Category Archives: Uncategorized

CLOs where is your content?

MCX Wallet – QR Codes and Gemalto?

Rumor is MCX is going with a “Starbucks model” QR code payment mechanism. Gemalto is rumored to have won the wallet (… arghh why another one?).

There are many Merchant benefits to this approach, primarily it skips the entire bank owned payment network as QR codes are read directly by the ECR (IBM, Micros, Aloha, NCR, ..) with minimal hardware changes. MCX members with Loyalty cards (ex CVS) would be able to skip the phone based wallet and leverage common MCX infrastructure (cloud) to enable payment on loyalty cards.

Fraud infrastructure will be critical to the success of this approach. Retailers have tremendous historical data for loyalty card customers… but they really don’t know who their customers are. Banks are certainly able to help solve this fraud, identity and reputation problem. MNOs may also be able to add value here IF they move quickly (example Payfone would be perfect here).

Another story I heard was the Starbucks was a founding member of MCX, but then left. If this QR code approach is accurate, their departure makes sense.. as they are the team that paved the way for the success of this approach. Why would they throw their technology and standards away for something exactly the same?

The payment mechanics of all this certainly look good. However what will be the consumer value proposition? I hope this QR code can be ported to other wallets (let the customer decide).

Retailer CRM … enabled by ?Payments?

Question for the day: As a consumer goods Retailer, how do you build a CRM solution when you don’t know who your customers are?

Back in my Oracle days, Larry launched Oracle CRM. Quite frankly I was a little slow picking up “front office” back then. My areas of focus were: banking, supply chain, online stores, B2B businesses…. in all cases we knew our customers (although not always our prospects). At Citi we were much more focused in online acquisition and tuning the marketing funnel, we were able to improve performance 2x-4x by looking at where profitable customers were coming from and the costs to obtain them. Running sales teams helped me appreciate how wonderful a tool salesforce.com is… and of course my partner Peter Burridge (former CEO of Seibel Asia) and friend John Buchanan (founder/CEO of Retek) helped fill in many other “gaps” in my retail CRM understanding: demand planning, config management, merchandising, inventory optimization, behavior tracking, …

Customer Relationship Management “CRM” still has not clicked for me.. it is not an obvious “bundle”. Given $2.4T in retail sales, and $750B in US marketing spend.. isn’t it amazing that there is not more “structure” managing the customer in retail? Why? I believe itss primarily driven by a lack of KYC (know your customer). Not KYC the way bankers interpret it.. but just a basic understanding of who shops at your store. I was in a forum with the CMO of Gap and she said “I get at least 2 calls a week from start ups and I have bandwidth to do 2 things next year… one will be with someone big like Google… the other with someone that will help me use my data to better reach my customers”.

How can Retailers get to know their customers? The traditional solution has been loyalty programs (Colloquy is a great resource for industry data), however we are begging to see some significant innovation as the business models of Square, Google, Amex, MCX are all starting to shift to address this problem.

Example was given by Ken Chenault and John Hayes last month. Amex has a pilot going with Loyalty Partners (which it acquired in 2011) in Europe. Retailers contribute their line item data to Loyalty partners and then they are able to couple it with issuer data for both analytics and targeted marketing/incentives.

Targeting individuals based on hard data (ie beyond the website you visited), and getting feedback on marketing effectiveness (actual purchases) is the holy grail of marketing. Don’t think of Amex’s activity as payments, think of it as helping retailers execute a CRM strategy. Card linked offers, prepaid offers are fundamentally broken.. they only solve a yield management problem … while destroying brand and pricing. At the end of the day CLOs and PPOs don’t build loyal customers and reinforce price as the central decision point.

By helping Retailers know their customers, Square/Amex/Google are tackling a VERY BIG problem. These are not the only companies.. my bet is that we will see a wave of participants:

- Banks work to extend payment networks,

- Retail CRM providers extend software,

- Loyalty systems (like Catalina) work to extend services, and

- Retailers build new ad/payment data networks (MCX)

- Advertisers extend to POS integration

- …etc

This is a VERY VERY big wave with tremendous implications for big data, marketing, advertising, enterprise software, privacy…

What should we call this wave? Enabling retailers to know who their customers are? Would you give up your anonymity for real value? Would you allow an advertising agent to take bids to reach you? Think of yourself as a professional athlete.. sponsors lining up.. What is the price of your loyalty? Is this where Amazon Prime is today?

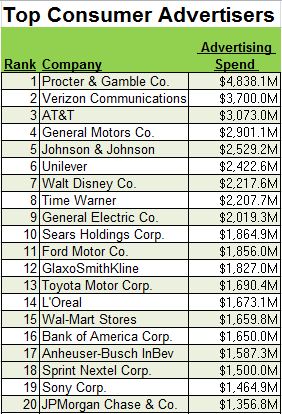

If retailers and CPGs could focus marketing spend ONLY on relevant customers, just imagine the impact to other advertising channels.. no more free TV? no more billion dollar Olympics?

Happy Thanksgiving.

New Blog location

blog.tomnoyes.com

This blog will still remain active, as the archive of 390 past notes.. new postings will be on both sites for the next few months.. but at start of the year all new posts will only go on above.

I’ve moved the blog over to Amazon EC2 in an environment I can control. Quite frankly I was a little frustrated over the layout restrictions and limitations on putting in Google Analytics.

You can start signing up now.. your feedback is always appreciated.

Future of Retail… ?

26 September 2012

(apologize for typos in advance.. send corrections to my editorial staff)

In last 2 weeks, I was with a fantastic group of payments people: execs, investors, innovators, advisors, speakers… It struck me that most of the people in payments have been in the industry for quite sometime.. just as the execs in telecom have stayed in that industry… likewise with the execs in retail. There is very little cross pollination of talent across industries. Thus ideas and innovation is very “biased” toward a market understanding of the company which is guiding it. Sure business heads can bring in a consulting group like McKinsey to help them build an informed strategy, but the pace of change in mobile, payments, advertising, social, …etc has put the real cutting edge of innovation inside companies.. not within consulting groups. One reason: if any consultant had a really great understanding of the market and a new idea they would go start a company… after all the investors are willing and the personal wealth equation is much better.

Today’s thought for the day is Retail. I’m certainly no retail guru.. back when I was at Oracle (98-02) our ERP suite was much more geared toward discrete manufacturing with Cisco, Sony, Motorolla, TSMC as some of my key accounts. In banking I can only recall one direct retail conversation, it was with Jane Thompson (former CEO of WMT Financial Services, now a good friend) her team came to visit Charlotte and I can still remember someone asking WMT what they thought the right rate of interchange should be. Their answer: 0%.. all the bankers laughed… but then we suddenly stopped when we realized WalMart wasn’t joking.

Over the last few years I’ve taken a crash course in retail, both through my time with Google and with people like John Buchanan (former founder and CEO of Retek)… I have new respect for the world of Retail. Certainly one of the toughest business I have ever touched. Many of my thoughts about retail, and investment hypothesis, were laid out back in January – Remaking of Commerce and Retail.

During my meetings this week, I was struck by the biased views in the room. For example, contactless will take off because it is part of the Visa mandate to retailers (see this week’s EMV blog), obviously the bank issuers were not aware that the top retailers are moving only with Chip and PIN.. not contactless. Why is information here so poor? Well it is certainly not in Visa’s best interest to advertise it… and the banks have other things to do.

Another example is Card Linked Offers (CLO); assume you own a brand restaurant like Applebee’s .. do you want to discount your food 10% every week to every customer? Of course not! What these restaurant chains want is customers.. loyal customers.. just like any business. Yet they are being approached by 6-10 CLO start ups every week for a “deal”. Its like no one ever heard of CRM… No retailer wants to compete on price.. they want to compete on quality, brand, experience.. they want to move away from price as the basis for competition. Sure some retailers do want to manage excess inventory, or a loyalty program (see LevelUp), or mark downs, but they don’t want to compete on price.

Reid Hoffman is a brilliant investor, but I shake my head at the thought of the Card as the next App Platform (see Forbes Article). Why? Well card companies have no understanding of what you bought (item level information).. only your merchant preference. One other piece of information (sorry for the repetition here), retailers spend very little of their own money on marketing.. it is manufactures that spend the ad dollars.

So this results in a CLO focus on Restaurants and Services.. both of which are require tremendous execution in hyper-local sales. Ask Groupon how easy that is.. but its worse for CLO companies as a basket level discount offered through a card is not performing as well… due to brand, value, redemption experience, …

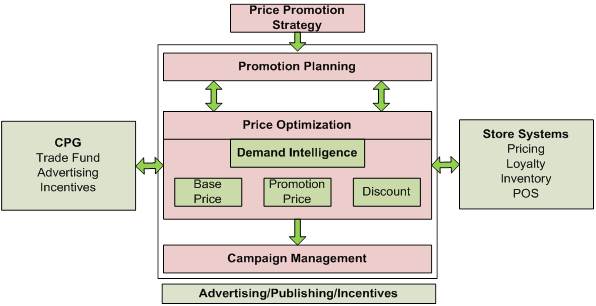

Retailers have a CRM strategy… believe it or not they have a price promotion strategy as well with digital, direct, and mass media components. Retailers want customers.. but not at any price, and certainly in support of their brand (one of the few things they have left). When I look at any “offer” or “payment” company, targeting physical retail, I look at how it can fit within a Retailer’s existing business model. How can X improve Y’s execution. Good news is that there are 100s of opportunities out there.. as advertising is fundamentally broken for most retailers. As a corollary… PAYMENT IS NOT BROKEN.

Key questions I ask

- Customer Acquisition

- Customer Loyalty

- Distribution of Incentives (reaching customer where they are)

- Brand impact – improve retailers brand or not? Is it white label?

- Consumer Value

- Consumer Experience (Acquisition, In Store, Checkout, Support, …)

- Merchant Value/Cost

- Impact on Retailer Competitive Dynamics (ex increase price competition?)

- Require change in consumer behavior

- Flexibility (one flavor for all..? )

- Existing footprint

- Privacy/Data Protection (likely to change substantially)

- Data flow/participation by key participants

- Value shift (ex. From Mass media to targeted)

- … I could go on (see the NRF.com or Shop.org for more details here)

Retailers all have very distinct strategies.. after all its very challenging to sell a commodity good based on anything but price. For example CVS has the top loyalty program in the country. They certainly don’t want to throw it out the door for someone else’s … their loyalty program manager is Catalina… one of the best data analytic companies in the world, run by former CEO of DoubleClick and meshed with Neilsen. Take a look at their participation in something like MCX. My guess is that they will want to enable payment on their CVS loyalty card.. to make it operate like Target’s Red Card. They don’t want PayPal running it.. or Visa… they want to run and control it themselves. MCX will provide dumb pipes (low cost payment routing/clearing) to a smart loyalty program. This goes to my last bullet above: Value Shift… If retailers are smart they will realize that their decisions on data are far more important than their decisions on payment. Data is key to orchestrating value.

For physical retailers to succeed the orchestration of value must move from a focus on price competition. A challenge for Retailers is that Orchestration requires a network… primarily a demand generation (advertising) network (although orchestration could also include other like: entertainment, custom manufacturing, …etc). What else can physical retailers do? What does the future of retail look like? Well the NRF just completed its conference on the subject so you should chat with some of the attendees. My answer is that the market is: ripe, highly complex, heterogeneous, with privacy and data as key.

My actionable recommendations to Retailers:

- Start with demand generation, consumers that do not currently shop with you

- Ensure your partner emphasized your brand front and center

- Find a Partner either IN CONTROL of the consumer experience (Apple/Google) or one that already has massive consumer adoption (ie Facebook).

- Focus on creating a fantastic customer experience from end-end

- Minimize the number of partners involved

- Throw out partners that don’t know how to manage campaigns, data or your business

- Have a plan “post acquisition”.. how do you retain them?

- Ensure your partner can reach/influence consumers WHERE THEY ARE.. not where you want them to be. Email address is not influence

[youtube=http://youtu.be/t49JkakYAoE]

Fantastic must see from Tesco Korea if you haven’t seen their virtual subway store

PayPal at POS – Take 4

24 September 2012

Previous Blog – Paypal at POS

Just met with an institutional investors who was really high on Paypal @POS.. here is his recap of Paypal’s pitch:

Amazon is the enemy let me help you compete with them. We can help you with our marketplace to position your product, with our payments to pay for it, with GSI to help you distribute your orders and manage it for you, with our new tools to help you engage the customer before or during their [physical] shopping. We don’t want to compete against Visa, we want to help you compete against Amazon.

Price?

– 180bps for payment

– 9% of sales on eBay marketplace

Wow what a great deal.. no wonder they have 6 sales people working full time on it at PayPal. I asked Fred how this works for JambaJuice or HomeDepot neither of which do much online sales..

Here are 4 scenarios… let’s see if PayPal works in any of them

1) Best Buy. $1000 big screen … but only $800 on Amazon

2) Home Depot. 8 2x4s, 5 bags of mulch and a new drill

3) Restaurant

4) Grocery store.

Scenario 1 – Best Buy

How did the customer decide on the product? Did the customer go into best buy to see it? Did Best Buy’s team influence the customer in the sale?

If the customer has decided on the product independent of best buy it will be hard for any retailer to win them separate from price. PayPal can’t possibly help BestBuy on price, actually its online marketplace competes with BestBuy.. as many other merchants sell there too. Does BestBuy really want it’s brand in the eBay flea market? Doesn’t a manufacturer direct model make more sense here? What value is Best Buy bringing?

It would also seem very difficult for eBay to help BestBuy EVER compete on price, particularly when it is charging 180bps for payment and up to 9% in sales fees (http://pages.ebay.com/help/sell/fees.html) for its marketplace.. It is actually 4x the cost of Visa.

The only circumstance I can identify, where eBay can assist in sales, is when a customer is searching for a product, and BestBuy has the lowest price, will they be able to assist. However, consumers don’t leverage eBay for price comparison shopping.. they use other tools like Google particularly when looking for merchandise in a nearby physical store (see Google Local Support).

Can eBay assist in guiding a consumer to a product? Keys are content, touch and brand. Do consumers normally go to eBay to research products? Do consumers normally trust the eBay brand to give them good shopping recommendations (online and offline)? Again I don’t see how eBay or Paypal can play in the shopping experience until a consumer has selected a product. If selection is made what services do they have to help in completing the purchase? A: Payment… However payment does not drive product selection or purchase decision, it is a just the last phase of a long process.

Could Paypal uniquely deliver incentives to the consumer during the product selection process to influence them? sure… so could Santa Claus and ShopKick (both equally real) .. but this is not what PayPal does today so PayPal must first build credibility to establish a NEW customer behavior pattern. Paypal today does not do advertising, they do not do physical POS purchases, nor do they do enterprise sales, … in general consumers just don’t care about the PayPal brand off line. Sure, Paypal could invest to establish itself in each of these areas. But these are not trivial investments, it takes tremendous marketing investment to change consumer behavior. Little Square ($8B TPV) has more than 8x of PayPal’s POS volume… which today is primarily driven by their Masterdcard debit (only works against a balance with PayPal).

I was planning to go through 3 more scenarios.. but what is the point? How can PayPal help any physical merchant? eBay’s only asset here is a consumer account.. they may make the point that 100M consumers have a PayPal app loaded on their smart phone.. well that does not equate to usage for payment (rather balance checking)… and it certainly does not equate to usage for shopping.

Top 20 retailers take the view ” we just won Durbin.. we have $0.21 payments… we can steer… why on earth would we want to accept any other form of payments and confuse customer, or our efforts to encourage debit?”

Neither PayPal nor eBay drive sales of traditional retail. For small retailers they are a hero.. giving massive distribution to unique goods. To traditional retailers: they are a flea market that further dilutes your brand and puts emphasis back on price.

Why are retailers playing in the sandbox with paypal.. ? A: To experiment (at someone else’s expense)..

I’m open to comments..

Footnotes. Based on 2012 reporting earnings

- Marketplaces on average charges 9% commission on transaction volume (for 2011, 10.4% in US and 8.2% International). Volume sellers will receive discount (could be 20% or higher) on final value fees (and other fees).

- PayPal Regular rate is 2.9% + $0.30/transaction, can go down to 2.2% + $0.30

Interpreting Square-Starbucks Deal

18 August

From Press Release, key deal points are:

- Customers will be able to use Pay with Square, Square’s payer application, from participating company operated U.S. Starbucks stores later this fall, and find nearby Starbucks locations within Square Directory;

- Square will process Starbucks U.S. credit and debit card transactions, which will significantly expand Square’s scale and accelerate the benefits to businesses on the Square platform, especially small businesses, while reducing Starbucks payment processing costs;

- Using Square Directory, Starbucks customers will be able to discover local Square businesses — from specialty retailers to crafts businesses — from within a variety of Starbucks digital platforms, including the Starbucks Digital Network and eventually the Starbucks mobile payment application;

- Starbucks will invest $25 million in Square as part of the company’s Series D financing round;

- Starbucks chairman, president and CEO Howard Schultz will join Square’s Board of Directors

My interpretation: Starbucks is selling their customer base to Square for a revenue share and an equity upside.

- Square is buying the Starbucks payment user base, with all stored “reload” cards. This customer directory will move from Starbucks to Square and support both legacy Starbucks payment and enable all Starbucks customers to be “PaybySquare” capable with acceptance of new terms. Square is “processor” in the sense that it is now responsible for pre-paid balance and reload.

- Its about DATA.. payments will be free (for Starbucks), and SBUX hopes to enable Square incentives that are BOTH loyalty and line item based. Square’s driver is to find a way to monetize Starbuck’s payment and location data before it gets to Chase PaymentTech. This means increasing consumer network so that it can make better case to prospective merchants.

My guess is that Square is processing payments at no costStarbucks is paying a lower overall cost for payment acceptance through Square/ChasePaymentTech for all existing Starbucks customers, and will actually PAY Starbucks (revenue share) for any ad revenue they can generate from Starbucks customers. There are 3 consumer transaction tranches: Starbucks mobile payment, Starbucks card, and Pay with Square (Square Register). All will go through Square so they can use the data. - Starbucks will start to roll out a new service: SquareRegister (pay by voice, see my previous blog). This will eventually replace the bar code if all things go well. Again, my belief is that Square will bear all of the cost here.

Revenue implications?

Short term there is no revenue upside for Square in this deal, it is about growing network (primarily on consumer side). Starbucks will see costs decline slightly and open up a new revenue channel by monetizing its consumer network outside of its stores. I have some thoughts on precise numbers, but making my own bets right now so I can’t share them.

Random Thoughts: Settlement, NFC and CLO

16 July 2012

Retail settlement

As most of you have read a $7.25B settlement was reached with some US retailers (led by Kroger, Safeway, Payless, Rite-Aid). I’m not going into depth on the settlement but rather the likely response by retailers, and potential impact on Visa/MA earnings. The big retailers have been assuming that this settlement would be reached and have been in the midst of a plan. What would you do if someone was taking 3% of your sales and your average profit margin was 2.4% (ref page Aii IMAP Study)? Well the retailers have plans to leverage a portion of this $6B windfall and invest it in a payment network they can control. Perhaps they should turn around and buy Discover (DFS market cap $18B). This rumor has been in the market (perhaps a driver of 2012 performance).

The US has 2 other countries which serve as benchmarks for a shift away from credit card at POS: Canada (Interact – debit launched 1994) and Australia (EFTPOS). Unfortunately I have limited information on Visa/MA transactions in these geographies to generate a decent analysis of spend shift. From http://www.interac.ca/media/stats.php we see in Canada that roughly 80% of all retail card present transaction are done via Interact (2011 GDV was $182B). I’m not implying a 40% hit to Visa’s GDV is imminent (US is $507B out of global $956B GDV for quarter 31Mar12), particularly since there is no competing network like Ineract (YET). But there are certainly references for success.

I presented some of the Retail Drivers last week and also in my March post (Retailer Wallet). My bet on retailer plans? Well Retailers are not exactly a small group marching in unison, so response will likely differ by segment, ticket size, purchase type (ex non-discretionary gas) and influence.

Gas/Automotive

- Credit card use fee in 2-4 months nationally

Grocery

- Slower roll.. we will see marketing to inform customers of the costs of credit and plans to implement a fee for use of credit cards

- We will also see tests of fees in isolated stores/geographies. Not only assessing customer issues, but also competitive responses.

- Loyalty cards that will be integrated into a payment system

- Loyalty cards that have integrated digital wallet (WalMart issued a Digital Coupon RFP over 18 months ago).

- Incentives dependent on payment type

- Push for PIN Debit.. as it allows the retailer to route away from Visa/MA directly to the bank.

Big Ticket Retail

- No fee likely as they benefit from access to consumer credit

- “Carrot Trials” of Rewards programs and targeted offers will be contingent on payment type

- New loyalty cards

Apparel / Luxury

- Least likely to implement a fee.. wait for other stores to establish customer behavior.

Travel/Entertainment

- No fee likely…

- Discounts for debit, particularly with airlines.

NFC

I’m still just laughing at the mainstream press’ reaction to Apple iPhone 5 plans. Perhaps I should crying at the disinformation that mobile payments (at POS) are taking off. Everyone should ask: what kind of mobile payments?… Transit/ticketing is a slam dunk for NFC technology, yet NFC is having problems (witness London TFL’s decision to defer). Other mobile payments segments which are doing quite well: mCommerce with Amazon reporting around $2B, Digital goods with Zynga leading the category around $1.2B (investor relations).

But the mobile payments at the physical POS? This has not even started. (update.. Starbucks is clear leader here)

I don’t know how much more bluntly I can educate the NFC aficionados, but retailers have not gone gaga over mobile POS payments.. In fact I will state that Payment is not the killer app for NFC.. payment delivers NO VALUE to the Retailer.

For all of you looking at Apple’s patents and thinking they will eventually put NFC in… here is news for you: every one of the patent claims could be fulfilled by Bluetooth (replacing NFC). In order for NFC to take off, the carriers must let go of control (see my long blog here on MNOs walled garden strategy). There is nothing wrong with NFC technology, but unless the carriers are willing to front all investment for retailers, consumers, marketing , … this will never take off. There is a value proposition problem (payments only) AND a control problem. The US MNOs won’t even work with Google who has built everything for free.. free is not good enough for them…. They want control…

Card Linked Offers

I have new stories of just how bad the open rates are on these offers, but most revolve around a central problem. It goes something like this

1) Banks want to get consumers interested in offers. The consumer experience is TERRIBLE (no discount on the receipt) and banks are experimenting with 3 types of distribution. Integrated into online banking (Bank of America), e-mail, and secure messaging.

2) Retailers are not buying basket level discount advertising.. they never have. Retailers must pay for the offer (15% back), the revenue share (% of margin) AND the tax on the offer since it is technically treated as a retailer rebate. Total Retail cost for the offer is approaching 25%.

3) Given lack of retailer participation, Banks (and the offer companies) are thus forced to create offers themselves with no retailer participation (see my WalMart Story)

4) Banks do not want to let consumers go with “no offers” so all available inventory is distributed to “everyone”

5) The poor targeting (universal distribution) has a twofold effect: Consumers see garbage offers and start to tune out the channel, retailers see poor lift in performance as the offer redemption is done by existing customers that would have normally come to store

I could go on.. the exception to the rule of CLOs is Card Spring.. I like them quite a bit. Also Linkable just purchased the assets of Offermatic, which will enable them to link offers across card networks (using Yodlee)..

Nokia and MSFT: 2 Mobile Turkeys?

Today’s WSJ Article

http://online.wsj.com/article/SB10001424052702303822204577465771376539532.html

My detailed analysis in April

http://tomnoyes.wordpress.com/2012/04/11/nokia-apple-android-and-the-stage-4-value-shift/

Rumor is that when Google’s Andy Rubin was told Elop spurned the Google opportunity he responded: 2 Turkeys don’t make an Eagle. Nokia is a tremendous engineering organization, just like RIM was, and Apple still is. What sets Apple apart? Marketing Genius and business planning that DRIVES engineering (not the other way around). When the “value” equation shifts from feature/function to “experience” engineering is stuck.. as few companies can lead the vision that excites customers.

Elop needs to be taken out.. 92% of Nokia’s value has been destroyed … he has led them toward a huge miss in perhaps their last opportunity to restructure. What a shame. There are many growth opportunities in this market where Nokia could compete (if they still have any of those great engineers left). However the current path for Nokia resembles a HTC style contract manufacturer that only builds Windows phones (and low cost handsets for emerging markets).

What would I recommend? something distruptive.. leveraging existing handsets. Example:

– Leverage MSFT and Skype to create solid urban phones no longer dependent on carriers. Enable local wi-fi providers to be paid for their bandwidth in early stage to encourage them to set up stations. Create integrated backhaul to ensure that the ISP Carriers to not influence pricing.

– Integrated Retailer. Big stores are a black hole for bandwidth… retailers don’t want to enable 3g/4g services as consumers only use it for price comparison (a slight exageration). How can Nokia/MSFT create integrated retail experiences.. example femtocells in all retailers (Samsung is market leader here), integrated into new mobile POS systems (MSFT does own RetailDynamics) and some new ad platform.

– Integrated Home.

– Integrated Auto.

Thoughts appreciated.