27 July 2010

![]()

- Financial Times – July 27

- Business Week – July 27

- Previous Blog – Citi “Bank of the future”

- Previous Blog: Citi – Branch Strategy and Bundle

- WSJ – Citi to cut back to 6 Metro Regions

Admittedly I’ve been critical of Citi’s recent NA efforts (Bank of the Future, Bundle, …), but I’m a big fan of Manuel and the new Citigold strategy described in the FT Article above. This blog is addressed to companies looking to partner w/ Citi (insight into the labyrinth), as it is one of the most complex organizations to understand globally. If it makes you feel any better, its hard for people inside the organization as well.

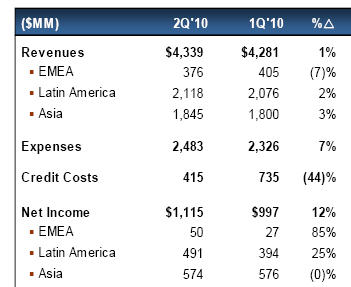

For you outsiders.. Banamex is not a poor stepsister to anyone in retail. As a proof point, in Citi’s most recent quarter (2Q10) LATAM alone provided 2x the earnings of Citi North America. The BOD (and most in Citi) consider Manuel to be a banker’s banker, and in Citi’s Banamex franchise excellence attracts excellence. Over the last 3 years retail strategy has been stunted by the churn of executives in its top ranks, the loss of Ajay Banga was a particularly hard blow. Manuel’s experience combined with that of the LATAM team (and BOD support) position him well to “turn around” Citi NA; an audacious goal that will enhance Manuel’s position as successor to Vikram.

Under Teri Dial, thousands of man hours were spent by every Citi retail (and card) executive planning for “bank of the future”. While customer servicing, touch screens and iPhone apps are important.. you first need to get the customer into the store and sold on your products (in person or remotely). Bank of the Future was an effort that frustrated Citi’s cadre of excellent business leaders; an empty strategy that gave no near term focus to BAU.. nor a “profitability” for the “future” end state.

Citi’s international retail franchise is a star globally: an affluent bank strategy with minimal branch footprint. Citi’s breadth of products and expertise was an original goal of the Sandy Weill’s supermarket. While loosing significant wealth talent and capability at the top end (with SSB’s $2.7 spin out), Citi still retains products and capabilities globally to serve the affluent segment in the US (just as it does internationally).

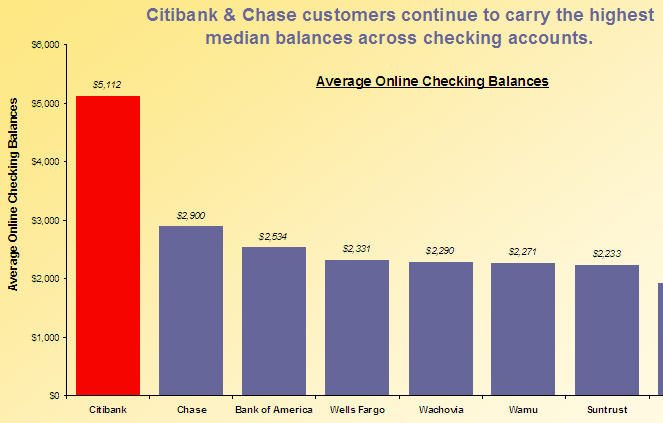

Manuel’s US CitiGold strategy is an excellent approach. Citi is already an affluent bank (as shown in 2006 Comscore data below), maintaining average balances twice that of their nearest competitor (my rule of thumb is that the average BAC customer has twice the products, and the average Citi customer has twice the balances).

Re: US CitiGold, the international team has long questioned why the US continued to push sand up hill in a mass market focus given its minimal branch footprint (#9 as stated in WSJ article above). A new affluent focus will drive marketing, product and most importantly sales.. Citi DOES have unique capability, internationally it also maintains a great brand, let’s see if it can dust itself off for a premium US debut.

This new affluent US focus will not be without challenges, from both existing banks and new start ups (like Bill Harris’ SafeCorp Financial). However, Citi’s capabilities uniquely resonate with several high end demographics that are already customers of its other lines of business (CEOs, Investment bankers, hedge fund managers, expats/international executives, CFOs, …). Internationally CitiGold services normally started with clients of the institutional side and expanded to the expat community. My guess is that Citi’s decision management team would say that the ability to sell CitiGold in the US (absent these connections) is not well established. On the execution side we will probably see many more relationship managers (wealth lite) pop up in the branches that do exist, and focused marketing efforts outside of mass media. Affluent is about brand and service.. which does align with a few of the CitiForward initiatives.

On the innovation side the “Citi Forward” concept has been around the table for quite some time. Evolving over the last 4 years and piloting itself in Citi Australia. This is all good stuff: integrated financial management tools, comparison and cross selling. However all of this servicing will not bring you customers if the products are not competitively priced, limited marketing and no sales team (discussed in my previous post – Citi/Bundle). Hope to see Manuel empower a strong US retail head with a focused strategy that will empower them to take the reins of all technology and innovation activity. Citi has fantastic technical capability, but the business needs to focus it (particularly after the bank of the future mess).