Warning.. I ramble a bit in this one.

23 March 2012

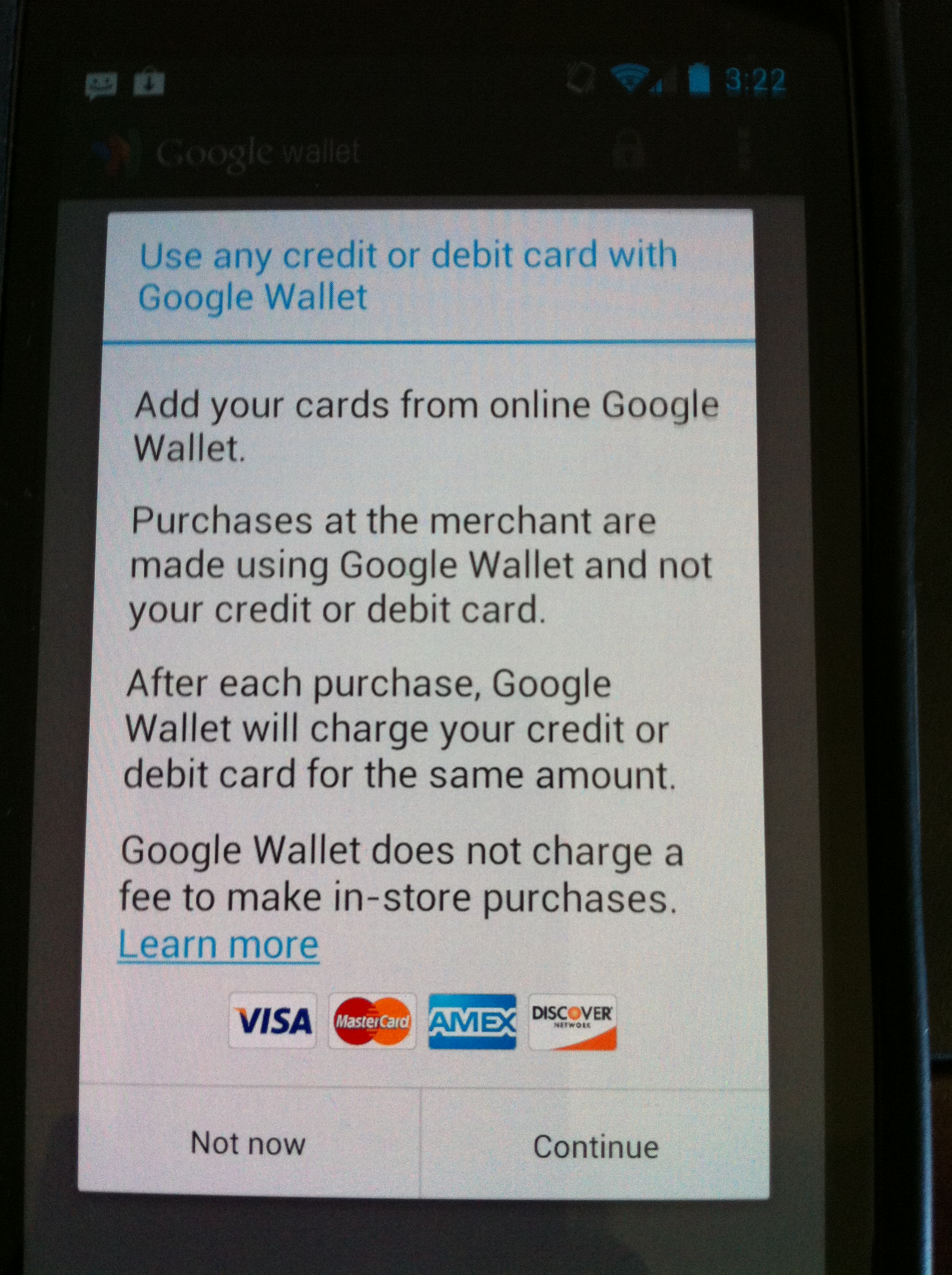

Does anyone remember Microsoft Wallet circa 1997 (See Wikipedia)? Digital wallets are certainly not a new phenomena. Today we are struck with eWallet saturation: Google Wallet, ISIS Wallet, Visa Wallet, iTunes accounts, Amazon Accounts, Square, PayPal, … How many places must store all of my credentials?

Does anyone remember Microsoft Wallet circa 1997 (See Wikipedia)? Digital wallets are certainly not a new phenomena. Today we are struck with eWallet saturation: Google Wallet, ISIS Wallet, Visa Wallet, iTunes accounts, Amazon Accounts, Square, PayPal, … How many places must store all of my credentials?

For my own benefit I thought I would take a brief look at the history to determine what the future may look like (As the future holds the key for my investment decisions). With respect to Wallets, what are they? What are successes and why? What is the consumer value proposition? What are the risks? What does the future hold?

My last blogs on this topic were in November 2009, Investors Guide to Mobile Money, and in 2011 – Tough Start for Mobile Payments.

What is a Digital Wallet?

My all time favorite YouTube video definition is below (Courtesy of Google)

http://www.youtube.com/watch?v=gKGptWtzeaU

[youtube=http://www.youtube.com/watch?v=gKGptWtzeaU]

Proposed Definition: A consumer owned and controlled account that can store any electronic form of what is normally held in a physical wallet, including: payment, ID, coupons, loyalty, access cards, business cards, receipts, keys, passwords, shopping lists, …etc.

This definition sounds broad enough..

As a consumer, what would you think of having multiple physical wallets? I personally don’t have that many people I trust. Trust is a very important element to a consumer. Some of the information in my wallet is sensitive, and there is also a financial risk associated with loss of payment information (particularly outside of the US). What kind of entity would want to assume the risk of holding all of this information? Which reminds me of a story,

I was in a Board Meeting with a senior partner of a “Top 3” VC discussing consolidated sign on. A start up was proposing to hold all of the login credentials for all of your bank accounts. As the former internet head for both Wachovia and Citi I had some firm views on the topic and asked “who is going to take the risk if credentials are compromised”? I further explained “it is not a technology problem, but a risk problem.. Bank’s will not let someone keep their Customer’s keys if they can’t insure the risk”. As a side note, I also instituted a policy that if a customer discloses their credentials to anyone, they are responsible for any losses that result (sorry Yodlee).

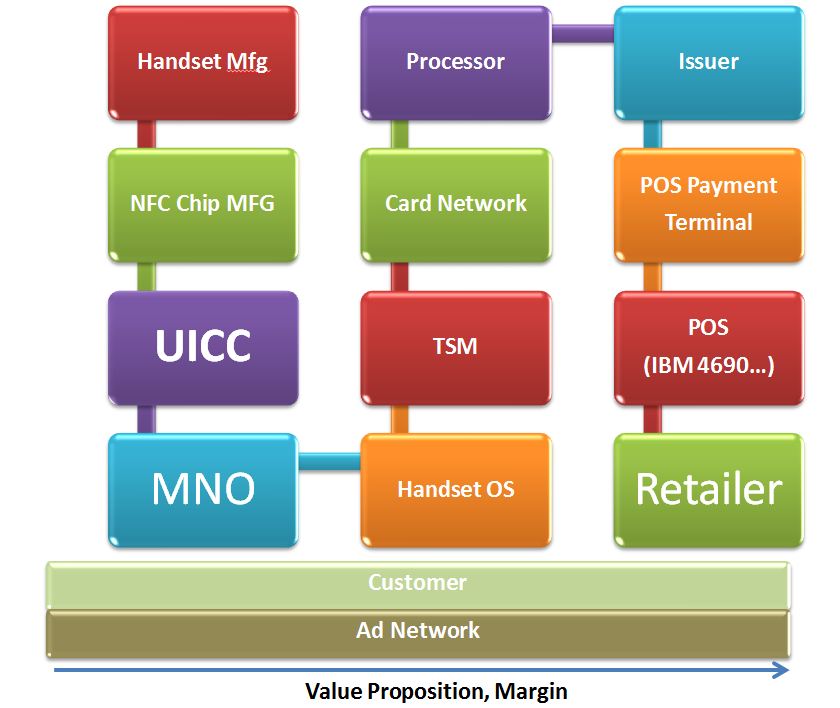

Within a Digital Wallet, securing information AND giving Consumers the exclusive ability to control what is shared with whom is a challenge (beyond technology and trust). We thus have many limited “Wallets” that are constructed around specific purposes, for example Microsoft’s wallet has evolved to LiveID. From a pure technology perspective, the mobile phone (with NFC) seems to present an opportunity to provide the Consumer with a device that can uniquely handle the security and authorization aspects of a holistic digital wallet. In my view, the challenges faced by the “phone as wallet” are business related. Per my definition above, a wallet should allow consumers to control what goes in and how it is used. Today we see the carriers (ex ISIS) create a platform based upon their control, allowing only cards that have paid a fee to enter into their wallet. I digress…

What makes for a successful wallet?

Customer Trust, Customer Control, Convenience, Ubiquity (opposite of lock in), Intuitiveness, Experience in Use (buying, redeeming, accessing, ..), Security,

If I have a wallet that only accepts 3 cards that are not accepted at any of the top 20 retailers (ie ISIS), it is of little value. Why not let consumers control what goes in? This is where carriers must get to in order for NFC to survive. Even then, NFC phones are far from my recommendation. After all if your payment information is locked in a mobile phone how do you use it when you are at your computer buying something on Amazon? Locking information in a phone is just plain stupid in the age of the cloud.. most agree that individuals should have a their information in a cloud they control. The NFC zealots reading this blog will respond that it NFC doesn’t require a network and is more reliable… my response, the POS and payment terminals are connected.. NFC doesn’t need to hold the card in the SE.. it just needs some sort of identifier.. or in the Square cardcase example no NFC at all just your voice print. After all if there is no auth from the payment network.. the transaction will not happen.. so something is connected in 99%+ of card transactions.

Consumer Value Proposition

My primary digital wallet is Amazon, with Paypal as a close #2. The buying experiences are just superb, unfortunately neither extend well into the POS. I have a PayPal debit card I use here.. but I have a hard time justifying why I would use a paypal debit card that pulls money from a pre-funded account which is tied to my Bank of America Checking.. why not just use my BAC Debit Card? I don’t think I’m alone here.. The thought that comes to mind: why do I use PayPal at all? Convenience is certainly a key element, but I also really don’t like giving out all of my personal information to every vendor I do business with. Why does any vendor need to know my name? Is there a business case for anonymity? For Readers in Germany I know your answer… of course there is.

My primary digital wallet is Amazon, with Paypal as a close #2. The buying experiences are just superb, unfortunately neither extend well into the POS. I have a PayPal debit card I use here.. but I have a hard time justifying why I would use a paypal debit card that pulls money from a pre-funded account which is tied to my Bank of America Checking.. why not just use my BAC Debit Card? I don’t think I’m alone here.. The thought that comes to mind: why do I use PayPal at all? Convenience is certainly a key element, but I also really don’t like giving out all of my personal information to every vendor I do business with. Why does any vendor need to know my name? Is there a business case for anonymity? For Readers in Germany I know your answer… of course there is.

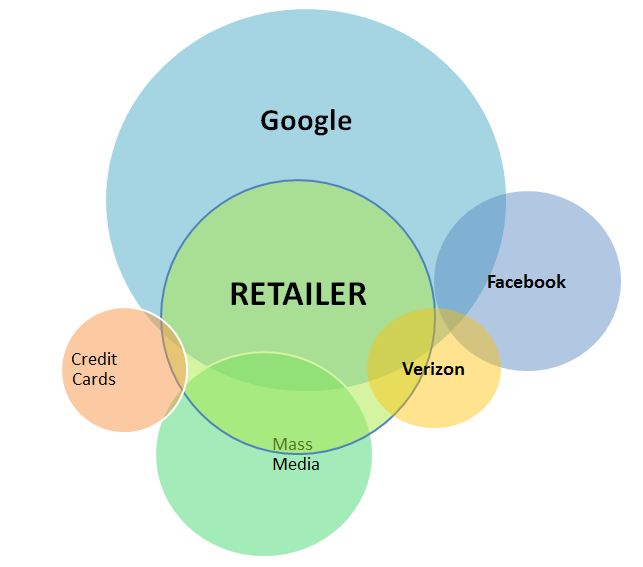

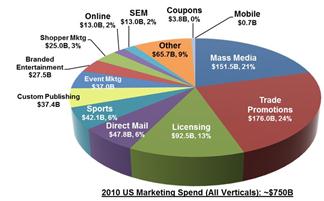

Most Silicon Valley eWallet business cases are being built around data sharing and “closing the loop”. In a network analysis model, every step away from the optimal consumer experience (control, anonymity, ubiquity,..) impacts broad based adoption. Alternatively, new value propositions (ex incentives, rewards, loyalty, …) can reverse entropy, but only within specific groups/clusters (that realize the value). Thus a highly fragmented world of wallets, each built around specific functions limited to narrow networks, where customers exercise only limited control and hence participate in a limited fashion.

Risks

My last blog on Payment Risk was associated with Square (I still don’t like the swipe, but I have eaten my shoe now that they have surpassed $4B GDV and have developed CardCase… which I love). Microsoft had grand visions for Wallet and Passport, and pulled back for a number of reasons. Globally, most consumers still have problems putting all of their information in one place. The Fed, OCC, FTC, CPFB, Banks have all been circling around the broad proliferation of consumer data.. what are the risks of having your payment instrument stored with 100s of vendors? While at the The Clearing House’s annual event, I was pinged by a JPM Chase exec.. what will be done to secure payment information? At the policy level, many believe there is a national security risk in the compromise of our payment systems… It is something all of the Banks are thinking about.

While cloud based storage of information sounds fantastic… there remains a gap in integrated controls, security and authentication. This is where I see both the US and EU taking action on consumer data access and controls much beyond what is now within PCI. Given today’s technology, there is little reason for any merchant to hold your actual credit card number.. yet it is still the case.

What business incentive is there for any entity to hold “unlimited” sensitive consumer information? If the information cannot be accessed without user consent? All of these factors will shape wallet functionality to either something focused within a given domain, or under complete control of the Consumer.

Wallet Strategies

1) Consumer Friendly.. Single store for all consumer information. Payment, loyalty, reciepts, … The players I see here are Google, Square. (note I acknowledge everyone at PayPal just rolled their eyes and point them to my Disclaimer above). Business case is around customer data access.

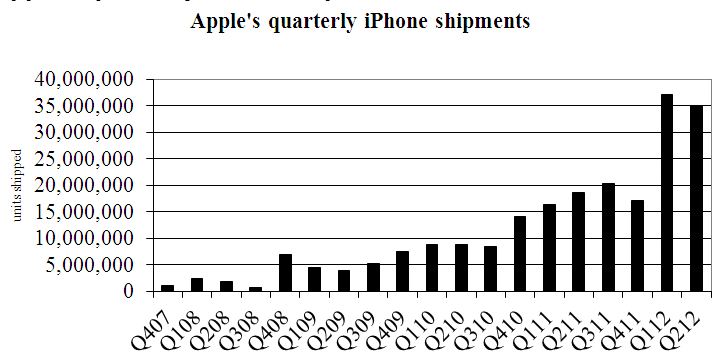

2) Marketplace focused. Obvious players here: Starbucks, Rakutan, Amazon, Apple, Paypal, Target Red Card. Objective: Deliver a fantastic customer experience in purchasing within a focused marketplace.

3) Form Factor/Device Focused. Mobile Operators, Card Networks, . Deliver technology and incent buyers/retailers to participate. This is not working out so well, exception is Edy.. may work in markets with dominant carrier.

4) Bank Consortium. We see this more in Europe at the moment, but I believe the US regulatory bodies are pushing banks to work together here. Much more payment focused, and thus minimal consumer value… Banks/Fed must realize mobile is not about a new form factor, but a new value network.

5) Retail/Transit Consortium. Transit is already clear leader here in Asia…. Transit actually resembles more of #2. Where there is only one transit company provider I believe it is.. this Category is defined as one wallet working across multiple retailers.. I look at this as incentives tied to something like a decoupled debit.

6) Commercial. Example outbound payments, payroll distribution, global dividend payments – hyperWALLET.

7) Other???

Future of Wallets

“Limited Wallets” can obviously be very successful: Starbucks, PayPal, Amazon, Apple iTunes, Oyster, Edy, Suica, Octopus, hyperWallet…. But all started around an existing marketplace/system. In order for an independent wallet to thrive it must deliver value within a core network. My approach to evaluating retail payments evolves around a central hypothesis: payments support a commercial system, they are only the last phase of a long marketing, incentive, shopping, selection, and buying process.

Networks are resilient to change, this is both an asset and a hindrance. The value that is delivered within an existing payment network is tied to the commercial system in which it operates. This includes both business agreements AND technology, neither of which are easy to change. As the nature of retail changes (example payments, and incentives across virtual and physical channels) new “value exchange” networks will form. Existing payment networks will certainly attempt to change, but given their distributed ownership, nodal control over rules, and legacy infrastructure it will be “a challenge”.

In the US today, this is what is happening with Google Wallet, Bank initiatives to form “the next Visa” and Large US retailer’s plans to form a new payment network that they control. Today’s wallet initiatives are operating in a very dynamic landscape: retail is changing, technology is changing, new value networks are forming, new marketing platforms are emerging.. The margin is always better in orchestrating the interaction, than in coordinating the transaction. Thus I place my “wallet” bets in the short term with groups that can control the commercial marketplace (ie Apple, Amazon, eBay, Retailers, … ), and with groups that can orchestrate new value propositions (ie. Google, Square, hyperWallet, ..etc).

Have a great weekend… My Asia thoughts are next.

Does anyone remember

Does anyone remember