Short Blog

© Starpoint LLP, 2025. No part of this site, blog.starpointllp.com, may be reproduced or retransmitted in whole or in part in any manner without the permission of the copyright owner.

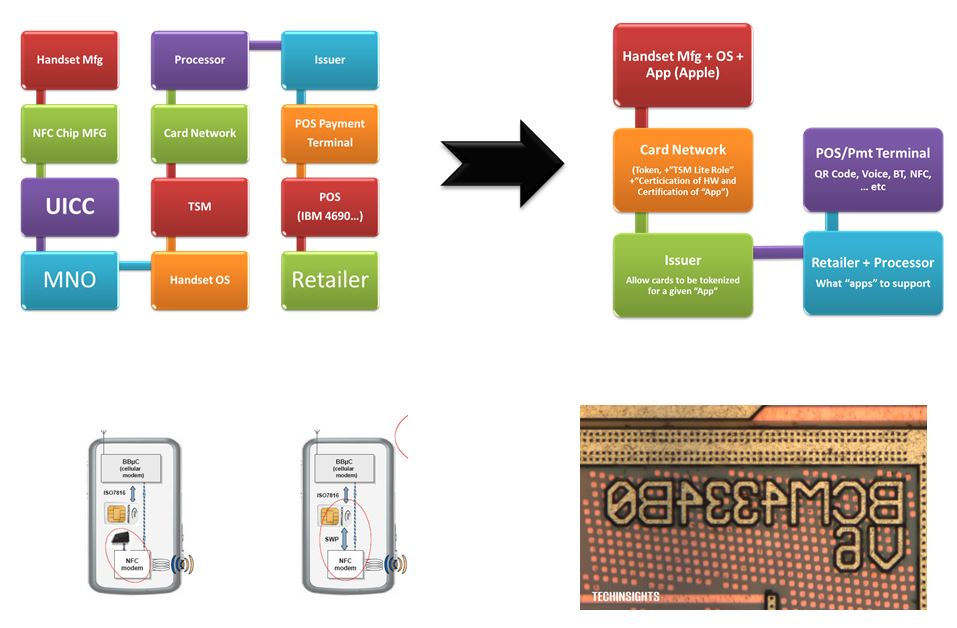

Adyen was the largest network “tokenizer” and realized the benefits through enhanced authorization rates and reduced fraud. As I explained in Tokens and Binding 101, this history of tokens in payments is long, with each stakeholder maintaining an ability to tokenize. While all token strategies protect data, network tokens differ in RULES, binding (to a customer and device) and acceptance. For example, Visa’s Cloud Token Framework (CTF) and Mastercard’s Digital Enablement Services (MDES) address 6 key areas: