Winners: Consumers, Merchants, Banks, Networks and Affirm

Losers: Branded PayPal and Venmo

Apple’s WWDC is on Day 2. Today we will see significant enhancements to ApplePay and Wallet in forthcoming iOS18 (to be released this fall). Here are the highlights in order of impact.

1 – ApplePay in eCom

ApplePay will be supported in every browser. This will be a game changer and dramatically increase payment volume flowing through Apple wallet (and their platform). Just last week, the WSJ published a great piece on why retailers hate that consumers make large purchases on their computers. Apple will expand ApplePay to support all browsers AND provide a major upgrade in experience, security and fraud.

Beyond the payment, Apple will improve fraud and create a new role in the payment flow. The new browser flow will use ApplePay in your phone as a second factor of authentication. Leveraging the secure token provisioned by your bank and your biometrics, all wrapped in Apple’s platform security. Beyond security, this also enables Apple to use the provisioned token in the phone vs the card stored in your browser. Those who set up their Mac to use ApplePay had issues synchronizing their cards between iOS and MacOS. The reason wasn’t Apple; instead, Banks only wanted to provision cards to phones (not laptops and browsers).

As a side note, Apple only earns wallet fees for cards provisioned in their phones, so this flow solves that problem, too.

For frequent blog readers, the added benefit is that Apple has constructed an alternative for network 3DS (see blog). In Europe, there is a regulatory requirement for Secure Customer Authentication involving a second factor. 50% of EU merchants have opted out of the bank 3DS flow. Now, Apple provides SCA-compliant security for either 3DS or merchant-owned risk flow. Apple’s efforts here will certainly help justify their fee.

Side note. Apple’s services are optional for both merchant and issuer. The merchant can decline to accept ApplePay, and the Bank can choose not to accept Apple’s step up phone authentication. But given that Apple is “first” in the consumer flow, it will be a VERY bad experience for consumers to have two step up requests in the same checkout session.

I estimate ApplePay eCom’s market share to be around 3% of GDV today; this will set them on a bath for 20% + in the next three years. This is very bad news for PayPal

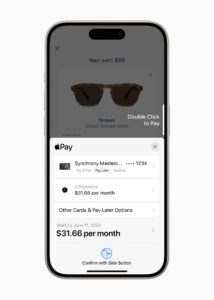

2 – BNPL for Every Card

Apple will add two additional features to every card in your wallet (with Issuer support). Pay later (installments) and pay with points. Apple is NOT using either networks’ installment products; instead, they created a new Apple scheme. This is a very big Ollive branch to banks from Apple. Rather than creating their own BNPL, Apple has enabled every bank to do so from their existing card relationship. This is just brilliant and a great thing for all banks.

My first thought was, “US banks will never take part.” While Issuers will love the card engagement (rewards and empowering cards to compete in BNPL), it is through Apple’s interface. I was surprised to be wrong. Citi and others are participating.

“The ability to redeem rewards for a purchase with Apple Pay will be available beginning in the U.S. with Discover and Synchrony and across Apple Pay issuers with Fiserv. The ability to access installments from credit and debit cards with Apple Pay will roll out starting in Australia with ANZ; in Spain with CaixaBank; in the U.K. with HSBC and Monzo; and in the U.S. with Citi, Synchrony, and issuers with Fiserv. Users in the U.S. will also be able to apply for loans directly through Affirm when they check out with Apple Pay.”

This is a hit to Mastercard’s BNPL program (see blog). Mastercard settlements had numerous issues; at the top of the list was the 325bps premium fee and the ability for merchants to opt-out, which all major merchants did.

If that wasn’t enough, Affirm is in the new scheme. I believe this will be a windfall for Affirm and regular consumer use. Most banks will be challenged to push out this feature by the fall. Leaders in this new experience will be Affirm, Citi, and Cap One. I see other issuers as late followers in 2025.

3 – AppleCash in P2P – Tap to Cash (Modernized Bump payments)

AppleCash will be the center of 2 new P2P experiences. SMS-based payments and Tap to Cash.

The Tap to Cash CX is just amazing and visually cool. No more QR codes or NFC close proximity smacking of phones together. This uses Airdrop. You can pay anyone close. I really like this… and see strong potential for use, given how much better the experience is than Venmo’s QR. I would love to see Apple add some kind of sub-account functionality to Apple Cash (for example, food, rent, and fun), as this is how GenZ uses Venmo.

This is another hit to PayPal in Venmo. I project we will see TPV impact in 18 months. As Venmo institutes new fees, I think we will see a mass migration. Apple’s card-based cash account is usable in eCom, POS and P2P. The experience is the same as the rest of your accounts. Venmo needs a Venmo-enabled merchant.

4 – Tap To Provision

One of the most significant fraud issues in wallets is the provisioning process. Fraudsters have been able to leverage stolen bank credentials. Many top issuers have under-invested in fixing provisioning (just as they have done in making 3DS work). Tap to provision solves multiple problems. Now, users must be in physical possession of their card AND direct their bank to provision (within a bank authentication scheme) AND 3rd party fraud screening (Prove is the leading provider here).

The customer experience from a consumer perspective is dramatically improved with a card tap vs a 16-digit PAN entry.

5 – Drivers Licenses, Ticketing .. and more

There are many more Apple Wallet features coming in iOS 18 this fall. Kudos to the Apple team. Great work.

Note to banks. Create great experiences on the platforms your customers use today. The only thing you’ve lost in this release is control of the UI. Apple did not roll out any bank services to take away your customers. They enabled your customers to do more WITH YOU in their platform. Enemy? Come on!

Thank you Tom. How do you mean here “Affirm is the new scheme”. Are they not just another financing option for the consumer at checkout via the apple rails?

no. See blog on Visa’s new Flexible credential (https://blog.starpointllp.com/?p=6571)

Pricing for Affirm (as issuer of credential) can be bi-lateral.. it can run under any price that affirm and merchant agree to. FOr instance Peloton wants 0% financing and pays 8% MDR.