I’m glad I made the decision to attend my very first Merchant Risk Council event this week. For those that don’t know, MRC Vegas is the second largest payment event in the US (after M2020) but with a VERY different focus. MRC is attended by the “hands on” payment leaders from all the top merchants and the vendors that serve them: Stripe, Adyen, PayPal, V, MA, risk, fraud, …. Etc. Whereas M2020 is attended by FinTech, Crypto, Venture, Institutional investor, and strategy audiences, MRC is much more focused on making payments work.

Tag Archives: card

Google’s Browser Tokens Payments

Short Blog – Chrome AutoFill

I missed a key development 6 months ago: Google’s Chrome autofill began using network tokens in May 2022 (see article) after the Google Wallet relauch which was announced as part of Google I/O. Google now allows issuers to provision cards to the mobile device and to the browser desperately (see Web Push Provisioning) using network tokenization services (VTS/MDES). I discussed this in detail in my 2016 post Browser Tokens.

A Correction to previous blogs. Google’s Chrome autofil has network tokens, but (within the US) does not obtain a liability shift. For Google autofill to get a liability shift (within network rules), they would need to enable the 3DS 2.2 authentication features. Exceptions to 3DS 2.2 are where Issuer has provisioned card with Cryptogram (ie ApplePay card provisioned into wallet by bank). See Mastercard API doc for detail.

Continue readingGoogle’s “Bank” Plans

Summary – Google is not becoming a bank, but rather enabling:

- New integrated tools that will provide the BEST mobile bank experience

- Instant account opening

- Consumer incentives that will unlock the power of data (w/ consumer’s consent)

- New predictive analytics, recommendations, alerts, reminders, coupons, offers and engagement

Public PR

Over last 6 months or so we have seen several Press Releases relating to Google’s bank partnerships:

- Google Pay Partners – Mobile Payments Today – Aug 3

“We had confirmed earlier that we are exploring how we can partner with banks and credit unions in the U.S. to offer digital bank accounts through Google Pay, helping their customers benefit from useful insights and budgeting tools, while keeping their money in an FDIC or NCUA-insured account,” stated the release.

- Google – Not about becoming a bank – PYMT.Com – Nov 2019

Smart, according to Google, because it will provide its checking accountholders with money management tips to optimize and manage the funds in those accounts – funds linked to payments and identity credentials that consumers can use to buy things, pay bills and send money to others in and outside the Google ecosystem.

CEO View – Battle of the Cloud Part 5

Google in Payments: Why Yesterday was BIG News

Least Cost Routing – Part 1

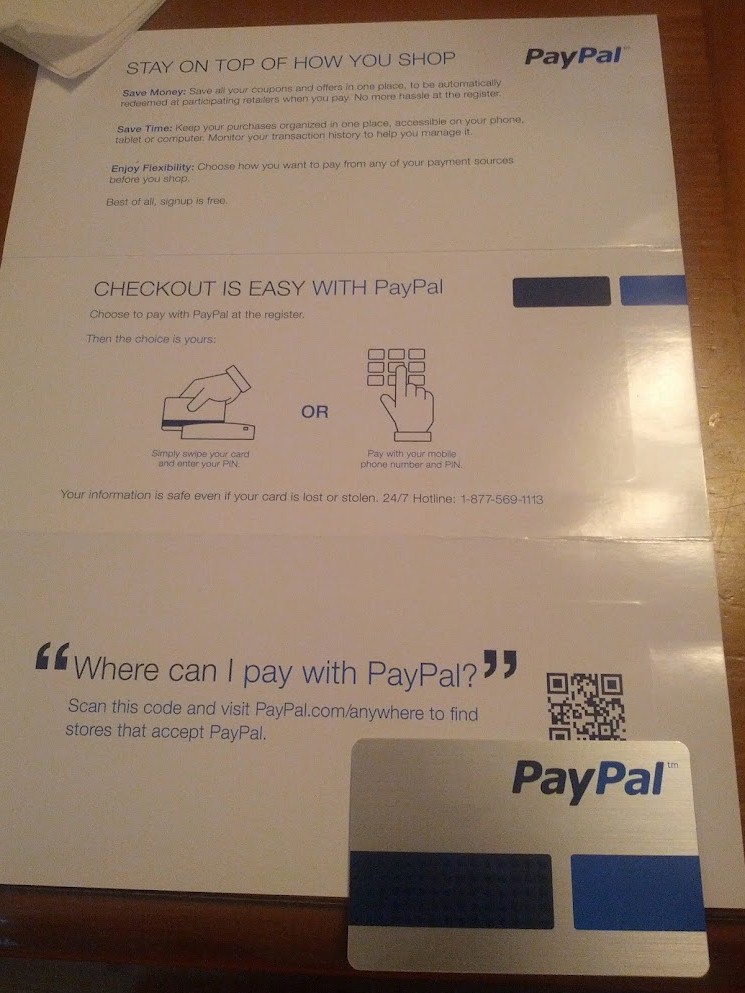

PayPals New Plastic

![]()

No Mastercard Logo on this one…

Quite impressed that they have pulled this together.. a new card network…

This is more than a decoupled debit.. although PayPal could choose to assume settlement risk through either ACH, stored debit card (or even ATM??). Paypal has the facilities to provide lending via BillMeLater (previous post) or to a consumer’s other preferred lender (via stored card). They are completely in control of a much larger value proposition as well.. with integrated rewards and a 3 party financial network that will compete with Discover and Amex.

I’m very, very impressed.. this is a new product that could completely disrupt traditional credit cards. Not only in rewards, coupons and incentives.. but in interest rates for every single purchase. This could be the only card you carry.. Forget about the “pay by phone number”.. the product innovation here is much more interesting than how it is delivered (plastic, phone number, bump, …).

Paypal also has a new site (beta) a few screen shots of which are below.

This new plastic is currently only accepted at Home Depot. My understanding it that Chase Payment Tech will be a lead acquirer for this new Product… I’m sure Vantive, FirstData … et.al will not be far behind. I will attempt a more thoughtful analysis later… thoughts appreciated.

Protected: Categorizing Offers Programs

Apple’s P2P: Visa Money Transfer

Update 13 March 2011

It would seem that there is some amount of disconnect between the bank eCommerce, debit and inter bank teams. The banks are working on a new interbank P2P service. This service will be based on ACH and follows on to what was pulled from the BAC/WFC Pariter scope last year. My guess is that JPM is also a “partner” and is committing to directory integration just as it is with CashEdge (Citi, 5th 3rd and 200 odd banks).

The Visa Money Transfer commitment may be an “accident”, and the banks may not know that Visa is working with Apple. This Visa service would clearly compete with the new bank owned service.

11 March 2011

In previous blog I spoke about Apple and NFC, although I still don’t know if Apple’s wallet will be ready for the iPhone 5.. it does seem that they plan to launch with a P2P transfer system powered by Visa (See previous blog on Visa Money Transfer). Apple’s iTunes wallet does not “store” funds like PayPal nor Apple does have money transfer licenses. It was therefore searching for a way to allow consumers to pay each other. News I have is that they have selected Visa Money Transfers for this. Is it the only way? perhaps not… but I give it 90% confidence of being in scope for wallet launch. (Sorry for the confidence thing.. it was Gartner Group’s way of making shit up)

I just can’t believe that bank payment heads are allowing this. I was on the phone with the head of debit for 2 of the top 5 banks.. their eCommerce teams love the idea of partnering with Apple.. but the debit cards head have said “no way”. It is just a terrible idea for banks to give Visa a way to circumvent ACH.. and it will be very, very hard to shut down once it gets moving. Reasons:

- – Visa runs it.. Continues to build Visa brand on your ACH

- – You own the risk, Visa develops new services

- – Circumvents all of the industry controls on ACH (ex. TCH, Early Warning)

- – Unfunded Reg E research burden and consumer support reqs.

The big banks that have taken the plunge are JPM and BAC. Not sure if both have committed on debit AND credit.. or just credit. The business case for credit is pretty solid and I don’t have any issues here, but allowing Visa to control transfers on debit is not in the best interest of banks. Why would banks want to allow Visa to develop a consumer directory and a new service that directly competes with ACH (see blog)?

Bankers, my recommendation is to buy Interlink or Star and put it in TCH… then run the this debit service there.

Start ups.. I would not focus on payments in Apple’s platform. Think there would be new opportunities in intgrating POS to Apple’s payment mechanism, or even a “billtomobile” kind of function where you can pay online with your apple ID. My head is spinning at the chaos this will cause within ISIS AND each carriers own billtomobile efforts. Apple is near a tipping point with the carriers. I would expect them to start aggressively pushing a much more friendly Android model.

Debit Card in Peril?

27 October 2010

- Bank of America’s 3Q Earnings (19 Oct)

- Financial Times

- Merchant Payments Coalition Response to BAC Charge

- Visa Downgrade (Bloomberg)

The biggest story of the week has largely gone unreported. Bank of America (BAC) has taken a $10.3B goodwill impairment charge in 3Q.

The Merchant Payments Coalition responded to the impairment charge (reference above)

“With a Federal Reserve decision on debit interchange rates not expected until mid-2011, today’s claims by Bank of America dramatically overstate reality and represent a feeble attempt to divert attention from its mortgage foreclosure problems,” said Doug Kantor, counsel to the Merchants Payments Coalition.

In the 8-K, Bank of America said it plans to take (ref The Street)

“a number of actions that would mitigate some of the impact when the laws and regulations become effective,” but it didn’t provide details about what those actions might be.

Will write more later, but I can assure you BAC is looking for debit alternatives. Given their size, most anticipate a new product driven from both their retail and global card team (including merchant services). So in addition to AT&T/Discover, we will now have another major bank led team developing a new payment product with a multi billion dollar incentive.

What does this mean for MA and Visa? Not good news for US growth.

Related Article