8 Feb 2011

I’ve had quite a few questions from start ups on this subject, so I thought I would address here. In the past few months we have seen press from Obopay on Star/NYCE integration that would allow for “instant” transfers, yesterday there was a press release from Cashedge/NYCE on the same subject. In my previous blog on Visa Money Transfers I discussed the top 2 fallacies: Instant and Mandatory. These same issues plague NYCE’s and Star’s PIN Debit “credit push”.

For the non-bankers, there are 5 basic payment networks that surround a typical US DDA account:

- PIN Debit/ATM (Interlink, Pulse, Star, NYCE)

- Signature Debit

- ACH (example The Clearing House, Jamie Dimon Chairman)

- FedWire (the US RTGS system run by the Fed)

- SVPCo (Check Images)

- Optional (ex. SWIFT, Western Union, …)

For further information see the FFIEC’s Examination Guide on Retail Payment Systems.

From a global perspective, we are quite a few years behind the UK and most of EMEA. While consumers in the UK can expect that 98% of domestic payments to clear in “real time”, most ACH “payments” in the US clear in the 3-5 day horizon. This blog is focused on “instant” payments. Important to note that the definition of “instant” is relative to both bank and consumer. For example, each bank has its own policy on funds availability and posting (vs clearing). A consumer could see funds posted to their account, but the funds may not be available for withdrawal. Other banks choose to show the consumers available funds to avoid confusion.

FedWire is a Real Time Gross Settlement (RTGS) system run by the federal reserve. Each bank in the US maintains funds with the federal reserve, and FedWire performs real time exchange of funds between member banks. Consumers and Commercial Businesses know of this service as a “wire”, and it is the only real time payment network in the US with universal adoption. FedWire Fees (~ $.52) are paid by the sending bank.

PIN Debit

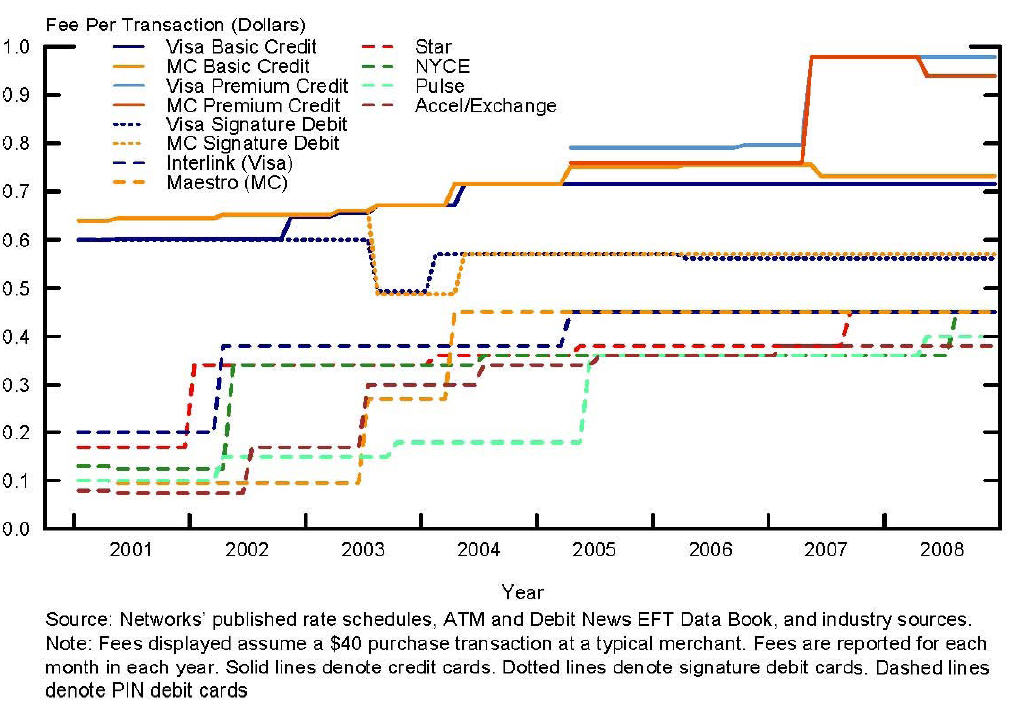

The other “real time” payments systems (surrounding a US consumer DDA) are PIN Debit and Signature Debit. PIN Debit Networks evolved from ATMs, connecting ATM nodes to bank run authorization  systems. Bank Authorization processes for PIN Debit/ATM systems are rather straight forward: validate the PIN and funds available (I emphasize this authorization process as it is key to understanding why a “credit” is difficult to process on this debit system). PIN Debit fees are typically paid by the merchant and average around 85bps + $0.10. For ATM use, banks control fees and can assess surcharge for use of bank or foreign ATMs.

systems. Bank Authorization processes for PIN Debit/ATM systems are rather straight forward: validate the PIN and funds available (I emphasize this authorization process as it is key to understanding why a “credit” is difficult to process on this debit system). PIN Debit fees are typically paid by the merchant and average around 85bps + $0.10. For ATM use, banks control fees and can assess surcharge for use of bank or foreign ATMs.

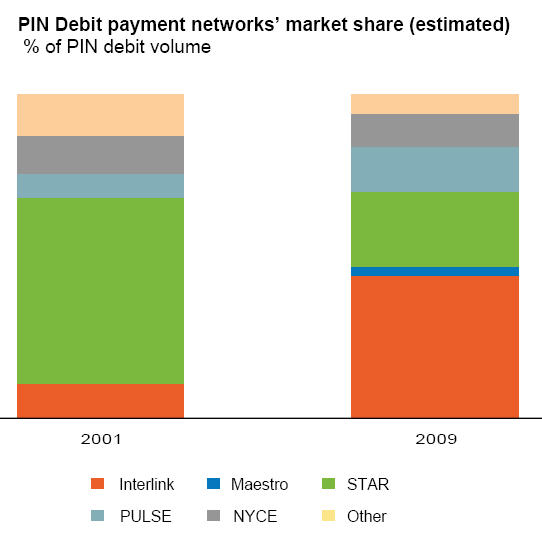

ATM Networks grew as groups of banks banded together to monetize ATM infrastructure, and further expand network into the retail POS. This expansion led to further change in structure, from bank ownership to independence. The driver of any independent network is to add volume, nodes and services. ATM Networks evolved into PIN Debit Networks, with Visa’s 1987 contract to operate Interlink serving as a key milestone. Today, Pulse is owned by Discover, Star by First Data, Interlink by Visa (these 3 make up over 83% of PIN Debit Volume).

PIN debit networks have been working to fill the real time “hole” in DDA payment services for many years. Star’s Expedited Transfer, NYCE’s A2A Money Transfer , Visa’s VMT all attempt to EXTEND their respective PIN Debit networks to handle credit transactions. In EVERY CASE, the networks must sell their members banks and get them to extend a PIN based network (which processed only debits in a simplified authorization process), into a funds transfer service. Who owns fraud? Compliance? Reg E burdens? Consumer Support? Returns? Reporting? Integration into online banking? Statements? .. yep the banks.. Oh and by the way.. the other “benefit” to a bank is that once you implement it you can forget about those expensive wire fees. The result of their efforts is what you would expect… VERY poor adoption.

Today, PIN debit networks are looking at a very bleak future. Signature and PIN debit rates will be moving to a flat fee of $0.21 as a result of the recent Dodd-Frank Act (pending completion of the comment period). As a result, my guess is that we will likely see consolidation and bank ownership of shared PIN network infrastructure as with any commodity payment service.

Signature Debit

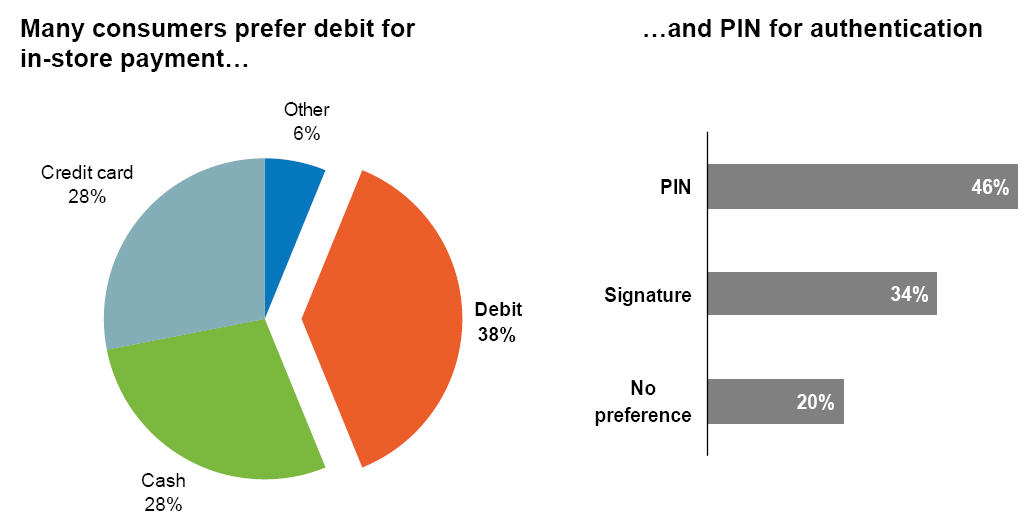

Signature Debit varies from PIN Debit in that it evolved from Credit Card (as opposed to ATM). Visa was and has always been the leader in signature debit penetration, a look back at this 2003 article provides much insight into the history here. Most US consumers today don’t understand why their debit card has both a PIN and signature feature… many books could be written on this subject alone… but oddly enough consumers prefer PIN (see Pulse Federal Reshttp://3dmerchant.com/blog/how-can-i-reduce-american-express-transaction-fees/erve Presentation 10/10).

In the signature debit model, transaction authorization is much more complex, with most banks leveraging either network shared infrastructure (example Visa DPS), or their credit card systems. The complexity arises as the lack of PIN requires the banks to risk score transactions in a manner akin to credit card (absent the credit risk). There are limited facilities for a credit transaction within most Signature Debit systems, and most relate to a merchant credit relating to a previous transaction (ex. Overcharge, returned merchandise). DPS, Mastercard IPS, and most other platforms perform usually perform a daily net settlement with member banks (multiple settlement files are sent throughout the day.. but netted just once) . Just as with PIN Debit, Signature Debit is also designed as a DEBIT ONLY system…

In VMT, Visa is attempting to enhance signature debit network into a quasi RTGS transfer service by leveraging its DPS hosting and authorization role. The QUASI is very important… as DPS, Interlink or any of the debit systems are “real time” ONLY in the instruction, NOT the Settlement. To suggest that any of these services are an actual RTGS system is a significant stretch of the imagination and thoughtful invention. A payment system cannot be faster than its underlying settlement system. The PIN and Signature Debit Networks DO NOT SETTLE, but rather depend on existing bank settlement processes (which are daily batch runs). The “message” to post or credit a transaction to the customer can be “instant” but the funds will not clear into the customers account until settlement occurs (dependent upon each bank’s policy).

What does this all mean for real time transfers in the US?

Only FedWire offers real time transfers between all financial institutions. All other solutions have sporadic coverage unless balances are held within the same institution (bank, paypal, … ).

How should you view NYCE, STAR, Visa “credit” Capabilities?

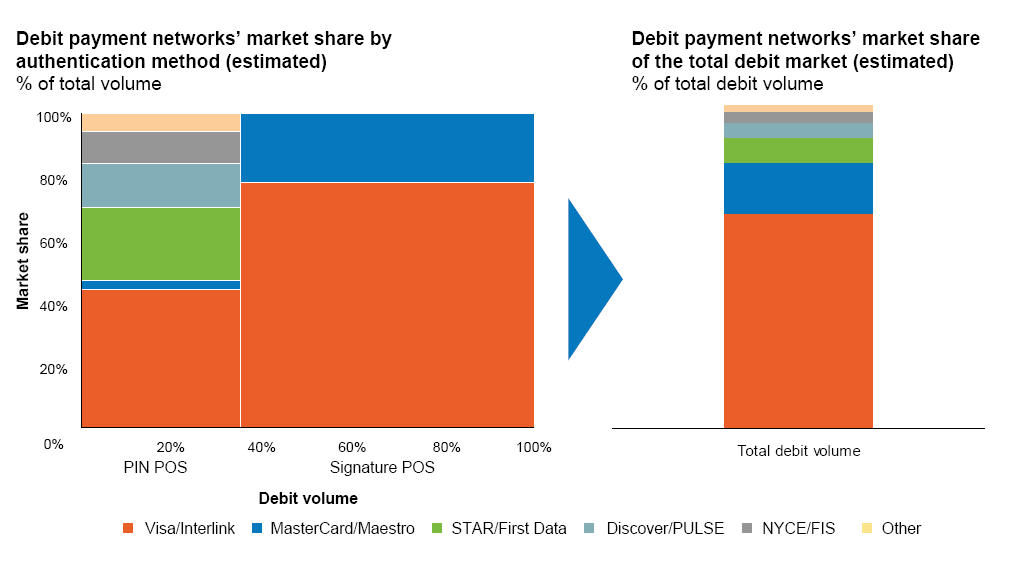

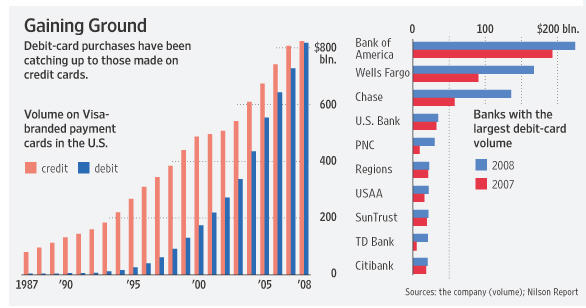

It works at some banks, with many provisions. I estimate that combined coverage of NYCE, Star and VMT “credit” covers less than 5% of all US deposit accounts. As you can see from WSJ graphic below, the top 5 banks account for 80%% of debit volume…. given that these banks have not adopted the credit services (in debit), there is little likelihood of success.

It is likely that independent PIN debit networks will go the way of Canada’s Interac… a bank owned service.

Messages for banks

Keep bank control of transfer facilities.. new services that give consumers real time transfers compete with wire, increase fraud exposure and enable rate hoppers… Why role this out today when you will likely get it from a bank owned network in 2-3 years.. ?