Tag Archives: visa

Visa Acquires CyberSource for $2B

22 April 2010

126x earnings? $3M/employee Why? Did Carl Pascarella (former Visa CEO added to CyberSource Board of Directors on March 5, 2009) intend to drive this when he joined the CYBS BOD?

Part of the job of any payment network is to ensure a balance between network efficacy, profitability, risk and “value” received by each participant. (http://en.wikipedia.org/wiki/Network_effect)

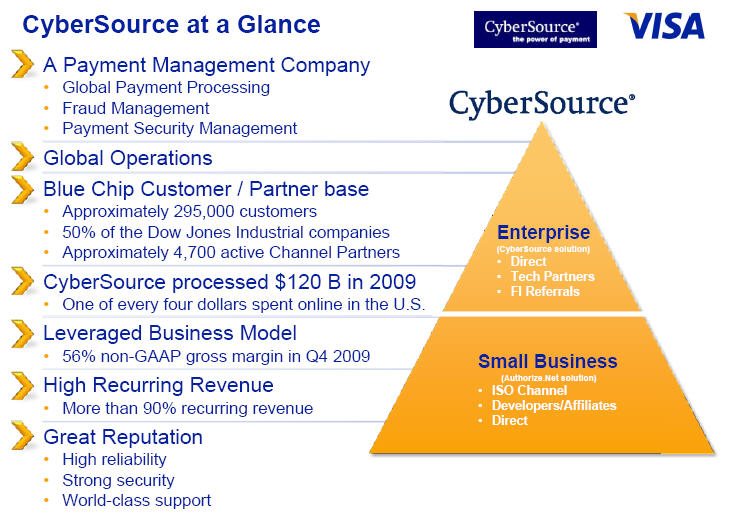

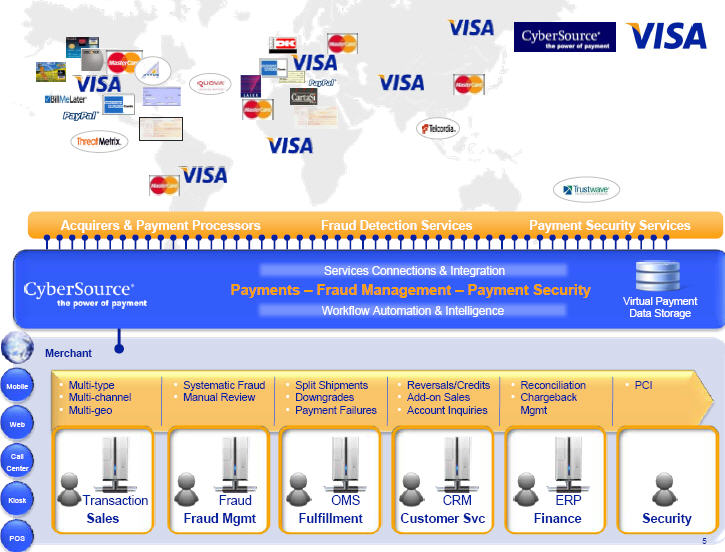

CyberSource bills itself as the “The World’s First eCommerce Payment Management Company” and initially focused on enabling “bricks and mortar” retailers expansion into the online channel. CYBS has evolved to provide global turn key services to any retailer selling goods online… from payment to distribution (ex. Digital software).

CYBS 1009 10K

Our customers range in size from small sole proprietorships to some of the world’s largest corporations and institutions. Our customer base includes leading companies such as Air France, Borders Group, British Airways, Christian Dior, Eastman Kodak, Home Depot, Louis Vuitton, Massachusetts Institute of Technology, Microsoft, Nike, Starbucks, and Yahoo!, among thousands of others. To properly serve this diverse set of needs, we divide our potential market into two customer profiles, enterprise and small business merchants, which require different solutions.

Enterprise merchants have high sales volumes and generally demand the greatest range of payment options and the most sophisticated risk and management tools. These customers often sell in multiple countries and require support for local currencies and local payment options. Enterprise merchants also frequently need to integrate payment processing with one or more internal business systems. We serve enterprise customers by providing solutions that address and simplify the breadth of these requirements.

Small business merchants generally seek simplicity and ease of use. We serve small business merchants by providing bundled services and integrations into popular online shopping cart software, while bringing to the small business market some of the advantages of our enterprise-level services, including important new payment options such as electronic checks, as well as high-reliability and quality customer support.

Retailers face huge hurdles in building teams capable of navigating the complex rules and regulations associated with processing payments from PCI, Sepa, CARD, Reg E, Reg Z, … etc. The very existence of CYBS (and competitors below) show the market for value added services as a precondition to Visa’s goal of: EXPANDING THE NETWORK.

We face competition from merchant acquirers, independent sales organizations, and payment processors such as Chase Paymentech, First Data Corporation, and Royal Bank of Scotland. We also face competition from transaction service providers such as PayPal and Retail Decisions, as well as eCommerce providers such as Accertify, Inc., Digital River and GSI Commerce Inc. Furthermore, other companies, including financial services and credit companies may enter the market and provide competing services. Another source of competition comes from businesses that develop their own internal, custom-made systems. Such businesses typically make large initial investments to develop custom-made systems and therefore, may be less likely to adopt outside services or vendor-developed online commerce transaction processing software.

Cybersource will provide Visa with an enhanced portfolio of services which could address merchant needs, particularly in risk, compliance,  payment/fraud operations. However the expansion of Visa into these services poses a substantial risk to its business model as it runs the risk of alienating acquiring banks and other processors. Currently, I would view that risk as small because of the tremendous issues associated with online (eCommerce/mCommerce) payment system integrity and fraud.

payment/fraud operations. However the expansion of Visa into these services poses a substantial risk to its business model as it runs the risk of alienating acquiring banks and other processors. Currently, I would view that risk as small because of the tremendous issues associated with online (eCommerce/mCommerce) payment system integrity and fraud.

This is a bold move by Visa to drive network expansion, in mCommerce and eCommerce, and expanding value added services which cover ownership of payment risk and operations. The price does seem high if we view integration without synergies (CYBS will have to run at a 45% CAGR to be accretive in a 10 yr horizon). Therefore, Visa’s business case must be driven by new services which can be offered in the short term to all merchants and acquirers (ex Fraud data sharing, digital goods distribution, …).

Can Visa grow this business more effectively under the Visa brand? Absolutely, but expect other network participants (issuers, acquirers, processors) to pressure Visa into managing CYBS as a separate entity. It is important to note that there is no love loss between most merchants and Visa. To address this, Visa should lead with a road show on how it will deliver value. Example.. it will take on fraud loss responsibility, improve marketing and take on compliance risk.

Tangentially, I believe Visa will also likely add significant $$ to merchant marketing programs. Visa is investing heavily in a new mobile marketing/advertising engine... that will sit on the Visa switch. Their existing merchant agreements do not handle this kind of “marketing” services agreement so they needed a new contract vehicle. Given CYBS’s merchant footprint, they now have vehicle which can be leveraged to expand the advertising business in a turn key model which also tracks fraud and fulfillment.

Apple’s NFC Patent

On my other blog http://wp.me/pG4GT-4O

Citi/Mastercard beats Visa/BAC to market

8 April 2009

Great Article

http://www.nfctimes.com/news/citi-makes-its-first-move-mobile-payment

As a friend told me this week “if you put an NFC sticker on a bicycle.. is that mobile payment?” Sure a sticker on the back of a phone is not necessarily “Mobile payment” but NFC has taken so long.. who cares? Lets just get started!

Will Citi/MasterCard beat BAC/Visa to market with a US NFC sticker rollout?… Regardless of who is first out of the gate, I think it will be a win/win for both institutions as significant marketing money is necessary to get this moving. Citi has the upper hand w/ numerous NFC pilots, established card marketing and 55M card accounts.

[youtube=http://www.youtube.com/watch?v=8aWpzGE431k]

Although Citi is first out of the gate, Visa has put together a much more impressive array of services which will work for any card and any bank, with more thoughtful “integration” (See FirstData/Device Fidelity/Monitise).

“Let the NFC games begin”.

Note to NFC times:

This US initiative did not originate in Citi’s growth ventures, but rather with US Cards (likely led by mobile guru Kurt Weiss).

Mobile Money – Navigating in the Fog

5 April 2010

Great recap of CTIA session: http://bit.ly/bmOFQS

Being an ex-Gartner guy I love to analyze the spin machine. What has been the return on the “mobile investment” made by established payment players (approx $500M in US/EU over last 2 years), or the $200M /yr that VCs (MobileMonday services estimate) have pumped in?

As an investor or P&L owner… a look at the hard numbers of teams focused in this space over last 2-3 years would not drive you to bet aggressively on mobile payments. For example, QCOM’s 2009 10-k shows a 4 year old Firethorn unit running at $34M expense generating $3M in revenue (page F-29). This is a “successful” team that had contracts w/ Wachovia, Citi, Chase, USBank, …

Mobile investment exceptions revolve around delivering short term value or supporting an existing value chain. Within the US, payment data would show that PayPal and the banks are the clear leaders here. Customer listening data shows that the average US consumer today does not view mobile as a separate channel, or a separate product, but rather as a convenience which supports existing products and relationships. As my mobile head in HK said to me “what is so urgent that I must use my mobile and can’t wait to gain access to my computer”? There are times when all of us do have that urgency, but it is difficult to build a business case on irregular, sporadic use of mobile payment services. There are certainly “niche” needs, but few result in a profitable ‘stand alone’ business case (the banks are very adept at serving the market). It is far easier for banks (or existing players like paypal) to “extend” into the niche then for a new product to enter (the nature of network effects).

Bank of America, Wells, and Chase have solid plans for supporting “mobile payment”. Rather then creating a separate organization, they have treated it as an extension of the existing customer experience (online or on the phone). As the payment head of one of the majors told me 2 months ago “what payment problem can I not address today with one of my current products”? This same “extension” approach is taken by AT&T and PayPal as well, extending existing products and services into a mobile experience.

Within the US, as Obopay/MA, Firethorn, MPAYY and other mobile specialists struggle to keep 2,000 active users (I’m not missing any zeros) existing players are meeting their customers needs and making plans to expand services for a seamless “inter bank” experience.

Similarly, outside the US, MNOs are extending their existing value chain by adding payment services. All of this seems to prove the axiom that “payments” is a challenging “stand alone” business (perhaps a separate blog on this?).

Beyond value chain extension, there are significant investment opportunities in infrastructure. Mastercard and Visa are very pragmatic here, investing in upgrading “rails”, rules, and “riders” which will drive increasing volume. An example of which we will see from Visa next month in a mobile marketing engine integrated with card use. “Payment innovation” history shows that adoption follows infrastructure 20 years after investment. Early adopters will be the consumers with the compelling need (or the trend setters). For most US/EU businesses, being a “late follower” has limited downside as infrastructure is built and consumer behavior adapts, there is little risk in waiting.

Within emerging markets, common payment infrastructure is required in linking all nodes of the network: Bank, MNO, Agent, Consumer, Merchant… This is a much more exciting space as consumers evolve from a model where they must travel 2 hours to reach an agent to pay a bill in cash. It would seem that investment will be driven by MNOs as they have developed an economic model which has adapted to serve these markets. MNO efforts will be driven internally and by vendors that already serve them today (example Roamware/Macalla).

Comments appreciated.

Related Post http://finventures.wordpress.com/2009/11/10/investors-guide-to-mobilemoney/

Bumping payments? Paypal Bump

26 March 2010 (updated April 13)

- Fast Company

- Bump Technologies

- Related Post (10April Apple NFC Patent)

Excellent Video overview below (30 sec commercial)

[youtube=http://www.youtube.com/watch?v=suCe4-SWsHo]

I’m reading the CTIA press and see this come out, wondering how my iPhone communicates with another iPhone. The bump application listens to the iPhone accelerometer and when it reads a bump (when running) it sends time and event to the bump cloud. The bump cloud looks for 2 events and then requests that your bump user information be shared (from bump)

When you bump, if we find a match with a phone that felt the same bump, our servers ask each phone to send up the contact information each user chose to share, but nothing more. If and only if both users then confirm that the match is indeed correct will the contact information be sent down to the other person. None of your personal data is ever stored on our servers.

Very ingenious…. What I’m most impressed with is Paypal’s ability to extend itself in niches like this. Their open APIs, ability to manage risk and extend “payment rails” beyond internet merchants is 5-10 years ahead of what any other payment network can do. Beyond the technology side, it certainly helps that Paypal’s user penetration within the iPhone’s customer base is “rather high”.

This application also highlights the opportunity for NFC in Apple’s platform. For those that aren’t familiar with my previous posts, industry G2 indicates that Visa and AT&T are going without Apple. Obviously a good strategy for AT&T as Apple already has significant leverage in the “relationship”. Of course, NFC P2P will require an intermediary to own “risk” of card acceptance and work through (payment network related) merchant and third party payment aggregator (TPPA) issues.

From a regulatory perspective, it is fortunate that PayPal has already gone through the “heavy lifting” in obtaining money service licenses in the 50 states (see related post).

What other vendors/payment networks could compete here? A: CashEdge and Money Bookers. In the UK I could almost envision the video clip for a money bookers “Bump Bet”. In the US CashEdge is a 3rd party service provider with 60-70% of US retail deposit accounts in their footprint (BAC, Wachovia, Citi, …). CE has a much more efficient (low cost) ACH network and is one of the few US companies with proven operational risk management in “remote” payments. CE should look into riding PayPal’s marketing wave and leverage bump technology to allow me to do everything PayPal does, only directly from my bank account (at no cost). On the regulatory side, Cashedge runs as a bank service provider… in essence you are dealing with your bank to “push” funds (ACH debit) when you use POPMONEY.

Great job Paypal.

ATT-Discover Prepaid

15 March 2010

Previous Post NFC Break Out – VISA/FirstData/AT&T

My updated prediction is now first week of April. This is real.. and it is imminent.

Q: What will it mean when every AT&T subscriber receives a pre-paid Discover card with an NFC sticker? (Note back in March I did incorrectly guess it was Visa instead of Discover)

Answers

- Tipping point for mobile commerce, ushering in a new era where the mobile phone can transact with a wallet that spans the virtual and physical world, aggregating every other account type and payment instrument.

- A new business for AT&T which could drive 30-60% growth in LT revenue

- Software REVOLUION. The “Next wave” for iPhone AND the entire mobile commerce ecosystem (see googlization)

- New mainstream marketing channel as couponing integrates with payment, location awareness and detailed knowledge consumer behavior/preferences

- Card business killer for Bank/Issuer revenue as MNO Pre-paid encroaches on the consumer relationship AND issuer debit/credit products (Decoupled Debit)

- Cash replacement for small value payments as merchants of all types adapt POS to accept NFC, and small merchants take out POS terminals in favor of making their phone a cash register

- .. would love to hear from you on the next 100…

Business Model

Retention or revenue play? AT&T Universal card changed the credit card landscape in 1990. ATT demonstrated it could both create a card business AND leverage distribution muscle as it attracted over 10M card holders in under 2 years. Citi acquired the AT&T Universal card for $3.5B+ in 1997 and it remains the largest affiliate card in Citibanks’s portfolio.

The biggest variable with anything “consumer facing” is the marketing investment needed to push it into critical mass. Example, will AT&T develop some program to incent “pay by phone” use like a $50 credit with $200 of spend? Discounted airtime rates? Rewards program? AT&T has proven it can deliver new technology and ecosystems (iPhone and Universal card)… and subsequently has many options.

AT&Ts pre-paid revenue model will likely see MUCH lower margins than their 90s card business, perhaps something of a split between a pre-paid card and a “decoupled debit” (which the US banks have long feared). How will customers “load the funds”? How will they encourage bank funding? Will Citibank get its act together and partner to extend credit (existing universal card holders)?

Given that there are many unknowns, here is my high level estimate on year one financials. Assumptions:

- 85M subscribers (7M iPhone)

- Year one penetration of 5% (4.25M or 60% of iPhone base),

- Average purchase amount $40

- Annual TPV = 50%(85M*0.05*$40*5*12) = $5B (note: 50% for linear ramp up)

- Take rate 120bps (Note there are current issues w/ NFC interchange, see BestBuy)

- Revenue $60M

- Processing expense (30% of Rev, 100% ACH funding) – $18M

- Marketing spend – $50M

- G&A – $3M

- 12 mo EBITDA – $(11M)

$11M loss obviously doesn’t take into account many unique one time expenses, but it does provide some insight into the dynamics. It seems as though AT&T is spreading out the other “investment costs” through a consortium of First Data, Visa and a number of smaller companies. I would also expect to see a number of new revenue streams (marketing) as merchants experiment with other new Visa sponsored services like mobile coupons. The tech industry needs an initiative like this to expand the “mobile app” world consumer base beyond its current iPhone demographic.

Related Posts

- Payments Views(decoupled debit)

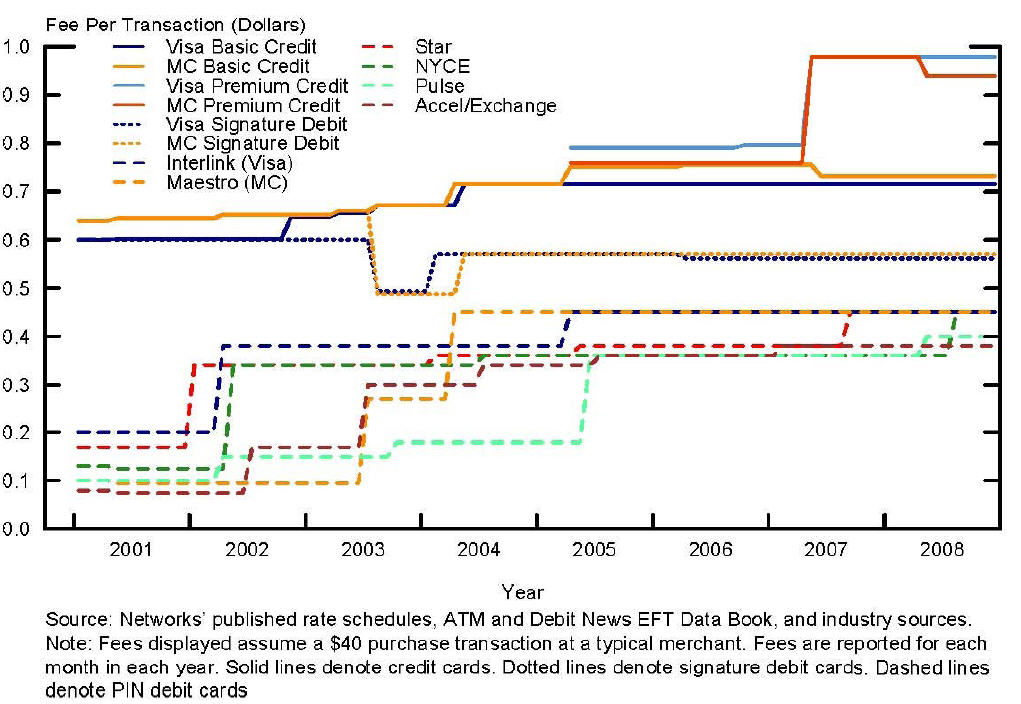

- Visa Interchange Rates

- NFC Tea Leaves (Feb)

- NFC Break Out – VISA/FirstData/AT&T (23 Dec)

- Visa – New Mobile Payment “Rails”?

- Google-ization of Financial Services (24 Sept)

- $5B MNO Opportunity: KYC

- China Mobile

- First Data/Tyfone

- Visa Changes Debit Debate, Backs Contactless

- NYTime Interchange

Obopay and Firethorn

2 March 2010

Related posts

Spoke to most of the top 5 US banks this week. Interesting to note that Firethorn is out of all of them.. even in the model where Firethorn paid one of the majors $1M to take the application and integrate it. As of the latest QCOM 10-Q we can now see that total Firethorn revenue was $3M for the 2009 YEAR! Wow.. no wonder Len lost his head for buying this thing and making it a separate division.

QCOM and Firethorn have a new product planned: SWAGG (www.swagg.com). Good luck trying to figure out what this thing is.. could this be associated with Visa/ATT? (Youtube here). There seems to be a pre-paid debit card associated with it (from Dr. Jacobs CES presentation). Hey QCOM is one of my favorite companies… the people there are absolutely brilliant. But the Firethorn team is adopted.. and therefore the genes do not extend here. They need a top exec to drive this thing.

On another note, Obopay showed up to at least one of the top 3 banks last month (BankX) touting its mobile payment solution. Undoubtedly with “millions” of subscribers (actual estimated at less then 20k). Always interesting to see spin here, they also reportedly told BankX that Citi’s departure was only temporary. Other banks should ask them to get specific.. very specific.. (probably not the US and there is no commitment on use).

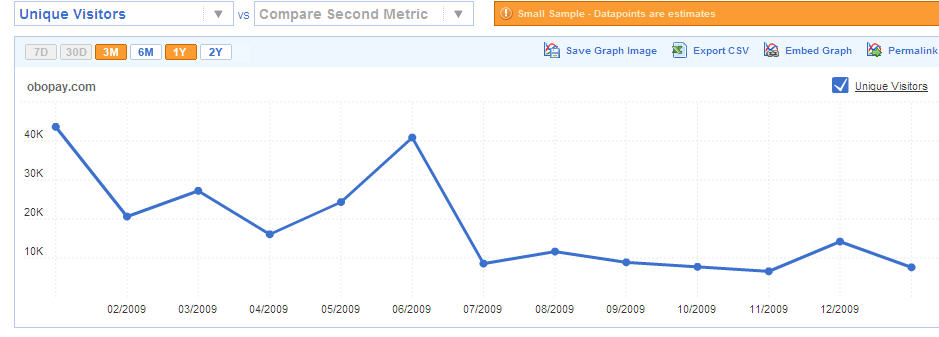

From compete.com (Hard to spin facts..8,000 unique visits last month .. estimate only 20% use the service)

The “big secret” in mobile payments is that there aren’t any… (with very few exceptions). Those exceptions usually deliver “payments” as part of an existing value proposition (see MNOs will rule in Emerging Markets). Banks know that changing consumer behavior is a 20 year effort. Card based payment schemes have particularly high hurdles in emerging markets due to interchange rates and rules that are ill suited for low value payments by unbanked. Toward this end countries such as India are contemplating the development of new domestic payment networks.

Thought for the day

NFC Tea Leaves

9 February 2010

Previous Post http://tomnoyes.wordpress.com/2009/12/23/visa-att-mobile/

In the last week of December I made an “informed” prediction on a major NFC announcement…. the predicted time has now past.. and… no announcement. This seems to be common place in this space.. NFC presents the best chance for development of a new ecosystem and a new “boom” for small companies… Unfortunately the keys to the “ignition switch” are held by multiple established (read entrenched) overlapping and competing networks (bank, mobile, card, …). Apologize for getting hopes up.. it does look like more of a slow burn than “break out”..

Visa’s mobile apps at CES 2010

[youtube=http://www.youtube.com/watch?v=c3Ff6uYXBD0]

VivoTech

[youtube=http://www.youtube.com/watch?v=Kzyy6ZLbDZk]

All of the activity listed in the previous post has been validated:

– FirstData is acting as a TSM (in vein of Germany’s Giesecke & Devrient)

– Visa does have €200MM planned for NFC (See here)

– Top 3 US bank is planning a major mobile initiative w/ Visa to roll out in early 2Q

– AT&T has TBD initiatives into pre-paid card and pre-paid plans, I do have conflicting information on whether this will be led by AT&T or Apple and time period has extended significantly.

http://www.youtube.com/watch?v=330RZpwrmAg

http://www.youtube.com/watch?v=z0BwYz1P0BE

SEPA: Chicken or the Egg?

4 January 2010

I was reading an update on SEPA : New Alliances Required to Tip the Market. The report gave me new perspective on how challenging it is to change a networked business. This challenge is exacerbated by the ‘well intended’ EU political compromises in SEPA (specifically) and EU regulation of retail finance (more broadly). Clearly “payment networks” can benefit from innovation, but as Juergen correctly states “In a network industry, cost reductions and/or additional revenues that can be realized by applying the new standards have to exceed the network effects currently realized with the old standard”.

SEPA is struggling to resolve issues in cost/benefit allocation given the slow growth and adoption for SDD and SCT. The greater growth in SEPA Cards Framework can be attributed to the “control” and investment from Visa/MA as they manage compliance (and marketing) or the new SCF brand. An excerpt from the report above:

Key strategic decisions have to be made almost simultaneously in organisations that are in competition with each other, follow different strategies and have different abilities to innovate or prepare for an industry change. Only if consensus on a new business model can be reached – among stakeholders who represent significant market shares and hold key positions in the industry– will it be possible to generate the synergies promised by SEPA. As already described, the cross-border business within SEPA represents only a small share of the payments market. The dominant national standards, which all would have to be replaced by the new SEPA standards, are built around national market requirements.

International banks (for example, Deutsche Bank) have separate organisational units in several European countries that run their own national payments engines. They maintain different payment infrastructures in Europe. Modifications in response to new compliance requirements (for example, money laundering or new requirements of the PSD) create several similar projects [for this single bank]..

The costs for SEPA (estimated at €10B) fall heavily on the banks, and the benefits (ex. e-invoicing, cross border competition in payment products, …etc) are expected to be realized by the consumers of bank payment services (with and estimate €7B revenue hit to banks). Fortunately for the Banks, in 2002 the approach decided on by the EPC was to create SEPA in a market-driven and self regulated process.

The over arching goal of SEPA is to make the EU a single market on “payment” par with the U.S. Perhaps the best way to start is not by incenting changes to “payments”, but to open the EU retail banking market. (Think of the US banks operating under a Fed charter). “All banking is local” can be the mantra ascribed to the EU today, with each country maintaining tight regulatory control over domestic financial institutions (i.e. M&A and Liquidity). Significant market forces could be unleashed when local banks can operate throughout the EU, and a German consumer can seek the best rate and apply for an account at a “Spanish” bank. Today the regulatory hurdles for this retail competition are significant.

The EU, ECB and the EPC started with payment standards and “infrastructure” as it did not alienate any of the existing participants (market driven.. .not mandatory). What we have is the fruit of this compromise, standards for payments across the EU without the ability for companies to compete for business across the EU domain. The unrealized value of the “SEPA Innovations” are thereby constrained by the market in which banking operates. Perhaps integrating EU retail financial markets would be a better first step. This “openness” would certainly provide an attractive carrot for bank led investment in common payments. Which comes first? The Chicken or the Egg?

See data here