25 October 2011

My top question for October has been “What is Apple up to” in payments/commerce? It matters to me because investments and strategies have to line up. Is there new risk? Should I be running from NFC? Where do I place my bets?

Data Points (From previous blogs)

- Apple/iPhone is staying away from NFC…Apple has something brewing that revolves around its iTunes account base.

- Chase is working with both Apple and Square

- Square just secured a billion dollar valuation on $3-6M in Rev from one of the best VCs (IMHO) KPCB.. SO they must have some big idea…

- WSJ Article reports Jamie Dimon is talking to Dorsey on Payment.. what possibly could Jamie be so enthused about?

- Keith Rabois said he would never have gotten involved in Square if it was just about a doggle and payments..

- Visa is on board.. so they must have a plan to drive card volume. Visa invested at a time when new mobile PCI standards were “in flight”

- The Square doggle is mag stripe only.. (doesn’t work outside US)

- They are pushing the doggle like mad, expanding distribution to WMT stores this week.

- My previous blog outlines how Square has shifted into V3 of a business strategy that is about commerce (not payment). V1 was “Payments for Craigslist community”, V2 Small Merchants alienated by terms of today’s Acquirers, V3 Commerce

- Square card case shows TODAY’s product for working in physical retail. To make this work efficiently (and at scale..) many people have to be “registered” with Square as Payers (to open a Tab). Visa Wallet, and Apple iTunes would seem to be logical extensions to expand this registration rapidly. See Card Case demo Square’s site http://www.youtube.com/watch?v=la0zz-pPEl4

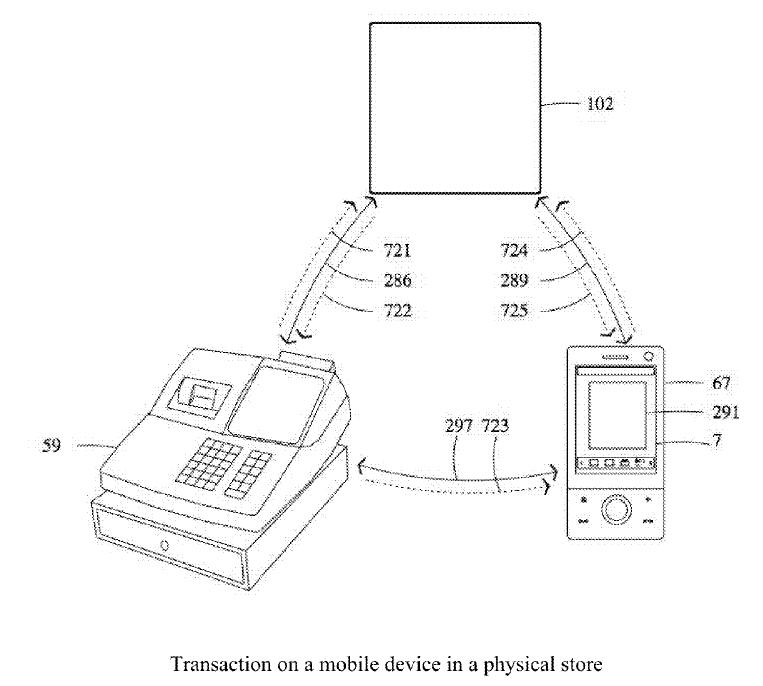

- As I stated previously, there is no need for NFC… anything that NFC can accomplish can also be accomplished with a single key exchange.. whether that key is biometrics, a loyalty card or your GPS location

- In this blog 2 years ago (wow I’ve been writing about Square for that long!?), outlines how a commerce process of the future may look like the local country store of the past. I know who you are when you walk in.. ask “would pay like you did last time or put it on your account?”.

Apple/Square – the Anti NFC?

All indications are that Apple has a new “location registration” type of service.. Allowing users to determine “Who” they want to make aware of their presence. I’m sure most of you familiar with Square’s card case can see the immediate link: if you walk into a “registered” store you have given “permission” to be aware of your presence the store will be able to market to you during your shopping experience AND when you go to register it will know who you are based on Voice (Square example), picture, GPS, or some other proximity indicator. Assuming your payment is on file (iTunes/Square) and the retailer is “connected” (to same cloud as consumer): the entire marketing, shopping and checkout process is done without ANY select, scan, tap, swipe or anything … throughout your entire shopping experience. For example, you could be watching targeted iPhone ad videos while shopping with discounts automatically applied at checkout.

Hey I could be wrong … and should have just kept my mouth shut while I go patent this.. but I think this is already in flight.. so my goal is to inform investment decisions. My confidence level?

Square is building this? 60-70%

Apple is participating? 30-40%

This would make Square’s Wal-Mart distribution efforts look brilliant. Give away millions of free doggles to get consumers to sign up.. then leverage this network as the basis for future in store payment network.

Is this really a Killer App?

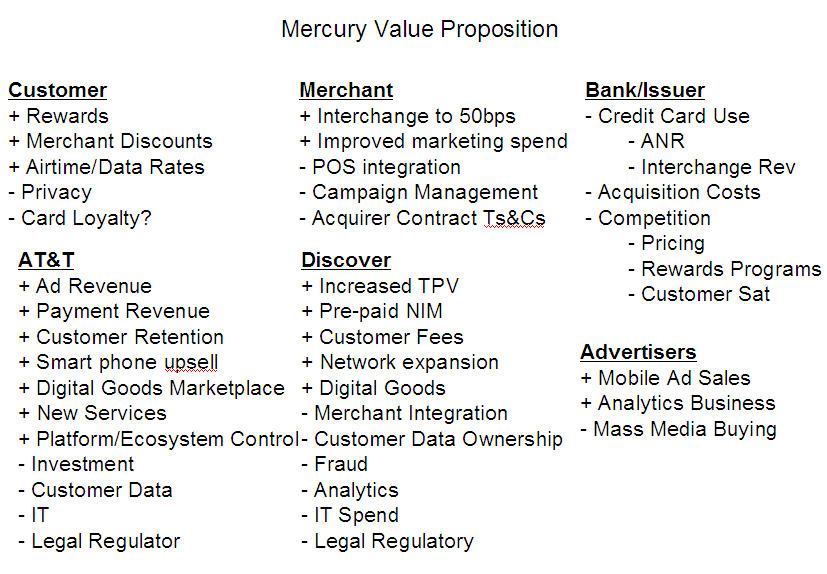

My response centers around this question: How would retailers (and existing value chain) react?

- Where is the value to the retailer? In store marketing is not valuable without knowing intent to shop or buy.. or brand preferences..

- What do Square, Visa, Apple know about physical advertising and retail?

- What incremental sales with this drive? New customers? Basket Size?

- Will I lose business if I don’t do this?

- This use case solves a “payment” problem and an “instore awareness” problem.. What is the benefit to the merchant? Speed? Reduced Interchange?

- If Chase and Visa are driving this.. retailers will not be jumping over themselves to be first on board

- IBM has an 80% share registers in top 20 retailers.. Are they going to give up the POS to Square?

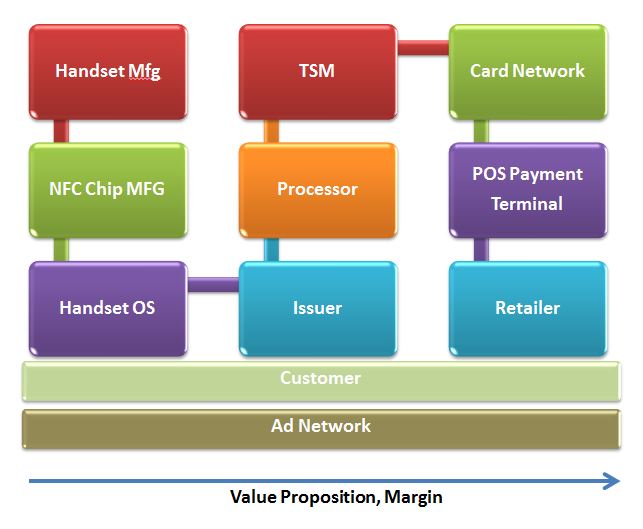

On the positive side.. this is certainly MUCH cheaper than NFC.. Merchants: Why should you buy NFC terminals at all? This highlights again why the MNOs insistence in following a “control” model for delivering value through NFC will be such a failure (see related blog). Data should not live on the phone.. but the cloud.

Investment Implications?

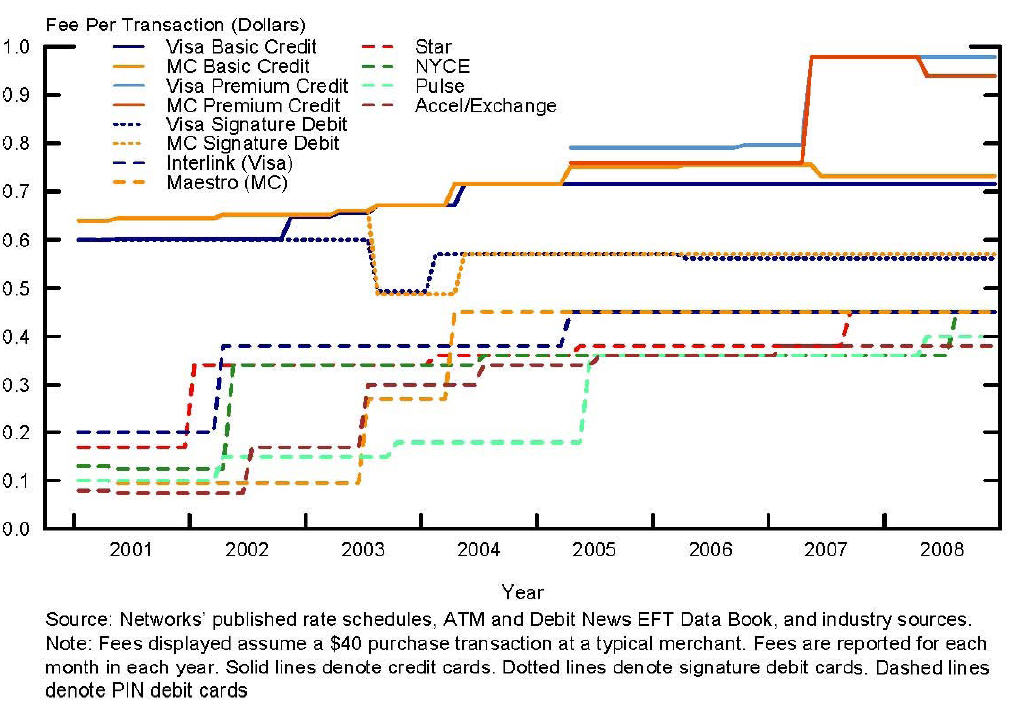

- Be cautious in over estimating the uptake of NFC. It is not a panacea for payment. It is a great tool for machine/tag to machine communication (ticketing, door opening security, RFID reader, music sharing, …).

- Verifone’s vision of new terminals everywhere should be balanced with a view of no more payment terminals at all.

- There are some very big bets going on here.. Apple, Kleiner, Visa, Chase. If you are not aligned to one of the big players you could get stepped on quickly

- Many opportunities to add value within this “future” scenario.. SAP, Oracle, and other retail experts are well positioned to help retailers

- Visa and Chase’s involvement make retailers participation less certain… therefore increasing retailer interest in other “retailer friendly” value propositions.

- My favorite one.. in store bandwidth. Stores are sink holes for radio signals.. Verizon and AT&T could gain control over this entire value chain by selling connectivity solutions (ie microcells) into stores. They can control the content in the phones to a much higher degree.. for example blocking any non-retail friendly site while a customer shops.

- Government Regs.. We need to start managing who has access to location information in a much more “regulated” fashion. I’m more concerned about my location information than I am about my payment info. Why? I know I won’t be held liable for my fraudulent card data.. while a bunch of physical thieves could rob me blind if they know where I shop and when I’m gone from my house. There is an assumption that customers will let this happen. My recommendation is for Square and Apple to spend a little time in Germany..

- Visa Offers could have a new outlet in store.. unfortunately.. they don’t know how to “sell” offers to retailers..

Make no mistake.. I like this model and think it is brilliant. But others are much better positioned to execute on it. Starting a network business is hard.. cracking the nut on a retailer value proposition.. harder.

If this is true.. I could be flipping to a fan of Square.. errr… Apple?? I finally see Kleiner’s investment approach at work. As one of their partners said to me “Tom, if we get a great team in place.. they will figure it out… Google had no idea of how it would make money when it started.. they turned out OK “