. Neither consumers nor merchants are clamoring for a new retail solution. While a new payment network could bring internal efficiencies within an organization, externalizing requires a critical mass of users to make and accept. There could be opportunities in consumer bill payment, or commercial supply chain payments, but these are categories operating at a very low cost basis (or at a loss).

If it weren’t for Chase’s continued efforts to gain traction with Amazon and WalMart, and TCH’s involvement in tokens with Google (since 2015), I would have thought commercial payments or bill pay were the logical starting point. However, it seems as If Jamie and TCH are intent on BEGINNING with consumer payments while understanding they can not change everything at once (see 2020 Blog TCH RTP).

Side note. for those that didn’t read the blog.My best guess at RTP’s first effort was in last week’s blog: TCH Phase 1 – eCom SRC. eCom is a logical first step from a capability perspective (ex no need to issue a TCH RTP Card), consumers both satisfied and ingrained with wallet behavior (ie ApplePay, Amazon, PayPal, …etc). There is no consumer “problem”, or merchant “problem”. In fact merchants are prioritizing BNPL with 2x-4x higher cost of acceptance because it improves conversions.

If there are no unmet market needs, no competitive threat and existing bank networks are efficient, what other reasons could drive the need for a new bank network? Given that there are over 20+ bank CEOs on board with this new network, with a new CEO (hired 2 weeks ago), there must be a significant cause to drive alignment. Here are my top 5 (comments appreciated):.

-

- Define the Future of Payments instead of waiting for the impact (see Impacts of DLT to FS). Take a leadership role in payments and resolve the spaghetti mess of internal systems.

- Internal Bank Efficiency. Replace the copper with fiber optic. TCH would create a parallel universal routing system that would enable any bank to reach any channel based upon rules, cost and routing. Enable banks to sunset older systems and replace 50 yrs of antiquated systems to improve time to market.

- Protect core banking rails against non-banks (see TCH RTP the New Debit Network?). FinTechs are not operating on a level playing field. They have a lighter regulatory burden and lower transaction costs. Specialist banks like TBBK and Cross River are enabling this competition.

- Neutralize V/MA service expansion. Prevent banks as unbranded dump pipes (see Evolution of V/MA Beyond Payments). Create friction in Visa Direct (ex charge for OCT/AFT), create bank alternative for FinTech.

- Prevent the “PayPal effect” and further disintermediation. Protect bank brand and bank data in payments with Apple is current enemy #1. Banking is the original data business (see Data Games, and Trust Assertion). This is not just a payments battle, all bank products depend on the data associated with the payments interaction.

What is TCH Building? A Master Switch

What is the uniting purpose behind Jamie’s payment directive? What have 20+ banks agreed to? What is TCH building?

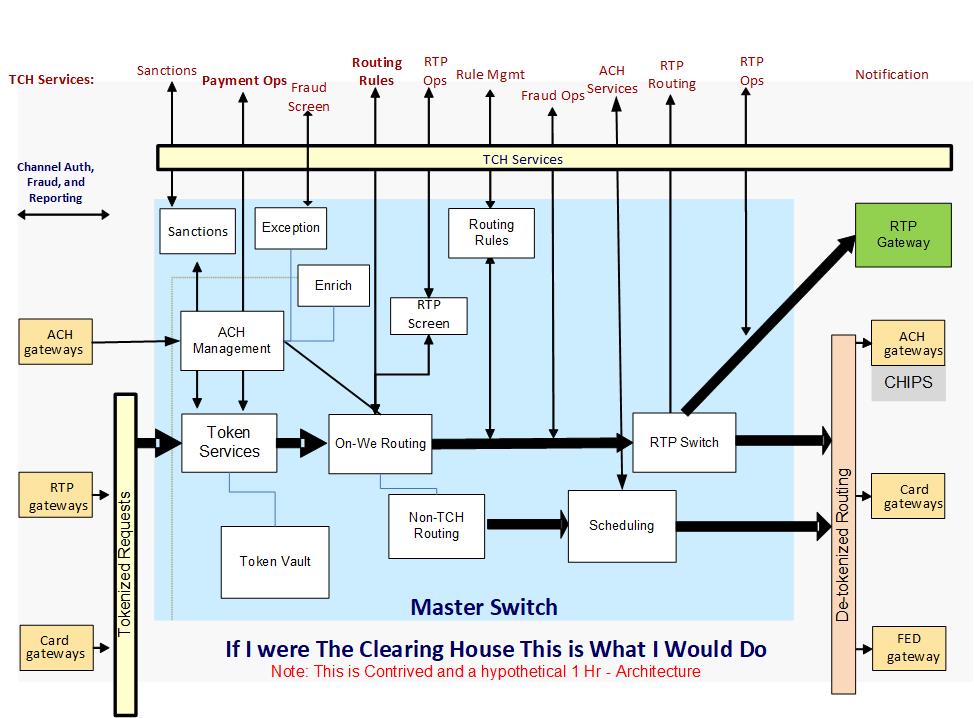

This is much more than an eCommerce wallet, or a “new debit” system. I believe TCH is building a new payment “master switch” that encompasses: RTP, ACH, Card and other payment types. This view is not based upon any disclosure or unique insight.. But rather it is the only thing I know of that would drive CEO commitment at this level. I’ve been around payments for 25 years, and have seen the complexities of bank systems across markets. This is what I would build:

Note I did NOT put Ph.D. level effort into this diagram. I will drill down on this much more in the blog series. For today let me list a few examples of what this “Master Switch” would do:

-

- Bank transition to RTP. For example, a new RTP bank could code 100% of transactions as RTP transactions and the master switch would translate, transform and tokenize to the appropriate destination network based upon the counterparty.

- Create a MUCH better model for “open banking” with a clear case for banks to be members of TCH. Work with any bank, any network and any fintech. Choose the best route for every transaction.

- Route any request to the best channel for fulfillment based upon a given bank’s capabilities and rules. For example an ACH transaction to an RTP or OCT transaction

- Enable banks to begin sunsetting internal systems.

- Enable intra-bank fraud and sanctions screening.

- Common request API for FinTech to work directly with Banks (ex through Akoya)

It is important to note that the new CEO of the IntraBank payment switch is James Andersen, formerly head of Mastercard’s tokenization efforts and also the brains behind Mastercard’s Track a B2B service with similar ambitions to above.

Comments on the FT Article

Credit cards are the MOST profitable consumer banking product on earth. There is NO PLANS to kill credit cards. The “master switch” concept above is not simple.. it may look like “pay by bank” to the payment novice. Credit cards will not go away. For those familiar with JPMC’s business, particularly the traction of JPMC in merchant acquiring, you can see where they stand to gain unique benefit if they are freed from routing rules in V/MA.

Does this represent a threat to V/MA? Not yet. I do think the networks need to be very thoughtful in how they enforce tokenization and routing. They should also add OCT/AFT to their list of activities to plan around.

Note that this blog has no read restrictions. The remaining blogs in the series will be for subscribers only.

Tom, I’d be interested to hear how you think this sits alongside Onyx.