Tag Archives: WMT

Private Label.. “New” Competitive Environment?

Random Thoughts: Settlement, NFC and CLO

16 July 2012

Retail settlement

As most of you have read a $7.25B settlement was reached with some US retailers (led by Kroger, Safeway, Payless, Rite-Aid). I’m not going into depth on the settlement but rather the likely response by retailers, and potential impact on Visa/MA earnings. The big retailers have been assuming that this settlement would be reached and have been in the midst of a plan. What would you do if someone was taking 3% of your sales and your average profit margin was 2.4% (ref page Aii IMAP Study)? Well the retailers have plans to leverage a portion of this $6B windfall and invest it in a payment network they can control. Perhaps they should turn around and buy Discover (DFS market cap $18B). This rumor has been in the market (perhaps a driver of 2012 performance).

The US has 2 other countries which serve as benchmarks for a shift away from credit card at POS: Canada (Interact – debit launched 1994) and Australia (EFTPOS). Unfortunately I have limited information on Visa/MA transactions in these geographies to generate a decent analysis of spend shift. From http://www.interac.ca/media/stats.php we see in Canada that roughly 80% of all retail card present transaction are done via Interact (2011 GDV was $182B). I’m not implying a 40% hit to Visa’s GDV is imminent (US is $507B out of global $956B GDV for quarter 31Mar12), particularly since there is no competing network like Ineract (YET). But there are certainly references for success.

I presented some of the Retail Drivers last week and also in my March post (Retailer Wallet). My bet on retailer plans? Well Retailers are not exactly a small group marching in unison, so response will likely differ by segment, ticket size, purchase type (ex non-discretionary gas) and influence.

Gas/Automotive

- Credit card use fee in 2-4 months nationally

Grocery

- Slower roll.. we will see marketing to inform customers of the costs of credit and plans to implement a fee for use of credit cards

- We will also see tests of fees in isolated stores/geographies. Not only assessing customer issues, but also competitive responses.

- Loyalty cards that will be integrated into a payment system

- Loyalty cards that have integrated digital wallet (WalMart issued a Digital Coupon RFP over 18 months ago).

- Incentives dependent on payment type

- Push for PIN Debit.. as it allows the retailer to route away from Visa/MA directly to the bank.

Big Ticket Retail

- No fee likely as they benefit from access to consumer credit

- “Carrot Trials” of Rewards programs and targeted offers will be contingent on payment type

- New loyalty cards

Apparel / Luxury

- Least likely to implement a fee.. wait for other stores to establish customer behavior.

Travel/Entertainment

- No fee likely…

- Discounts for debit, particularly with airlines.

NFC

I’m still just laughing at the mainstream press’ reaction to Apple iPhone 5 plans. Perhaps I should crying at the disinformation that mobile payments (at POS) are taking off. Everyone should ask: what kind of mobile payments?… Transit/ticketing is a slam dunk for NFC technology, yet NFC is having problems (witness London TFL’s decision to defer). Other mobile payments segments which are doing quite well: mCommerce with Amazon reporting around $2B, Digital goods with Zynga leading the category around $1.2B (investor relations).

But the mobile payments at the physical POS? This has not even started. (update.. Starbucks is clear leader here)

I don’t know how much more bluntly I can educate the NFC aficionados, but retailers have not gone gaga over mobile POS payments.. In fact I will state that Payment is not the killer app for NFC.. payment delivers NO VALUE to the Retailer.

For all of you looking at Apple’s patents and thinking they will eventually put NFC in… here is news for you: every one of the patent claims could be fulfilled by Bluetooth (replacing NFC). In order for NFC to take off, the carriers must let go of control (see my long blog here on MNOs walled garden strategy). There is nothing wrong with NFC technology, but unless the carriers are willing to front all investment for retailers, consumers, marketing , … this will never take off. There is a value proposition problem (payments only) AND a control problem. The US MNOs won’t even work with Google who has built everything for free.. free is not good enough for them…. They want control…

Card Linked Offers

I have new stories of just how bad the open rates are on these offers, but most revolve around a central problem. It goes something like this

1) Banks want to get consumers interested in offers. The consumer experience is TERRIBLE (no discount on the receipt) and banks are experimenting with 3 types of distribution. Integrated into online banking (Bank of America), e-mail, and secure messaging.

2) Retailers are not buying basket level discount advertising.. they never have. Retailers must pay for the offer (15% back), the revenue share (% of margin) AND the tax on the offer since it is technically treated as a retailer rebate. Total Retail cost for the offer is approaching 25%.

3) Given lack of retailer participation, Banks (and the offer companies) are thus forced to create offers themselves with no retailer participation (see my WalMart Story)

4) Banks do not want to let consumers go with “no offers” so all available inventory is distributed to “everyone”

5) The poor targeting (universal distribution) has a twofold effect: Consumers see garbage offers and start to tune out the channel, retailers see poor lift in performance as the offer redemption is done by existing customers that would have normally come to store

I could go on.. the exception to the rule of CLOs is Card Spring.. I like them quite a bit. Also Linkable just purchased the assets of Offermatic, which will enable them to link offers across card networks (using Yodlee)..

BAC – Offers Success?

4 June 2012

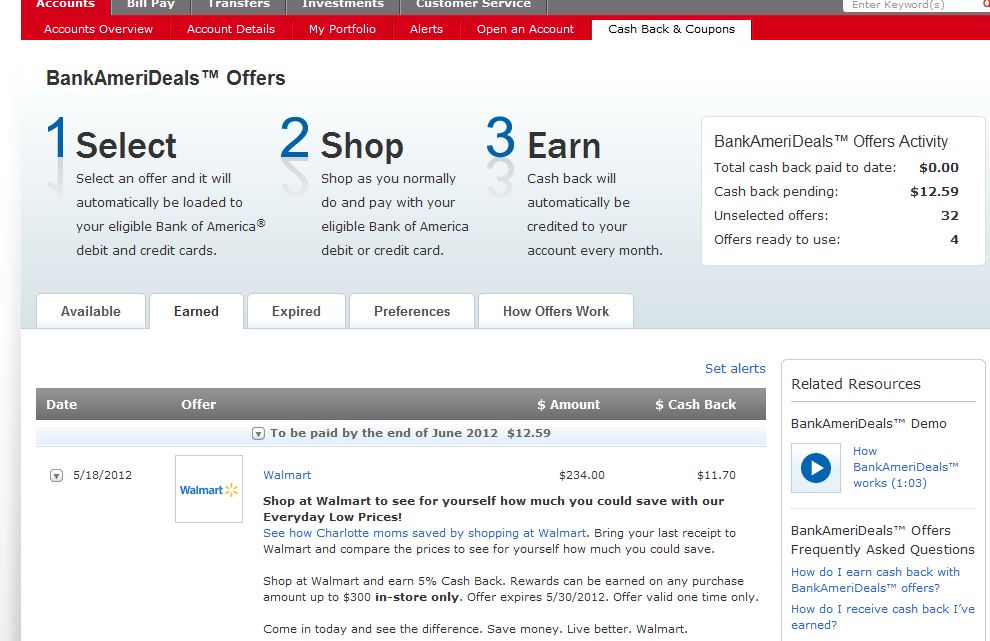

I’m using my new BankAmeriDeals and I like it.. really cool. Here is my WalMart redemption. What is success here? For Bank of America? For Wal*Mart?

10 Years ago I was a banker in the room with Wal*Mart and they asked “what justifies any card taking a percentage of my sales”? “What customer have you ever brought me”?

Will Card linked offers be the vehicle by which banks finally deliver value to retailers?

As I mentioned in my previous CLO Blog the average gross margin in Retail (globally) has gone from 4.2% in 2006 to 2.4% in 2010 (ref: IMAP’s Retail Industry Global Report 2010). Given this margin compression, and the fact that retailers spend very little of their own money on marketing, you can see why basket discounts are not widely used, but rather targeted. Given that this Wal*Mart incentive is for 5% cash back, it would seem to be somewhat unsustainable. Even worse.. it was given to every Bank of America Customer.

For this 5% cashback offer, Walmart receive no incremental spend, it was my wife’s normal trip to the grocery store. She didn’t even know I registered for this program.

Quiz time. Who funded the BAC WalMart offer?

1) Wal*Mart

2) Cardlytics

3) Bank of America

Yes it is #3 according to my sources. Bank of America is funding almost half of the incentives in their program, and they are not alone. Retailers are not advertising in the CLO space because of issues associated with “lift”, “reach”, targeting and distribution (outlined in my previous blog). BAC is not alone, rumors are that almost 50% of all CLOs are actually funded by the participating banks or even the venture money received by the “platforms”. Wow.. I had no idea it was this bad.

My guess is that BAC will now have data to take to Wal*Mart and show what incremental spend they drove. Although 0 incremental spend for me, BAC will be able to show WMT that some consumers chose to switch their grocery purchase because of this 5% incentive. This will in turn lead to “targeting” of incentives to particular audiences and also lead PERHAPS to Wal*Mart participation. I think this is a very smart move by BAC, and they are 3+ years ahead of this on debit.. all of the other banks are chasing the credit side.

The downside is that the retailers know this is a VERY SLIPPERY SLOPE. Now that WMT participates.. the banks will go to the other grocers to switch them back.. and then these incentives will be an added cost of doing business for all who wish to influence highly elastic customers. The alternative is to target product level incentives to customer (item level) elasticities. This is what the retailers are planning to do outside of the CLO space, and why BAC will find few “takers” for this. Coupons.com is the leader in grocery space with Safeway and WMT, google is close behind with its recent Zave Networks acquisition and Inmar with recently purchase mdot.

Outside of grocery the same dynamic exists.. cards can indeed motivate a switching behavior with some customers.. but is this a Faustian bargain for retailers?

Take aways:

- Card Linked Offers have a very long way to go

- CLO Companies and the banks are paying for the incentives

- BAC is only bank active for CLO on debit

- … all of the other issues on value proposition mentioned in previous blog

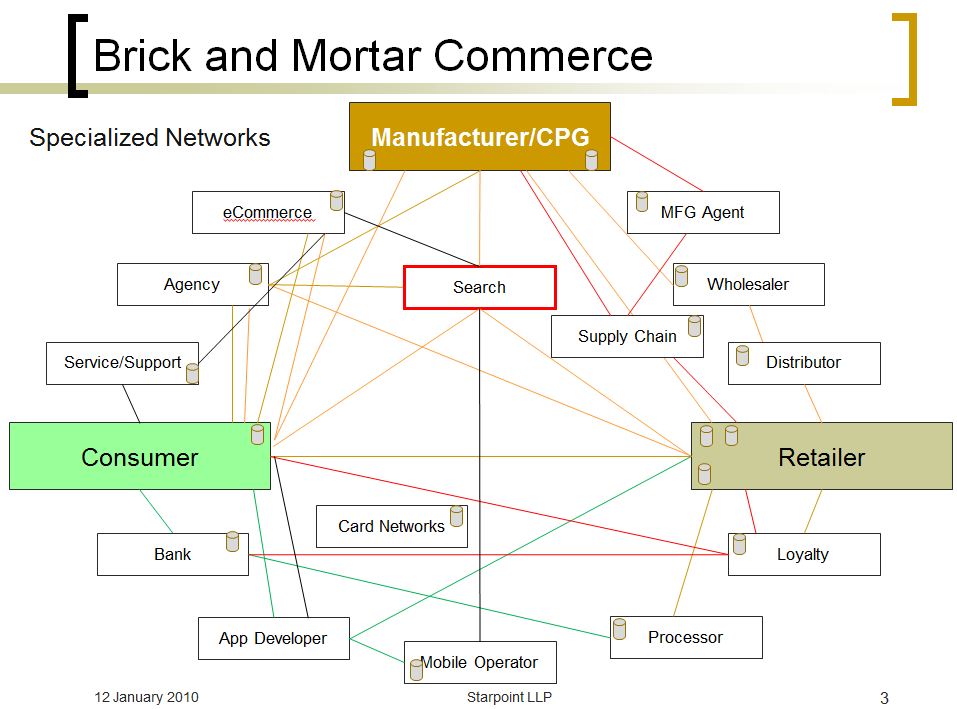

Commerce Network Puzzle

This is brief.. just something top of mind. This is an extension of my previous blog this month on Remaking of Commerce and Retail. I wrote today on linked in

POS and Payment Terminal mfgs have 30+ groups trying to add coupon and payment functionality. Their message.. FIRST get a retailer that wants it. Verifone’s Verix architecture provides retailers with capability to run 100s of POS apps… but retailers are skeptical.. will “apps” drive revenue? will it confuse customers? What will drive loyalty to MY BRAND vs. some start up? who is going to manage the mess when something doesn’t work?

All of the Card Linked Offer companies (see my blog), PayPal, ISIS, Google, Groupon, Living Social, Fishbowl, Inxent …are trying to integrate into the physical POS. There are 2 primary options to integrate marketing into the checkout process: the Electronic Cash Register and the Payment Terminal.

I speak quite a bit with Verifone’s investors about their POS vision.. Will NFC drive reterminalization? Will payment terminals morph into a rich customer interaction environment? Big retailers like Safeway and WalMart have teams of 500-2000 developers around their core IBM 4690 ECR (ACE, GSA, SurePOS,…) and heavily customize it. Take a guess how many people retailers have in managing their payment terminal? The answer is usually zero.. The reason the payment terminal (where you swipe your card) came into being was that retailers did not want to deal with PCI compliance, so their processors (like FirstData) came in with the terminals. The Cards get encrypted at the swipe and no one but the processor has the key to unlock the numbers. The ECR sends total amount and the payment terminal tells them it is paid with an auth number. I thus find Verifone’s Verix architecture somewhat amusing… I certainly see how retailers would benefit by taking electronic coupons from this terminal (and sending to ECR), but the terminal does not give receipts and certainly doesn’t allow for matching of UPC information. Even if it did… the retailers don’t want to create a new IT team to manage this mess on a piece of hardware they don’t own.

Will Verifone sell new terminals because of NFC? YES. Perhaps even as much as a 20% reterminalization (over baseline) in next year… BUT my bet is that the POS manufactures will win the battle long term both due to retailer IT competency and the tremendous capability for POS manufactures to deliver complex business solutions (IBM is 80% of top 20 global retailers).. Things like coupons are not some abstraction… they relate to pricing and loyalty and must be integrated into a retailers price promotion strategy. Currently we are in experimentation mode… with leaders like Google, Catalina and Coupons.com.

What are the puzzle pieces that will make “rewiring commerce” work? Small companies are very challenged in delivering value within networked business. They certainly do not have the heft to create their own, so they must choose sides. Within the card linked offers space, they align to the big card networks. This alignment has implications for attracting retailers and the targeting which can be done from bank data (store preference) vs the targeting which retailers can deliver (brand and price).

In general, the Marketing and Shopping phase of a NEW commerce process requires the following

1) know the customer,

2) deliver an incentive that is relevant and prompts action,

3) in a way that is integrated to the retailers brand and price promotion strategy,

4) with a great redemption experience

5) and prove to the advertiser that the campaign was effective

The Business platform necessary to deliver on this?

1) Campaign Management

2) Customer Data

3) Advertising distribution (virtual, physical, … how do you get eye balls)

4) POS Redemption/Retailer Integration

5) Massive Customer value to change behavior (relevancy, value, usability, convenience, entertainment, social, …)

6) Global sales force that can sell to retailers

Notice that Payment is not listed.. Payment is not a problem in physical commerce. Now that Durbin allows for STEERING.. you can imagine what Retailers want to incent…

Green Dot Bank: Finally Wal-Mart gets to Play

16 Jan 2012

http://www.reuters.com/finance/stocks/GDOT.N/key-developments/article/2447460

GDOT Bank – Federal Reserve Authorization

GDOT bought Bonneville Bancorp for $15.7M + $14M Capital Infusion on 8 Dec 2011. Bonneville was a Utah licensed state bank and a Fed member (regulated by Fed). This is a very significant deal for several reasons:

- Sets a new regulatory guidepost in the creation of “national” bank with a pre-paid focus. See Bank Talk article on how GDOT was able to get Fed Approval, specifically around CRA responsibilities.

- Is essentially WMT’s retail bank for consumer services (WMT owns ~15% of GDOT)

- Model for future deals in State Chartered banks (particularly for retailers)

- Highlights need for reassessment of “pure play” banks in pre-paid space (ex. Meta)

- NEW PRODUCT potential in interest bearing pre-paid accounts targeted to the lower mass market

This is a brilliant move by the Fed, and by GDOT. The Fed is rightly concerned about the fact that the bottom 4 deciles of customers are no longer profitable for the big banks.. and there is an exodus. How does the US financial system retain customers in the lower mass? GDOT and WMT believe it is not through the typical branch model. Just as with Tesco in the UK, Retailers are proving to be excellent distributors of banking services. Retailers do not need to make their margins on bank services alone, in fact banking services improves the overall retail value proposition, brand and loyalty. The same holds for mobile operators internationally. Why should I pay for all of those branches and sales people if all I need are basic payment services?

I joined Citi in 2006 with the mandate to grow the retail business without growing the number of branches. Creating the ING direct competitors.. the HOOK was high yield savings. GDOT bank could be catalyst for a new retail banking model, with a HOOK associated with “payment”, retail convenience, loyalty and data use.

What are the core product innovations? Here is my list:

- Combining a GPR card with retailer brand and distribution (WMT). Banks normally have to seek charters that enable them to operate nationally (ex. Fed, the now defunct Thrift, …) when doing business in multiple states. Virtual GPR cards don’t have this problem as consumers are buying a banking product in another state.

- Stand alone consumer value proposition. GPR card that can earn interest on funds held on balance. GDOT/WMT also have a established a rate structure that is one of the best in the business.

- WMT’s integrated value proposition. International transfers ( WalMart owns part of MGI they are 30% of MGI’s TPV), International Banking (Mexico, Canada, GDOT, …), StraightTalk prepaid mobile, … they have all the components to deliver value. Can they bring it all together?

Banking is a network business.. the GDOT opportunity is to build the network quickly through key retailers (as physical distribution). What other innovations can they bring to market? At the top of my list would be instant credit (Paypal BillMeLater does this through a WebBank a Utah ILC). Or real time transfers to any bank (using $0.58 Fed wire…).

Today, MSBs are restricted in both offering interest on accounts and the length of time they can hold a balance (escheatment). There will be some regulatory scrutiny by the State Regulators on how cash in/out is performed at the physical retail outlet, and what constitutes a “bank”. From the Retailer’s perspective, the GDOT card is a product which can be bought (buy $100 GDOT reload), with cash out from ATM or through a Mastercard purchase. GDOT is a licensed MSB in 39 States (according to their 10-k) with a network of 50,000 cash in/out locations. Previously GE Money was the US bank for the WMT MoneyCard. A single state licensed bank owned by an MSB network may face some state regulatory scrutiny. GDOT can probably address by keeping as separate legal entity with its own BOD and capital.

If I were thinking of starting the next PayPal… I would skip getting MSB licenses in 47 states and start looking for a Utah bank I could buy.

What to look for:

- Retailers following this model (including ISIS, Amazon, …). Particularly retailers serving lower mass market

- Salary d0miciliation (direct deposit) onto a card

- Future of GE Money. GE has been looking to sell Mark Begor’s business for some time. It is subscale, and WalMart is its largest US customer. My guess is that WMT had to develop fall back plans in case GE did sell the business. I would not be surprised to see GDOT bank be the primary bank behind the MoneyCard.. but it hasn’t happened yet.

- Pre-paid processors and platforms looking to create their own brands.. or change their relationships to retail branded banks

- MSBs moving toward a state bank license. Issue is cash in/out. MSBs that require their own branded physical distribution will keep MSB license… those that are virtual will move to GDOT model.

- Consumers making switch to a “new” banking model centered around payments.

- Semi closed payment networks with integrated loyalty and incentives.

- New Payment Banks which make money on marketing and data (not interchange). See Googlization

For those interested in a Utah Bank.. please call my favorite Utah Banker.. Crawford Cragun..

Your thoughts are appreciated. As always sorry for the typos and the brevity.