10 January 2011

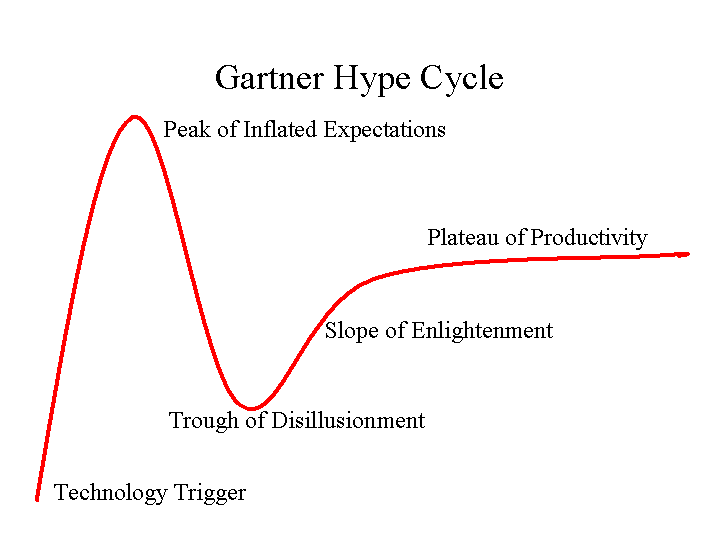

I learned my lessons on the Valley hype cycle early (from the source). In 1997, at the ripe old age of 32, I joined GartnerGroup with the goal of participating in a great research and advisory team. Well… that lasted about 11 months. I learned that there was no research and  their business model never broke away from its roots as a division of McGraw Hill. It was all about reporting, writing, buzz and sensationalism (with a very few exceptions .. Schulte/SOA). It was great fun listening to buyers of IT talking about new products issues and then meeting with the software vendors (with more information on hand then their product heads had) to watch them watching them turn green. But fun aside, I wanted to go run a business…. not become an industry analyst (this blog serves as an outlet for my minor competencies here).

their business model never broke away from its roots as a division of McGraw Hill. It was all about reporting, writing, buzz and sensationalism (with a very few exceptions .. Schulte/SOA). It was great fun listening to buyers of IT talking about new products issues and then meeting with the software vendors (with more information on hand then their product heads had) to watch them watching them turn green. But fun aside, I wanted to go run a business…. not become an industry analyst (this blog serves as an outlet for my minor competencies here).

The Gartner experience reinforced the importance of marketing in creating new products, of creating “buzz”. After all IT periodicals and research firms must fill their pages with something every week. Of course ISVs and start ups are happy to oblige… Buyers and Investors must be able to cut through the fog and assess business viability, valuation and risk. My data indicates that mobile payments is at the top of the hype cycle. I read the Nov 2010 Javelin report on mobile with great amusement: $7B in P2P mobile transactions in 2010!? I would be very surprised if the number broke $100M. Obviously the $7B number is driven by Javelin’s methodology, perhaps a mobile payment includes when I get an SMS message that my bank paid a bill….

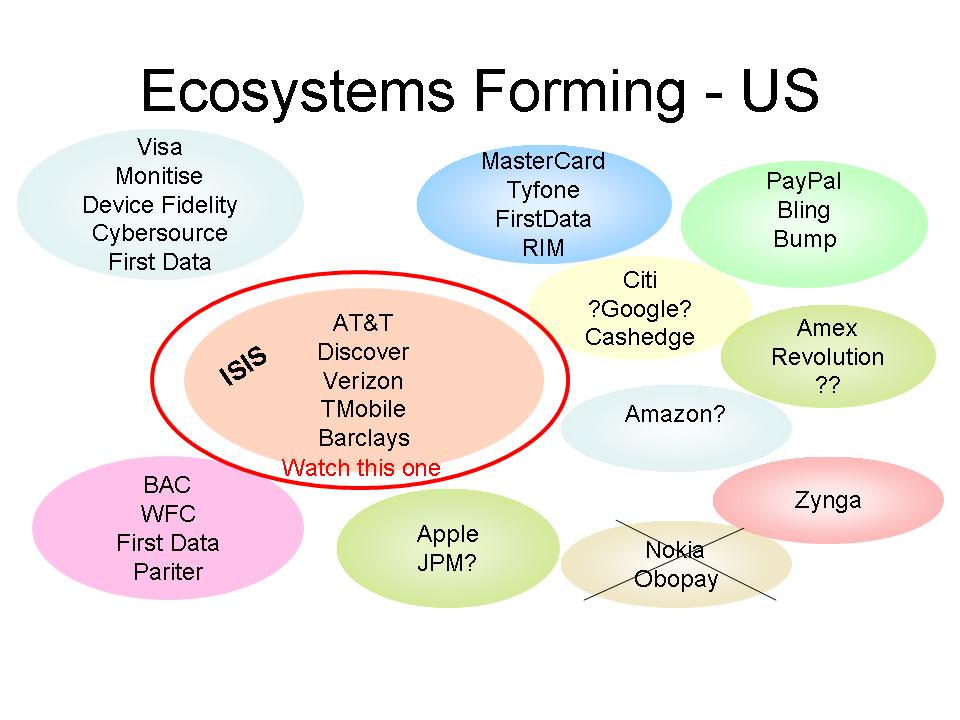

Javelin’s methodology obviously does NOT include looking at financial statements. If it had (and the $7B number were real), we would not have seen the continued bloodshed in the space. 2011 has been a rough start for mobile payments. Early bets in the space are running out of cash, and established industry players are placing $1B+ bets to compete with new MNO ecosystems. An industry status of early movers here:

- QCom pulling plug on Firethorn

- Citi/SKT exiting MMV

- Obopay’s CEO out, burned through $130M of capital, $4M in REV for 2010, exiting US market, Nokia to lead India (Obopay takes operations)

- Monitise (Visa’s primary bet in this space) had revenue of less than 5M GBP

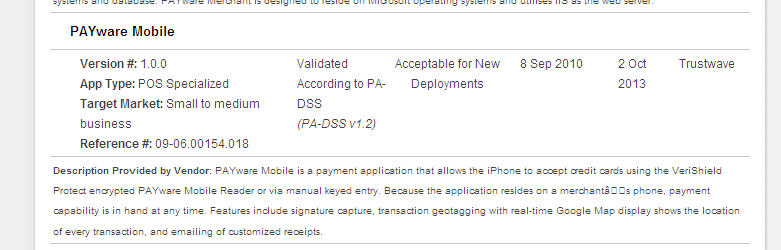

In every case above, there was complete failure in a value proposition. For Example, Obopay charging $0.50 to send money. The key lesson learned (over and over) is: small companies cannot LEAD development of a payment network. The industry is replete with examples which substantiate this point(see list here). Payment networks are 2 sided, and compete against well entrenched competitors with deep pockets. Payment networks must start with delivering value to 2 parties (ex PayPal Consumer to EBAY). Going at consumers alone (p2p) or as a bank partner alone (Monitise) will not drive volume. As Clayton Christensen asks in Innovator’s Solution: “what problem are you solving”? Moving money through a phone does not create value.

To be clear, there is a very real potential for mobile payments (and NFC) to be the driver 100s of new companys. But their business models must deliver value today (example NFC to unlock doors), or serve in a supporting role to new industry ecosystems. This supporting role requires a FUNDEMENTAL change in how valley firms typically operate: Start Ups must learn to work with and support multiple large companies and ecosystems. Supporting ecosystems is a B2C model.. NOT a direct to consumer model. This supporting role has new risks, as VivoTech (one of my favorite companies) has learned. Small Companies which support emerging ecosystems are challenged to influence their overall shape and value proposition. Further, if transaction volume is low, there is minimal revenue or pricing power without a clear value proposition (see Google/Boku).

New ventures operating within NFC ecosystems have prospect of attracting 30-50% of the $6B in mobile venture capital. Investors should be wary of hype and tag along investing as risk profiles are unique (ie NFC ecosystem play vs. consumer mobile app). Look hard at the talent running the company (see investors guide). Social networks are much different than payment networks. Payment networks require alliances, regulatory/risk acumen, understanding of history, experience and relationships (see key skills). Banks can win in the move to electronic payments. The top 5 US banks are in a much better position to influence ecosystem development (see lessons learned) than the mid tier, however the mid tier is in a much better position to partner (ex. Barclays US in Discover).

Deal of the Week

From a valuation perspective, the latest “head scratcher” in mobile payments is Square’s $27.5M raise at a $240M Valuation. From VentureBeat:

Rabois acknowledged, but he pointed out that Square is already achieving impressive growth without paying for traditional advertising or other promotions. He said Square is processing millions of dollars in transactions every week, and that it’s signing up 30,000 to 50,000 new merchants every month. Rabois said many of those merchants were previously cash-only, but they were attracted by Square’s ease-of-use (the card-reading device plugs into iPhones, iPads, and Android phones) and low financial risk

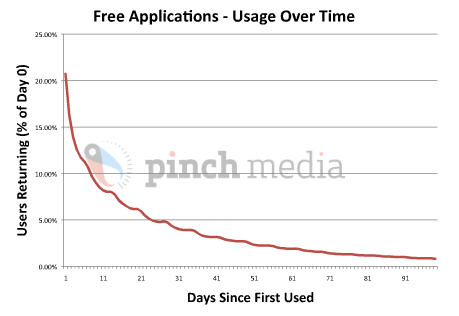

I estimate they are doing about $20-$30M TPV per week (5k users $5k/wk) this translates into revenue run rate of $6M/yr … which would equate valuation of $240M to 40x REVENUE. Square may have 30k downloads of their iPhone app /wk, but does that translate into transactions. This valuation is NOT based upon financials, but upon the people involved in this company. Existing investors took a bigger stake.. they have every right to set the price. This makes complete sense, particularly if they are looking for a Revolution Money kind of exit.