Tag Archives: Network

Payment Tokenization

Reputation – Commerce Implications

9 January 2013

I’m sitting in NYC waiting on my plane.. thinking about reputation, not only explaining the importance of a “good one” to my 12 and 8 yr old boys, but also thinking about its broader importance in commerce. Where do I have reputations today?

- Commercial: Bank, Credit Bureaus, Card Issuers, Local Merchants, Employers, Customers, Suppliers, Amazon, Linkedin, eBay, Blog, Google, …

- Community: Friends, Neighbors, Schools, Church, Organizations,

- Personal: Hospital, Government, Police, Government, Friends, Colleagues

Throughout history reputations were 100% dependent on relationships. These personal networks were the primary conduit of reputation information. Financial services have benefited greatly, over the last century, from improvements made to reputation portability and standardization.

In this modern era, eBay offers many lessons in relevance of reputation, demonstrating what great things can happen when tools exist to manage it. There are also many negative lessons here. For example in 2004, eBay launched into China. Prior to launch eBay’s risk organization wanted to keep the China community separate from the US. Community separation was a logical recommendation given that reputations take time to build, and dependent on community context. In the US buyers and sellers work for years to build trust and “confidence”. Reputations forged by self-dealing, or other fraudulent practices, were ferreted out. Unfortunately Meg didn’t want this community separation… she wanted one big community. Within weeks Meg saw the downside of operating these 2 together, as fraud shot through the roof.. thus separating the communities and opening the doors for other competitors (See this Stanford University Case Study).

Reputation has a very strong societal and community context. I told my sons that a Chef with a great reputation in New York or Paris means something completely different than a great Chef in a community of cannibals (… well it made them laugh). Markets hold people and money accountable, and the ability to measure and convey a commerce reputation is critical for network growth and efficacy. Banks have long held a central intermediary role in commerce as both a “reputation authority” and a manager of the corresponding risk. For example, letters of credit (LOC) are an instrument extended to a supplier receiving an order from an unknown buyer. After all, receiving an order for 100,000 widgets from a known buyer carries a far different weight that one from one that is unknown. Thus an LOC reduces the risk to the supplier by allowing money to be held by a 3rd party bank while the order if fulfilled.

Another excellent reputation example is in serving the poor at the base of the pyramid. In 1976, Muhammad Yunus created the concept which led to Grameen Bank, a success which resulted in the 2006 Nobel Peace prize (see Wikipedia). Muhammad recognized that lending must be tied to a reputation which is critical to maintain: that within the local community. The Grameen model lends money to a community group, whose individual members are mutually responsible for the loan. This is a fantastic model. What further opportunities could exist if participating individuals could expand their reputation outside of the community?

Modern markets have demonstrated that improving the portability of reputation expands the capital attracted to that market. For example financial markets expanded by specialists operating in a securitized model where risks could be aligned to capital. In retail banking, local markets evolved from local banks to national. Each bank could make rational decisions on where to participate and specialize in this market.

In business-business commerce reputation is a critical factor in the success of JIT inventory, virtual supply chains and vendor managed inventory. Few companies would be willing to let an unknown participant into their network. In the online world, eBay and Alibaba have done a tremendous job building communities around reputation. Wouldn’t it be nice if you could take your reputation with you? For example if Prosper or Zopa could get through regulatory hurdles (see here on their issues), lending could be done in an ad hoc community of investors without a banking license. Commerce would be done based upon your community reputation (eBay/Amazon), and risk would be managed through non financial data from retailers, facebook, MNOs, …

Unfortunately few of the holders of your reputation are incented to share it (in a positive sense). Few people know that there are roughly 4 times the number of negative credit bureaus as there are positive. In other words, every bank and supplier are willing to share their negative customer information (ie didn’t pay their bill), very few are willing to share their positive customer information. In most OECD 20 countries, positive bureaus are not the result of commercial initiative, but rather a legal or regulatory one (Wikipedia Equifax).

In the US we have more of an aggregation problem.. how do we manage multiple reputations. In emerging markets the problem is much different: How do you build any kind of reputation? One of the first problems to crack is identity. How do you assign an ID that sticks? We see many government initiatives around National ID, but this takes time. Is there another number or ID that we could use in the interim? It certainly seems that a cell phone number makes the most sense given its global penetration of 5.3B consumers (75%+ of the worlds population). Could emerging market carriers enable an opt in “reputation” consumer service?

I’d love to see a few companies work toward this end.

In the US, I’d love to see a consumer service that just measures my reputation in all of these places (beyond banking).

Sorry for not finishing this blog cleanly…

2013: Payment Predictions – Updated

2 January 2013 (updated typos and added content on kyc, cloud, and push payments)

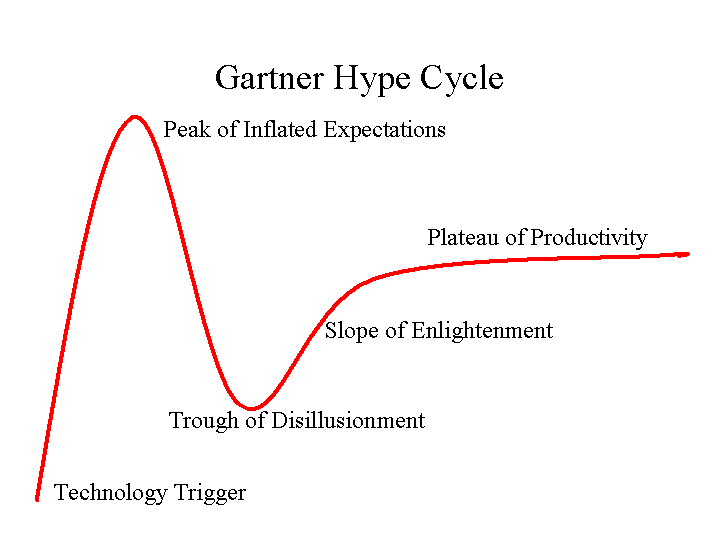

Looking back to my first “prediction” installment 2 years ago, 2011: Rough Start for Mobile Payments, not much has changed. Although I am personally approaching the “trough of disillusionment”. Lessons below are not exclusively payment (ie mobile, commerce, advertising) but seem relevant .. so I mashed them together. Key lessons learned for the industry this year:

- Payment is NOT the key component of commerce, but rather just the easiest part of a very long marketing, targeting, shopping, incentive, selection, checkout, loyalty … process. Payments are thus evolving to “dumb pipes”.

- Value proposition is key to any success for mobile at the POS. There are no payment “problems” today. None of us ever leave the store without our goods because the merchant did not accept our payment. There are however many, many problems in advertising, loyalty, shopping, selection, …

- There is no value proposition for the merchant or the consumer in NFC. NFC as a payment mechanism is completely dead in the US, with some hope in emerging markets (ie transit).

- 4 Party Networks (Visa/MA) can’t innovate at pace of 3 party networks (Amex/Discover). See Yesterday’s blog.

- Visa is in a virtual war with key issuers, their relationship is fundamentally broken. This is driving large US banks to form “new structures” for control of payments and ACH. Control is not a value proposition.

- US Retailers have organized themselves in MCX. They will protect their data and ensure consumer behavior evolves in a way which benefits them. Key issues they are looking to address include bank loyalty programs, consumer data use, consumer behavior in payment (they like chip and PIN but refuse to support contactless).

- Card Linked Offers (CLO) are a house of cards and the wind is blowing. Retailers don’t want banks in control of acquisition, in fact retailers don’t spend much of their own money on marketing in the first place. Basket level statement credits don’t allow retailers to target specific products and it also dilutes their brand without delivering loyalty. Businesses want loyalty… Companies like Fishbowl and LevelUp are delivering.

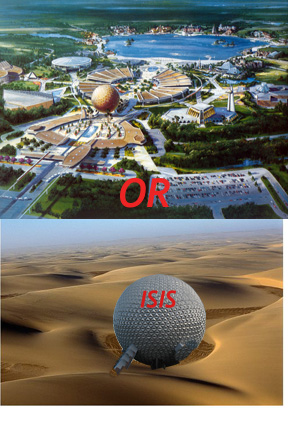

- Execution. This may be subject of a future blog… Fortune 50 organizations, Consortiums, Networks, Regulated Companies all share a common trait: they are challenged to execute. Put all of these groups together (

without a compelling value proposition…) and we have our current state (see my Disney in a desert pic). Take a look at who is executing today and you will see product focus around a defined value proposition. My leaders: Square, Amex, Amazon, Sofort, Samsung, Apple, SKT, Docomo and Google. Organizations can’t continue to stick with leaders that are focused solely on strategy, or technology, or corporate development… You should be able to lock any 3 people in a room for a week and see a prototype product. The lack of depth in most organizations is just astounding. Executives need to bring focus.

without a compelling value proposition…) and we have our current state (see my Disney in a desert pic). Take a look at who is executing today and you will see product focus around a defined value proposition. My leaders: Square, Amex, Amazon, Sofort, Samsung, Apple, SKT, Docomo and Google. Organizations can’t continue to stick with leaders that are focused solely on strategy, or technology, or corporate development… You should be able to lock any 3 people in a room for a week and see a prototype product. The lack of depth in most organizations is just astounding. Executives need to bring focus. - In a NETWORKED BUSINESS, it’s not enough to get the product right. You must also get retailers, consumers, advertisers, platform providers, …etc. incented to operate together. Today we see broken products and established players throwing sand in the gears of everyone else in order to protect yesterday’s network. Fortune 50 companies have shown poor partnership capabilities. Their strategies are myopic and self interested. For example Banks DO NOT DRIVE commerce, but support it. Their “innovation” today is self serving and built around their “ownership” of the customer. Commerce acts like a river and will flow through the path of least resistance. There can only be so many damns… and they will be regulated.

- The Valley and “enterprise” startups. There are billions of dollars to be unlocked at the intersection of mobile, retail, advertising, social. Most of the value requires enterprise relationships. Most investment dollars have flowed to direct to consumer services. I expect this to change.

- Consumer Behavior is hard to change, particularly in payments, it normally follows a 20 yr path to adoption. For example, in every NFC pilots through 7 countries we saw a “novelty” adoption cycle where consumer uses for first 2 months then never uses again. My guess is that there are fewer than 1-2 thousand phone based NFC transactions a week in the entire US. (So much for that Javelin market estimate of $60B in payments).

- Consumer Attention. Who can get it? They don’t read e-mails, watch TV adverts, click on banner ads. My view is that the lack of attention is due to a vicious cycle relating to relevant content and relevant incentives.

- Hyperlocal is hard. The Groupon model is broken, CLO is broken.. Large retailers have a targeting problem AND a loyalty problem. Small retailers have a larger problem as the have no dedicated marketing staff. Their pain is thus bigger, but selling into this space requires either a tremendous sales team or a tremendous brand (self service).

- My favorite quote of the year, from Ross Anderson and KC Federal Reserve. [With respect to payment systems].. if you solve the authentication problem everything else is just accounting.

Predictions

Here are mine, would greatly appreciate any comments or additions.

- Retailer friendly value propositions will get traction (MCX, Square, Levelup, Fishbowl, Google, Facebook, …)

- MCX will not deliver any service for 2 years, but individual retailers will create services that “align” with principals outlined by MCX (Target Redcard, Safeway Fastforward, …etc). The service which MCX should build is a Least Cost Routing Switch to enable the most efficient transaction across payment “dumb pipes”. This will enable merchants who want to take risk on any given customer the ability to do so..

- Banks will build yet another consortium in an attempt to control payments. They will work to “protect consumers” by hiding their account information and issue “payment tokens”. I agree with all of this, yet this is a very poorly formed value proposition and Banks will find it hard to influence consumer behavior.

- We will see more than one bank start a pilot around Push Payments (see blog).

- Facebook and Google will gain significant traction in mobile ad targeting…. following on to targeted incentives… which will lead to mobile success. Bankers, please read this again.. success in mobile will begin with ad targeting and incentives. Payments are an afterthought…

- Retailers at the leading edge will begin to see that their consumer data asset is of greater value than their core business.

- Banks will follow Amex’s lead in creating dedicated data businesses. What is CLO today will morph into retailer analytics, offers and loyalty.

- Apple will put NFC in their iPhone.. but usage is focused on device-device communication… not payment. NFC will be just another radio in the handset, there will be multiple SEs with the carriers owning a SWP/SIM based one.. and the platform provider managing the other. Which will succeed? A: the group that can best ORCHESTRATE value across 1000s of companies.

- Visa will lose a top 5 issuer to MA, and they will see a future where their debit revenue is gone (in the US) as MCX and bank consortiums take ownership of ACH and PIN debit.

- We will see 100s of new companies work to create new physical commerce experiences that include marketing, incentives, shopping, selection. Amazon is the driving force for many, as retailers work to create a better consumer experience at competitive price.

- Chaos in executive ranks. Amex, Citi, MCX, PayPal, Visa all have new CEOs.. all will be shaking up their payment teams.

- Retail banking is going through fundamental change. Bank brands, fee income and NRFF are declining, big dedicated branches will be replaced by more self service. Mass market retail will see significant leakage into products like pre-paid. Retailers and Mobile Operators are better able to profitably deliver basic financial services, to the mass market, than banks…. see my Blog Future of Retail: Prepaid.

- Unlocking the Cloud… and Authentication. KYC is a $5B business. Look for mobile operators to build consumer registration services that will tie biometrics with phone. Digital Signatures on contracts, payment through biometrics, .. all will be possible in a world without plastic. Forget NFC… See previous Blog on KYC and Cloud Wallets.

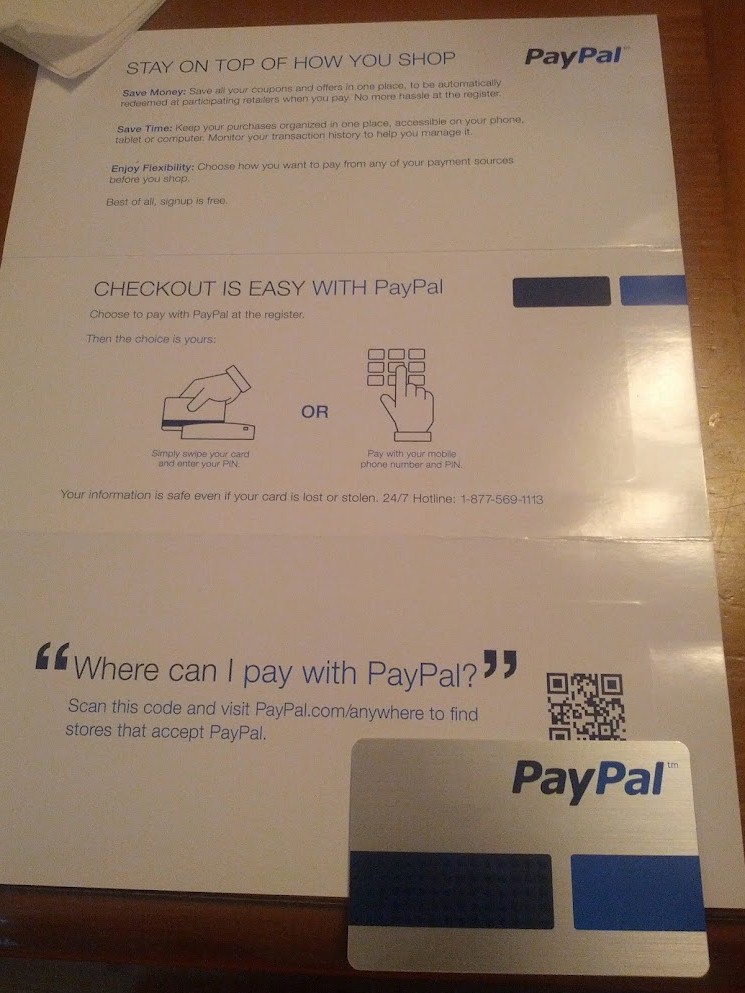

PayPals New Plastic

![]()

No Mastercard Logo on this one…

Quite impressed that they have pulled this together.. a new card network…

This is more than a decoupled debit.. although PayPal could choose to assume settlement risk through either ACH, stored debit card (or even ATM??). Paypal has the facilities to provide lending via BillMeLater (previous post) or to a consumer’s other preferred lender (via stored card). They are completely in control of a much larger value proposition as well.. with integrated rewards and a 3 party financial network that will compete with Discover and Amex.

I’m very, very impressed.. this is a new product that could completely disrupt traditional credit cards. Not only in rewards, coupons and incentives.. but in interest rates for every single purchase. This could be the only card you carry.. Forget about the “pay by phone number”.. the product innovation here is much more interesting than how it is delivered (plastic, phone number, bump, …).

Paypal also has a new site (beta) a few screen shots of which are below.

This new plastic is currently only accepted at Home Depot. My understanding it that Chase Payment Tech will be a lead acquirer for this new Product… I’m sure Vantive, FirstData … et.al will not be far behind. I will attempt a more thoughtful analysis later… thoughts appreciated.

Nokia, Apple, Android, Value Creation and Distributed Innovation

10 April

(Cool title…? You can tell I’m an engineer)

(Cool title…? You can tell I’m an engineer)

I was catching up on some reading this Easter weekend and saw one of my old MIT Technology reviews lying around. Article was on Nokia’s new CTO Henry Tirri (Dec 2011). Question came to mind: to what extent does technology influence Nokia’s future success? Is Apple’s current success built on technology? Of course, although any CTO’s job gets harder when their CEO is forming alliances that are 100% potential and 0% market traction…. Oh I forgot Elop also sold your own OS to Accenture so there is “no way back”. (For more background on Nokia/MSFT see this UK Guardian Article).

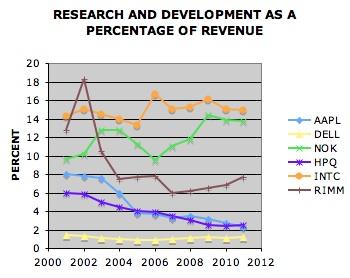

What factors will influence success in Mobile? Obviously it is not R&D, as Nokia’s 2.9B EUR ($3.8B) budget was roughly twice Apple’s $2B (see global 2012 R&D Spending report from Battale). Most would agree that Nokia lost in connecting the phone to the internet.. No amount of internal R&D could have led Nokia to build an equivalent network.. yet they did not fully realize the value that consumers could unlock … at least not much beyond e-mail. (RIM suffered from a similar myopia.. security vs usability locked into the corporate environment). Nokia’s R&D engineers thus toiled away with features they could control and build.. That is what engineers do.. Nokia thought the battle was in feature/function.. and hundreds of specialized designs for many global “segments”. However the consumer opportunity that Apple discovered was not in hardware, but rather in delivering new ways to connect consumers to all things digital… particularly networks (internet, home, social, entertainment, … and eventually office).

What factors will influence success in Mobile? Obviously it is not R&D, as Nokia’s 2.9B EUR ($3.8B) budget was roughly twice Apple’s $2B (see global 2012 R&D Spending report from Battale). Most would agree that Nokia lost in connecting the phone to the internet.. No amount of internal R&D could have led Nokia to build an equivalent network.. yet they did not fully realize the value that consumers could unlock … at least not much beyond e-mail. (RIM suffered from a similar myopia.. security vs usability locked into the corporate environment). Nokia’s R&D engineers thus toiled away with features they could control and build.. That is what engineers do.. Nokia thought the battle was in feature/function.. and hundreds of specialized designs for many global “segments”. However the consumer opportunity that Apple discovered was not in hardware, but rather in delivering new ways to connect consumers to all things digital… particularly networks (internet, home, social, entertainment, … and eventually office).

Will “Apps” be the key to unlocking the value of mobile?

In the press last month, we saw the analysis by Flurry that Amazon is kicking Google’s rear in App store revenue (89%), and that Google itself makes 5x more on IOS than Android. Other recent research from groups like ABI Research reported that mobile app revenue was $8.5B with 39% due to in app purchases (Gartner says $15B). Personally I find both these numbers a little hard to believe, given Google’s Android revenue is $550M and Apple announced back in July that it paid developers $2.5B (cumulatively over life of AppStore). Best guess for Apple’s FY11 Appstore sales is somewhere around $1.6B (see my July Blog)

Total App Store ECOSYSTEM revenue from these Big 3 is therefore approximately

$1.6B + $1.42 (Amazon’s 89% of Apple’s) + $0.55B = $3.57B

Could it be possible that these big 3 contributed less than 50% of global App Revenue? Not likely (sorry Gartner/ABI). As an investor, I’m not keen on Apps as a long lived mobile environment outside of entertainment (subject of another blog). Suffice to say my view is that “apps” are only a temporary technology metaphor for connecting clusters, goods and data. Although not a fan of “apps” I am very grateful that the App environment exists, as it is driving much innovation within a “developer community” (per Platform). Having thousands of brilliant engineers from around the world work to deliver value benefits us all. Which brings me to the topic of distributed innovation.

Open/Distributed Innovation

Open Source is a model most of us are well familiar with. (further reading… I ran across a very nicely done paper from 2 MIT students: Implication of Open Innovation and Open source to Mobile Device Manufacturers). Given that mobile, advertising and payments are all networked businesses… it seems business models supporting distributed innovation will advance at a faster pace than those where only a single entity controls the entire product or supply chain. For example, Amazon, Samsung, Motorola, LG, HTC, Verizon, ATT, Vodafone, .. all make much larger investments in the Android platform (than in IOS). (I would love to see an analysis of combined capital investment in android platform)

However, this distributed innovation hypothesis is NOT playing itself out (ie Apple). Apple’s 1Q12 showed iPhone revenue alone was $24.4B, which is bigger than all of MSFT revenue combined. Analysts have shown that Apple now garners 75% of mobile handset profits, with only 9% of handset market share. So while Samsung alone has outsold Apple in Units this quarter (41M vs. 32.6M), and Android just topped 50% market share (vs Apple’s 30.2%).. Apple’s handset business PROFITABILITY dwarfs that of all of the competition (COMBINED).

So… What are the factors of competition today? Can someone else change the game?

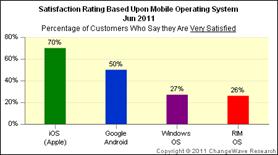

Most would agree that Apple has won through a focus on design and customer satisfaction. Nothing looks as good, or works as reliably as an iPhone. It brings a consumer’s digital life together; it is also the channel by which we stay connected when we are not at home.  Apple’s unique ability to control design and manufacturing quality has obviously provided many benefits (which customers have proven willing to pay a premium for).

Apple’s unique ability to control design and manufacturing quality has obviously provided many benefits (which customers have proven willing to pay a premium for).

The big downside in distributed innovation is complexity, there is a need for a “channel master” or chaos reigns. Many Android users witness this chaos when an app won’t work on a new hardware/OS combination.. Distributed innovation is not something that established businesses are good at. It has proven most successful in product PLATFORMS where the pace of change in each component is changing at a rate where no one company can make the capital investment to remain competitive (ex. Moore’s Law, PC architecture through present day). Intel played a very important role in this process, as it worked outside the scope of the CPU in areas such as: Intel Architecture Lab (IAL, developed common standards like PCI), stimulated external innovation (developer training, testing, Intel Capital), industry marketing, patent/licensing. Intel defined what the PLATFORM was.. something that is common sense to us today.. but rest assured it was not given to them, rather it was something that they stepped into and took leadership of.

As we look for where the form of mobile competition may change, it would seem to be outside: hardware, software and network bandwith. With respect to hardware, features have recently begun to surpass “good enough” . Samsung’s Galaxy Nexus is an excellent example of how focused hardware innovation has enabled them to surpass the iPhone’s capabilities. If hardware is good enough, and not the primary factor of competition, it must be software, services or data that will drive competition in the next phase…

If platform is decided on software only.. then software platform with most open standard and most users (ANDROID) should dominate as any connected devices (handsets and everything else) have lower cost and more ability to “specialize”, particularly if intelligence is in the network (not the device). But software is currently not the point of competition either… If not DEVICE software.. then what?

Stage 4 – Shift from Integrated Platform to Value Orchestration

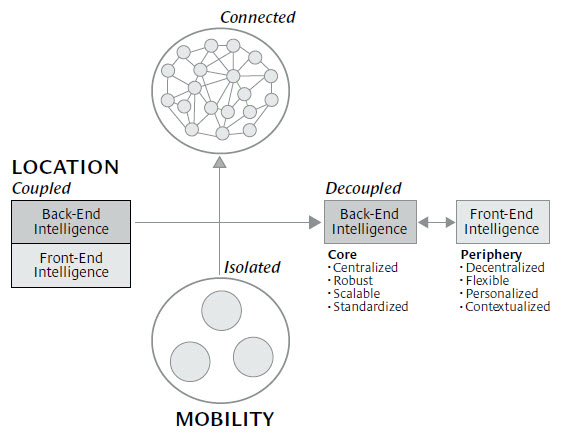

Keeping with the assumptions above: hardware becomes “good enough”, platform/software become “ubiquitous”, patents are widely shared (ok this is a joke.. checking if you were sleeping), and the mobile phone transforms into the networked device “bridging” the virtual and physical world then value (and profitability) will shift from platforms executing transactions to entities coordinating interactions. This interaction of entities is what I refer to as Value Orchestration, certainly not a concept I developed. A January 2001 Harvard Business Review Article: Where Value Lives in a Networked World put it this way:

In more general terms, modern high-speed networks push back-end intelligence and front-end intelligence in two different directions, toward opposite ends of the network. Back-end intelligence becomes embedded into a shared infrastructure at the core of the network (cloud), while front-end intelligence fragments into many different forms at the periphery of the network, where the users are. And since value follows intelligence, the two ends of the network become the major sources of potential profits. The middle of the network gets hollowed out; it becomes a dumb conduit, with little potential for value creation. Moreover, as value diverges, so do companies and competition. …. In a connected world, intelligence becomes fluid and modular. Small units of intelligence float freely like molecules in the ether, coalescing into temporary bundles whenever and wherever necessary to solve problems.

This orchestration hypothesis seems to have proven itself in PCs as margin shifted away from the integrated manufacture to component “performance” differentiation (ex. peripheral price/performance) then again to software finally transforming again to orchestrators and “connected” businesses that orchestrate network value (like Amazon, Facebook and Google)…. as hardware evolves into a commodity like business.

The long term investor risk for Apple is that it will not be able to shift to a value orchestration role, and its handset business (while excellent) will no longer garner 75% of industry profits. Where will the high margin businesses develop? If we take a network view, opportunities to create value exist in interaction between clusters (ex. Retailer to consumer, Facebook community to Retailer) and within a cluster (ex Supply chain, healthcare , …etc.). Within this cluster matrix, l like to take a Clayton Christensen view: “what problems are there that the mobile phone can solve”? which each “opportunity” assigned 5 key measures:

1) TAM (Consumers, $ Volume, Growth, …)

2) Disruptive innovation measure – price/performance (ex. Mobile targeted advertising vs. Coupons)

3) Information Control. Who owns it, how is it obtained, accuracy, privacy, (impacts pricing power)

4) Key Alliances and stakeholders

5) Execution risk (ex. Compete with Facebook vs. Building a mobile application for a retailer)

Much of Value orchestration is dependent on data. Consumer data is highly fragmented in the physical world, do consumers/clusters want it consolidated? What are the benefits? Where is it stored (node or cloud)? The HRB quote above painted a picture where “small units of intelligence float freely like molecules in the ether, coalescing into temporary bundles whenever and wherever necessary to solve problems”. Perhaps it is my time as a senior director within Oracle that has ruined my views on data.. but if it floats freely …how on earth can anyone organize it? Doesn’t someone need a directory? for at least one side? How can intelligence be “self assembling” in business?

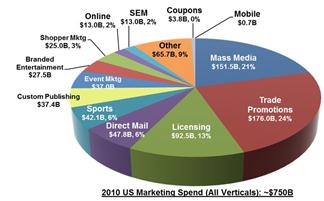

My firm belief is that we will start a mobile “boom” that will dwarf what we have seen with either the internet, PCs or the industrial revolution. How big? Will at the top of my list for calculating the basis of a “New Mobile” TAM is marketi ng.. With the US alone accounting for over $750B .. how much of that spend is targeted?

ng.. With the US alone accounting for over $750B .. how much of that spend is targeted?

Because mobile is at the intersection of both virtual and physical, the network is larger.. it touches every consumer, every business and every “cluster”… it is therefore many orders of magnitude more complex. In this dynamic environment, small companies are much better positioned to deliver “focused”, simple orchestrated solutions between clusters.

Examples of Cluster ochestration:

- Machine-machine interaction (mobile to open hotel room door)

- Person-Person interaction (health history, alergies to Doctor)

- Consumer-Retailer interaction (ex Mobile marketing in brick and mortar retail)

As intelligence develops, it will aggregate (ex Google/Facebook). I covered this topic back my December post Building Networks “The network forms around a function and other entities are attracted to this network (affinity) because of the function of both the central orchestrator and the other participants”. Given that each node and cluster is resource constained.. they maintain connections to a finite number of “efficient” orchestrators/networks. Early networks build very substantial momentum..

Summary

Wow.. this went on too long.. They say a blog over 2 min of reading is a looser.. hey.. you get what you pay for.

Given the mobile device’s unique ability to serve as a point of convergence between the virtual and physical world, a Stage 4 evolution will take place where handsets are cheap and ubiquitous and networks are high speed dumb pipes (both low margin businesses). This Stage may be the leverage point where Apple’s competitors gain differentiation. Perhaps if they had some cash.. and a few bright people they could respond.

There are certainly many scenarios where stage 4 could evolve from. Orchestration requires both back end “cloud” infrastructure and localized intelligence. Both entail a complex interaction of: data, distribution, platform, cluster relationships, business intelligence, control, regulation, trust, … to deliver value. Companies like Google, IBM, Oracle, Facebook… should be able to succeed in the central function. If any of them agree with this blog.. they should actively endeavor to build “interfaces” and standards by which small companies can deliver the localized intelligence.. much the way Facebook has started giving some access to data.

Sorry for size

Comments appreciated.

Building Networks and “Openness”

8 Dec 2011

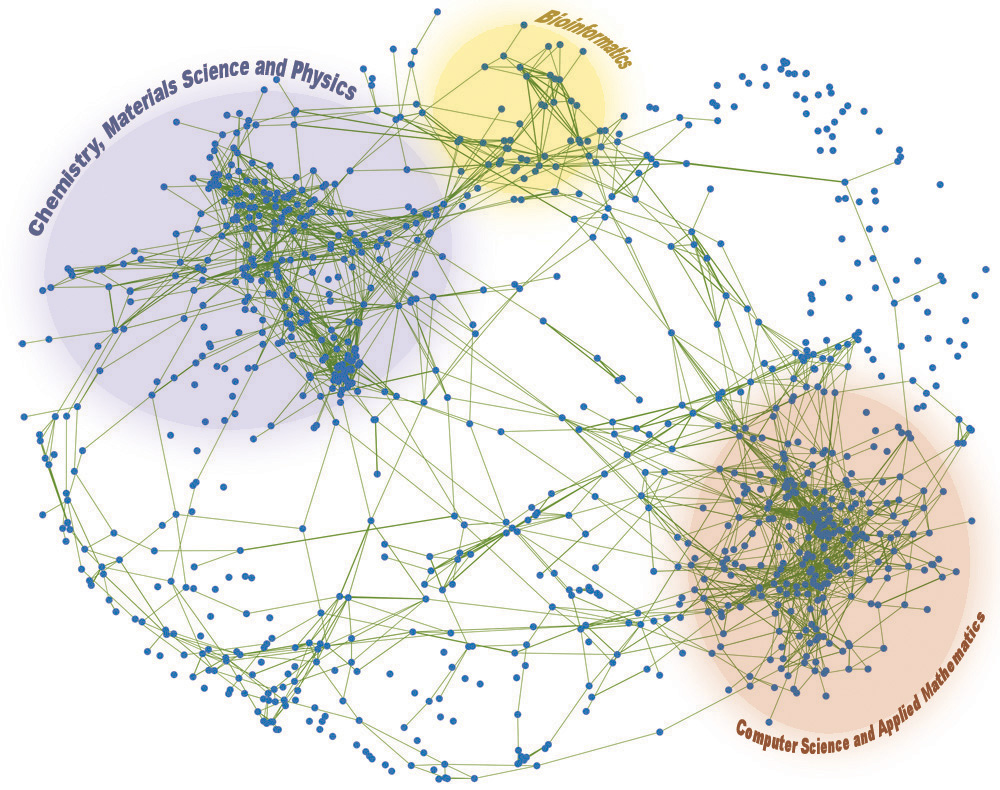

I’ve been reading some off beat stuff lately. One book “Weak Links: Stabilizers of Complex Systems from Proteins to Social Networks” was very thought provoking. As Mark Stefik (PARC Fellow) said ‘Something magical happens when you bring together a group of people from different disciplines with a common purpose.’ The combination of people, experience and approaches often leads to unexpected consequences.

As an engineer I like to solve problems.. I usually learn more from mistakes than I do from successes… but it is the learning that is fun. As an investor and entrepreneur I don’t like making mistakes… my preference in the start up environment is to have the learning cycle counted in minutes and days (vs customers and capital). I was speaking with a US Central Banker last month and the concept of “openness” was discussed. A hypothesis was laid out by the Fed “Mobile payments are not taking off because of a lack of common standards”. The Fed team is very good, the best way to encourage a good dialog is to lay out something radical; as for this hypothesis I disagreed completely. As stated in my numerous blogs: history has clearly showed that closed systems must form before open ones. I also told the Fed that the problem in US mobile payment IS NOT lack of standards but lack of a value proposition to consumers and retailers. In other words existing payment instruments solve all of my problems.. mobile payment simply does not add additional value (in isolation) compared with existing products (See Mobile Advertising Battle). In order to stimulate a change in behavior (merchant and consumer) there must be a strong value proposition. Two years ago I discussed the implications for broad payment standards in SEPA: Chicken or the Egg and in March of this year I outlined how SEPA has depressed payment innovation in the EU.

Given all of the chaos in NFC at the moment, I woke up this morning asking myself what is the “right amount” of openness and standards? How do successful networks form and mature? What are successful “open” networks? What is the first “open” standard you think of ? TCP/IP? Linux? Java? RosettaNet? EDI? Open Network? Internet? GSM? US Interstate system? SEPA? The Weak Links book opened my eyes to many new concepts, one was on how affinity influences network creation, and another on how few open networks exist in Nature. Networks form around a function and open networks are not necessarily the most efficient.

Scale-free distribution (completely open networks) is not always the optimal solution to the requirement of cost efficiency. .. in small world networks, building and maintaining links between network elements requires energy…. [in a world with limited resources] a transition will occur toward a star network [pg 75] where one of a very few mega hubs will dominate the whole system. The star network resembles dictatorships in social networks.

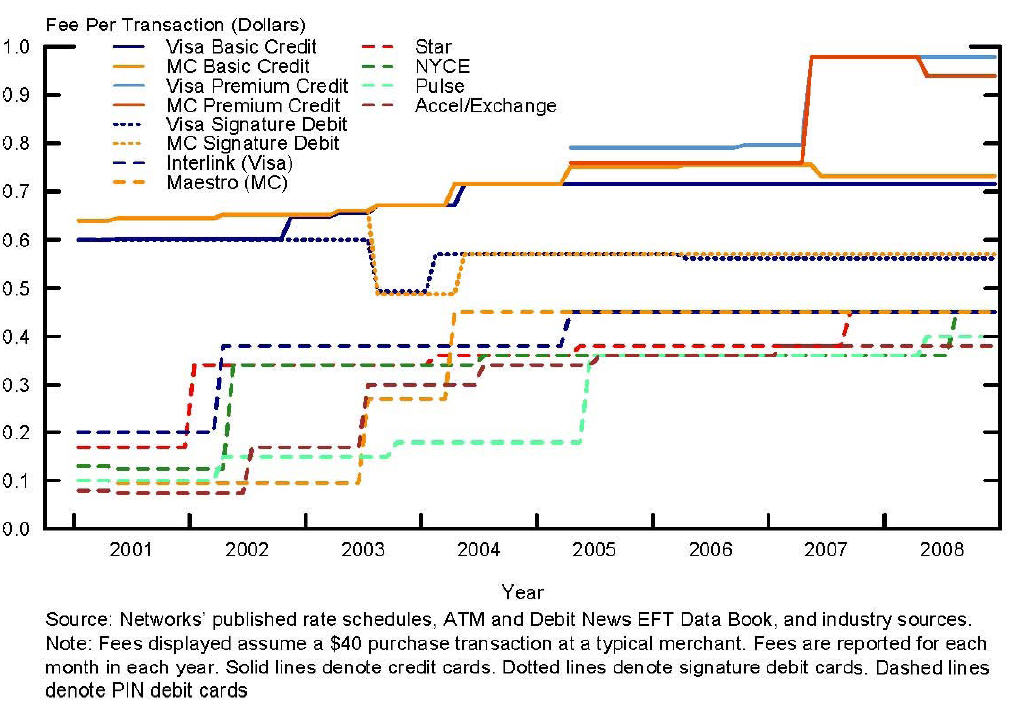

The network forms around a function and other entities are attracted to this network (affinity) because of the function of both the central orchestrator and the other participants. Of course we all know this as the definition of Network Effects. Obviously every network must deliver value to at least 2 participants. Networks resist change because of this value exchange within the current network structure, in proportion to their size and activity. Within the EU, SEPA undertook a rewrite of network rules and hoped that existing networks would go away or that a new (stronger) SEPA network would form around its core focus areas (SCT, SDD, SCF, ..). It was a “hope” because the ECB has no enforcement arm. In other words there was a political challenge associated with ECB’s (and EPC specifically) ability to force an EU level change on domestically regulated banking industry.. given that SEPA rules destroyed much value in existing bank networks, the political task was no small effort. We have seen similar attempts (and results) when governments attempt to institute major change in networks (Internet NetNeutrality v. Priority Routing, US Debit Card Interchange, …)

Mobile Payments Standard?

If we take a look at today’s payment networks what are the biggest problems to be solved? I have a perspective, but its certainly biased. How about payment routing and speed? These seem to be common merchant and consumer concerns. Keeping with an internet analogy, can you imagine if there were no DNS servers to route IP traffic? Every router would have to keep the directory for the entire internet not only of the final destination, but also the most effective route to forward traffic. What if the internet were not indexed? No ability to find information (thanks Google for fixing this). In the payments environment, the central assets of Visa and MA is 1) A Directory and 2) the rule that EVERY participant must route traffic through them (with a new PIN debit exception in US).

Outside of card transaction’s banks maintain their own directory for routing retail and commercial payments; this is called “least cost routing”. A key bank service I  would propose (note: I’m not the originator of this idea) is a universal directory service mapping e-mail, phone and account numbers. In Australia, the banks have this today run by my friends at Cardlink and completed under project Mambo. In the US, The Clearing House (TCH) has had the UPick service completed for a number of years.. without much interest.

would propose (note: I’m not the originator of this idea) is a universal directory service mapping e-mail, phone and account numbers. In Australia, the banks have this today run by my friends at Cardlink and completed under project Mambo. In the US, The Clearing House (TCH) has had the UPick service completed for a number of years.. without much interest.

My thought here, is that rather than facilitate a EU mistake in mandating a change in all rules.. decrease the switching costs between networks so that market forces can take hold. I’m not proposing to take the directory public.. but at least give regulated entities equal access. In Australia the driver was to decrease bank switching costs, also note that Australia has no Signature debit.. just as in Canada. A common directory could also follow rule that non-regulated institutions could not hold account data (or card number).. Just as I don’t have to know my Bank’s IP address.. I could use another identifier (email, mobile, …) for online transactions. The danger for banks is that this would certainly open up the world of least cost routing to non-banks. Payments would become “dumb pipes”.. which is perhaps what it should be.

Mobile payments is certainly not critical government infrastructure. So what is Government’s proper role? Consumer data protection, transparency, regulatory requirements, equal participation/access.. ? I don’t know the answer. I like the idea of the Government creating a model service for R&D purposes.. perhaps based on Fedwire and letting non-banks have access to it… I also like the idea of a common directory.

ISIS

For 2.5 years I’ve been writing about ISIS.. I’ve always have been a huge advocate.. until lately. What has changed? My position, and that of retailers, is that today’s payment networks are heavily tilted in favor of the banks. The opportunity I originally saw for ISIS was constructing a new merchant friendly network that was an “extension” of the current mobile network which the carriers run (The original business case for ISIS is outlined in ISIS: Moving Payments from Rail to Air).

Keeping with my theme of openness and standards how is ISIS creating a platform for other to invest in? What value is an ISIS mobile payment to a retailer? Yesterday’s blog talked about the complex supply chain necessary to deliver on NFC. Don’t get me wrong, there is nothing wrong about NFC technology.. it is a very well defined specification. But it is complex.. if it was a NEW WAY of doing payments (or better yet commerce) perhaps it should have started a little less ambitiously. The team seems as if it prudently sought to reduce risk, but it also gave up on a central element to its value proposition. My analogy for today is that ISIS project is like Vanderbilt’s skipping steam and going straight for high speed mag lev in 1880…. While the entire country was growing at a 10x pace and he had no right of way..

Big projects are tough in normal times.. but mobile is changing at an unbelievably fast pace. Small focused projects are certainly lower risk when innovating at the cutting edge. Everything is changing.. how could anyone architect an open system in such a fast changing environment? It would seem that technical standards like TCP/IP or GSM were successful because of their ubiquity and distributed control. They could be used by all to create different networks with different value propositions.. which incented millions of companies and consumers to invest. I just don’t see how MNOs can create a business platform based on NFC. Their best shot may be to work with someone like Sequent Software to create an architecture for 1000s of applications to access secure element data.. instead of the one single CSAM wallet coming out in Pilot Dec 2012.

Your thoughts are appreciated

Previous Blogs (Nokia NFC Ecosystem, ISIS Ecosystem or Desert, Banks will win in Payments.. but WHICH ones?)