16 February 2011

LOL.. this blog is dead wrong. leaving it up here as a history lesson

—————————————–

Yeah.. thought the headline would make you read this one. This was the theme of yesterday’s WSJ article covering a NYC Mobile Monday Confab. I agree with these young CEOs, as I’m sure would James Gosling, Grady Booch, Marc Andreesen, Alan Kay (and the Xerox PARC team). Most of the readership of this blog are business/payments folks, and probably don’t recognize the names or the technical dynamics at play. Objective of this blog is to give a business perspective on a “death of apps” dynamic as these business execs are the ones who actually fund (and take the risk) on these technical approaches.

Let me start off with 2 stories

Story 1 – 1994

A long, long time ago (1994)… Netscape launched and gave ability to view basic HTML. The experience was rather dry, with even “drop down” boxes a major accomplishment. There was very little transacting, and the internet looked like one big marketing brochure. Early stage corporate use was limited to “employee directory” kind of functions, and interactive employee applications were built on … wait for it… POWERBUILDER, VisualBasic, or … for the more advanced companies… Smalltalk (an excellent language and my personal favorite). IBMs OS2 Warp was easily winning the enterprise war against Microsoft’s 3.1, a release which required a TCP/IP add on (Win95 came the next year in 1995).

Enterprises had a desktop mess, applications had to be installed with all of their supporting libraries, on multiple machine types, with multiple operating system versions, hardware versions, most of which conflicted. Fortunately internet browsers began to develop more and more functionality, with scripting and embedded virtual machines of their own. “Light” applications began to migrate to the browser with a significant advantage in cost to deploy and a slight disadvantage in functionality. As browsers and standards further evolved, more applications changed their architecture, attracting more top tier developers. Fat client apps became an ugly legacy (for all but Microsoft’s Office applications).

Lessons learned: multiple proprietary architectures won in “functionality” but lost in cost to develop, cost to deploy and cost to service. Greater investment in a “sub standard” approach enabled faster growth, focus and subsequent adoption. Open architectures allowed multiple parties to create profitable businesses, and further invest.

Story 2 – Fat Mobile Applications

I had a tremendous global team at Citi, quite frankly some of the best and brightest people I have ever worked with at any company. As head of channels for Citi Global Consumer, mobile (outside of the US) was in my domain. Banks are highly driven to reduce cost to serve and acquire. Mobile was (and is) a channel with much experimentation. At Citi I took a look at 6 key mobile initiatives within the last 3 years to look for patterns of success/learnings that could be leveraged. We had developed “fat client” mobile applications in US, Germany, Japan, Mexico, AU as well as SMS based applications in PH, SG, IN, Indonesia, … In every case fat client mobile applications failed. Why? Technology, user experience, cost to deploy, MNO “support”, … The testing matrix of handset types, OS types, screen size, OS versions, …. was just not manageable.

Perhaps the biggest learning of all.. is how mobile is viewed by the customer. As my head of mobile in HK (Brian Hui) told me “what is so urgent that the customer can’t wait to get back to their PC”? Customers want speed and simplicity in their mobile interactions. For services like “what is my balance”? Fat clients are not needed. Even today, bank mobile applications are largely a competitive “me too”, as deployment costs to support 3 platforms (RIM, iPhone and Android) are much lower than prior “universal” support attempts. Although the statistics are not widely published, more than 3x customers access their bank through a mobile browser than through their bank’s mobile application (not everyone has an iPhone.. imagine that).

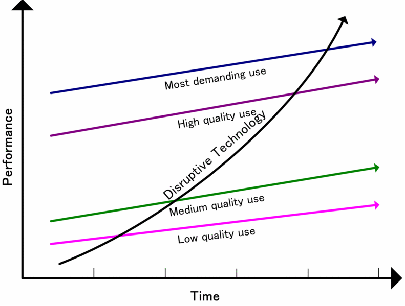

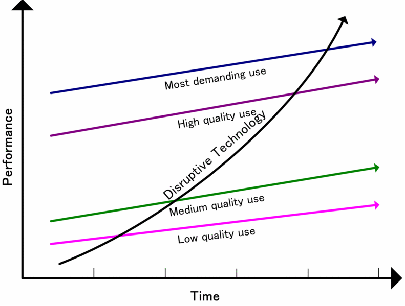

Proprietary Closed Systems must go first in NEW markets… then evolve or fail

As I mentioned in my previous blog, history has shown that closed networks form prior to open networks (in almost every circumstance). Closed networks are uniquely capable of managing end-end quality of service and pricing. This enables the single “network owner” to manage risk and investment. How can any company make investment in a network that does not exist, it cannot control, at a price consumers will not pay, with a group that can not make decisions or execute? Answer: Companies cannot, it is the domain of academics, governments, NGOs and Philanthropic organizations.

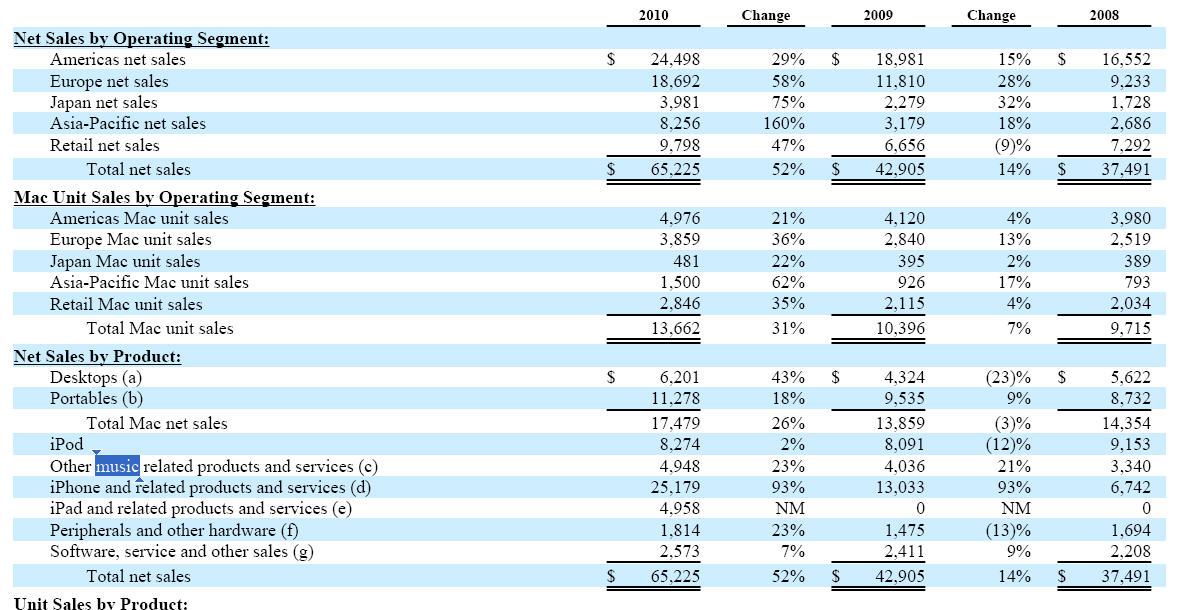

The principle challenge in evolving a closed business platform is financial. The margins associated with maintaining “control” of a platform are substantial… they are very hard for any company to give up (ie Microsoft, Apple, IBM). Just take a look at today’s WSJ regarding Apple’s subscription service plans. Apple wants to take a 30% cut of everything ever sold to its platform… for eternity. Can you imagine Microsoft asking to take a 30% cut of every fee on any item viewed or played on a Windows PC? How do you think Amazon or the music industry feel about this? Every iPhone App developer? It must feel like a Faustian bargain at best.

Apple’s big advantage today is app revenue, as it provides:

- Terms and Control

- In App Billing

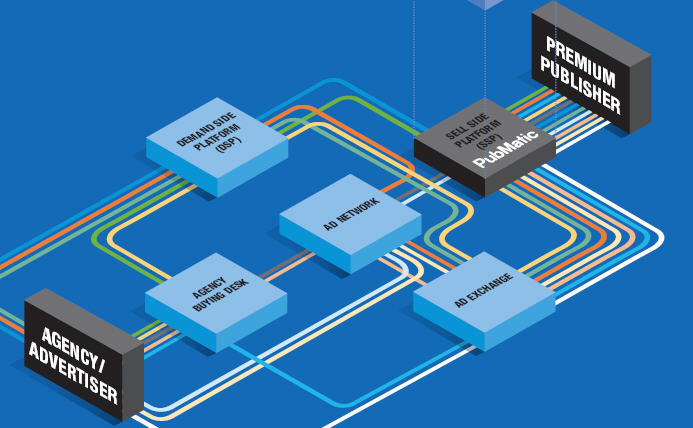

- In App Advertising

- Consumer Payment Management

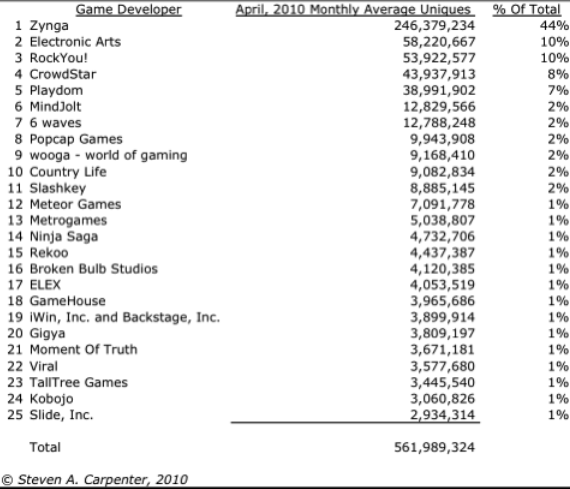

Yet I digress…. what about fat apps? This is why I like Google’s model, and why it will be so hard to compete against them. As Google evolves Android into an open mobile platform, the “app” revenue model will evolve as well. Just as with Apple’s Mac experience, it will be difficult for Apple to attract continued investment. Given the tremendous talent at Nokia, MSFT, Google, RIM.. I’m sure they see the analogy to the 1994 example I have provided above. An “open” mobile browser with enhanced features would destroy the Apple ecosystem. App developers would choose “open” first (IF they could monetize their investments). Every handset manufacture and MNO has incentive to develop and invest in a “kill the app” mobile browser standard to compete with Apple and change the competitive dynamic.

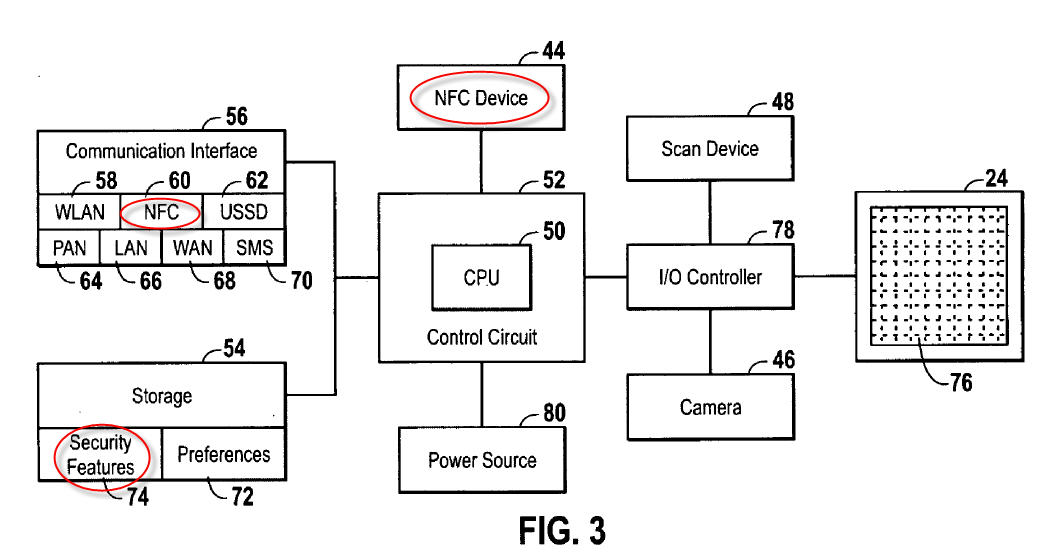

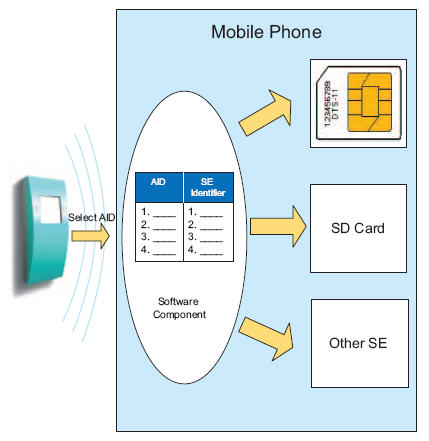

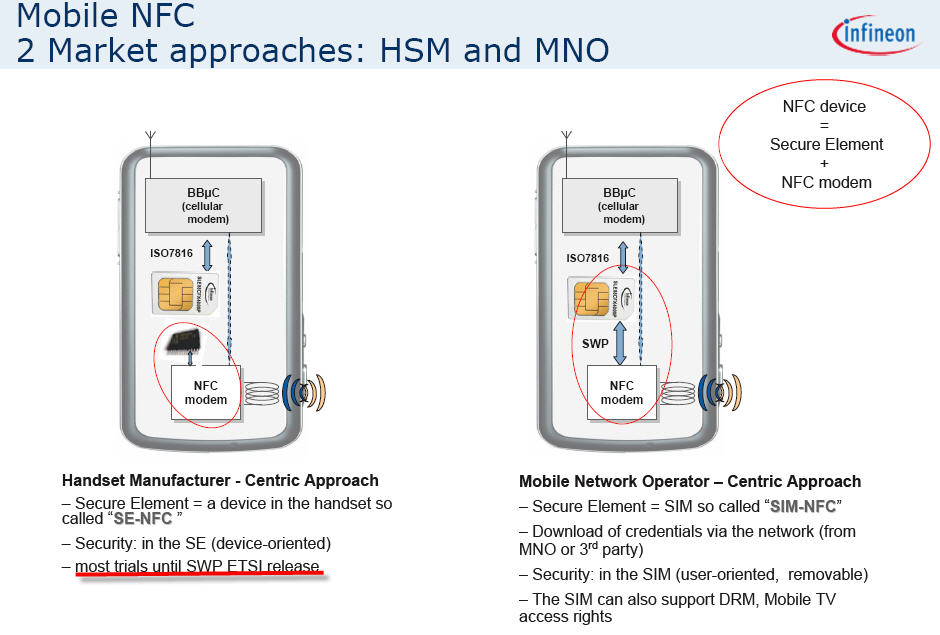

One exception I see is in mobile “secure” applications. In this the GSMA and NFC Forum are absolutely brilliant… they have defined a common standard.. unfortunately the business model to monetize it has not yet developed. They had the right technical team design it.. can they get the right business leaders to make is successful? (see related blog)

Excellent TechCrunch Article on HTML 5 Feb 5, 2011