Category Archives: mobile money

Apple iPhoneX .. no more SIMs?

Apple and NFC – Part 2

Controlling Wallets – Battle of the Cloud Part 3

Banning Credit Cards – FUBAR?

Gemalto QR Codes.. One Giant Leap _________ ?

10 Jan 2013

NFC is a beautiful technology with uses far beyond payment. In the payment use case however, it is not the technology, but rather a business battle over control and ownership (a 12 Party NFC Supply Chain Mess) which has conspired to create many forces against NFC’s payment success.

As I stated yesterday, latest news is that MCX has chosen QR code based approach from Gemalto (following Starbucks success). My guess is that Gemalto has developed a one time use QR code that is derived from device information (it will change for every transaction… ). You can safely assume that ACH will be the primary funding mechanism (just as in Target’s Redcard and Safeway’s FastForward). The banks had some idea of MCX’s plans are thus moving aggressively to create a directory service to “protect” customer DDA information via tokenization. My guess is that this protection will come at a price….

Here is my best guess of the transaction flow (assuming the rumor is true).

Registration

- Customer downloads Gemalto’s wallet

- Account is created unique to the phone

- Consumer registers phone, DDA, loyalty cards, backup funding instrument

- Bank account is validated, consumer risk scored, back up payment instrument run for auth

- Wallet is activated on first use at a participating merchant after ID is validated

Usage

- Customer opens wallet at checkout

- Unique QR code is generated based upon phone information (ex IMEI, time, network, phone #, …)

- Cashier selects “check” or “loyalty card”

- QR code is presented to register and scanned. Note MCX merchants are large multi lane merchants with POS development teams.. there will be some work to be done here

- Authorization – ECR passes QR code to MCX. Example via store controller routed much the same way coupons are done today.

- MCX validates code, performs fraud screen, authorizes payment (performed by FIS).

- Individual stores also will be able to leverage code as key for consumer “cloud wallet” access where coupons are stored and redemption is paperless.

- Coupons are applied

- Loyalty price/promotions are applied

- Payment is applied

- Zero balance

- Consumer gets electronic receipt and paper one.

I like QR codes for their ubiquity and established consumer behavior (thank Starbucks in the US). Stores don’t need to buy any new hardware for this to work, there is a zero cost of issuance, and it will work on a broad spectrum of phones. Development cycles for Store POS software are normally 18 months… so it could be some time before we see something come out.

QR codes may not be rocket science, but NFC has demonstrated the downside of tech heavy solutions. We may not need a $400M F22 when a simple bicycle will do. Carriers face a future as dumb pipes, a future share by banks, as both work to control their market positions instead of delivering value. MNOs and Banks (in the US) have proven themselves equally incapable of succeeding with new walled garden strategies. Commerce will find the path of least resistance, like a mighty river…

The big challenge for MCX will NOT be in technology, but rather a consumer value proposition. Retailers stated goal is to bring death to merchant funded bank card reward programs. What will convince me to part with my Amex card at the POS?… it will need to be something substantial.

Another often asked question is can MCX keep a bunch of fierce competitors working together in the same tent? This approach seems broad enough to insulate MCX from retail competitive forces and align them in fighting a common enemy. Per Sun Tzu “the enemy of my enemy is my friend”. Retailers are looking to turn the tables on the 2% “payment tax” on their business. There is serious enterprise commitment to making MCX work, banks will do well to treat them with respect.

Who will lose in this approach?

- Payment Terminal Manufactures

- Anyone dependent on NFC

- Existing Payment Networks – Debit Volume primarily (if MCX can create a value proposition)

- Retail banks. The primary payment relationship is a strong “daily use”… there are many downside for banks if they loose it.. for example retailers could offer instant credit based upon your history and network reputation.

- Start ups building case for value around bank cards or payment networks

- Consumers that want anonymity.

Other Related Blogs

2013: Payment Predictions – Updated

2 January 2013 (updated typos and added content on kyc, cloud, and push payments)

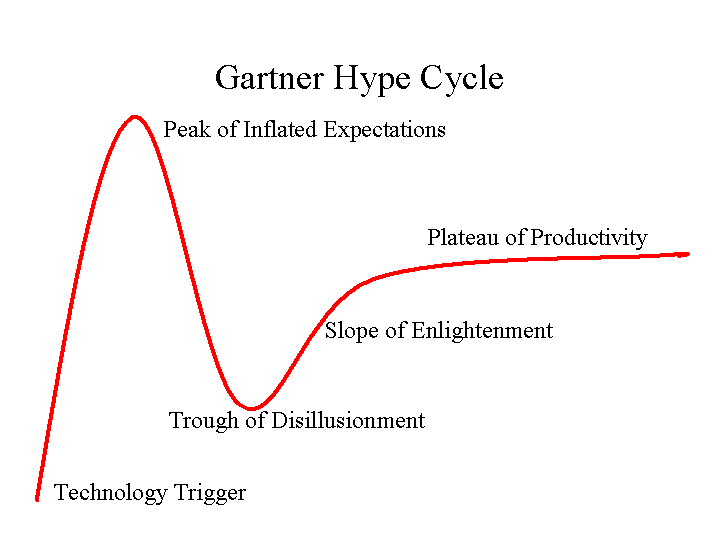

Looking back to my first “prediction” installment 2 years ago, 2011: Rough Start for Mobile Payments, not much has changed. Although I am personally approaching the “trough of disillusionment”. Lessons below are not exclusively payment (ie mobile, commerce, advertising) but seem relevant .. so I mashed them together. Key lessons learned for the industry this year:

- Payment is NOT the key component of commerce, but rather just the easiest part of a very long marketing, targeting, shopping, incentive, selection, checkout, loyalty … process. Payments are thus evolving to “dumb pipes”.

- Value proposition is key to any success for mobile at the POS. There are no payment “problems” today. None of us ever leave the store without our goods because the merchant did not accept our payment. There are however many, many problems in advertising, loyalty, shopping, selection, …

- There is no value proposition for the merchant or the consumer in NFC. NFC as a payment mechanism is completely dead in the US, with some hope in emerging markets (ie transit).

- 4 Party Networks (Visa/MA) can’t innovate at pace of 3 party networks (Amex/Discover). See Yesterday’s blog.

- Visa is in a virtual war with key issuers, their relationship is fundamentally broken. This is driving large US banks to form “new structures” for control of payments and ACH. Control is not a value proposition.

- US Retailers have organized themselves in MCX. They will protect their data and ensure consumer behavior evolves in a way which benefits them. Key issues they are looking to address include bank loyalty programs, consumer data use, consumer behavior in payment (they like chip and PIN but refuse to support contactless).

- Card Linked Offers (CLO) are a house of cards and the wind is blowing. Retailers don’t want banks in control of acquisition, in fact retailers don’t spend much of their own money on marketing in the first place. Basket level statement credits don’t allow retailers to target specific products and it also dilutes their brand without delivering loyalty. Businesses want loyalty… Companies like Fishbowl and LevelUp are delivering.

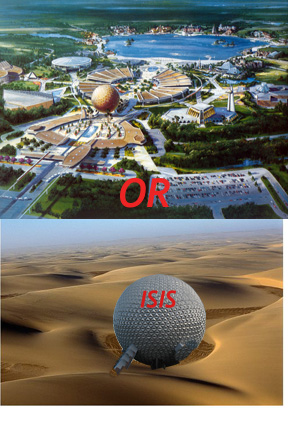

- Execution. This may be subject of a future blog… Fortune 50 organizations, Consortiums, Networks, Regulated Companies all share a common trait: they are challenged to execute. Put all of these groups together (

without a compelling value proposition…) and we have our current state (see my Disney in a desert pic). Take a look at who is executing today and you will see product focus around a defined value proposition. My leaders: Square, Amex, Amazon, Sofort, Samsung, Apple, SKT, Docomo and Google. Organizations can’t continue to stick with leaders that are focused solely on strategy, or technology, or corporate development… You should be able to lock any 3 people in a room for a week and see a prototype product. The lack of depth in most organizations is just astounding. Executives need to bring focus.

without a compelling value proposition…) and we have our current state (see my Disney in a desert pic). Take a look at who is executing today and you will see product focus around a defined value proposition. My leaders: Square, Amex, Amazon, Sofort, Samsung, Apple, SKT, Docomo and Google. Organizations can’t continue to stick with leaders that are focused solely on strategy, or technology, or corporate development… You should be able to lock any 3 people in a room for a week and see a prototype product. The lack of depth in most organizations is just astounding. Executives need to bring focus. - In a NETWORKED BUSINESS, it’s not enough to get the product right. You must also get retailers, consumers, advertisers, platform providers, …etc. incented to operate together. Today we see broken products and established players throwing sand in the gears of everyone else in order to protect yesterday’s network. Fortune 50 companies have shown poor partnership capabilities. Their strategies are myopic and self interested. For example Banks DO NOT DRIVE commerce, but support it. Their “innovation” today is self serving and built around their “ownership” of the customer. Commerce acts like a river and will flow through the path of least resistance. There can only be so many damns… and they will be regulated.

- The Valley and “enterprise” startups. There are billions of dollars to be unlocked at the intersection of mobile, retail, advertising, social. Most of the value requires enterprise relationships. Most investment dollars have flowed to direct to consumer services. I expect this to change.

- Consumer Behavior is hard to change, particularly in payments, it normally follows a 20 yr path to adoption. For example, in every NFC pilots through 7 countries we saw a “novelty” adoption cycle where consumer uses for first 2 months then never uses again. My guess is that there are fewer than 1-2 thousand phone based NFC transactions a week in the entire US. (So much for that Javelin market estimate of $60B in payments).

- Consumer Attention. Who can get it? They don’t read e-mails, watch TV adverts, click on banner ads. My view is that the lack of attention is due to a vicious cycle relating to relevant content and relevant incentives.

- Hyperlocal is hard. The Groupon model is broken, CLO is broken.. Large retailers have a targeting problem AND a loyalty problem. Small retailers have a larger problem as the have no dedicated marketing staff. Their pain is thus bigger, but selling into this space requires either a tremendous sales team or a tremendous brand (self service).

- My favorite quote of the year, from Ross Anderson and KC Federal Reserve. [With respect to payment systems].. if you solve the authentication problem everything else is just accounting.

Predictions

Here are mine, would greatly appreciate any comments or additions.

- Retailer friendly value propositions will get traction (MCX, Square, Levelup, Fishbowl, Google, Facebook, …)

- MCX will not deliver any service for 2 years, but individual retailers will create services that “align” with principals outlined by MCX (Target Redcard, Safeway Fastforward, …etc). The service which MCX should build is a Least Cost Routing Switch to enable the most efficient transaction across payment “dumb pipes”. This will enable merchants who want to take risk on any given customer the ability to do so..

- Banks will build yet another consortium in an attempt to control payments. They will work to “protect consumers” by hiding their account information and issue “payment tokens”. I agree with all of this, yet this is a very poorly formed value proposition and Banks will find it hard to influence consumer behavior.

- We will see more than one bank start a pilot around Push Payments (see blog).

- Facebook and Google will gain significant traction in mobile ad targeting…. following on to targeted incentives… which will lead to mobile success. Bankers, please read this again.. success in mobile will begin with ad targeting and incentives. Payments are an afterthought…

- Retailers at the leading edge will begin to see that their consumer data asset is of greater value than their core business.

- Banks will follow Amex’s lead in creating dedicated data businesses. What is CLO today will morph into retailer analytics, offers and loyalty.

- Apple will put NFC in their iPhone.. but usage is focused on device-device communication… not payment. NFC will be just another radio in the handset, there will be multiple SEs with the carriers owning a SWP/SIM based one.. and the platform provider managing the other. Which will succeed? A: the group that can best ORCHESTRATE value across 1000s of companies.

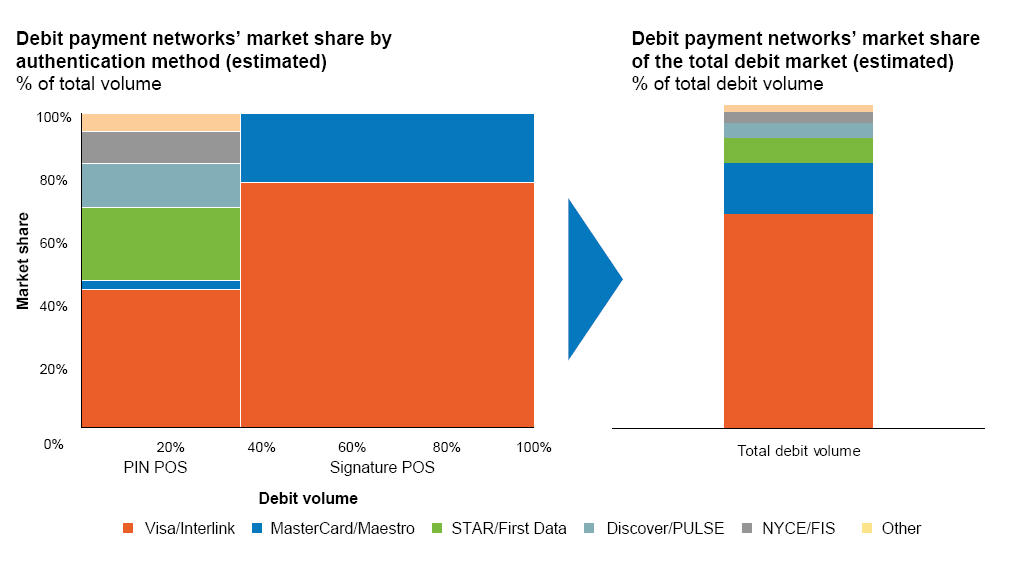

- Visa will lose a top 5 issuer to MA, and they will see a future where their debit revenue is gone (in the US) as MCX and bank consortiums take ownership of ACH and PIN debit.

- We will see 100s of new companies work to create new physical commerce experiences that include marketing, incentives, shopping, selection. Amazon is the driving force for many, as retailers work to create a better consumer experience at competitive price.

- Chaos in executive ranks. Amex, Citi, MCX, PayPal, Visa all have new CEOs.. all will be shaking up their payment teams.

- Retail banking is going through fundamental change. Bank brands, fee income and NRFF are declining, big dedicated branches will be replaced by more self service. Mass market retail will see significant leakage into products like pre-paid. Retailers and Mobile Operators are better able to profitably deliver basic financial services, to the mass market, than banks…. see my Blog Future of Retail: Prepaid.

- Unlocking the Cloud… and Authentication. KYC is a $5B business. Look for mobile operators to build consumer registration services that will tie biometrics with phone. Digital Signatures on contracts, payment through biometrics, .. all will be possible in a world without plastic. Forget NFC… See previous Blog on KYC and Cloud Wallets.

Push Payments

As I wrote in a previous note Banks will win in Payment: But which ones? Banks are very well positioned to execute. They have the consumer relationship, the merchant relationship, the IT infrastructure, and have always taken a key role in “commerce”. However, Banks have tended to operate in a slow “evolutionary” model.. and are now in a very dangerous position. Their network is complex and brittle, their value proposition and brands diminished, and the value equation has shifted.

If you are a bank and looking to “optimize” your approach to mobile payments, what are your key assets and constraints?

- Control of Network (vs. Visa, Telecos, Google, Apple, )

- Leverage existing assets

- Massive proliferation of consumer information and account numbers

- Risk Management

- Consumer Relationship

- Margin/Fees

- Value to consumer

- Value to retailer

- Regulatory issues

As a bank, would you invest in NFC? A standard owned by the card groups, and telecos and despised by retailers? Of course not.. it does nothing to help banks, merchants or consumers…

The centerpiece of any Retail Bank strategy should be to protect the consumer relationship. If you “blew up” payments today and started from scratch, how would you redesign it? I agree with Ross Anderson (See KC Fed) Ross Anderson “If you solve the authentication problem.. everything else is just accounting ..” . Why should I pass my credentials to a merchant, processor, acquirer, network, .. all just to give them to my (issuing/originating) bank? Why on earth would I pass around real account numbers (ex Checks)? Why do all these entities get to see me? What if I could interact with the originating bank directly to instruct them to send the payment?

We have seen “credit push” attempted globally with Sofort, SMS Pay, NACHA Credit Push, SEPA Credit Transfers, UK Direct Credits, US Trials with Padiant,…etc. All have a “mixed” record of success, with the biggest issue being consumer adoption and margin/bank incentives. Given US Bank recognition of the innovation problem with 4 party networks, and the need to consolidate debit processing, it would seem there is some movement in furthering this model in the US.

Unfortunately, the trials with Padiant have been a flop. A specialized payment terminal creates unique QR code which is captured by a payors phone camera. Phone sends to code to acquiring bank. Processor looks up consumers bank in directory and sends to originating bank for consumer auth/approval. Funds are then PUSHED directly to merchant and terminal gets auth. Top issue is consumer phone data connectivity, and a rather complex user process. Of course this is a starting point, and can be improved.. retailers just needs to get the buyer a few critical pieces of info:

- TID (terminal ID)

- MID (Merchant ID)

- Transaction ID

- Bank

- Amount

I like this “Push model” MUCH.. After all I can push the payment from either a debit or credit account. The merchant need not know, and consumers remain anonymous throughout the transaction. Push takes almost all fraud out of the system and keeps authentication with the entity that KYC’d the consumer (the originating Bank). It gives the Banks tremendous flexibility in constructing new focused solutions at POS, eCom and mCom. Heck, its also aligned with Apple’s QR code wallet. The perspective will feed my update on Part 2 of Directory Battle.

For investors, impact is as follows

- Loss of debit volume

- Further chaos in mobile payments

- Need for better auth on phone (Iris, bio, …)

- POS/ECR expansion to deliver info to User phone (QR Code, BT, WiFi, …)

- …

As a side note, I recommend the reading of Visa’s Debit Defense Strategy

www.digitaltransactions.net/public/frontend/files/0207net.doc

Google Wallet Goes Plastic

2 Nov 2012

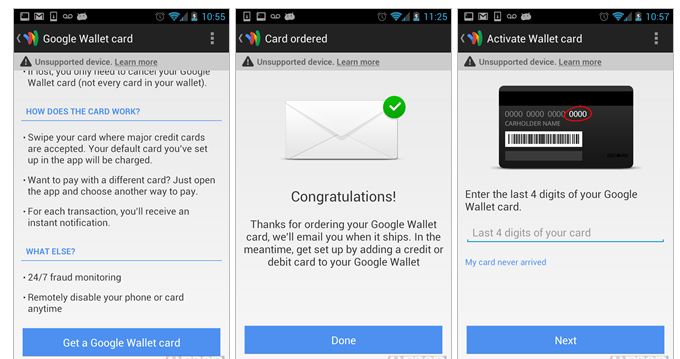

Android Police published a story on Google’s forthcoming plastic pilot yesterday.

What do we know? Very little beyond the photo above.. If the story does pan out, it could be a tremendous win for retailers, consumers and even banks. The only loosers? NFC and carrier led payment initiatives.

Solution overview:

- Everything that Wallet 2.0 does today on NFC, only now you can do it with a swipe of plastic

- In today’s NFC wallet, consumers scroll through their list of cards to choose the plastic they want. The picture from android police outlines how this will be the same for physical plastic “want to pay with a different card? Just open the app and choose another way to pay.. just as you can today only now there is no NFC dependency.

- New for consumers? well a cool looking black card.. all of your tickets, incentives, coupons in one place (in the cloud). Don’t worry about loosing your offer e-mails.. Google also has POS integration working at 10+ grocers so your coupons automatically come off on the paper reciept.. and in the cloud. No one else has payment and incentives put together like this.

- New for retailers? Integrated advertising.. look at performance of local search, adwords, offers, coupons across google properties.

Business Strategy Changes

- Expand beyond NFC phones to any Android handset (and IOS according to article)

- Allow offers to be redeemed on plastic

- Allow Google to compete for payments business with retailers and consortiums (ie MCX)

- One wallet for eCommerce, mCommerce, and a plastic card for POS. This is exactly what PayPal is doing with its own physical plastic, and American Express plans to do in SERVE 2.0.

- Expand Google wallet into IOS? That will certainly crimp Apple’s plans here. Google will establish itself as both a payment network AND and Ad network

- No more TSMs. Google will see the transaction data for every card used in the wallet. Just as Amazon, Apple, PayPal see every transaction for eCommerce.

My guess is that Google will proceed with a small scale pilot, just as it did with Wallet 1.0.

Why do retailers win? (see related blog)

Google will be in a position to drive the lowest cost payment (perhaps better than 0bps MDR) AND allow retailers to drive marketing to their consumers online and via mobile.

Why do consumers win?

With Google, use any card you want, use any phone you want … consumers get to CHOOSE. (In ISIS the only card you can load today is a Visa credit card)

Google sorry that some idiot spoiled your release plans.. but this is super stuff… I always wanted a black card.

My biggest questions?

- Will Google integrate a direct ACH connection.

- Who is the network?

Don’t Wrap Me

26 Oct 2012

Today when you use iTunes, PayPal, Amazon or Google wallet do you think about which card in the back end your purchase will go on? Most of us take the view that “it just works”, and perhaps ensure that the default card is the one which allows you to accumulate the most points (Amex for me). When eCommerce started, there were few entities capable of managing card not present (CNP) risk hence specialists evolved (PayPal, Cybersource, GSI, …) that could manage this risk on behalf of the merchant/community. Payment cards/accounts had to be wrapped by these risk specialists in order for payments to be processed. As mCommerce evolved (think Apple iTunes), digital goods purchases where integrated into the “platforms” to allow seemless purchasing of content… thus starting the process by which cards were associated with “cloud” accounts accessed in mobile phones. Today, mCommerce sales are around $170B in the US, and mCommerce sales are around $10B (Digital Goods ~$4B and physical the rest .. which includes buying from Amazon on your iPad at home). Quite frankly card companies

about which card in the back end your purchase will go on? Most of us take the view that “it just works”, and perhaps ensure that the default card is the one which allows you to accumulate the most points (Amex for me). When eCommerce started, there were few entities capable of managing card not present (CNP) risk hence specialists evolved (PayPal, Cybersource, GSI, …) that could manage this risk on behalf of the merchant/community. Payment cards/accounts had to be wrapped by these risk specialists in order for payments to be processed. As mCommerce evolved (think Apple iTunes), digital goods purchases where integrated into the “platforms” to allow seemless purchasing of content… thus starting the process by which cards were associated with “cloud” accounts accessed in mobile phones. Today, mCommerce sales are around $170B in the US, and mCommerce sales are around $10B (Digital Goods ~$4B and physical the rest .. which includes buying from Amazon on your iPad at home). Quite frankly card companies  didn’t mind letting other entities like Amazon and Apple store your card information so that you could buy in either the eCommerce or mCommerce markets…. This is all changing for physical commerce because the PRIZE IS BIGGER.

didn’t mind letting other entities like Amazon and Apple store your card information so that you could buy in either the eCommerce or mCommerce markets…. This is all changing for physical commerce because the PRIZE IS BIGGER.

With the Physical POS sales $2.4T (USA not including T&E, Auto, Oil/Gas)… The established networks and banks are saying “don’t wrap me”:

- Amex’s new Serve product 2.0 is wrapping other bank debit and credit cards

- PayPal’s new plastic is wrapping what they have already, Amex is threatening to cut both PayPal and Google down

- Visa has reportedly issued a cease and desist to Google at the behest of Chase (See NFC Times)

All of these wallets (Virtual, NFC, Cloud, …) are causing issuers to wonder “who is top of wallet”?.. and how does a customer select my plastic. They seem much more concerned about one physical plastic card wrapping them (ie Serve and Paypal) than a virtual wallet, but they are also very concerned about data and letting any ONE intermediary see transaction data (and add offers/services on top of them). In other words “DON’T WRAP ME” (see blog Paypal at POS). Of course there is not much to worry about yet. Paypal is reportedly doing less than 5 transactions per WEEK per Store at HomeDepot.. But the established players want to stop anything before it starts.

How do cloud wallets manifest themselves? Well it could be NFC/Paypass, physical plastic, a QR code, or a voice print (Square).. all you need is a form of authentication (see Battle of the Cloud). Add to this the complexity of retailer data, issuer pricing, loyalty and incentives and the market is just nuts. Who is doing what to whom…? its like a 70s drug and sex movie.