29 June

Death of Signature Debit

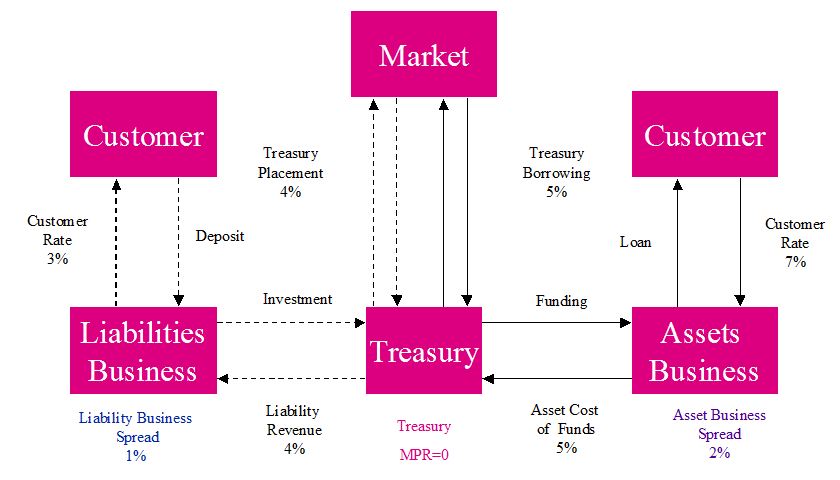

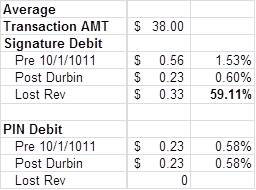

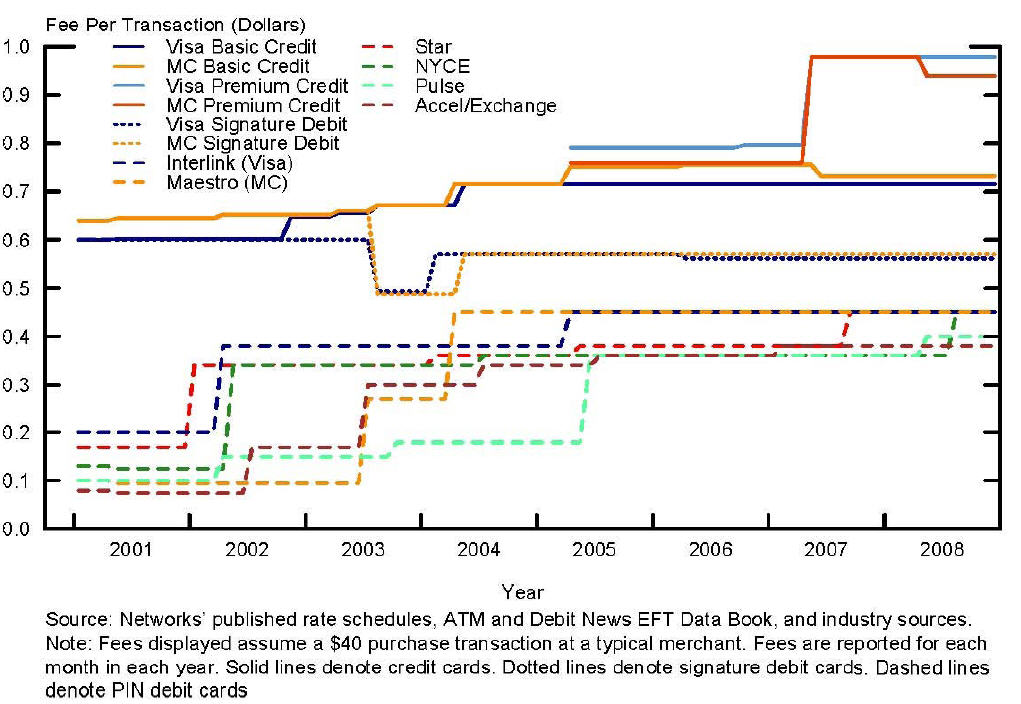

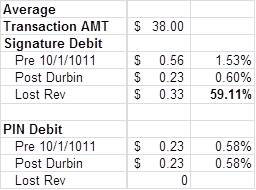

It’s hard for the banks to complain about yesterday’s Durbin caps. At $0.21 + 5bps, the caps provide no loss in revenue from a today’s average PIN Debit transaction (see yesterday’s blog). The loss is in Signature Debit. As I related in my post a few months ago, PIN Debit evolved from bank owned ATM networks while Signature Debit evolved from the card networks (and associated credit products).

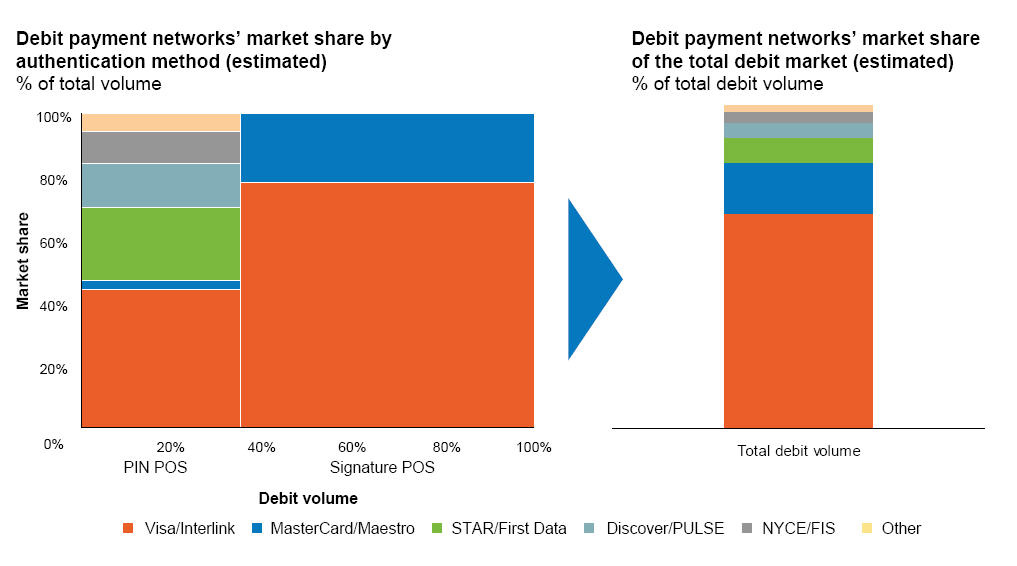

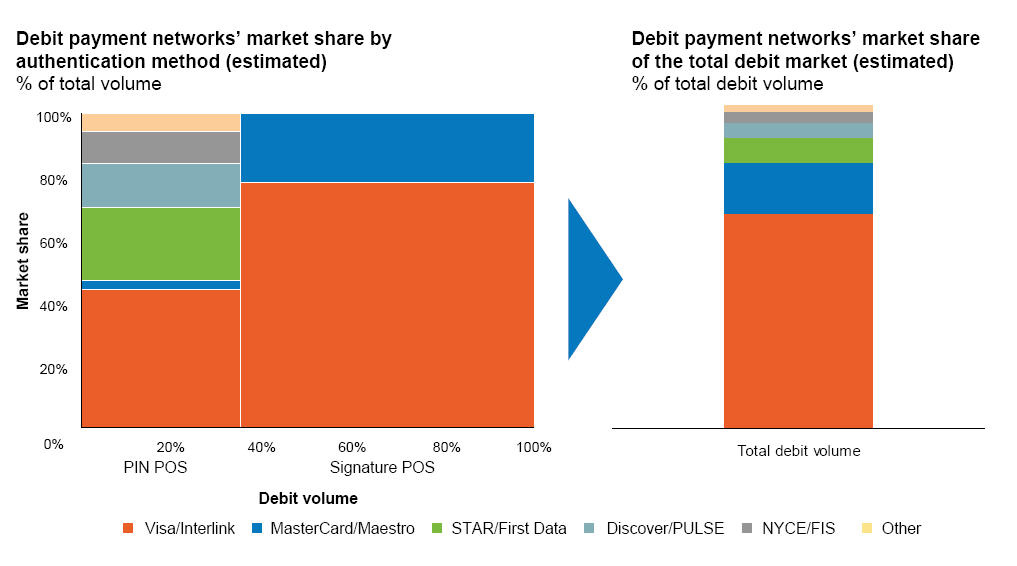

ATM Networks grew as groups of banks banded together to monetize ATM infrastructure, and further expand network into the retail POS. This expansion led to further change from bank ownership to independence. The driver of any independent network is to add volume, nodes and services. ATM Networks evolved into PIN Debit Networks, with Visa’s 1987 contract to operate Interlink as the key milestone. Today, Pulse is owned by Discover, Star by First Data, Interlink by Visa (these 3 make up over 83% of PIN Debit Volume).

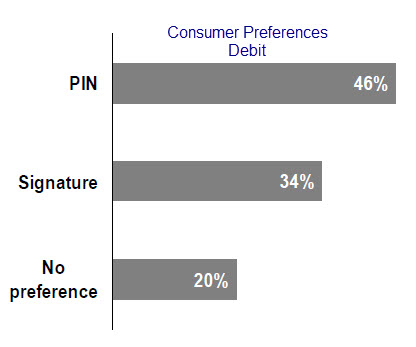

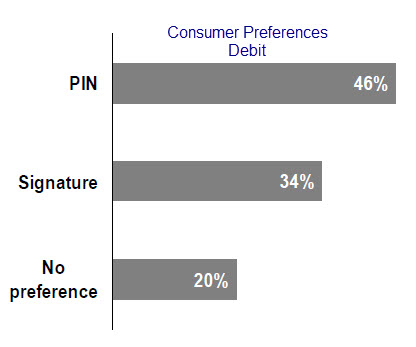

Visa was and has always been the leader in signature debit penetration, a look back at this 2003 article provides much insight into the history here. Most US consumers today don’t understand why their debit card has both a PIN and signature feature… many books could be written on this subject alone… but oddly enough consumers prefer PIN (see Pulse Federal Reserve Presentation 10/10).

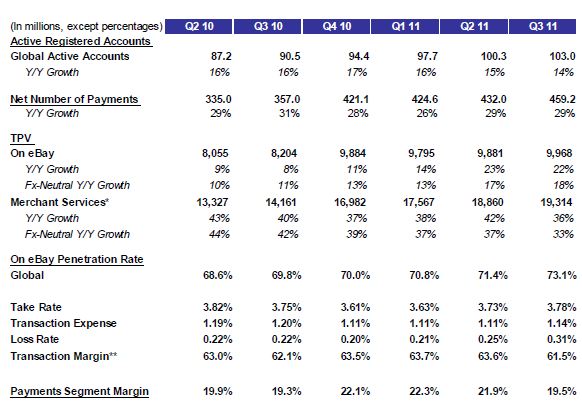

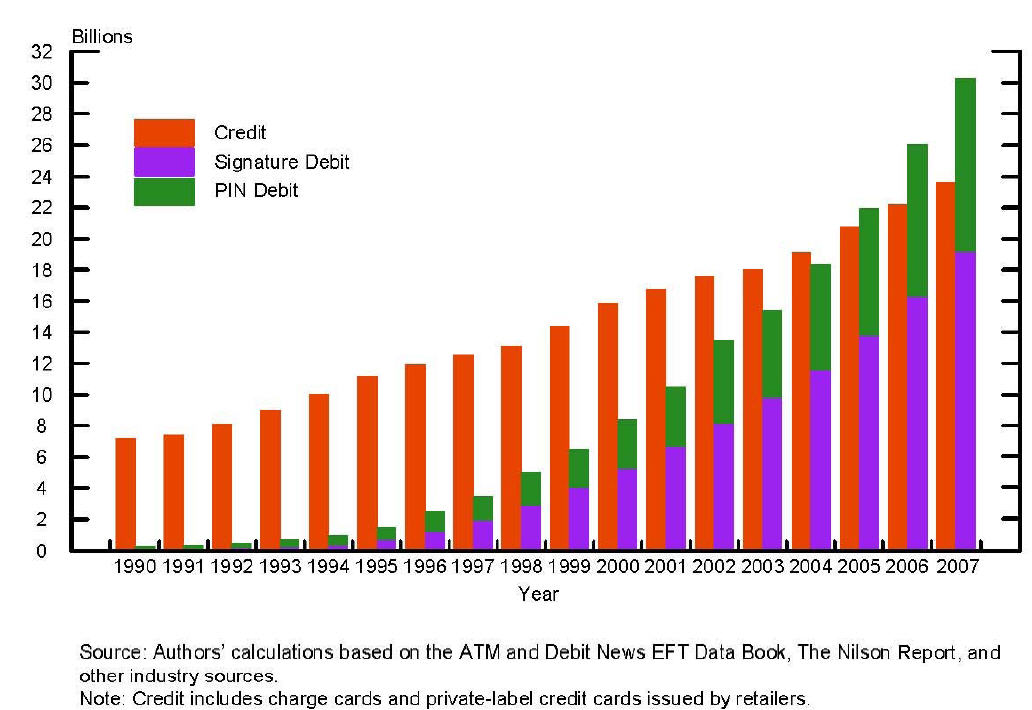

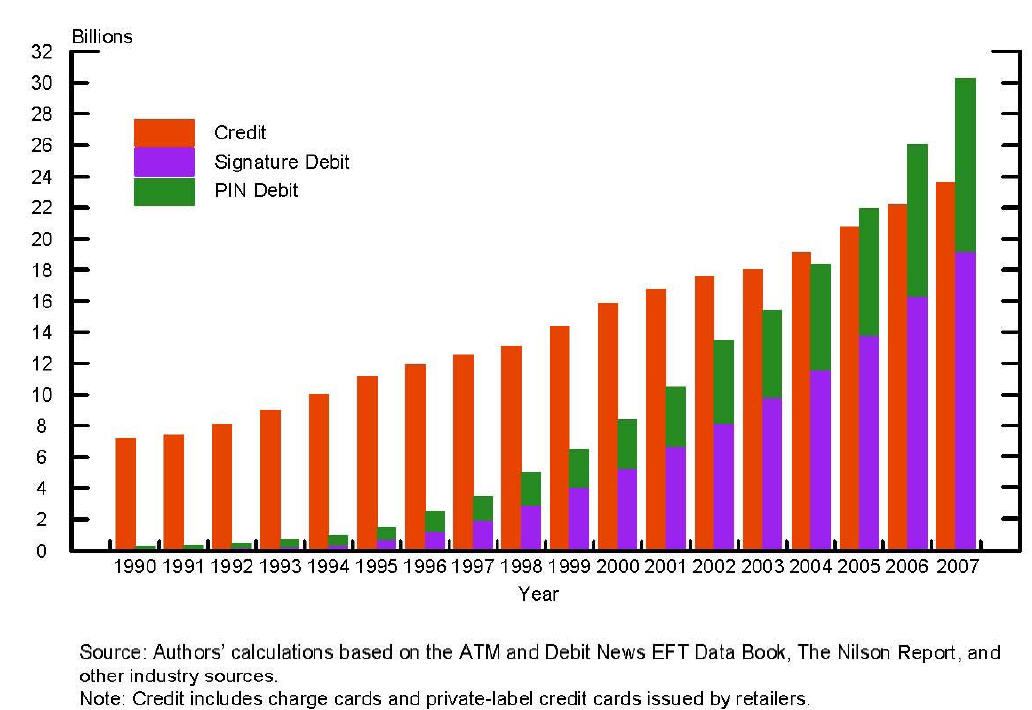

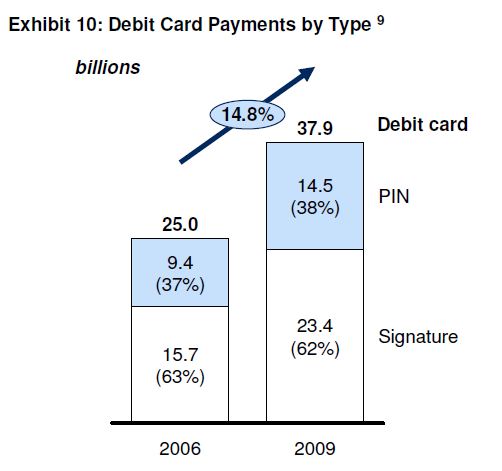

Signature-based transactions currently have a lead on PIN Debit. In 2009, Fed reports signature as having 23.4 billion purchase transactions, and $837 billion of transaction value while PIN-based debit transactions totaled 14.5billion transactions, and $555 billion of transaction value.

However, PIN Debit enjoys a slightly higher growth rate (15.6% vs 14.3%), consumer preference (48% vs 34%), lower fraud rate (2009 fraud numbers: Signature $1.12B, $181M PIN debit card), and obvious merchant preferences (interchange and fraud; 96% of PIN fraud losses assumed by issuers, vs 56% in Signature).

Retailer View

While yesterday’s announcement doesn’t impact average PIN debit rates (for average transaction), there are other elements of Durbin (routing and steering), which will eventually act to kill Signature Debit. Let’s first take a retailer view… Historically, retailers have been constrained in their attempts to deny signature debit transactions. Network agreements forced them to take “all cards”. The primary merchant “influence” mechanism was to default payment terminals to “enter PIN” and make it difficult to for a customer to use a signature debit card. While Durbin does not impact the “accept all cards” rule, it does allow for merchants to route debit transactions outside of the card network.

When I spoke with a few of Visa’s institutional investors last week, much was made about 30% PIN debit penetration. Its very important to note that this penetration is on merchant terminals, NOT as a percentage of total payments. Small merchants remain rather ignorant of their payment options. This merchant financial literacy issue, combined with ISO sales incentives, has led to an uneven PIN Debit adoption.. but this will change not only for small merchants, but also for ONLINE transactions. PIN debit has had no traction in eCommerce because retail banks (issuers) did not want the lower interchange and refused to accept PIN transactions from online merchants. This has also changed. (I have detail here.. but can’t really discuss in the blog)

Bank View

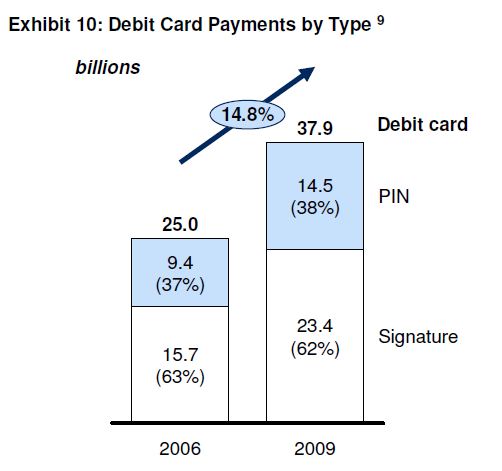

At least 2 of the major banks in the US are working with processors to establish direct “BIN routing” and circumvent all network fees. This makes complete sense for the larger banks like bank of America, with 10%+ of US Debit volume, as it would enable them to eliminate network fees. Merchants would also benefit with a lower cost (the purpose of this routing provision). The key activity necessary to make this happen is to enable major processors to sort and redirect transactions. Processors already perform BIN lookup, but instead of going to Visa or MA with a BIN.. they will be going directly to a large bank. Obviously BAC/BAMS, JPM/Chase Paymenttech, FifthThird, …etc would be the top teams implementing this model. With Durbin at $0.21 + 5bps they actually can improve their margin on PIN debit.

Future

The obvious corollary here is that once a bank is successfully routing transactions directly from the processor(s), what Value does Visa bring at all? 1) Merchants that are not using a processor that has not yet implemented the bank direct routing 2) International Debit Transactions, 3) ?Signature debit bank agreements?

As Bank “inertia” is directed toward maximizing bank margin, and merchants in decreasing debit processing costs, a new debit network is formed… and today’s Visa debit network begins a slow death. First to go will be PIN debit, but closely following will be the removal of the Visa logo off of all debit cards. The 2 countries where this has happened are Canada (interact) and Australia (EFTPOS). The next phase of death will be begin when banks recognize the synergies of maintaining a common directory with centralized authorization and fraud controls. The model here for the US is SEPA Debit.

Tom’s Predictions (Market)

1) 2 major banks will launch their own PIN debit network… starting with processors they control

2) Signature debit, as we know it, will die

3) Visa and MA logo’s on debit cards will have a slow death over next 5-10 years. With little impact to affluent customers in short term.

4) Card issuing banks will look for new ways to grow credit use. (Mobile payments, juicing rewards, educating consumers on unique Reg Z protections, …)

5) Merchant will be testing models to tie incentives to debit use and even create new products (Target Redcard is model)

6) Retail banks will be pushing out low end mass market customers. Pre-paid business will pick up the slack. Most of the major banks have solid plans on pre-paid card deployment.. but have delayed launch because they don’t want to be seen circumventing Durbin (see below)

7) Processors will pick up new fee revenue for “least cost routing”, but regulators will be keeping an eye on them to ensure that the bank owned processors are not acting in concert to circumvent cap definitions (see below)

8) Online PIN debit will begin to take off

9) PIN Debit merchant adoption will start to accelerate in 1-2 years

10) Visa’s US transaction processing volume will stay steady. Debit volume will go down, but processing margin will improve and pre-paid will begin to take off.

11) Banks will begin to couple payments with incentives in an attempt to avert retailer led models.. Look for BAC to be the leader here.

What does this mean for Visa earnings?

My summary view is that Visa has plenty of runway on international credit growth.. but their trajectory now has much greater risk ask it will be tied almost exclusively to credit. Visa’s recent success in processing services (ie DPS) wont suffer short term as the top 5 banks have minimal services with them.. but we will see erosion of debit revenue beginning as transaction volume further accelerates to PIN debit routed outside of Visa’s network and PIN debit adoption in small merchants accelerates.

Per final regs – 75 75 FR 81722, 81731 (Dec. 28, 2010).

Pre-Paid

ii. An issuer replaces its debit cards with prepaid cards that are exempt from the interchange limits of §§ 235.3 and .4. The exempt prepaid cards are linked to its customers‘ transaction accounts and funds are swept from the transaction accounts to the prepaid accounts as needed to cover transactions made. Again, this arrangement is not per se circumvention or evasion, but may warrant additional supervisory scrutiny to determine whether the facts and circumstances constitute circumvention or evasion.

Processor Fees

Merchant commenters voiced concerns that issuers may attempt to circumvent the interchange fee standards (applicable to those fees ―established, charged, or received‖ by a network) by collectively setting fees and imposing those collectively set fees on acquirers, and ultimately merchants, through the networks‘ honor-all-cards rules. For example, the largest issuers may collectively determine to charge interchange transaction fees above the cap and effect this decision by dictating to each network the agreed upon amount. The network, then,would permit each issuer to charge that amount, and because merchants would be required to accept all the network‘s cards, merchants would pay the amount determined by the issuers.

Section 920(c)(8) of the EFTA defines the term ―interchange transaction fee‖ to mean ―any fee established, charged, or received by a payment card network . . . for the purpose of compensating an issuer for its involvement in an electronic debit transaction.‖ Accordingly, interchange transaction fees are not limited to those fees set by payment card networks. The term also includes any fee set by an issuer, but charged to acquirers (and effectively merchants) by virtue of the network determining each participant‘s settlement position. In determining each participant‘s settlement position, the network ―charges‖ the fee, although the fee ultimately is received by the issuer. An issuer, however, would be permitted to enter into arrangements with individual merchants or groups of merchants to charge fees, provided that any such fee is not established, charged, or received by a payment card network. The Board has added paragraph 2(j)-3 to the commentary to explain that fees set by an issuer, but charged by a payment card network are considered interchange transaction fees for purposes of this part. The Board plans to monitor whether collective fee setting is occurring and whether it is necessary to address collective fee setting or similar practices through the Board‘s anti-circumvention