12 May 2010

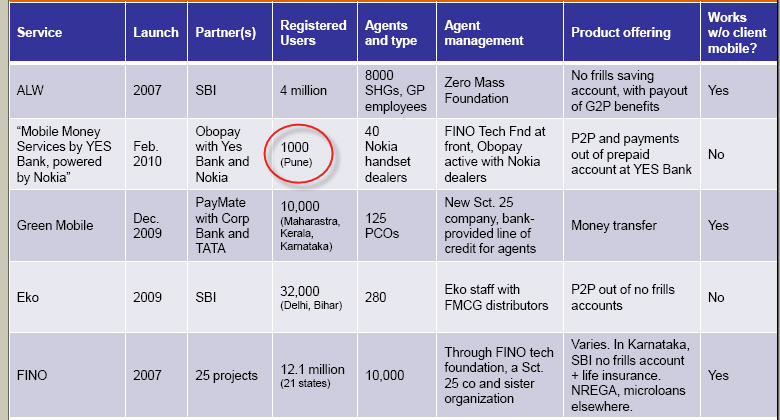

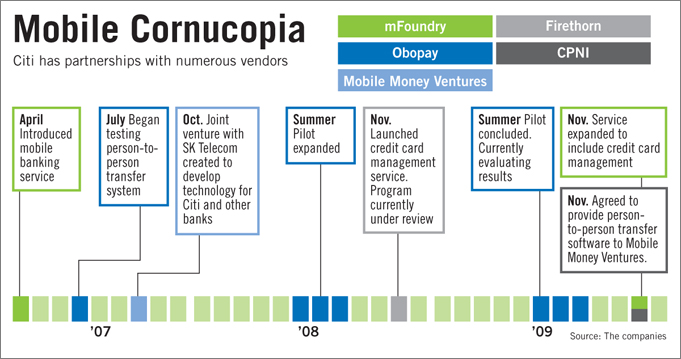

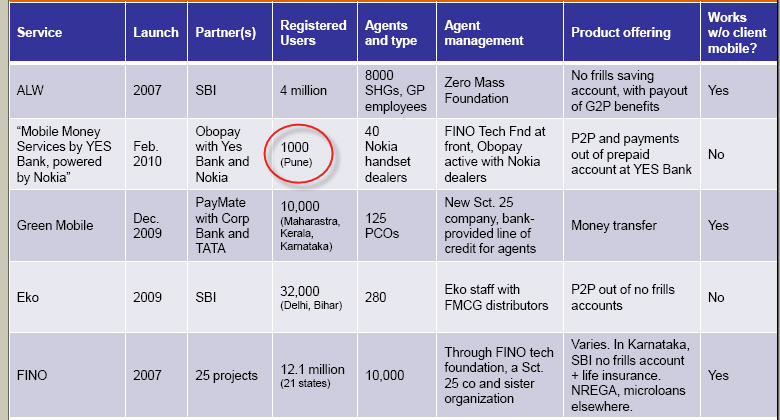

I’m just amazed at how groups that have the best interest of the rural poor in mind make life so difficult for those that are in a position to actually help. The bank regulations in India, with respect to mobile money, are particularly restrictive (Or perhaps I should say prohibitively restrictive). RBI is encouraging business models which are attempting to build agent distribution networks via business correspondents (ex Fino with 5,000 agents) and non bank financial companies (NBFCs). It would seem their goal is to disintermediate the MNO networks by giving certain agents the ability to represent the banking network AND MNOs. Note: For those unfamiliar with India, Agents are not employees of the MNOs and perform many other functions (sell many other services).

Two recent reports provide an excellent highlight of the challenges facing mobile money for the unbanked (MMU). The data here confirms that only MNO led initiatives stand a chance of succeeding, and even then at the margin:

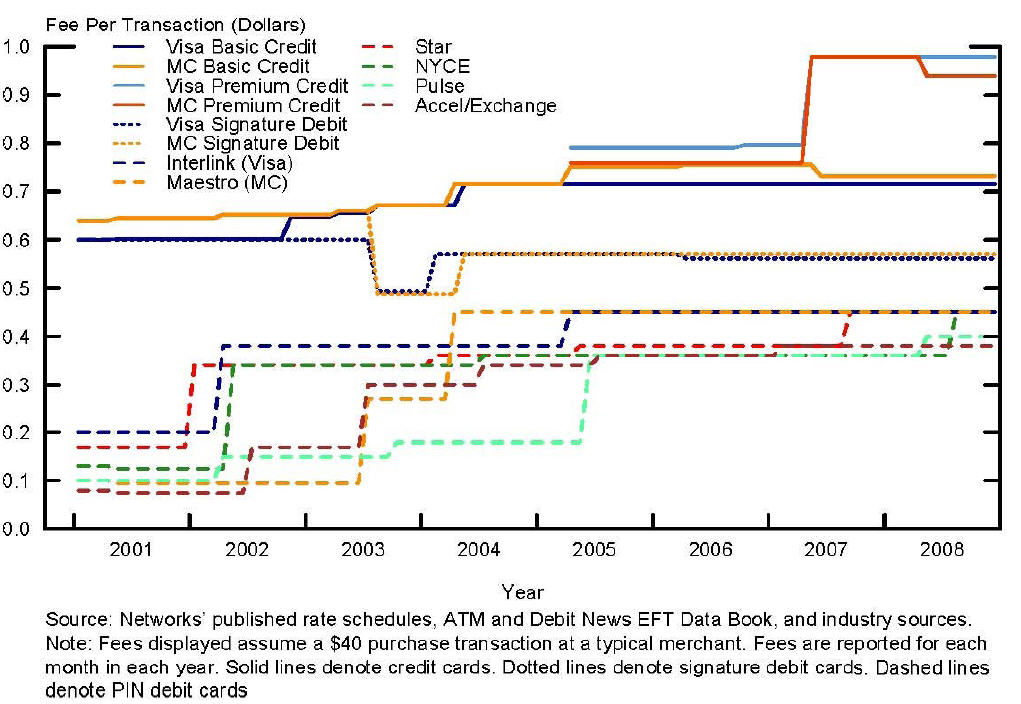

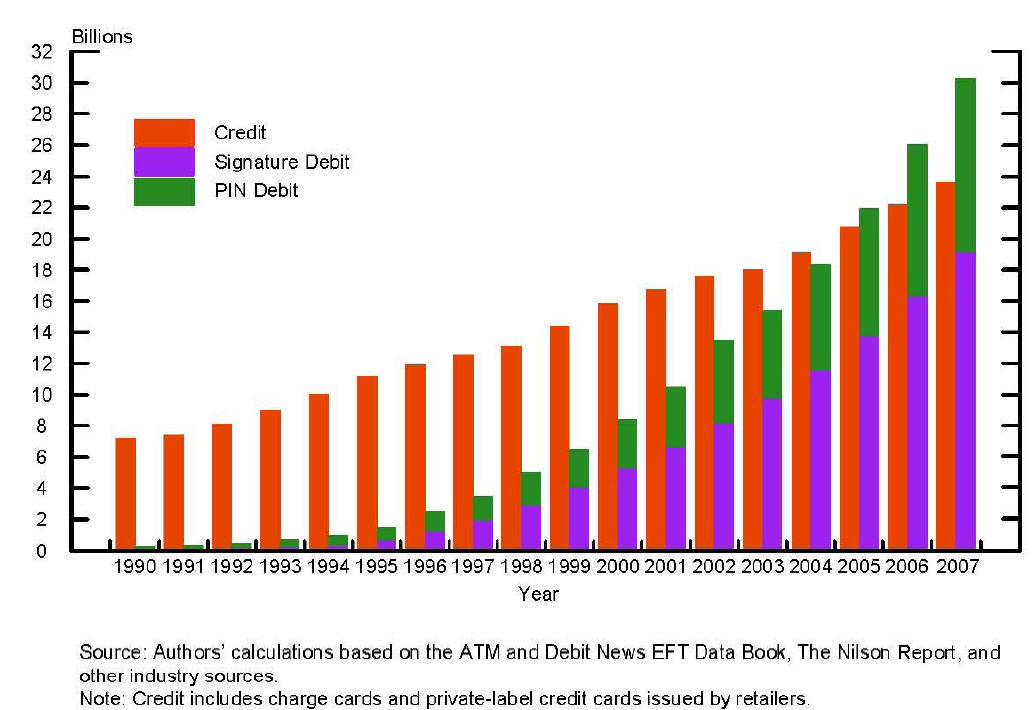

The lack of profitability in “payments” is something that banks understand well. (See my previous post and History of Interchange). Payment instruments typically compete on: speed, convenience, cost, risk, reward, acceptance, settlement time… Recurring transactions between businesses and consumers in mature economies take place on very low cost ACH type networks. P2P transactions are historically cash based with costs borne by central treasury. Payment services, physical distribution, regulatory compliance, consumer support are direct costs to retail banking. By restricting all payments to banks (and their agents) this cost must be distributed throughout the value chain. In an MNO led model, this infrastructure largely exists already.

Closed systems first

History has shown that closed networks form prior to open networks (in almost every circumstance) as closed networks are uniquely capable of managing end-end quality of service and pricing. This enables the single “network owner” to manage risk and investment. How can any company make investment in a network that does not exist, it cannot control, at a price consumers will not pay, with a group that can not make decisions or execute? Answer: Companies cannot, it is the domain of academics, governments, NGOs and Philanthropic organizations.

The success of MPESA, GCASH, Octopus, .. clearly indicates that payments can be decoupled from banking, with sound consumer controls and fantastic consumer satisfaction.

From CGAP (on MPESA)

- Users say it is faster (98%), more convenient (97%), and safer (98%) than alternatives

- 4 out of 5 say not having it would have a “large negative impact” on their lives

As a pragmatist (and capitalist) I firmly believe that the best approach to serving the unbanked in India is supporting a model where at least one entity has an economic incentive to invest. As I have stated previously (see Mobile Money: MNOs will Rule in Emerging Markets and Mobile Money: Emerging Markets/Emerging Models) MNOs operating in closed systems appear to be best positioned for creating a sustainable value proposition to the unbanked in next 2-3 years.

Example

As described in the CGAP reference above, both Fino and Bharti have completed pilots with Eko and State Bank of India (SBI). CGAP’s latest research (Fino Agent Profitability) shows a drastically different agent revenue model for bank led mobile payments in India. From the article:

FINO agents in Karnataka offer no-frill bank accounts from the State Bank of India (SBI). Some agents also sell insurance products. The business case for agents is working, but just barely. The average monthly profit is USD 23.42, far below what we’ve seen with M-PESA (USD 130.26) and Brazil (USD 134.42). Last November, account opening was halted while SBI migrates account data to its own servers, and the average monthly profit dropped to USD 8.08

I would hope that Indian legislators take a pragmatic look at the mobile money regulation. It will be up to consumers (ie Voters) to demand that the structures are in place to support a sound and fertile market for payment services. The economic growth and poverty imperatives greatly outweigh the justifications for RBI’s current approach.

Unfortunate news for the rural poor and unbanked: You will face a chaos of offerings from banks, agents, pre-paid cards, NBFIs, MSBs … the brand that you trust (ex. Bharti) and can most effectively deliver service to you is restrained by your regulator. Question to RBI: what is your objective and who is your customer? Most will agree that consumers don’t want (or need) a traditional bank.

Good news for MNOs: Shackled from serving your customer, you can take some peace of mind knowing that there will be no successful mobile money until regulations adapt and to allow your organization to lead delivery of it. Build it in another country and don’t stop talking about it within India.

Message for NGOs/non-profits: Quit pumping money into trials, and start influencing legislators and the RBI. The REAL risk for India is not loss of control of payments/AML and M4 (money supply), it is constraining growth and pro-longing poverty.

Comments appreciated

Related Articles

CGAP on building Agent Networks

Nokia Presentation: India Recommendations

Times of India on RBI regulations

CGAP on MNOs incenting w/ Airtime

Fino Blog covering business correspondents

Inclusion on reaching the unbanked