© Starpoint LLP, 2025. No part of this site, blog.starpointllp.com, may be reproduced or retransmitted, in whole or in part, in any manner without the permission of the copyright owner. Also, see our Legal/Disclaimer (this is a highly opinionated and partially informed blog).

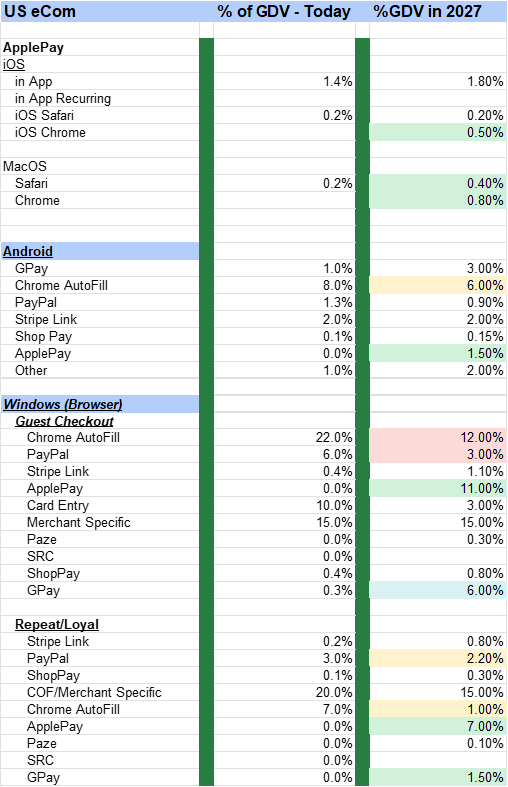

My estimates for how US eCom market share will shift in next 3 yrs are at the end of this blog.

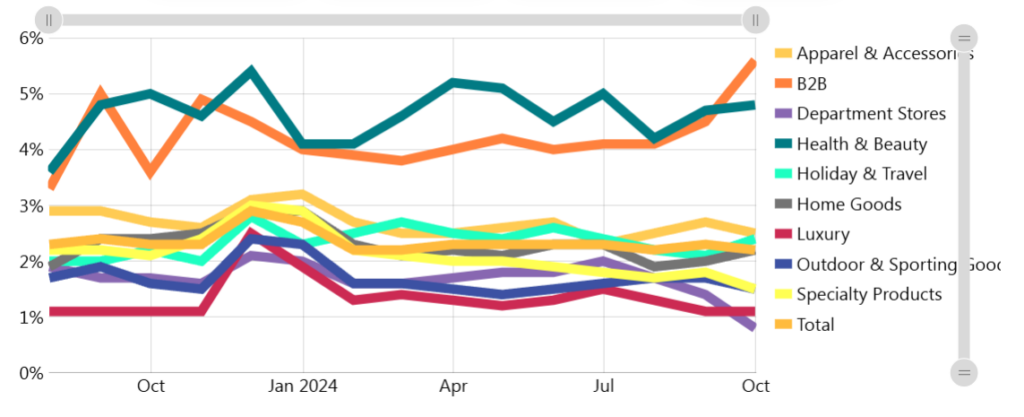

eCommerce is not a single monolithic market. There are many “segments” to optimize that vary by geography, retailer type, consumer device, customer type (guest vs loyal), transaction type (recurring vs new), ad type, payment type,…etc. A great source of this information is Monetate (highly recommend). For example, let’s look at conversion rates by industry, device and region.

By Industry

by Device

By Region

ApplePay

ApplePay dominates within the Apple domain (in App and on the browser on iOS and MacOS), and as I outlined in ApplePay 2.0, Apple is set to greatly expand beyond ~2% of browser-based eCom to 20% in the US within the next 2 yrs. How will share shift? Let me break down my numbers and assumptions for the US Market.

ApplePay eCommerce on iOS is approximately 10-11% of all eCom GDV.

- 85% in App Transaction

- 15% on Safari (on Mac OS)

- 0% recurring in-app transactions

- 0% Chrome on iOS

This means that only about 15% of 10% (i.e., 1.5%-2%) of all browser-based eCom is done using ApplePay. Given that 2025 US eCom GDV is 1.2T this equates to $18B.

The benefits to merchants using ApplePay in the US

- Best in-class conversion rate

- Best in-class fraud rate

- Consumer experience and awareness

- Consumer adoption and established behavior

- Improved terms (ie liability shift w/ Mastercard and Amex)

ApplePay is able to run under improved terms because it is the EMV compliant DPAN on the phone, provisioned by the banks with integrated biometrics that are used for payment (see blog). Google also has the same ability (see Google SPA).

Guest Checkout and the “New” Players

In addition to ApplePay’s expansion to Chrome, there are 6 other “new” players in the guest checkout space for 2025

- PAZE – the US bank consortium creating a white label SRC. To my knowledge there is no merchant discount nor merchant interest here. Thus I’m discounting it heavily.

- ShopPay. Together with ApplePay it came out #1 in authorization rates, fraud and conversion.

- Stripe Link. Huge gains with over 7.4% of stripe transactions using LINK. On this blog, stripe link represents almost 40% of transaction volume.

- SRC. This is already rolled out in Europe with FIDO servers live. I see it dominating non-US markets.

- PayPal Fastlane.

- Revised GPAY and Chrome Autofill. As the leaders in guest checkout, expect Google to retain their position.

US Market Share Shift

As I related in eCom 2025, I see massive shifts in eCommerce volume this year, with cards improving their customer experience across many innovators. This is the key point here, all of the innovations above are around card. While merchants complain about the costs of payments, they know it is what consumers prefer.

My estimates below are based upon merchant surveys, incentives (ex liability shift), performance (ex auth rates), costs and investments required.

The big news in the share shift?

- ApplePay will be the big winner, moving from 2% to almost 20% of eCom in the next 3 years.

- Google will also gain significantly and authentication becomes the key differentiator in customer experience. The lines between Chrome Autofill and GPA will blur.

- Stripe Link and ShopPay will more than double share.

- Bespoke merchant cards on file checkout will give way to platform payments because of the enhanced rules, better rates and improved conversions.

- Top eCom merchants will grow their own payment methods and mobile/loyalty platforms.

- PayPal branded payments will be the big loser.