25 January 2011

Part 1

Previous Blog – Bank Payment Councils

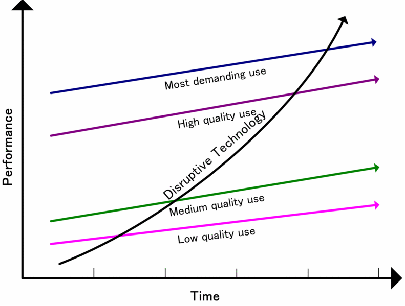

Banks will win in payments…. with one provision… payments that are profitable. Every successful payment type has at least one bank behind it. But WHO are the banks? Target, Sears, American Express, Wal-Mart, Tesco, General Electric, BMW …etc all have banking licenses. As the lines between retailers, banks and mobile network operators start to blur.. who will be successful? Now that MA and V are public companies, how are banks vested in their continued success? Will there be a new wave of creative destruction?

Bank Structures

This blog has a “payment view” on these answers. Typically, large banks do not view payments as a business, but rather a service that supports multiple products. Exceptions occur when the “product” is payment (Credit Card, Retail Lockbox, …). Within retail, credit cards are either a separate LOB (BAC, JPM, AMEX, C) or aligned within the retail Asset side of the business, while debit cards are managed within the consumer deposit team. A review of this organizational complexity is necessary in order to understand retail bank “initiatives” in payments and their corresponding business drivers.

For Retail Banks, credit is the primary business driver of payment investment. As a side note, this is one reason why there is such poor payment infrastructure in emerging markets. Bank credit is of value to the merchant and the consumer. Although not all Retailers seek to be depository institutions (ie Tesco and Wal-Mart), most are assessing how they can ensure access to credit, and are experimenting with differentiated credit value propositions. Most card issuers are quite confident in their ability to retain customers with substantial consumer data confirming strong loyalty.

Retailers have a different perspective, their consumer data indicates broad dissatisfaction with bank services particularly in segments below mass affluent (ie switching preference, satisfaction, bank fee sensitivity, store loyalty and general anti-bank sentiment). In addition, although Retailers are firmly in support of store credit, they have moved “beyond” the tipping point with respect to interchange, and are quite proud of their roles as architects of the Durbin Amendment.

For the US retailers, that have already expanded into the banking business, the most common structures we see are the ILC (See KC Federal Reserve Article) and Federally Chartered Thrift (moving from OTS to OCC). For US Retailers, Target (see Target RedCard) may provide a model case study with significant assets in team, infrastructure, and capabilities. UK and EMEA banks face a much less complex regulatory scheme, with Tesco PLC taking the global lead in innovative banking services (Wal-Mart Mexico is a very close second).

Credit

There are several excellent resources for those looking into the history of credit cards (I recommend Paying with Plastic: The Digital Revolution … ). Retailers and manufacturers have long realized that earnings from the credit business can well exceed that of the core business (GE Finance, GMAC, Target, Sears, ….etc.). But these endeavors are not without risk, as retail/mfg driven finance companies have also suffered the same fate as banks in consumer credit (ex Target looking to sell its own $6.7B Card portfolio ). Credit is the lifeblood of most retail, and while there are few issues with credit access for affluent consumers, there are many consumers with FICO scores below 800 that retailers want to serve.

Credit Card businesses have been hemorrhaging cash over the last 3 years because of NCL, and anticipated impacts of the new financial regulations. The most striking example is BAC’s $10.3B write down in 3Q10. 4Q10 earnings show that the credit environment is improving, with banks improving the quality of their credit portfolio (sub prime). US card issuers released earnings this week demonstrating improved credit quality as they also release reserves, toward the top of the list is JPM (card 27% of $4.8B Net Income). Citigroup’s card also returned to profitability in 4Q10 with North America Net Income of $203M for 4Q and -$164M for FY2010. But there are other indicators which point to a change in prime consumer credit behavior (ex TransUnion reporting that 8M fewer consumers used their credit card). Perhaps this behavior change is driven by card rates climbing to all time highs (today’s CNN Money). Regardless of the behavior correlation, it is clear that consumers  VIEW of credit cards AND consumer ACCESS to credit is changing. Consumer access to credit and change in payment behavior are both critically important to retailers.

VIEW of credit cards AND consumer ACCESS to credit is changing. Consumer access to credit and change in payment behavior are both critically important to retailers.

Historically speaking, the data clearly shows that most retailers DO NOT offer a better credit value proposition (See US House Store Card Rates). Intuitively this makes sense as their ability to manage credit risk should be below that of banks, hence requiring a larger risk adjusted rate of return on capital. Today many retailers are questioning the value of the Bank Card products in delivering credit. Prior to Dodd-Frank, merchant card agreements prohibited: card exclusion, steering, payment incentives, …etc. Today US retailers can offer incentives for cash purchases, steer, deny and develop their own cards (ex. Target RedCard).

As the US consumer credit market has matured, the industry has spawned numerous specialists to manage the various functions of credit issuance, from acquisition and credit scoring through processing, collection and portfolio risk management. Consumer credit application cycles have gone from 2 weeks in the 2002 to under 2 min in 2007. This specialization allows non-banks to develop turn key credit offerings.. and approach risk management with tools that are equivalent to best practice within established banks. Of course the ability to manage risk is more than tools, it takes solid credit/fraud risk management processes and talent… but I digress.

What do retailers want? Credit availability and brand. Given that most Retailers don’t want to form a bank, they pursued private label cards to achieve these goals. Banks were badly burned here, with both Citi and Chase disposing of their private label card portfolios. In many cases consumers took the one time discount and never used the card again, those that did continue use were largely sub-prime borrowers and the banks did not adequately manage the portfolio risk until after the economy tanked.

My biased credit summary is thus

- Bank card rates are at an all time high and consumer use of credit cards is declining

- Retailers are always willing to pay interchange for access to consumer credit, but credit access is shrinking

- Private label cards have been a very bad bet for banks

- Retailers have new opportunities within Dodd-Frank and are evaluating plans (credit, steering, loyalty)

- Retailers are expanding into banking and credit through licensed structures. Growth in industry specialists allow them to create new products quickly

- Visa/MA/Amex are facing new competition from store derived cards, and merchant relations are at a low point

How can Banks Win?

Trust, value, credit, relationship, anonymity, protection, security, service, brand. With debit interchange revenue legislated away, what incentives to banks have to continue pushing network debit? A: None. The US will begin to resemble Canada, Australia and Germany with unbranded debit cards. From a retail bank perspective, the focus is back on credit and loyalty with ONE NEW CAVEAT: Value.

Will there be retailers that develop their own cards and banks? Yes.

Will Consumers jump to these offerings? Only if they can price risk better than you can.

Or

They offer a better value (ex. Target 5% off everything).

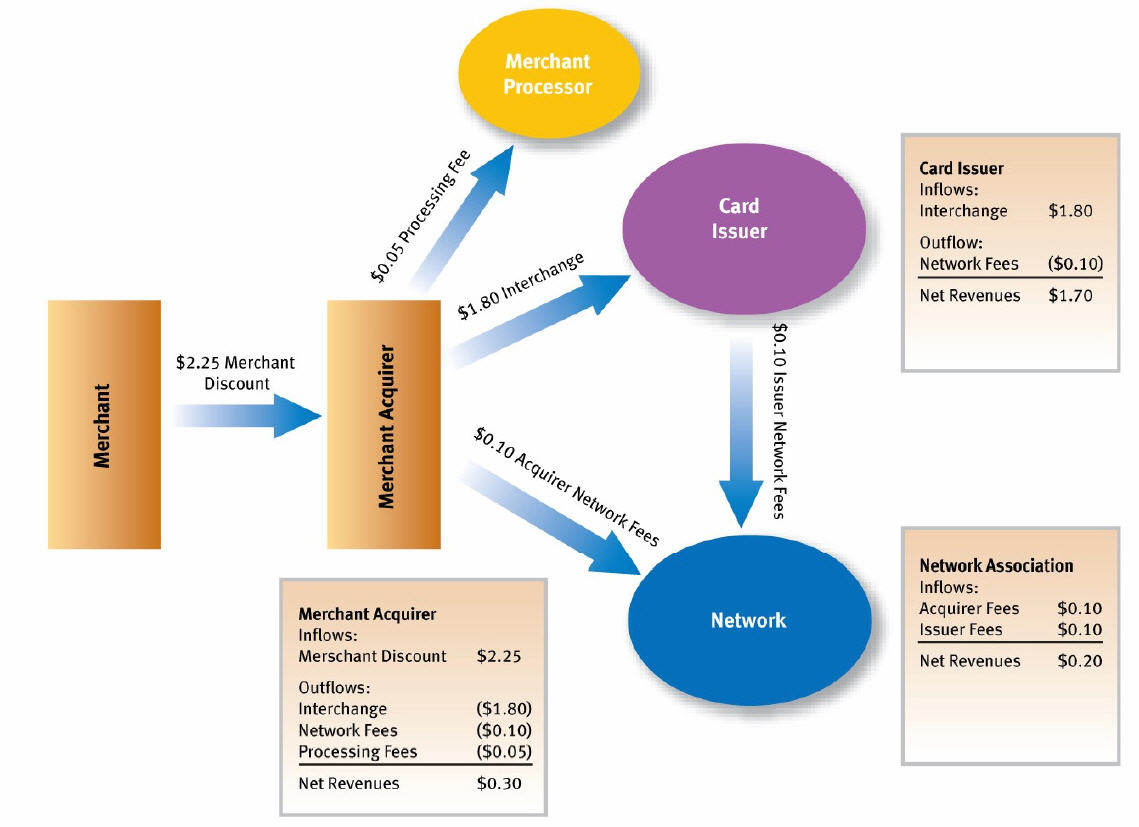

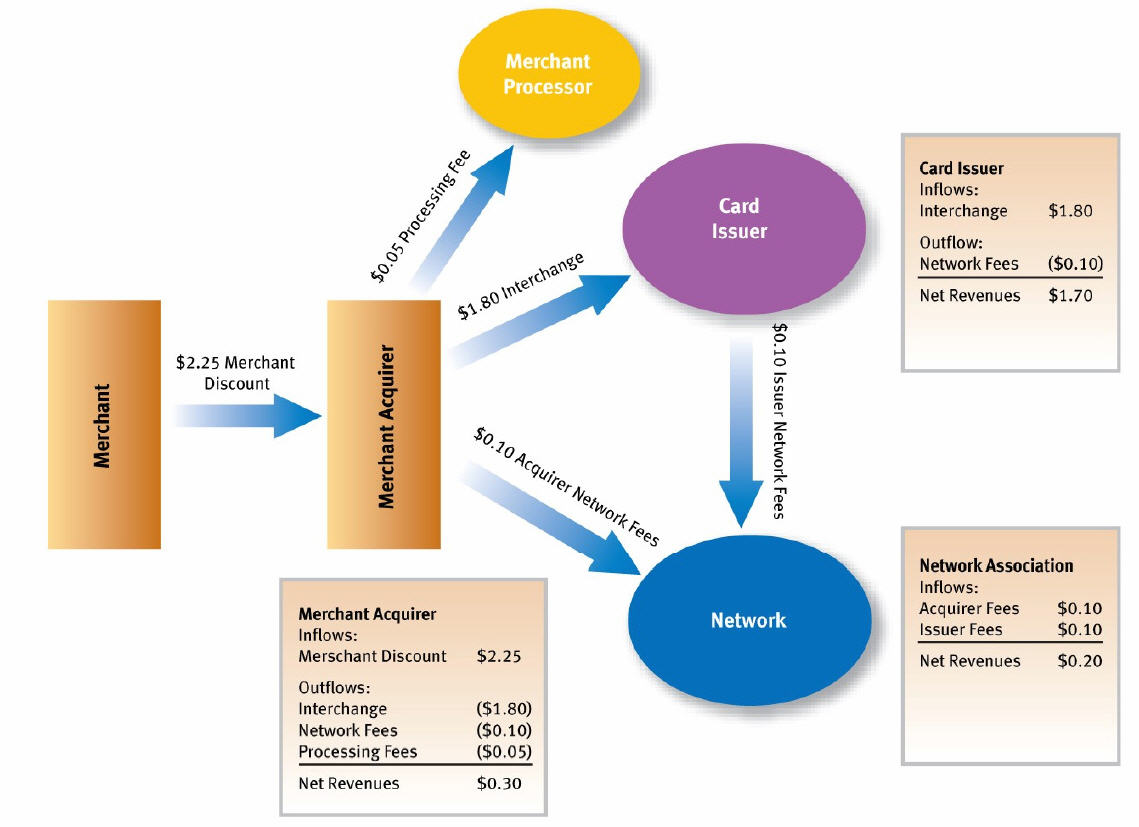

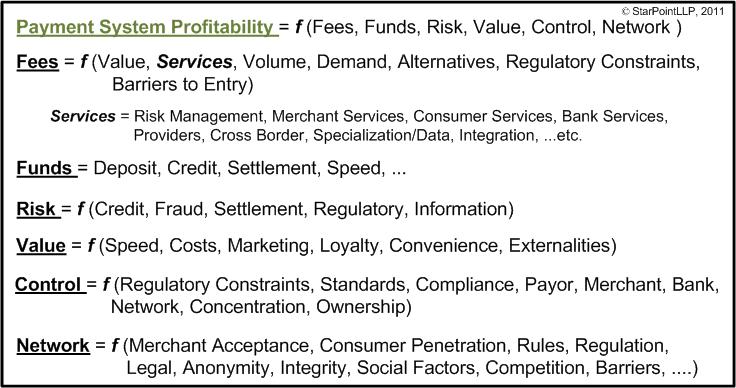

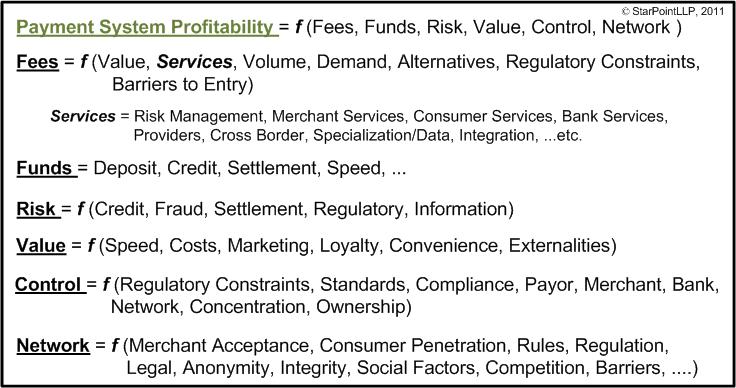

As a baseline, let’s establish a common view of what is a payment. For Banks, payment system profitability is a function of: fees, funds, risk, value, control and network.

It is this value element that many banks are overlooking. Loyalty based reward programs have been at the heart of most card schemes. My guess is that many of you are hooked on AMEX’s membership rewards (as I am). Why would you pay any other way? The merchant pays for my points and I get the goods at the same price.

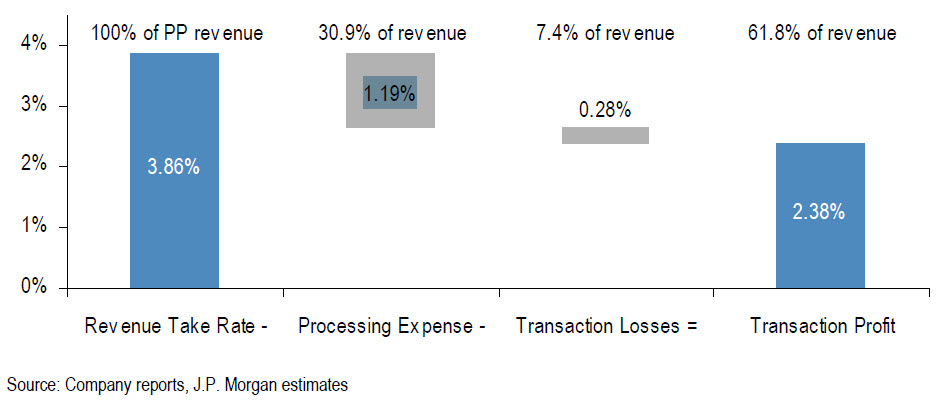

The model of interchange revenue driving payment system revenue (and rewards) is about to undergo fundamental change. Interchange is being regulated down and new “merchant friendly” value propositions driven by advertising revenue are being created. Given that most bankers are not retailers.. a quick 101 … in retail profitability nirvana is something called price optimization. Retailers, CPGs and manufactures want to influence consumer behavior and product selection based upon price/promotion. (I’m purposely vague here).

Most banks do not fully appreciate this consumer incentive dynamic. In a future scenario, it will not be convertible loyalty points driving payment selection behavior, but real dollar savings on every purchase with consumer behavior driven through rich personalized marketing. Retailers and advertisers will be able to influence behavior and generate revenue from it. In a conversation with a senior card exec on this he said “I can negotiate interchange down with any retailer I want to.. this is just a price issue”. I related my often used Wal-Mart quote “can you pay them for taking your card?”

Where is value creation … and the business case?

During my Holiday reading I ran across some old HBR articles: Skate to Where the Money Will Be (Clayton Christensen) and Where Value Lives in a Networked World (Mohanbir Sawhney and Dave Parikh). In the later, Dave and Mohanbir articulated a key principal:

In a networked world, more money can be made in managing interactions than in performing transactions.

This 10 year old HRB article was particularly thought provoking. These value tenants have broad applicability in assessing strategies and plans within both current and future network business models. Specifically,

Value at the Ends. Most economic value will be created at the ends of networks, At the core-the end most distant from users-generic, scale-intensive functions will consolidate. At the periphery-the end closest to users-highly customized connections with customers will be made.

Value in Common Infrastructure. Elements of infrastructure that were once distributed among different machines, organizational units, and companies will be brought together and operated as utilities.

Value in Modularity. Devices, software, organizational capabilities, and business processes will increasingly be restructured as well-defined, self contained modules that can be quickly and seamlessly connected with other modules. Value will lie in creating modules that can be plugged in to as many different value chains as possible. Companies and individuals will want to distribute their capabilities as broadly as possible rather than protect them as proprietary assets.

Value in Orchestration. As modularization takes hold, the ability to coordinate among the modules will become the most valuable business skill. Much of the competition in the business world will center on gaining and maintaining the orchestration role for a value chain or an industry.

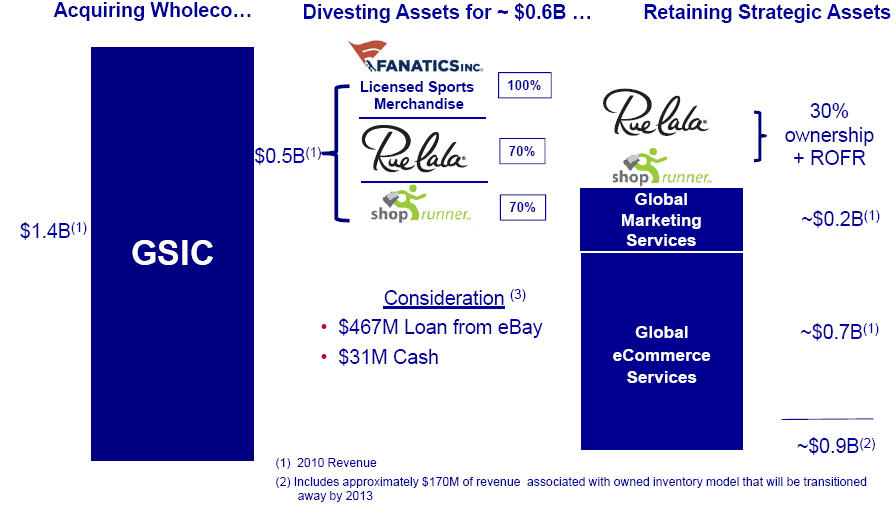

I will leave this section unfinished, it is clear that banks are uniquely capable of leading in all of these roles. What is also clear is that the business environment is ripe for a new network. What roles should banks have in its formation? Is there a downside to being a late follower and acquiring the “winners” after they have built the infrastructure?

Bank Action Plan

What are the bank assets here? Payment Infrastructure, Consumer Data, Trust, Existing Payment Mechanisms, Consumer Behavior information, Credit, Risk, Support, …

What do Banks need? A collective plan for action. Card Networks will not solve your problems, their initiatives to date around this have been complete failures and are severely challenged in creating a merchant friendly value propositions.

Recommendations for Banks

- Assign a senior exec.. #2 in your card organization

- Develop regular data backed trends and reports. Example: how is Target RedCard impacting your card profitability, spending shift, ANR

- You have 5 years.. develop a strategic plan that is multi-pronged. This is about standards, legislation, technology, IP, advertising, network, consumer data protection, innovation, payment, mobile, …

- Assess where there are synergies with existing consortiums particularly around standards and legislation.

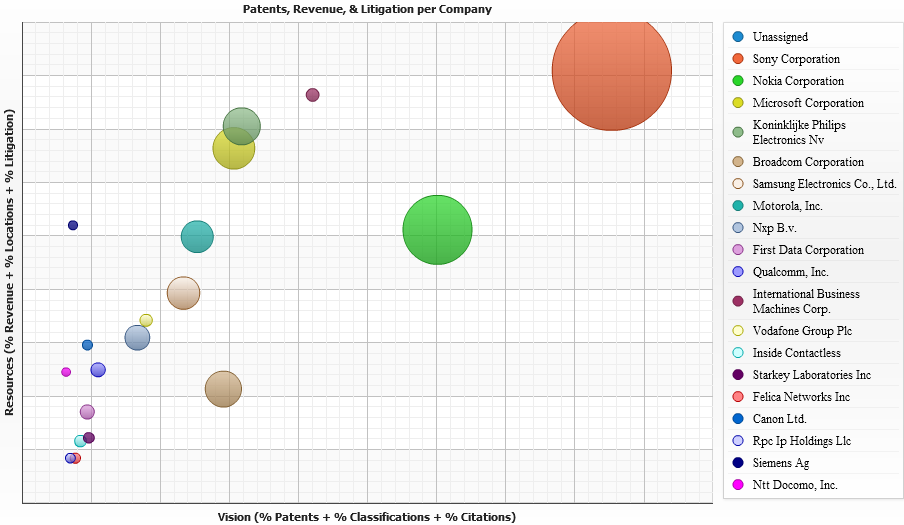

- Partner with non-banks. Google is active here now.. what do you know about their plans?? Have you seen their ZetaWire Patent?

- Assume your competitors are moving on this. BAC’s $10.7B write down is a level set on the investments which will go into this area.

Part 2 – Payments that are not profitable (at least not for banks).. this is beginning to look like Debit AND emerging markets.