2016 – This post is 4+ years old now.. I wouldn’t take it too seriously.. but good historical context

1 October 2011

First… 2 paragraphs of venting and perspective.

I was quite surprised to see BAC’s $5/mo debit card fee on the national news today. Personally, I think it is a great thing.. customers should pay for services they want to use.. sticking the merchant with the cost of debit leads to some very poor incentives. One of the biggest “innovation stifling” problems we have in the US is that consumers don’t care about prices, for things they should (payments, health care, fraud, education, … ). The cause? the direct costs are hidden. Once consumers bear direct costs for services, market forces can take hold.

This is not to say I’m a supporter for HOW the Durbin change came about.. Dodd-Frank, Wall Street Reform and Consumer Protection Act represent the most sweeping changes to financial regulations in the United States since the Great Depression. From my perspective the timing could not have been worse. Did Congress think the banks would just sit on the sidelines and patiently suffer? After being forced by regulators to act in good faith and “acquire” ailing community members like Country Wide? To suffer again as State AGs and the CPFB go after them for a few billion more (robo-signing). Retail banking is becoming a very unattractive business, particularly in the lower mass market segments. For the recovery to take hold, we need banks to be healthy… these are not a bunch of “fat cat” millionaires.. but a core component of commerce that is instrumental in managing the lifeblood of our economy.

Debit Reaction.. equal and opposite

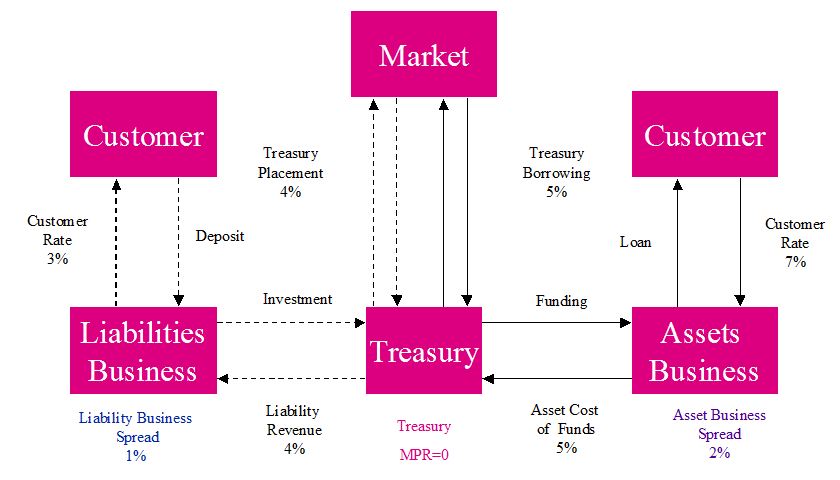

Well the banks have reacted to the finalization of Durbin fees. As I related in my previous blog on Debt, the fee plans have been in the works for some time, and for good reason: the lower mass segments are no longer profitable. US banks are well capitalized…. with excess liquidity, and a cost of funds near zero. There is very little incentive for them to seek to increase their deposit base (improve liquidity ratio). The core issue in retail banking profitability is asset quality (few qualified people to lend to… who want a loan). This is even more true now that Dodd-Frank has virtually gutted retail banking fees. Two excellent articles below detail the role of transaction revenue and service fees in retail banking.

http://www.bai.org/bankingstrategies/payments/general/protecting-dda-profitability

http://www.novantas.com/article.php?id=317

http://www.standardandpoors.com/ratings/articles/en/us/?assetID=1245235038776

Of course not all consumers will be paying this $5/mo cost. For example, the folks reading this blog will likely have account relationships that warrant a fee exception. Mass market customers will likely be up in arms and seek to move their accounts.. believe it or not.. this is what the large banks want to happen since many of the lower tier customer segments are no longer profitable.

See this American Banker Article for more detail on alternatives to mass market customers

In the next phase of bank plans, expect the Visa logo to disappear from the standard card issued for a base checking account. The card will operate as ATM card, just as it did 20 years ago. As a side note, the banks (and PIN Debit networks such as Star, Pulse, NYCE) will be working with merchants and processors to expand adoption of PIN Debit separate from the card networks.

Market Forces in Payment

Now that consumers have to bear the costs of using a Debit Card. They have new choices:

1) Use credit card. This would be best for the banks, and perhaps best for the consumer as they collect merchant funded card reward points. The looser here is obviously the merchant. An important point to make here is that this is exactly the strategy behind new NFC based mobile payment types.. there are NO NFC enabled debit cards.. banks and the networks want you using your phone for payment to drive credit card usage. This is also the strategy behind Visa’s new EMV mandate, to drive retailer reterminalization. This will be a subject of a future blog.

2) Leave the bank and use pre-paid cards. This will certainly be the path for many lower mass customers

3) Pay the fee

4) Improve your relationship with the bank to meet a threshold and avoid the $60/yr fee.

5) Shift your transactional relationship to new “non bank” structures like PayPal or Google Wallet (both of which are licensed MSBs in all 47 states).

Downside for banks

CEOs make decisions based on data they have. The first 4 options have all been through. I would profer that creating a market for new competitors has not. I outlined in my previous blog “Banks will WIN in payments.. but WHICH ones” that banks are firmly in the position of control today. However there is a strong correlation between control and value delivered. In my upcoming blog I’ll describe how to value a payment network. My view is that payments are on a course of a utility service (i.e. dumb pipes with least cost routing), and that payment services are only the last step of a much more important commerce interaction. Any network business is highly dependent on balancing a value proposition between participants. Today retailers and consumers are not pleased. I only wish I could tell of you the wonderful things I’m seeing in Silicon Valley… IT IS NOT about technology.. but about creating business value.

Within 5 years, I see the strong possibility that a new network which will be able to PAY merchants for accepting a payment method.. (see my 2009 Blog on Googlization of Payments).

BTW… sorry for the lack of content this last month.. I have 15 page blog I’m about to publish.. I will never again try to write so much in one article.