One of the 3 business questions I ask myself every day is, “what is gaining traction”? At the top of the list this week is Sling Money. Launching Nov 14 in the US, its growth is asymptotic

Category Archives: MPESA

Payments and Expanding the Global Economy

Of course I’m not the only one to see this. I’m very fortunate to know leaders much more skilled than I am in this area: Nick Hughes (MPesa creator), Amy Klement (Omidyar Network), Chris Brookfield (Elevar Equity), Sriram Jaganathan (CEO Bharti mFinance), Abrar Mir (UBL Pakistan), Monica Brand (Frontier/Accion), Nvalaye Kourouma (CEO AfricExpress), … Why hasn’t more been achieved? In my view it goes back to Capitalism and market forces. There is a conflict in approach to providing basic financial services. A conflict which much be discussed as it is impeding progress, or worse destroying sustainable initiatives. My strong belief is that success requires sustainability, and a profitable business is by definition sustainable. It’s fair to say that “profit” is an offensive word to many people in emerging markets…Yet our goal must be to enable markets and market driven services… there is no other option.

Investment Conflict

While there are many great people (with very noble objectives) operating at the base of the pyramid; there are few capitalists and business executives. It is very tough to build a business that serves the poor, margins are very tight and success therefore means building volume. When volume is important, existing networks with distribution are a key consideration (see previous blog MNOs rule in Emerging Markets). The areas where we do see great executives, and expert emerging market investors (ex Accion, Omidyar, Elevar, …etc.), their efforts are frequently impaired by money that seeks no return (Aid groups, NGOs, and Philanthropies).

Although grant money does wonderful things for areas that do not infringe on markets (ex. Pre-natal vitamins, clean water, …), the money can completely destroy competitive markets through the creation of unsustainable organizations. For example, if Pakistan had 5 companies competing in payments and only 2 of them received $10M Gates Foundation grants, guess what happens to the 3 that did not receive money? They are priced out of the market.

Money that seeks no return (Grant, Government, …) in commercial activities not only influences sustainability, it also influences the “orbit” and strategy of everyone in the ecosystem: regulators, banks, press, talent, …etc. Support entities develop in this fertile “free money” environment that are geared toward attracting grants, running the programs. For example, a consulting group operated as program manager to Gate’s UBL investment.. their expenses represented 30% of the total grant (I promptly left the formal advisory group)! Fortunately the UBL team is top notch and knew better than to pursue grant goals of financial inclusion over economic goals of sustainability.

For Capitalists and Investors the dynamics above translate into volatility. Volatility always exists when there is a high degree of uncertainty and money is not held accountable for performance. Commercial areas that attract NGO money are hit hardest (ex. Payments and financial services). Thus the very markets where I most want to help are harder to invest in. For example, our companies could do everything right.. and still fail because of external (non market) forces. Investors in this area could all tell 100s of stories about India particularly a country ripe with opportunity yet rife “entrenched interests” (to say it kindly).

Our common cause

The intermediate “flux” period in market creation is painful. There are many entrenched interests that want to keep competition at bay. However we all must agree on basic tenants when operating within existing markets, or we will continue to waste valuable time, capital and people. Investors in emerging markets must find ways to coordinate and discuss conflict more effectively. We must encourage governments to create policies and regulations which enable effective information flow, networks, and markets. As Brazil demonstrates, it’s much better to have a slice of a very big pie.. than control a share of a very small one.

Our objective is not to spread the global GDP around more evenly, nor are we talking about global labor arbitrage. Our objective is to grow the global GDP.. markets create wealth.. A premise which needs well informed defenders and advocates. We should not be ashamed to say we want to create profitable companies in emerging markets… this is a tremendous vocation.

Wrap up

Although Starpoint is 80% focused in OECD 20 countries, our emerging market activities are invaluable. My personal reasons for involvement are both philanthropic and aspirational. The opportunity to provide financial services for 600-800 million people over the next 6-10 years could be THE KEY event which drives global GDP growth (and hence poverty alleviation). Make no mistake the entire pyramid of consumers (affluent at top, poor at the base) will grow, but it is the base of the pyramid which will dominate the numbers.

Happy New Year

Other Reading

Of course I’m not the only one to see this. I’m very fortunate to know leaders much more skilled than I am in this area: Nick Hughes (MPesa creator), Amy Klement (Omidyar Network), Chris Brookfield (Elevar Equity), Sriram Jaganathan (CEO Bharti mFinance), Abrar Mir (UBL Pakistan), Monica Brand (Frontier/Accion), Nvalaye Kourouma (CEO AfricExpress), … Why hasn’t more been achieved? In my view it goes back to Capitalism and market forces. There is a conflict in approach to providing basic financial services. A conflict which much be discussed as it is impeding progress, or worse destroying sustainable initiatives. My strong belief is that success requires sustainability, and a profitable business is by definition sustainable. It’s fair to say that “profit” is an offensive word to many people in emerging markets…Yet our goal must be to enable markets and market driven services… there is no other option.

Investment Conflict

While there are many great people (with very noble objectives) operating at the base of the pyramid; there are few capitalists and business executives. It is very tough to build a business that serves the poor, margins are very tight and success therefore means building volume. When volume is important, existing networks with distribution are a key consideration (see previous blog MNOs rule in Emerging Markets). The areas where we do see great executives, and expert emerging market investors (ex Accion, Omidyar, Elevar, …etc.), their efforts are frequently impaired by money that seeks no return (Aid groups, NGOs, and Philanthropies).

Although grant money does wonderful things for areas that do not infringe on markets (ex. Pre-natal vitamins, clean water, …), the money can completely destroy competitive markets through the creation of unsustainable organizations. For example, if Pakistan had 5 companies competing in payments and only 2 of them received $10M Gates Foundation grants, guess what happens to the 3 that did not receive money? They are priced out of the market.

Money that seeks no return (Grant, Government, …) in commercial activities not only influences sustainability, it also influences the “orbit” and strategy of everyone in the ecosystem: regulators, banks, press, talent, …etc. Support entities develop in this fertile “free money” environment that are geared toward attracting grants, running the programs. For example, a consulting group operated as program manager to Gate’s UBL investment.. their expenses represented 30% of the total grant (I promptly left the formal advisory group)! Fortunately the UBL team is top notch and knew better than to pursue grant goals of financial inclusion over economic goals of sustainability.

For Capitalists and Investors the dynamics above translate into volatility. Volatility always exists when there is a high degree of uncertainty and money is not held accountable for performance. Commercial areas that attract NGO money are hit hardest (ex. Payments and financial services). Thus the very markets where I most want to help are harder to invest in. For example, our companies could do everything right.. and still fail because of external (non market) forces. Investors in this area could all tell 100s of stories about India particularly a country ripe with opportunity yet rife “entrenched interests” (to say it kindly).

Our common cause

The intermediate “flux” period in market creation is painful. There are many entrenched interests that want to keep competition at bay. However we all must agree on basic tenants when operating within existing markets, or we will continue to waste valuable time, capital and people. Investors in emerging markets must find ways to coordinate and discuss conflict more effectively. We must encourage governments to create policies and regulations which enable effective information flow, networks, and markets. As Brazil demonstrates, it’s much better to have a slice of a very big pie.. than control a share of a very small one.

Our objective is not to spread the global GDP around more evenly, nor are we talking about global labor arbitrage. Our objective is to grow the global GDP.. markets create wealth.. A premise which needs well informed defenders and advocates. We should not be ashamed to say we want to create profitable companies in emerging markets… this is a tremendous vocation.

Wrap up

Although Starpoint is 80% focused in OECD 20 countries, our emerging market activities are invaluable. My personal reasons for involvement are both philanthropic and aspirational. The opportunity to provide financial services for 600-800 million people over the next 6-10 years could be THE KEY event which drives global GDP growth (and hence poverty alleviation). Make no mistake the entire pyramid of consumers (affluent at top, poor at the base) will grow, but it is the base of the pyramid which will dominate the numbers.

Happy New Year

Other Reading

- IMF Brazil’s Capital Market Report – 2012

- http://tomnoyes.wordpress.com/2010/05/18/unbanked-success-pakistan/

- http://tomnoyes.wordpress.com/2011/03/28/reaching-the-unbanked-thoughts-from-pakistan/

- http://tomnoyes.wordpress.com/2009/11/12/obopay-india-another-failure/

- http://tomnoyes.wordpress.com/2009/11/06/mnosdepository/

- http://tomnoyes.wordpress.com/2010/07/01/emerging-markets-mmu-revenue-challenge/

- https://tomnoyes.wordpress.com/2009/12/16/cash-replacement-part-2/

- http://tomnoyes.wordpress.com/2010/11/23/india-instant-interbank/

- http://www.npci.org.in/impsVolumes.aspx $3.8M dollars

- RBI Presentation – Financial Inclusion and Payments – 2012.

- http://www.cgap.org/topics/regulation-and-supervision

Future of Retail Banking: Prepaid?

Nov 7 2012 (updated for typos)

Warning.. long monotonous blog. Sorry for the lack of connectedness, written over 7 days and my editor is rather slammed. You have been warned, so don’t complain….

Summary

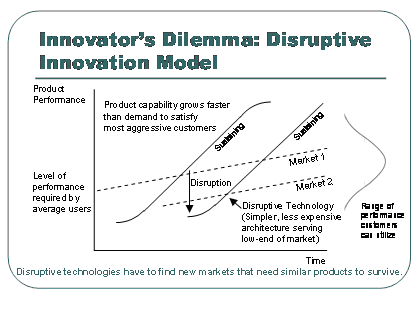

- The competitive dynamics surrounding a “transaction account” (ie DDA) are shifting. For example, Retailer banking/prepaid products (Wal-Mart, Tesco, ..) offer significant fee advantages to most lower mass customers. Three party networks like Amex and Discover have unique advantages when combined with Retailers distribution/service capabilities. This means prepaid has become a disruption: a new good enough product…

- Net interest income is 64% of total US retail bank revenues, yet the bottom four deciles of mass market customers are no longer profitable. Given that the transactional account is the #1 factor for retail bank profitability, what are implications if banks loose it?

- There is a high probability for disruptive value propositions in Payments, as advertising replaces merchant borne interchange. Payments and core banking will become a “dumb pipe” business unless Banks create value and assume a larger orchestration role. POS Payments are the central feature of a transaction account, if banks loose this relationship they will be in a poor position to orchestrate.

Does anyone else have trouble keeping up with state of the art? Who is doing what? My method of keeping up with change is to immerse myself in a given area for a day or two. It also gives me a reason to call my friends and colleagues. This week the theme is retail banking. I’ve spent too much time thinking about payments and how it relates to mobile, advertising, …etc. I thought I would dust off my banking hat and think in terms of a banker.

Retail Banking

I’m struck by how odd retail banking is. Why are banking services not more simple? Why do I have a separate savings, checking and card account? Why not one account? if the account runs in a arrears I pay interest and if it runs in credit the bank pays me interest? Why does a bank take 3-5 days to move money? How on earth do the banks afford all of those stand alone branches when I visit them perhaps once or twice a year? Why all of the regulation? What does my bank do for me? What problems do retail banks solve? Can someone else solve these problems more efficiently?

There is certainly no single answer. Retail banking serves many demographics, from the college student to the billionaire. Historically retail bank relationships were very important relationships, as banks only lent money to people they “knew”, based on the deposits they had. Younger consumers need to borrow, older consumers … savings. Banks focused on things like college student accounts to lock in that relationship as early as possible. Today’s modern financial markets provide for the securitization of loans, thereby spreading risk among various investors willing to assume it. Does a banking relationship matter anymore? to Consumers? to Banks?

I’m struck by how little change has occurred (in the US) on the liabilities side of the banking business? Quite frankly US consumers are treated like idiots who sacrifice “protection of capital” over risk. We now have an entire agency working to protect US consumers  from banks.. (BTW what is predatory lending?). Other markets let consumers take on risk.. and hence have many more choices, and innovation, in savings. For example, I’m very fortunate to have worked with so many fantastic people over the years. The great thing about running Citi’s channels globally is that each and every country had a somewhat unique competitive and regulatory environment. It was like running 27 different banks. There were many different strategies for deposit acquisition, for example:

from banks.. (BTW what is predatory lending?). Other markets let consumers take on risk.. and hence have many more choices, and innovation, in savings. For example, I’m very fortunate to have worked with so many fantastic people over the years. The great thing about running Citi’s channels globally is that each and every country had a somewhat unique competitive and regulatory environment. It was like running 27 different banks. There were many different strategies for deposit acquisition, for example:

- In Spain we had a 10/2 product that paid 10% interest on deposits for the first 2 months.. then went to 1%.

- In Japan Citi leveraged its global footprint, and the poor local consumer rate environment, to create foreign currency (FCY) accounts which allowed consumers earn higher returns by assuming currency conversion (FX) risk in uninsured accounts.

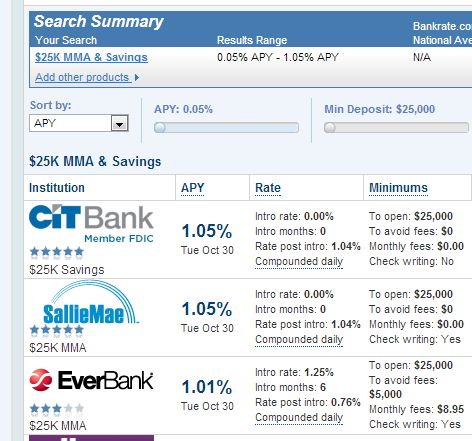

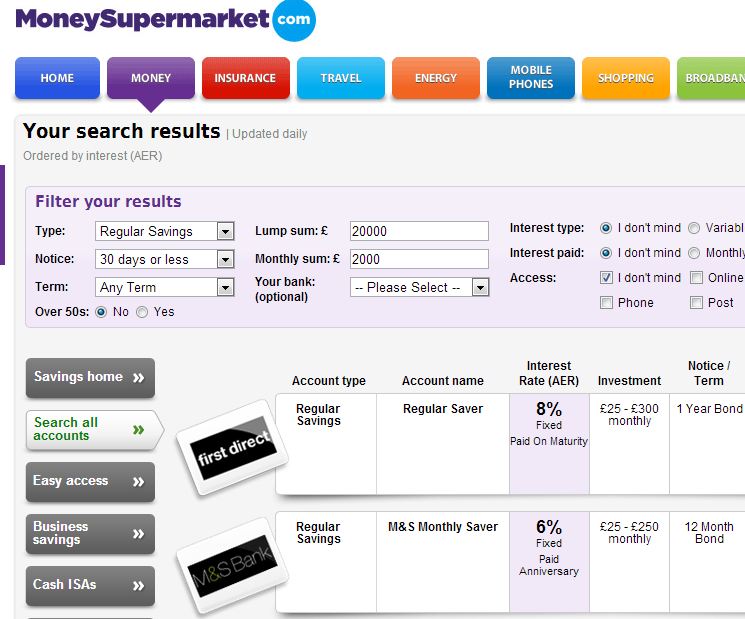

- The UK is perhaps the most competitive retail bank environment in the world. Consumers in the UK can switch banks almost as easily as changing shoes, it was thus essential to enable consumers to switch quickly and then get them into other products quickly. Take a look at today’s UK savings rates from MoneySuperMarket (8% on a fixed $30k deposit) vs the US (1.05% bankrate.com). Rate differences on this scale helped fuel the carry trade in Japan.

In the US, it is well known (inside the banking community) that banks are highly discouraged from competing on rates. Not that it matters, this amazing study by the Chicago Fed (Chicago Fed – Checking Accounts What Do Consumers Value – 2010) shows that US consumers are rate inelastic.. and care much more about fees. You have read this right, consumers don’t care about interest rates on their deposits.. which is certainly NOT intuitive. Perhaps rates are all so close to 0% that 5-10bps doesn’t matter. Or perhaps because the average US consumer does not save at all, and those that do have their money in another place.

Retail Bank Profitability. Net interest income (2011, represented more than 64% of total US bank revenues) is the rate spread between borrowing short and lending long, or more broadly the differential between asset yields and funding costs. Net interest  margins (defined as net interest income over average earning assets) were 3.6% at year-end 2011, just 11% higher from the 20-year low of 3.2% in the last quarter of 2006.

margins (defined as net interest income over average earning assets) were 3.6% at year-end 2011, just 11% higher from the 20-year low of 3.2% in the last quarter of 2006.

From DB Research

As low rates persist, loan-to-deposit spreads fall as prices adjust, and longer-term securities, held as assets, roll over to lower-yielding securities (the same holds true on the funding side, of course, helping to extend the positive impact of falling interest rates into the future). The net impact on banks’ net interest levels may be negative, though. In previous recoveries, this effect has been offset by increased loan volumes, allowing banks to return to sustainable growth levels. Furthermore, as an economy recovers, banks may quickly benefit as short-term assets roll over at higher rates

To summarize: Bank net interest income is important (64%), and falling. Banks have had a key revenue source taken away from them (Debit interchange) and are also facing another merchant led suit on credit card interchange. Bank brands and reputations are on a steady downward trend. Consumers don’t care about rates, but react strongly on fees. … A new regulatory agency to protect consumers is just now forming and looking to make its mark. What are banks to do?

Transaction Account

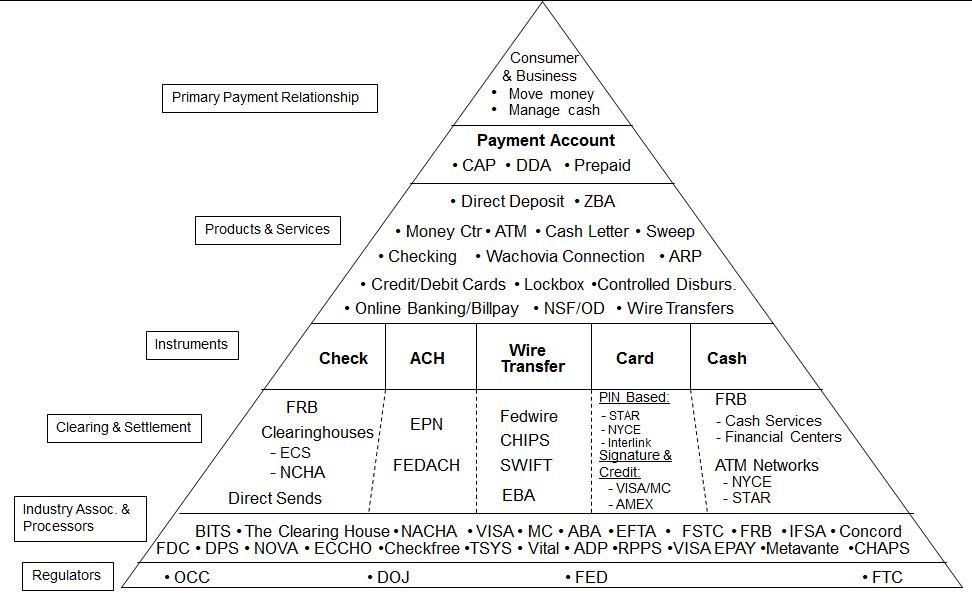

What is the purpose of a bank provided transactional account today? Well certainly our mattresses are a little less lumpy, and the relationship factors have largely gone away. So what is left? Transactionality?

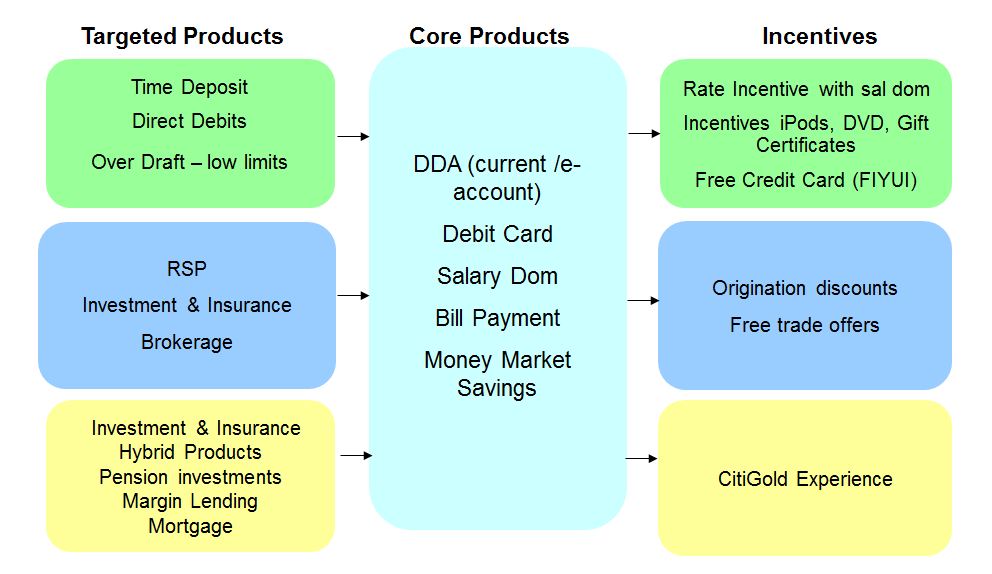

The banks have long recognized that the transactional account is the #1 factor driving a consumer relationship. Virtually every other banking product and service hangs from this account. Most retail banks view direct deposit (internationally known as Salary Domiciliation or Sal Dom) as the key indicator of the transactional relationship. Consumers have limited “energy” to connect to more than one network (as outlined in followed my previous blog on Weak Links).

This financial supermarket concept, authored by Sandy Weill and John Reed, has not exactly been a slam dunk success. Nonetheless every retail bank starts selling with a checking account, even if nothing else is attached. What are the key factors influencing the selection of a transactional account?

- Why are deposits important to banks?

- Driver of overall relationship à Customer Net Revenue

- Liquidity ratio ->Risk ->Agency Rating -> Capital Costs

- How do consumers select a bank?

The public compete data above is completely consistent with previous proprietary studies I’ve commissioned. Consumers tend to pick their bank based on how convenient the branch and/or ATM is.

Is there something fundamentally changing? What if consumers don’t visit a branch… or no longer use cash? Are there new value propositions? Where will consumers (and their deposits) go?

Recent market developments/Announcements

- American Express/WalMart BlueBird

- Tesco Bank

- Merchant Consumer Exchange (MCX)

- Safeway activating ACH on Club Card (Fast Forward)

- American Bankers Association – Prepaid from Banks

- Network Branded Prepaid Card Association (analysis)

- Barclays Pingit Service

- Google Wallet goes Plastic

- MNOs rule in Emerging Markets

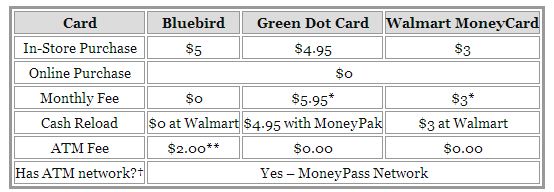

The Amex Bluebird product is revolutionary in terms of fees. It is the lowest cost reloadable card in the market today. Beyond the product, I’m even more impressed with WalMart’s business strategy here. They seem to be willing to break even on payments/banking in order to win the overall consumer relationship and increase foot traffic and loyalty in their stores. Take a look at the suite of products offered by WalMart. While banks are pushing out the bottom forty percent of mass consumers, WalMart has made a bet that it cannot only serve them, but do so profitably.

There are many different types of pre-paid cards (more below), however most are not regulated as bank accounts. In almost every geography, consumer deposits (interest bearing, insured) are regulated because they drive both bank liquidity (which drives lending and cost of capital) and profitability. Remember before capital markets existed to securitize assets (loans) retail banks could only lend to the extent of their balance sheet (deposits). Consumers put their money with banks in order to earn interest (the carrot) with the downside of fees on usage (the stick). In the US consumers are beginning to ask themselves “is the carrot big enough”?

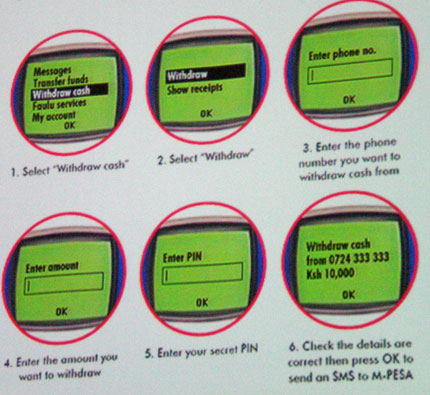

In emerging markets many banks have a poor reputation, additionally access to legal resources are limited, as are consumer protections. How would you feel if you showed up to your bank for a withdrawal and your bank said “sorry your money is gone” and you had no recourse? This dynamic has propelled other banking models in emerging markets. For example my friend Nick Hughes and his Vodafone/Safaricom team created MPESA in Kenya which provided enormous value to consumers. However MPESA caused an apoplectic reaction from the banking regulators as 10% of Kenya’s GDP sat in a non-interest bearing Vodafone owned settlement account. MPESA therefore impacted bank liquidity (IF the funds would have gone into a bank account as opposed to just M1/cash). Visa and MA have worked hard to try to make prepaid the underlying account for mobile money in emerging markets, to very little avail. The problem is not connecting people to the V/MA network.. and giving balances to an approved bank. The problem is first transferring money to entities currently not on any network, then paying a very small number of billers.

Why are consumers defecting in the US? Ernst and Young just published a phenomenal global study on this subject. The result of their analysis was that consumer confidence in banks is degrading. E&Y outlined a call to action by banks: reconfigure your business models around customer needs. My hypothesis is that consumers have reached a tipping point where they view banking services as commodities… In the UK, this is already well established.

Prepaid

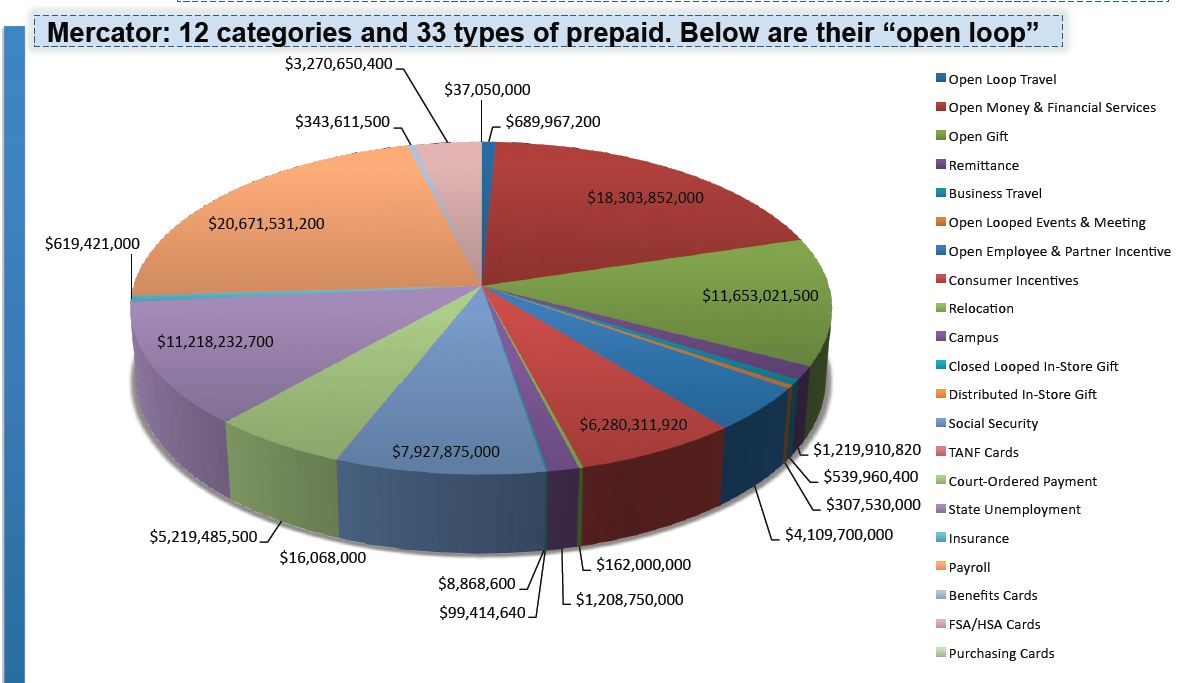

I haven’t spent much time thinking about prepaid cards so I thought it was time to refresh myself, particularly in light of MCX and the prospect of retailers acting as Banks.

From the US Fed

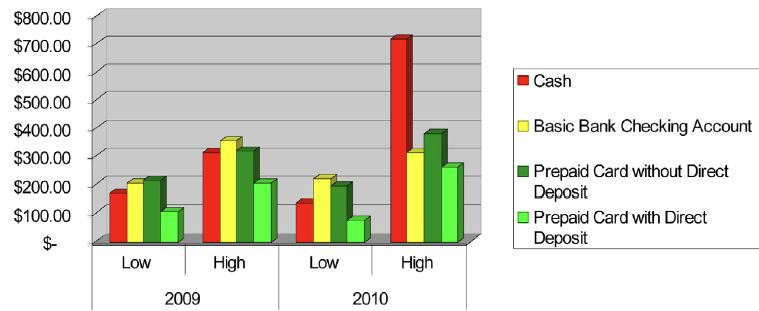

Prepaid cards offer much of the functionality of checking accounts, but that does not mean the underlying economics are the same. A typical prepaid card in the data is active for six months or less, a small fraction of the longevity seen with consumer checking accounts. As a result, account acquisition strategy and the recovery of fixed and variable costs are likely different than for checking accounts. …. prepaid cards with [direct deposit are uncommon but] remain active more than twice as long and have 10 times or more purchase and other activity than other cards in the same program category. As a result, these cards typically generate at least four times more revenue for the prepaid card issuer

Similarly Pre-paid cards also face a complex web of regulation (See Philadelphia Fed Paper 2010), across 31 different types of cards.

31 types of cards? Did anyone else realize the diversity here? Wow… For the sake of this blog, let’s focus on reloadable (GPR) open loop cards (references to prepaid below are on this card type only). It would seem that GPR pre-paid is following the general disruption pattern of serving a lower tier of the market at a more attractive price point. According to Mercator, In 2009, consumers loaded $28.6 billion onto prepaid cards. By 2015, prepaids will hold $168 billion.

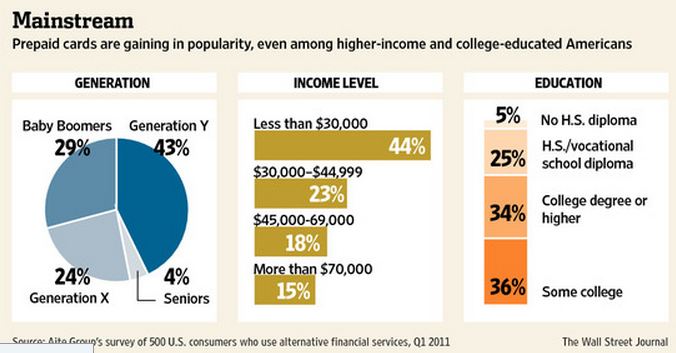

Last month’s WSJ ( Prepaid Enters Mainstream) outlined this dynamic

Traditional leaders in GPR pre-paid have been Green Dot, NetSpend, . The Durbin amendment exempted most prepaid cards. This means that pre-paid is largely example from the Durbin interchange restrictions… (with several conditions). Thus the business case for pre-paid is rather strong, and Banks themselves are assessing if they can make this the new “starter” account (ex Chase Liquid). However Three Party Networks (Discover and Amex) have a significant advantage.

From Digital Transactions, March 2012

While the Federal Reserve’s rule implementing the Durbin Amendment has its greatest effect on traditional debit cards, it affects prepaid cards too, especially its provision that banks’ prepaid cards can avoid Durbin price controls only if cardholders can access the funds exclusively through the card itself. That provision thwarted banks’ efforts to make prepaid cards more like demand-deposit accounts and led them to scale back or end bill payments through prepaid card accounts.

But American Express and Discover are not subject to Durbin’s controversial provisions, Daniel and Brown noted. Both companies are so-called “three-party” payment systems that function both as merchant acquirer and card issuer. In contrast, Visa and MasterCard debit and prepaid cards are part of “four-party” systems in which the issuer and acquirer are usually different companies and rely on the Visa and MasterCard networks to route transactions among them. The Durbin Amendment exempts, or “carves out” in industry parlance, three-party networks from its provisions, including interchange regulation.

“There’s no restriction on what AmEx can pay itself” for prepaid card transactions, said Brown. Thus, AmEx and Discover have a new opportunity to grow their prepaid businesses, the attorneys said.

Clearly Discover (DFS) and American Express (Amex) have an opportunity to “Kill” prepaid cards, what are they missing? Physical distribution, service and reach in the mass market. These are the very things that retailers like WalMart can provide, and in fact economically benefit by providing them.

As you can tell, regulations are driving the business models here. Most large US retailers leverage a fantastic team of attorneys from Card Compliant that specialize exclusively in prepaid cards (run by my friend Chuck Rouse). WalMart’s move to Amex is brilliant both from a regulatory and business model perspective.

Today’s pre-paid dynamics may be the tipping point by which 3 party networks begin to overtake V/MA in growth. A trend that will accelerate when other business models require “control”. This next phase will be centered around merchant/consumer transaction data, which will begin to unlock the advertising revenue pool, which is almost 4 times larger than that of payments.

Payments and core banking will become a “dumb pipe” business unless Banks create value and assume a larger orchestration role. POS Payments are the central feature of a transaction account, if banks loose this relationship they will be in a poor position to orchestrate. 4 party networks are very, very hard to change.

I see a battle where 3 party networks work to branch into orchestration and advertising, and existing orchestrators (ie Apple/Google) integrate legacy dumb pipes (payments and telecommunication) to deliver value to the consumer. What do consumers value today? This is the call to action for bankers… who are not always the best at creating alliances.

Here is one idea, focus on trust and helping consumers solve problems they don’t face frequently. For example,

- Make financial planning easier and less of a sales job.

- Help manufactures and retailers connect to target consumers.

- Become a buyers agent?

- Help navigate the college application and loan process,

- Help buy a new car for the lowest possible price…

I know this is not a clean finish.. but that’s all the time I have.

References

- August 2012 US Federal Reserve – Consumer use of prepaid cards

- Federal Regulation of the Prepaid Card Industry – April 2010

- Chicago Fed – Checking Accounts What Do Consumers Value – 2010

- AT Kearny Retail Banking Profitability – Europe

- Network Branded Prepaid Cards Association (NBPCA)

- American Banker – Amex Prepaid Card

- Center for Financial Services Innovation

- Top Global Brands – Interbrand

- WSJ Prepaid Enters Mainstream

Thank you Kansas City Fed for the fabulous brief from the: CONSUMER PAYMENT INNOVATION IN THE CONNECTED AGE. Bill Keeton and Terri Bradford were nice enough to invite me, but unfortunately I couldn’t attend. In my last visit to the KC fed we spoke about future payments types, but we also spent quite a bit of time discussing where mass market consumers will go if banks view the bottom 4 deciles of retail banking as unprofitable (according to proprietary McKinsey Study). Today I thought I would pull together a compendium of my learnings on retail deposits, MSBs and pre-paid… the “transaction account” by which payments flow.

Cash Replacement – Part 2

December 15, 2009 (PDF VERSION HERE)

Part 2 – Cash Replacement (V1)

In my previous Blog (see Investors Guide to Mobile Money) I outlined a simplified categorization of payment schemes for “first world” economies. The common win-win for both mature economies and underdeveloped appears to be Cash Replacement. Cash Replacement has been the subject of thousands of reports originating from: economists, bankers, academics, non-governmental organizations and consulting groups (a few of which are listed in references below). The objective of this blog is to provide a market basis for investors and small companies attempting to “quantify” the opportunity in cash replacement, specifically e-Money and non-card based schemes.

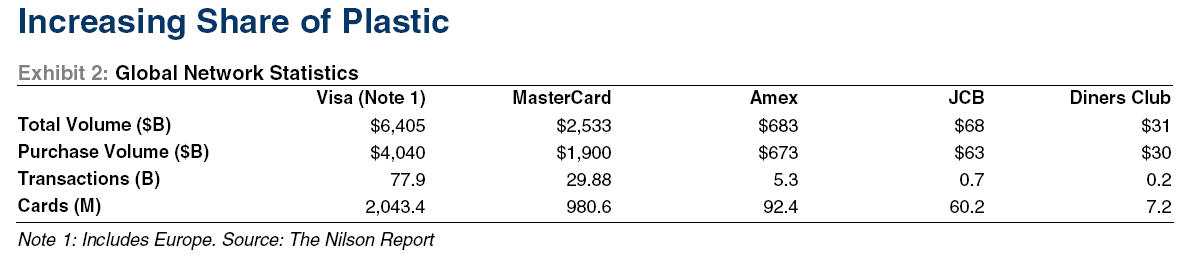

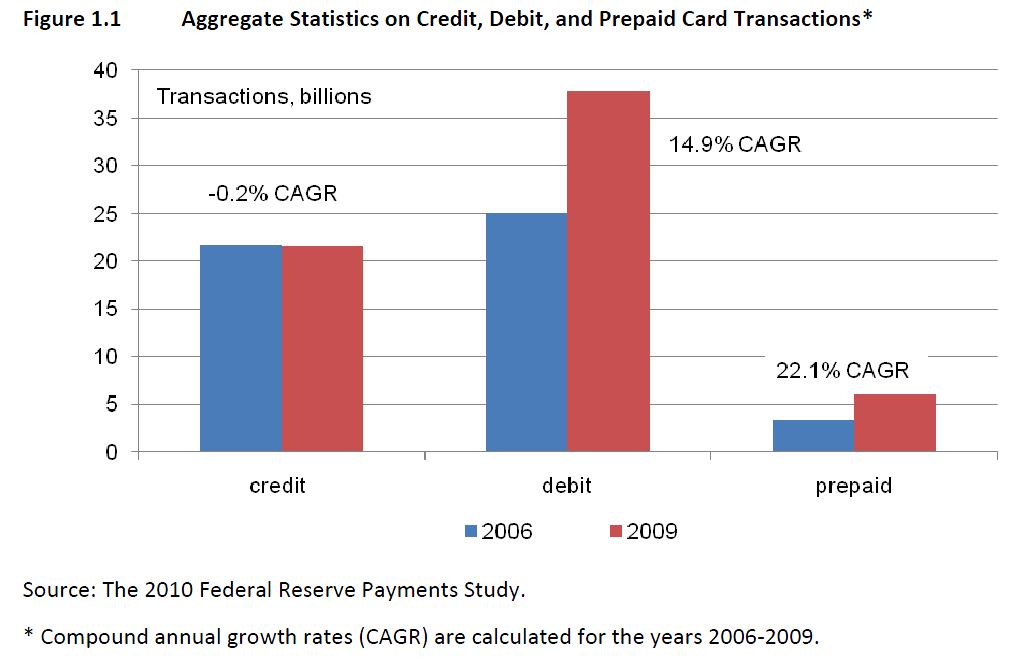

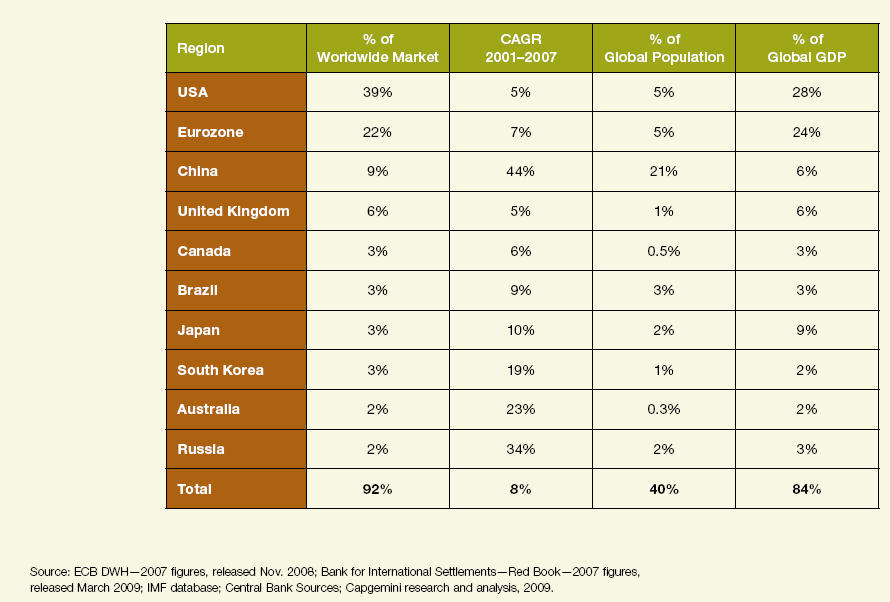

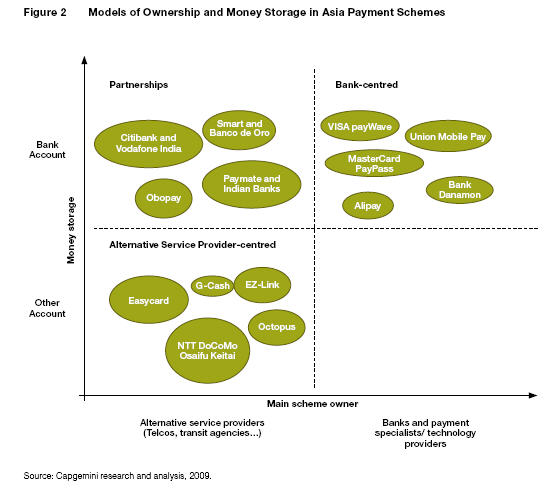

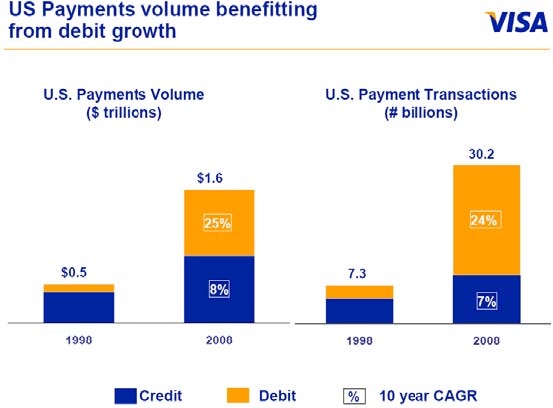

Global debit and pre-paid card growth have been the key instruments leading in cash replacement use within top global economies. The card infrastructure (ie “card rails”) that  provided for this success was “built” on the credit card value chain over the last 35+ years Cap Gemini’s 2009 World Payment Report provides an excellent overview of key trends. Key excerpts below:

provided for this success was “built” on the credit card value chain over the last 35+ years Cap Gemini’s 2009 World Payment Report provides an excellent overview of key trends. Key excerpts below:

- The worldwide volume of payments made using non-cash instruments (direct debits, credit transfers, cards and cheques) grew 8.6% to 250 billion transactions in 2007. The use of cards continues to be the single strongest driver of volume growth. Global card transactions (credit and debit) grew 14.5% in 2007.

- The ten largest markets accounted for 92% of all non-cash payments transactions in 2007 (when they represented 84% of global GDP).

- Unlike in the US, where cash in circulation has decreased by 7.4% in 2007, cash is still increasing in Europe, albeit at a slower rate of 7.8%.

Background

A historical review of products attempting to gain traction in cash replacement reveals a battlefield littered with the “corpses” of plastic and digital products. (Ref 1)

- Mondex, now owned 51% by MasterCard and national franchises owned by big banks, is after years of testing still confined to trials, often internal to banks.

- VisaCash. See history here http://www.mondex.org/main_page.html.

- DigiCash eCash, licensed by several big banks worldwide

- CyberCash never rolled out a stored value system at all; after announcing a trial in September 1996 the CyberCoin system was never rolled out except on a limited scale at Barclays in the UK.

- eGold. http://lawvibe.com/e-gold-founder-admits-e-gold-used-for-money-laundering/

- Geldkarte in Germany

- Paybytouch

- Obopay

These “failures” were less to do with technology, and more to with competing against an existing payment network(s). Payment networks are inherently “sticky” with investments required by consumers, merchants, and banks for effective functioning. Payment networks also have substantial government involvement to support Commerce and Treasury functions that ensure stability, resilience and protection of parties. Innovation in payments is challenged by this network dynamic. As most small companies know, getting a bank to make a decision is tough… but nothing compared to getting 4-6 groups (issuers, acquirers, merchants, MNOs, Regulators, networks, ..) to collaborate in making coordinated change. A level of difficulty that is only superseded by the challenge new entrants face in competing directly against these existing networks.

Why read further? Although I’ve painted a very negative picture of past payment failures and the challenges of competing against the traditional networks, the payments business is undergoing tumultuous change and where there is change, there is opportunity. To understand the forces and competitive dynamics of cash replacement, it is important to understand both the local and global forces driving this change (see pdf above).

Emerging Market Regulation

As this blog is largely focused on emerging markets, it is worth noting several “unique” regulatory challenges within emerging markets as regulations surrounding MFIs and Money Transfer Services have been evolving at an astounding rate. This regulation evolution is not taking place in a vacuum, as regulators always work with the entities they regulate. Teams  capable of local engagement and partnerships are therefore much better suited to operate in this dynamic regulatory environment. As an example, Vodafone has developed enormous competency in the payments space, extending not only its “product” success in MPESA, but developing talent which can be leveraged to seed other local teams (in the 40+ markets it serves).

capable of local engagement and partnerships are therefore much better suited to operate in this dynamic regulatory environment. As an example, Vodafone has developed enormous competency in the payments space, extending not only its “product” success in MPESA, but developing talent which can be leveraged to seed other local teams (in the 40+ markets it serves).

As a generalization, there are 4 bodies of legislation that impact mobile money:

- Bank Regulation (particularly role of non bank agents, and payment networks)

- Micro Finance Institution

- Electronic Transaction Legislation (Consumer protection, admissibility of electronic records, prosecution of electronic crimes, …)

- Telecommunication Regulation

MNOs success to date has not been in isolation, given that in every instance (above) the MNO partnered with either an MFI or Bank. 2009 Mobile Money Summit in Barcelona provided several excellent presentations covering the global regulatory environment, an environment that is both complex and evolving. It is imperative that your team understand the local regulatory environment. Regulatory changes have significantly impacted many investments made to date, with the key example of Reserve Bank of India’s Aug 2009 regulation preventing non-banks from domestic money transfer (destroying Obopay’s P2P plans).

Network Effects – Stating the Obvious

For payments to flourish, a coordinated system of instructions which can be read by trusted participants is necessary. Providers of payment services must consider what network participants are providing in order to collaborate in risk management and settlement; the greater the number of consumers and businesses that participate, the greater the collaboration and interdependency. As more people adopt the payment system, its value increases, since it provides access to more people; this encourages larger networks. Not only do the benefits increase as the network expands, but the per unit cost of service falls. This behavior is the basis for what economists refer to as a “network effect”.

Once a payment system reaches a “critical mass”, economic value will be created at the ends of networks. At the core- the point most distant from users-generic, scale-intensive functions will consolidate. At the periphery-the end closest to users-highly customized connections with customers will be made. This trend pertains not only to technological networks but to networks of banks as well as small merchants and even to consumers who engage in shared tasks9. From a payment network perspective, this means that the “routing” of payments will provide much less revenue opportunity than managing the end points (e.g. the customer interaction or the products which are sold on the network).

Transportation has proven to key opportunity for electronic money: Oyster in the UK, Octopus in HK, CashCard in SG, …etc. Success in these transportation initiatives has been “relative” because they have been challenged to generated consumer adoption beyond transportation “core”, and they have note generated an attractive margin to the network (for the economic reasons that Georgios lays out above).

The European Central Bank (ECB) has provided a new regulatory framework for electronic payments (see ECB ELMI overview by M. Krueger, and World Bank). The ELMI framework, as well as Singapore’s Electronic Legal Tender (SELT) concept, demonstrate a tremendous collaborative multi year effort between central banks, governments, financial institutions and business to provide rules, law, consumer protections and an environment which would support alternatives to cash. However, it also highlights the scale of effort needed to move a consumer behavior that has existed for millennia.

Financial Case

In general, economists and bankers agree that there is a strong macro economic case for cash replacement when accounting for the “shoe leather” costs (Ref 5). However, it remains to be seen “who” will pay for this convenience. Ref 1. Electronic Money and the Possibility of a Cashless Society by Georgios Papadopoulos provides and excellent analysis:

“…the high social cost of cash is all too general. The costs and the benefits for cash as well as for electronic money are not distributed evenly. The cost of issuing cash is paid by the state and financed by taxation. Most of the infrastructure for e-money is paid by the issuer, which in turn is charging the user for this payment instrument, even though the distribution of the costs between the consumers and the merchants is uneven. Consumers may pay a fee for the card (either directly or as a part of their checking account), while merchants have to pay a fee to the issuing bank(s) either pro transaction or as a percentage of the total value of the transactions and in addition carry the cost for the infrastructure“… from Georgios Papadopoulos

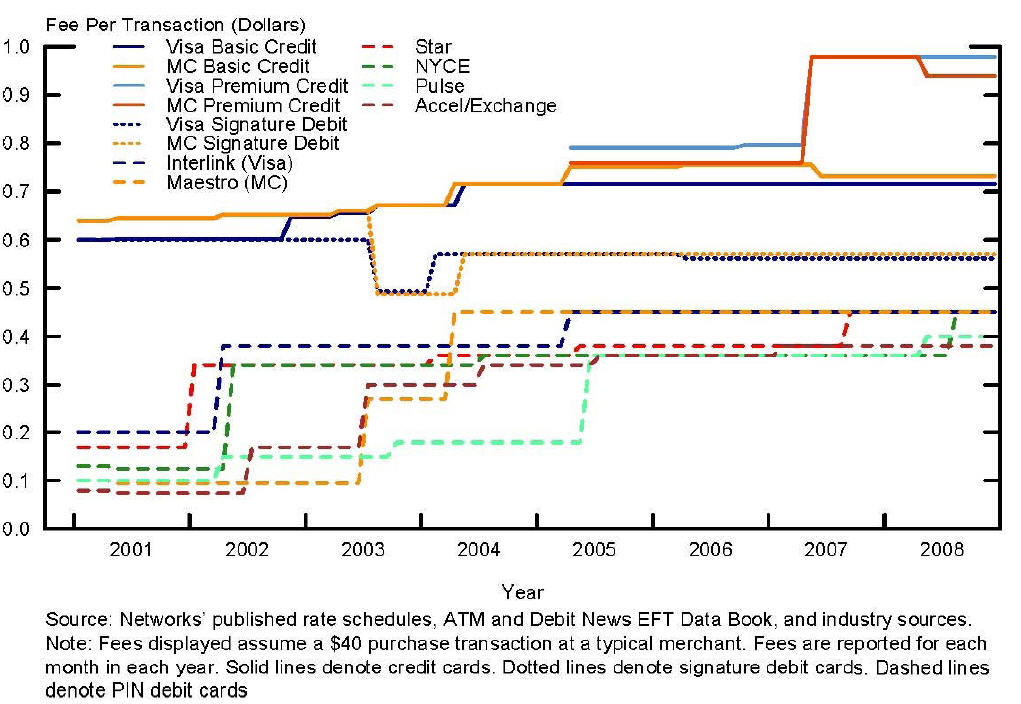

This “free nature” of cash, combined with its unique qualities (i.e. anonymity, history, physicality …etc.) further challenge new payment models and the barriers they face from existing card and bank networks. Payment networks are resilient, this is both a strength and a weakness. In 2000, the average transaction cost for credit card transactions was around US$0.70 (ref 1) and thus did not serve as a viable option for cash replacement. At the time, VISA cost studies showed that card transactions of amounts of less than about US$10 are in fact unprofitable for the Issuer bank and amounts of less than US$38 are unprofitable for the Acquirer bank. Any product attempting to take the place of cash must make low value transactions efficient and profitable to the parties providing the service.

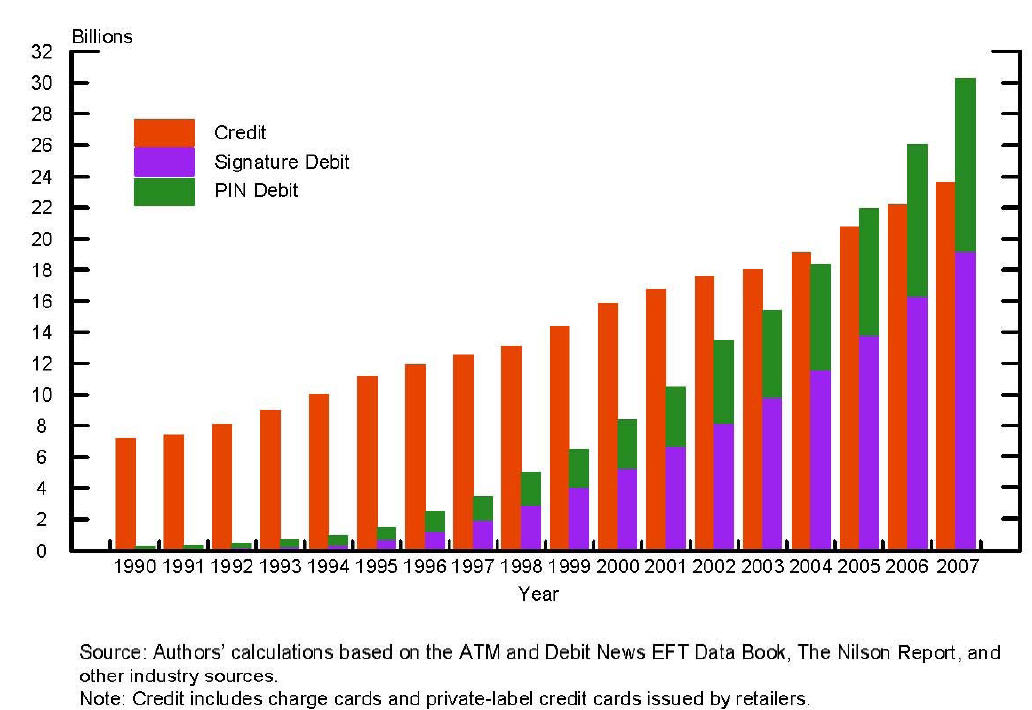

The “debit revolution” for the card networks began with pricing and risk. For the non-bankers reading, issuing debit cards was (and still is) a  highly contentious fight within banks. Large issuers did not want to forsake the high margins of credit cards (350bps + interest on ANR) for the paltry returns of linking a current account to a card (150-250 bps and no interest income). This fight was exacerbated by the fact that banks typically run the “card business” separate from the deposit “retail” business. Banks began supporting debit when they realized that Debit DID NOT displace credit cards, but rather supplemented it, providing net incremental (non-interest) revenue to the bank. After this realization, banks then began to take issue with PIN Debit vs Signature (another story).

highly contentious fight within banks. Large issuers did not want to forsake the high margins of credit cards (350bps + interest on ANR) for the paltry returns of linking a current account to a card (150-250 bps and no interest income). This fight was exacerbated by the fact that banks typically run the “card business” separate from the deposit “retail” business. Banks began supporting debit when they realized that Debit DID NOT displace credit cards, but rather supplemented it, providing net incremental (non-interest) revenue to the bank. After this realization, banks then began to take issue with PIN Debit vs Signature (another story).

The story of interchange rates, and how they are negotiated is complex and full of intrigue. For those of you interested, read the US Federal Reserve’s “History of Interchange”. As you can see from the table above the trend (across all products) seems to point “north east”, a trend not lost on merchants and consumers. It is important not to assume that these rates will remain static. Banks (issuers and acquirers) can respond to competition, a state which does not seem to be of an immediate threat.

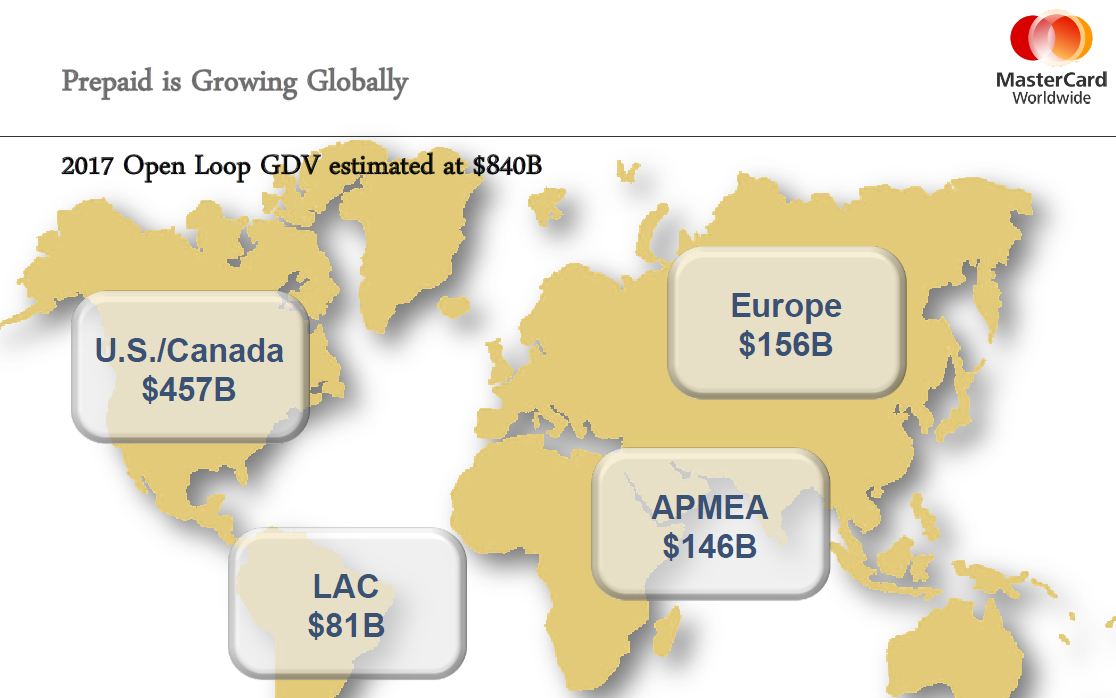

The debit success led the way for pre-paid cards. Pre-paid may present the best “global” opportunity to reach unbanked customers and further impact cash (See US Federal Reserve Study on Prepaid). Pre-paid is a category with both open and closed loop models. Open loop prepaid has benefited from Visa and MasterCard’s recent independence from their bank ownership model (in 2008 and 2006 respectively). In the US Pre-paid has seen substantial participation from non-banks such as Wal*Mart (11/2009 American Banker) whose business strategy aligns well with reaching the unbanked and delivering disruptive value in bank like services.

US Federal Reserve – Interchange Fees (Cross border excluded)

In the US, Gross dollar volume (GDV) for all prepaid cards is expected to grow at a compound annual growth rate (CAGR) of 21%, approaching $250 billion by 2012. Open loop prepaid cards are likely to produce a 36% GDV CAGR and closed loop gift cards a 5% GDV CAGR between 2008 and 2012 (First Annapolis). The EU provides a much larger opportunity in pre-paid market. Research indicates that the EU prepaid market is likely to generate a turnover of €132 billion across the predicted 418 million cardholder base, with transaction volumes of 4.4 billion by 2015. Within Asia and Africa, it remains to be seen whether prepaid cards will gain traction outside of Japan, Korea, SG, HK, and AU. New payment innovations present opportunities for non banks to create local (non card) networks (ex: MPesa, ZAP, GCash, …etc. )

The network motivation for pre-paid is quite simple, just as it is with credit and debit, there is very little incremental costs to adding transactions to the network. For merchants the incentive is to decrease costs. Unfortunately merchants are limited, within their existing card agreements, in their ability to pass on these costs directly to consumers ( surcharge on payment type). This limits merchant ability to incent consumer behavior toward the lowest cost payment channel. An excellent paper covering network effects economics and interchange is covered in Ref 7 (highly recommend).

Global Network Volume – 2009

Card products (particularly debit) are filling most of the convenience gap, as PIN Debit competes quite well with Cash at most merchants (see The Move Toward a Cashless Society: Calculating the Costs and Benefits) Debit card volume growth has exploded globally, many would argue that it is the closest competitor to cash. Consumers have shown a tremendous reluctance to bear the “direct” cost payment. In other words: would I like to wave my phone at Starbucks to pay for my next cup of joe? yep… would I pay $0.10 for it? nope… I will use cash.

The payment heads at the major banks echo this view, as consumer data and spending patterns don’t reveal significant gaps where consumers report that they are not served by current payment products. Within Europe, cash replacement in areas such as ticketing and public parking shows significant price sensitivity on part of consumer (assumption of convenience cost). SMS payment providers are heavily subsidized and largely unprofitable.

Payment Costs

The benefits of electronic payments are not without costs. Most analysis estimate the cost of payments to be 1.10% – 1.60% of GDP (EU Reference, US Federal Reserve, Journal of Network Economics, Africa, ). Most analysis point to a significant “social” savings potential in moving from cash to electronic payments. However, this data is highly skewed toward developed countries (as significant differences in infrastructure are not accounted for).

Many emerging economies which did not “ride the wave” of consumer credit access have limited consumer and merchant payment infrastructure (ie. POS terminals, credit bureaus, consumer laws, …etc). In addition to infrastructure issues “Cash is King” in many of these emerging markets because no financial company has developed business model to profitably serve the rural poor.

Banks typically have challenges pricing “down market” as concern over cannibalization prohibit price led competition of channel focused products which compete with an existing product. CGAP research (also see IAMTN) shows that MNO pricing of money transfer services is substantially lower than services available from either money transfer services or banks.

Most interviewees in Kibera say they chose M-PESA because of cost. For example, sending 1,000 Ksh (US$13.06) through M-PESA cost US$0.39, which is 27 percent cheaper than the post office’s PostaPay (US$0.52), and 68 percent cheaper than sending it via a bus company (US$1.16).

Within emerging markets, the primary distribution channel is local agents (An excellent cost analysis for agents has been done by CGAP.) Agent incentives are a very important aspect to any emerging market business case.

Just as banks have used payments as a “loss leader” to generate revenue from other products (current accounts, cards, …) MNOs and their agents have created a model where payments enhance the value proposition of their core product (communication).

e-Money

The ECB definition of e-Money is

… any amount of monetary value represented by a claim issued on a prepaid basis, stored in an electronic medium (for example, a card or computer) and accepted as a means of payment by undertakings other than the issuer, predominantly for small-value transactions (for example, the settlement of modest transactions over the Internet and of parking or telephone charges and payment for public transport services)9. In common with banknotes and coins, e-money is ‘fiduciary money’, deriving its value not from its intrinsic worth but, instead, from the bearer’s expectation that it can be exchanged for its underlying value.

Successful eMoney initiatives, in both developed and emerging markets, have typically been tied to an existing value chain. A few examples: Paypal-eBay, Oyster – UK Transit, Octopus – HK Transit, Payforit – UK MNOs, MPesa – Vodafone Kenya, GCash – Global/BPI. In almost every case, these initiatives began as a closed system and evolved to connect to other payment networks. Once value is stored in a network, every business will seek to connect, at an investment rate proportional to the network’s size, value stored and alignment to current customer demographic.

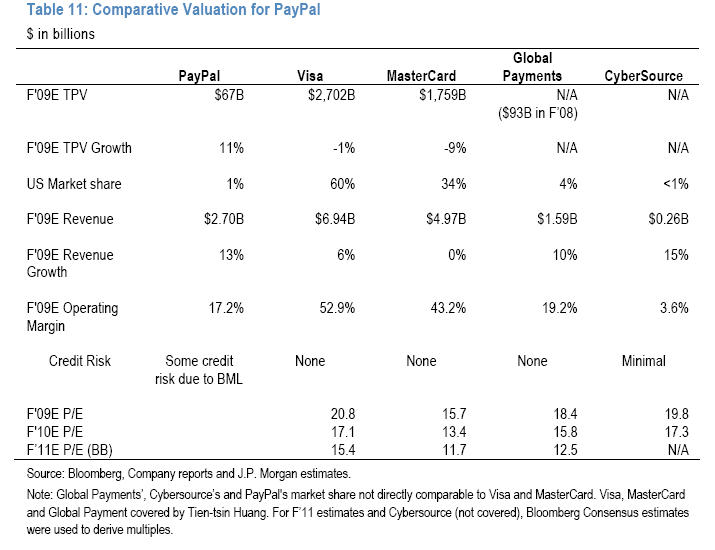

Paypal and Vodafone have shown that there are significant revenue opportunities in e-money. As the major card networks seek payment volume, they will likely develop new rate structures to incent MNO led payment initiatives to “ride on their rails” (ex. Pre paid card).

Network Profitability – 2008 US Volume

Mobile Money – Emerging Markets

The emerging market environment is a fantastic crucible for innovation as the network effects associated with the convergence of: finance, telecommunications, consumer access and business fuel economies within emerging markets. For those outside of the mobile payments industry, there are 3 principle emerging market success stories in mobile payments: M Pesa (Vodafone/Safaricom), ZAP (Zain Group), and GCash (Globe/BPI). Understand that my list is contentious given that all three are MNO led (I’m open to feedback, but it must be quantified by data). A more detailed list can be found here

M-Pesa certainly seems to win the “award” based upon Consumer Metrics and most talked about. Prior to getting started here, I encourage readers to review 2 fantastic briefs M-Pesa: M Pesa by Tonny Omwansa , CGAP brief. My stated bias toward MNOs in emerging markets (See MNOs Will Rule) is driven by the following facts:

- There are 3 success stories as proof points

- MNOs have developed a business model to profitably sell and service unbanked customers SEPARATE from banking (phone)

- Payments enhance the MNO business model in emerging markets

- MNOs have the resources to invest

The research on mobile money for the unbanked is tremendous and I can do no justice by trying to summarize. Imagine that you run a local shop in Kenya which sells dry goods and mobile phones, you must come up with 5 reasons why one of your unbanked customers would want to give up cash and pay a fee to load her money on cell phone. A few questions come to mind:

- Value Proposition? Cost? Convenience? Will it make my life easier?

- Use. What can I do with it? (something I can’t do with cash today)

- Trust. Who has my money? Do my friends use it? Brand? Government?

- Risk. Is it safe? (consumer protections, contract, access to legal system)

- Support. Who can I see if there is a problem?

Previously I have stated a radical hypothesis: the successes above were driven by the mobile proposition (communication), and payment supported the existing MNO value proposition. The path of evolution for MPesa and its competitors are unclear and will be heavily influence by regulation. Today, MPesa operates out of a single commercial account with the central bank. That account has a balance of almost 10% of the GDP, a fact that highlights the potential to serve the needs of the unbanked.

The emerging market evolution is not so unlike that experienced with credit cards, although the “value chain” which drove the adoption is different. US, Japan, and EU access to consumer credit drove the development of the card networks; Consumer’s did not want a “card” as much as they wanted convenient access to a revolving credit line. In emerging markets it is the demand for communication that is driving the development of the network.

Investment (Greater detail in my previous post – Investor’s guide to mobile money)

As we look a cash replacement we will find that initiatives are frequent and success is not. It remains to be seen HOW the highly regulated world will evolve. In the long term, Capital is attracted to success and growth. What we see today is a period of enormous flux and experimentation with established players making multiple “bets” (in the form of investment capital and revenue guarantees). Investments from established companies are in the form both in-house and partner led initiatives (examples: Citi Obopay, Obopay India, Nokia Obopay).

The Silicon Valley model, where a bet is made and a (US) team is built to “figure it out”, faces many hurdles; it is particularly challenged for creating products and services targeted to emerging markets (where paradigms are different and local knowledge is key). Valuations today are driven by either: revenue, customers or board members. MNOs will lead investment in emerging markets, small companies must find a way to either collaborate with them (or their agents). ISVs should look 2 years down the evolutionary path where value begins to exit the “closed network”. Outside of the top 10 card payment countries listed above, 80% of the world’s population lives… a population that only shops locally with cash. You will have a hard time tackling this opportunity in Silicon Valley.

http://technology.cgap.org/2009/11/11/new-business-models-in-mobile-banking/

http://technology.cgap.org/2009/11/11/new-business-models-in-mobile-banking/

References

1 Why do stored value systems fail? Andreas Furche and Graham Wrightson NETNOMICS. Volume 2, Number 1 / January, 2000

2 Electronic money institutions – current trends, regulatory issues and future prospects, by Phoebus Athanassiou and Natalia Mas-Guix, July 2008. http://www.ecb.int/pub/pdf/scplps/ecblwp7.pdf

3 ECB 2008 Annual Report http://www.ecb.int/pub/pdf/annrep/ar2008en.pdf

4 Survey of developments in electronic money and internet and mobile payments, Sept 2004. Committee on Payment and Settlement Systems. http://www.bis.org/publ/cpss62.htm

5 The Move Toward a Cashless Society: Calculating the Costs and Benefits/. DANIEL D. GARCIA-SWARTZ, ROBERT W. HAHN *, ANNE LAYNE-FARRAR. American Enterprise Institute-Brookings Joint Center for Regulatory Studies

http://ideas.repec.org/a/rne/rneart/v5y2006i2p199-228.html

6 Optimal pricing of payment services when cash is an alternative/. Cyril Monnet, William Roberds. US Federal Reserve. Oct 2007. http://www.philadelphiafed.org/research-and-data/publications/working-papers//2007/wp07-26.pdf

7 Interchange Fees and Payment Card Networks: Economics, Industry Developments, and Policy Issues. Robin A. Prager, Mark D. Manuszak, Elizabeth K. Kiser, and Ron Borzekowski. 2009. Finance and Economics Discussion Series Divisions of Research & Statistics and Monetary Affairs Federal Reserve Board, Washington, D.C. http://www.federalreserve.gov/Pubs/feds/2009/200923/200923pap.pdf

8 Electronic money and the possibility of a cashless society 18.02.2007. Georgios Papadopoulos http://papers.ssrn.com/sol3/papers.cfm?abstract_id=982781

9 ECB’s note on regulatory framework surrounding ELMI http://www.ecb.int/pub/pdf/scplps/ecblwp7.pdf

10 Where Value Lives in a Networked World, Harvard Business Review, Jan 2001, Mohanbir Sawhney and Deval Parikh).

11 NTT DoCoMo’s Osaifu-Keitai (http://en.wikipedia.org/wiki/Osaifu-Keitai),

12 “E-Money And Payment System Risks,” JAMES J. McANDREWS, 1999.Contemporary Economic Policy, Western Economic Association International, vol. 17(3), pages 348-357, 07.

13 The Economics of Interchange Fees and Their Regulation: An Overview David S. Evans and Richard Schmalensee

14 Why do stored value systems fail? Andreas Furche1 and Graham Wrightson.

15 Prepaid Card Markets & Regulation* Mark Furletti. US Federal Reserve. February 2004. http://www.phil.frb.org/payment-cards-center/publications/discussion-papers/2004/Prepaid_022004.pdf

MNOs as Depository Institutions?

Updated November 10, 2009

Excellent Background Articles:

- http://technology.cgap.org/2009/09/28/why-m-pesa-should-offer-savings-accounts

- http://www.reuters.com/article/pressRelease/idUS173067+17-Feb-2009+BW20090217

Success and value breed trust and loyalty. MPESA customer surveys by CGAP point to desire for MPESA to offer interest on balances. The genesis of MPESA’s success is not something that Banks have seen before (in emerging markets):

- Cash replacement (without their control)

- Technology

- Customer segment – Growth from the LOW end of customers that banks normally serves

Deposit taking, and payments are typically a regulated businesses which banks have excelled. However their past success was serving a customer segment that was far different then what MPESA serves today. Can Banks adapt to the new opportunities service the unbanked in emerging markets? Will new Micro Finance Institutions (MFI) emerge as the principle banking entity? Will MNOs seek approval to offer financial services separate from Banks or MFIs?

In Kenya, the explosive growth of MPESA has put both regulators and banks in a very awkward position. It was originally launched as a money transfer business, and has emerged as an effective cash replacement with an annual transaction volume of over 10% of Kenya’s GDP. Consumers have unexpectedly embraced MPESA, and regulations have had a challenging time adapting (or anticipating) the vector in which it has grown. The regulatory challenge now is “connecting” the MPESA network to the “banking” network and evolving the: regulatory authority, regulations and controls around it.

In 2005, Kenya drafted the Deposit Taking Micro Finance Bill which was past at the end of 2006.

http://www.microfinanceregulationcenter.org/files/25464_file_Kenya.pdf

http://www.microfinanceregulationcenter.org/files/39171_file_Microfinance_Act_2006.pdf

In addition to supporting traditional MFIs, the Act made it possible for non-banks to participate in deposit taking as an MFI (in the future), and now the first “non-bank” MFI has been accepted (just 3 months ago in June 09).

http://www.microfinanceregulationcenter.org/resource_centers/reg_sup/article/57056/

It remains to be seen whether an MFI license will be granted to MPESA, to extend its money transfer license. A more likely route will be for (multiple) MFIs to be approved to source funds from MPESA (MPESA as payment network)

The Philippines may provide the best example for MNO/Bank collaboration in mobile money. GCASH in the Philippines is the mobile money solution from MNO Global in conjunction with Bank of the Phillipines (BPI).

http://www.bpiexpressonline.com/index/find_page.aspx

Last year Global and BPI partnered in the creation of a new microfinance provider: Pilipinas Savings Bank

The Philippines was one of the first countries to develop a comprehensive law in support of MFIs. In 2000, Philippine regulators acted in response to the updated General Banking Law which mandated recognition of microfinance as a legitimate banking activity. Regulators developed a unique set of rules and regulations MFIs as the updated Law declared microfinance as a flagship program for poverty alleviation.

http://www.microfinanceregulationcenter.org/resource_centers/reg_sup

Bank as Depository Institution

Before tackling the issue of Deposit taking in Kenya, let’s discuss the issues surrounding existing (non MFI) banks servicing MPESA customers. Having spoken to several of the key parties in Kenya, the business issues surround: who “owns the customer”, who is assuming the risk (“money transfer” v. bank ) burden for this connection. For purposes of example, let’s take the KYC requirement in Kenya (as in most countries) a customer sighting (by a bank employee) with valid ID. Kenya has had problems with counterfeit IDs

http://www.standardmedia.co.ke/InsidePage.php?id=1144013210&cid=472&

How should regulators proceed? Bank infrastructure in many parts of the country is immature. There are over a million people that would need to go through the KYC process, most of which do not have an identity card (separate from issues in article above). Should regulators relax the KYC burden? Should money transfer agents be allowed to operate under MFI regulation? In my post below, I’ve outlined a few of the regulatory approaches

http://tomnoyes.wordpress.com/2009/11/01/mnosrule/

I would certainly like additional feedback, but my understanding is that regulators are taking a concurrent track: Updating the MFI regulations (originally designed in 2005), updating the “Money Transfer” regulations as covered within the General Banking Act, approving MFIs to source funds from MPESA (services on the MPesa Network) and defining a new regulatory scheme for mobile money which would touch both banking and telecommunications regulations. Vodafone’s regulatory experience here will likely prove to be a tremendous differentiator in future markets, as their ability to field a team capable of partnering with regulators further enhances their creditability.

(A very broad summary of the issues, apologize in advance for the gaps.) From a Bank perspective, concern is justified over MNOs ability to create a liabilities business. Banks should have the right to compete for these deposits, with a level regulatory playing field. From a MNO perspective, banks have not served these customers in the past. For MPESA, the Banks interest in this segment arose after the MNO developed it. The banks should pay for this “customer acquisition” and servicing, and the MNO should be able to offer products and services that support customers.

MNO Deposit taking

There are currently 3 separately regulated parties that are positioning to provide interest bearing accounts: Money Transfer Services, MFIs, and Banks. Emerging markets have invested significant resources in defining MFI regulations, however these were drafted prior to the success of services like GCASH and MPESA. The CGAP data in Kenya clearly shows customer “interest” (pardon the play) in using MNO services beyond that which a “money transfer agent” is licensed to perform. However accelerating the attractiveness of these money transfer services, by providing interest bearing accounts, may further exacerbate an already challenging regulatory situation. I would expect to see regulators requesting that MNOs open up/partner with traditional banks (as the depository institution) prior to approving MNOs as an MFI, or enabling traditional MFIs to compete. Interoperability between these licensed entities must be addressed. This view flows out of MNO incentives (e.g customer ownership, high fees for cash out) and current agreements with bank(s) with regard to settlement of funds. With that said, I would expect very little success for traditional banks attempting to provide this service, as it does not align to their business model. A model which will likely succeed is MFIs access to “non-traditional” payment services, as both MNOs and MFIs are nimbal and able to adapt quickly here and support their existing business model. See Western Union example below (in India)

http://www.dnaindia.com/money/report_western-union-takes-mfi-route-for-rural-spread_1299994

The challenges that MPESA faces, while challenging, are extremely exciting as it represents the “Phase 2” success of mobile money in emerging markets. Just look at the rate of change in issues facing service in Kenya today, compared with 18 months ago

http://technology.cgap.org/2008/05/28/can-m-pesa-work-for-microfinance-clients/

Mobile Money: MNOs will Rule in Emerging Markets

Updated Dec 15, 2009

Regulators in Africa and India are working actively to ensure consumers (and the global banking system) are protected in the exciting confluence of mobile and finance. Their involvement is completely appropriate given the opportunity to improve the lives of millions of unbanked people around the world. Defining responsibility and the commensurate controls associated with connecting non-traditional (unregulated) networks to highly regulated banks is a herculean effort which may lead emerging markets to remake a “payment system” that is more efficient than that which exists in today’s developed countries. This opportunity for “leap frog” improvements will be driven by the unique path emerging markets are evolving. Key stakeholders will be able to leverage learnings of developed countries, and trials in emerging markets, as they develop infrastructure necessary to support a network that enables both financial services and telecommunications.

Today’s regulatory approach, within these emerging markets, may be best summarized as an “experimental period” with simplified controls. Very early regulations have focused on simplicity by ensuring that the “value” stays within the MNO network, and limiting: balances, ticket size and beneficiaries. By constraining transfer of “value” to well defined MNO services (ex top-ups) regulators have certainly addressed many risk, AML and audit issues. These early controls have provided time for regulators to review progress and fashion new regulations in which existing regulated entities can comment. This order, with which emerging economies are proceeding, may come as a shock to some in the developed world.

Many believe that this more cautious orderly approach in mobile payment was driven by the unstructured success of MPESA (links below). An estimated 10% of Kenya’s GDP currently passes through this channel. Governments, banks and MNOs leveraged the learnings of the Kenyan market, first among them is: once a new payment system takes hold, it is hard to change. The alacrity with which MPESA was adopted by Kenyans has caused “a new awareness” among governments and business for both the opportunity to provide access, and the challenges faced in managing it. For regulators, there is a renewed sense urgency for defining the “rules” by which to protect consumers and hold participants accountable. Ex in India below

Regulatory changes have significantly impacted many investments made to date, with the key example of Reserve Bank of India’s Aug 2009 regulation preventing non-banks from domestic money transfer (destroying Obopay’s P2P plans). Banks have created much friction for the expansion of “pilots” and their capabilities. The banks’ position is that once value is exchanged between network participants, or to another network, that these services compete directly with a regulated “payment system”. So we have a “dance” of 4 parties: Regulators, MNOs, Banks and Consumers. In my discussions, the regulatory approach may be generalized by the following:

A) Experiment. Set interim guidelines with expectations that they could be revoked/changed. Communications regulators are driving this approach as they try to assist their stakeholders. MPESA began because of Communication regulatory authorization… not KCB

B) Review. Require submittal of plans to both communication and banking regulators.

C) Establish. Legal/Regulatory accountability. Define responsibility and audit guidelines for responsible regulators. For example in Kenya their was very little consumer protections for electronic transactions, the Kenya’s electronic transactions act was just established this year and serves as a model for Africa.

D) Define Audit responsibility for MNO. May force partnership with regulated bank for clearing and settlement. Set auditing guidelines for MNOs under communications regulations (Monitor/audit payments and transfers).

E) Constrain. Set limits on MNO services and “value” allowed to accumulate in MNO “wallet”, …etc. Example RS 5000 in India, Prohibit/restrict any bank functions in MNO. ex, No interest bearing accounts.

F) Isolate. Restrict payments connections external networks. Ex in Africa.. Commercial “beneficiaries/payees” must be approved over a certain volume threshold. (regulatory Instrumentalism). Note: MNOs have addressed this by shifting value to a “regulated” payment (ex. Pre-paid card) and partnerships.

G) Enforce KYC responsibility for MNOs engaging in payments at Cash in/out points. Example retail partner is responsible for validating identity.

Business Model

It is difficult for established businesses to create effective business models “down market” from their current customer base (see Clayton Christensen – Innovators Dilemma). MNOs may be best positioned to execute, on the mobile money value proposition, given that the “unbanked market” is market that they serve much more effectively today (reputation/brand/service/efficiency), and the fact that “mobile money” is a key to sustaining their growth. I cannot underestimate this point. For banks serving the unbanked represents a low margin (if not money loosing) value proposition for all of their current products. Similarly, payments are a profit neutral business for banks separate from the lending or commercial services which surround them. Bank product lines are typically not focused on accounts with balances of less the RS 5,000 ($100). In addition, existing Bank systems typically do manage millions of small ticket real time money transfers (think SEPA or Wire) with associated risk, authorization, and AML controls. This “gap” in serving emerging markets is prompting indigenous efforts (ex RBIs: RTGS, National Infrastructure for Mobile Payments, and India Card).

For MNOs in emerging markets, mobile money is aligned to their current business and in fact essential for growth. Allowing “cash in” and “transfer” enables customer usage through pre-paid plans. For MNO consumers, access to money services provides ADDITIONAL value to their EXISTING MNO relationship (more on this later). MNO success in “mobile money” is assured because the service further enhances the EXISTING MNO business model, a model which the team and infrastructure to: market, sell and service the unbanked is established (and profitable).

The consumer value in mobile money stems from the macro economic transformation that exchange of value provides in moving from “informal” communication to money centered “business” communication. Payments and value may well evolve differently in emerging markets over the next 5 years as payments, telecommunication, regulation and new services establish a unique ecosystem that serves 1 Billion consumers never “connected” to the world’s economy. It is the combination of “network access” and “value access” that provides transformational opportunities to the world’s consumers. This market dynamic leads to transformational “leap frog” opportunities within emerging markets.

MNO Fragmentation

The principle challenge for MNOs to address is in emerging markets is: fragmentation. A large reason Vodafone was successful in Kenya was that they had 80% of share. Fragmentation of consumers in highly competitive mobile markets, combined with conflicting standards, technology and retail partnerships may cause consumer confusion. This chaos is anathema to the “trust” necessary to establish consumer confidence in payments and value storage. For example, in Nigeria can you pay your utility bill on any cell plan? Dominant MNOs will likely race to establish payment networks and partnerships, even in the constrained regulatory environment. Less dominant MNOs will likely look to regulators, standards, interoperability and other mechanisms to level the playing field. It is essential that MNOs get this right the first time, as “trust” is something earned over many years and quickly destroyed.

In emerging markets, MNOs may be best served by attacking “breadth” opportunities first. Very simple services that can have very broad impact, with very little assistance from external vendors may provide better support for immediate growth:

- Nature of network effects are that you must deliver value to everyone on the network (whether a bank or an MNO). Successful networks must have established physical distribution points.

- Objective in payments is to establish use and acceptance. Example, receive your pension… now establish a savings account, or send money to your grandson.

- Trust.. Serviceability, manageability, and risk management in “simple services”.

For Bankers

As a banker myself, I never admit defeat in attacking a profitable market segment. Given that payments are not particularly attractive for banks (separate from the products and balances that support them), there are several strategic options (Beyond the scope of this post.. but which I would love to discuss). In general banks should maintain engagement with regulators and MNOs, and focus on providing services that protect their network and enable access to consumers. Examples:

- Switching. Extending payment capabilities in existing accounts and networks. Switching between multiple MNO value stores

- “Participating” on the mobile network. Micro lending through “supporting role”.

- Risk Management.

- Partner w/ large existing customers in their participation. Example, Pension/Payroll to mobile plans, or connecting to MNOs to business (retail lockbox on mobile)

- Managing compliance. Example: Cash out

For Software Vendors (ISVs)

In emerging markets, I would expect to see rapid evolution constrained only by regulation. Expect to see very simple services that can have very broad impact, and support MNOs existing value. A key distribution point for these services are local agents. For those of you in the US, think of these agents as the local “country store” of 80 years ago, trusted members of the community that frequently extend informal credit. Banks in Kenya are just gained access to agents in distribution of their services in order to compete with Vodafone and ZAP.

Many of the “consumer facing” services will require very little assistance from external vendors until the networks mature and value is transfered beyond the MNO network. Example issues for vendors today:

- MNOs have very solid SMS development skills. Look at MPESA, ZAP, GCASH.. who developed the software behind them? The MNO.

- Simplicity lends itself to better risk management, a key for reinforcing the “integrity” of a new payment system. Solid risk management is even more pronounced in the face of new regulations.

- CEO visibility with MNOs, Banks and Retailers. Paying a “US Vendor” for anything relating to a payment function is not likely. Citi mobile teams have built tremendous SMS applications in weeks (sorry Silicon Valley).

- Government Visibility. In addition to CEOs, governments and regulators are highly involved in addressing the needs of their citizens, whether “unbanked” or “unphoned”. Regulators globally are looking to share learnings from Kenya, Philippines, India, … Banks expect between 600M-800M people will gain first time access to financial services over the next 8 years. A tremendous market, that will be served much differently then banks (and retailers/MNOs) have operated in the past.

This is not to say that ISVs have no role, but rather their role will be supportive of facilitating exchange of value… NOT leading with a brand (ex Obopay). Examples:

- Government pension distribution across multiple MNOs

- Business connection to multiple MNOs payments

- Businesses clearing settlement, AR integration and reporting

- CRM solutions for customers, automated response

- Assist MNOs, Banks and Businesses in compliance and reporting.

- Bank connection to MNO networks. Ex: micro lending… receive your pension… now establish a savings account, or send money to your grandson.

- ISVs should look at supporting services in connecting business to this new network.

Related articles

- http://www.safaricom.co.ke/index.php?id=655

- M-Banking: Vodafone’s M-Pesa Hits Regulatory Roadblock | MediaNama

- http://allafrica.com/stories/200910060118.html

- http://wirelessfederation.com/news/14384-zain-launches-zap-mobile-banking-targets-100mn-customers/

- http://venturebeat.com/2009/03/26/obopay-scores-70m-from-nokia-for-mobile-payments/

- http://deals.venturebeat.com/2009/08/26/nokia-readies-mobile-payment-service-nokia-money/

Unbanked: Cash is King

Tackling regulatory and consumer issues in emerging markets

While I was consulting w/ regulators and banks in Malaysia, I asked about the penetration of cards. The response from a lead banker was “Cash is King”. This response is a great summary for the key issues facing MNOs, FSIs and Regulators attempting to improve electronic payment penetration in emerging markets. Adoption of new payment mechanisms in developed countries has historically taken 20-30yrs. Emerging markets will surely proceed at a faster pace, but the work to be done is greater given the absence of: regulations, consumer protections, and electronic/physical infrastructure (among both banks and MNOs).

“Cash is King” may be too much of a generalization to extend to all markets, but in Malaysia consumer research indicates there are substantial consumer hurdles for FSIs trying to capture the unbanked population (trust, access points and overall committed to cash chief among them). For domestic FSIs in SE Asia, the consumer data shows that MNOs are better positioned (reputation/brand/service/efficiency) to deliver on the mobile money proposition. MNO’s position stems from the value that they deliver, with mobile money serving as the principle mechanism to retain access to MNOs services AND move from “informal” communication to money centered “business” communication. MNOs in emerging markets therefore have a unique opportunity to attract consumers to mobile centered “value store”.

Software providers (ISVs) attempting to address the “unbanked” world will face the following challenges:

- MNOs are adept at software development. Look at MPESA, GCASH, ZAP, …

- Business case separate from MNO is very, very challenging. Payments is a difficult business for banks.. it may be an impossible business separate from either bank or MNO.

- No private investment capital. NGO and micro-finance organizations I have spoken with are highly skeptical of technology use for unbanked (even for loan officers). Further, their involvement suppresses margins as government resources are allocated to achieve goals that are not following a profit motive. ISVs will need to make difficult decisions on whether to focus in the “For Profit: of “Not for Profit” areas.

- Many willing to listen to your idea, or let you prove out your value.. without much commitment for revenue.