7 February 2011

(Note: I apologize for the typos here in advance.. I really do need an editor)

At the end of the year, I try to do a little research… catch up on reading and relationships… all while updating my assumptions and predispositions. We are all creatures of our environment. Past experiences influence our views on current events and future expectations.

During this annual Holiday refresh process I try to develop some big picture “themes”. The questions I’m trying to answer: where are the opportunities? Where should I place my “bets”? What fundamental challenges that must be addressed? Are “fundamentals” changing (core innovation or at periphery)? Who has built a great team? Distruptive Innovations? The 3 areas I’m currently focusing on are: payments, mobile, and convergence (digital/real world).

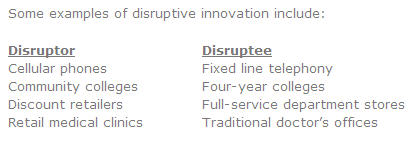

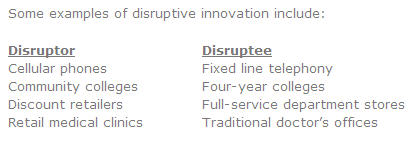

Anyone that has read this blog knows I am a big fan of Clayton Christensen (author of Innovator’s Dilemma and coiner of term “Disruptive Innovation”). From claytonchristensen.com:

An innovation that is disruptive allows a whole new population of consumers access to a product or service that was historically only accessible to consumers with a lot of money or a lot of skill

The litmus test for disruption involves delivering service in a substantially different cost structure. A key example is delivering simplified “good enough” product to a demographic that is “over served” by existing providers. From my (very limited) purview, there seems to be 2 core disruptive innovations that will influence payments at the Point of Sale (POS):

The litmus test for disruption involves delivering service in a substantially different cost structure. A key example is delivering simplified “good enough” product to a demographic that is “over served” by existing providers. From my (very limited) purview, there seems to be 2 core disruptive innovations that will influence payments at the Point of Sale (POS):

- NFC as a Payment Platform

- Mobile as an Incentive/Advertising Platform

There are numerous environmental forces that are shaping how these disruptive innovations will manifest themselves, for example:

- Bank Ownership/Control of payment networks

- Non Traditional Banks (Target, WalMart Mexico, Discover/Barclays)

- Regulations

- Specialization of Labor in Payment Services (Ops, Fraud, Risk, Platform, Support, Compliance, Banking, Acquiring, Processing, Authorization, … )

- Handset Platforms (Android, iPhone, …etc)

- Mobile Network Operator (MNO) platforms (NFC, ISIS, Advertising, Carrier Billing … )

- Retailer Analytics (ie Price Optimization)

- Advertising Analytics (ie. Adding location context)

- Consumer Behavior

- Price Transparency (Merchandise, Bank Fees, …)

- Social Networks (Groupon, Facebook, … )

- Consortiums and Partnerships

NFC as a Payment Platform

Mastercard’s PayPass was the first major contactless card program. Within the scope of the 2003 pilot program:

- PayPass Technical Standards

- PayPass Certification

- Consumer PayPass Tokens

- POS Terminals (which accept tokens)

- Issuer Participation

- Retailer/Transport Participation

Following MA, all of the other card networks have launched their own proprietary contactless products. They have numerous form factors, including: stickers, Key fobs, chips in cards, …etc. Although most are based upon the same ISO 14443 technical specification… each payment process is proprietary and technology must be certified by each card network. Contactless cards ARE NOT a disruptive innovation, although pilots have been “successful” from a consumer use perspective, there were no new markets served nor was a more efficient cost structure developed. Many contactless issues remain unresolved today, these include: merchant POS costs, retailer/network/bank relationships, card reissuance, network effects/consumer demand, mobile application integration. (See previous blog for more detail).

NFC

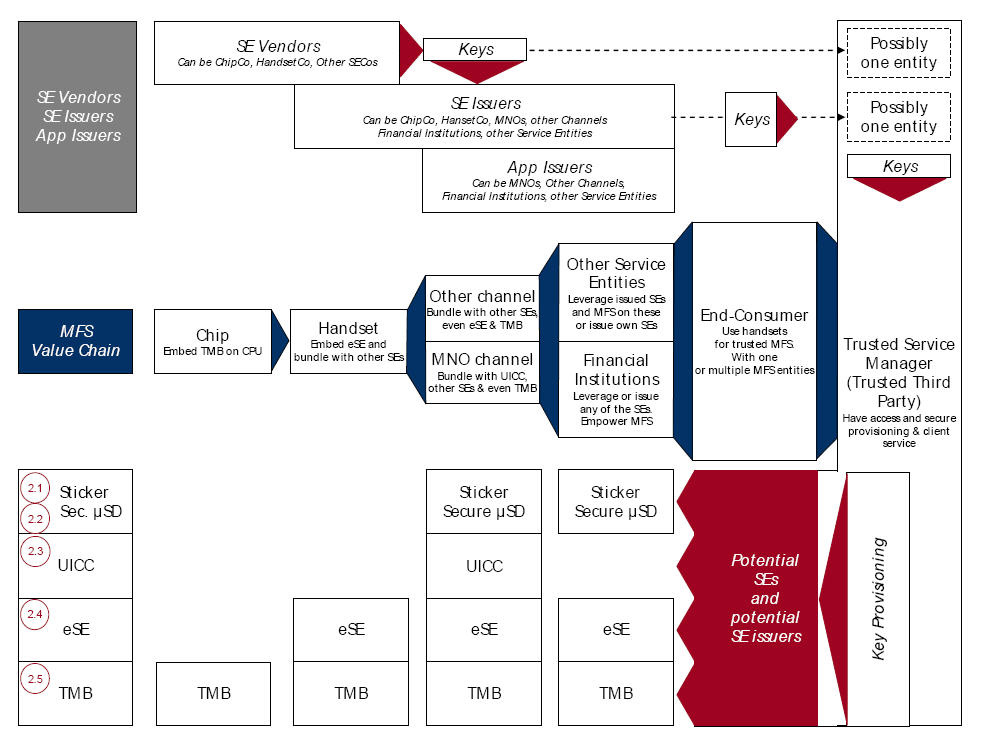

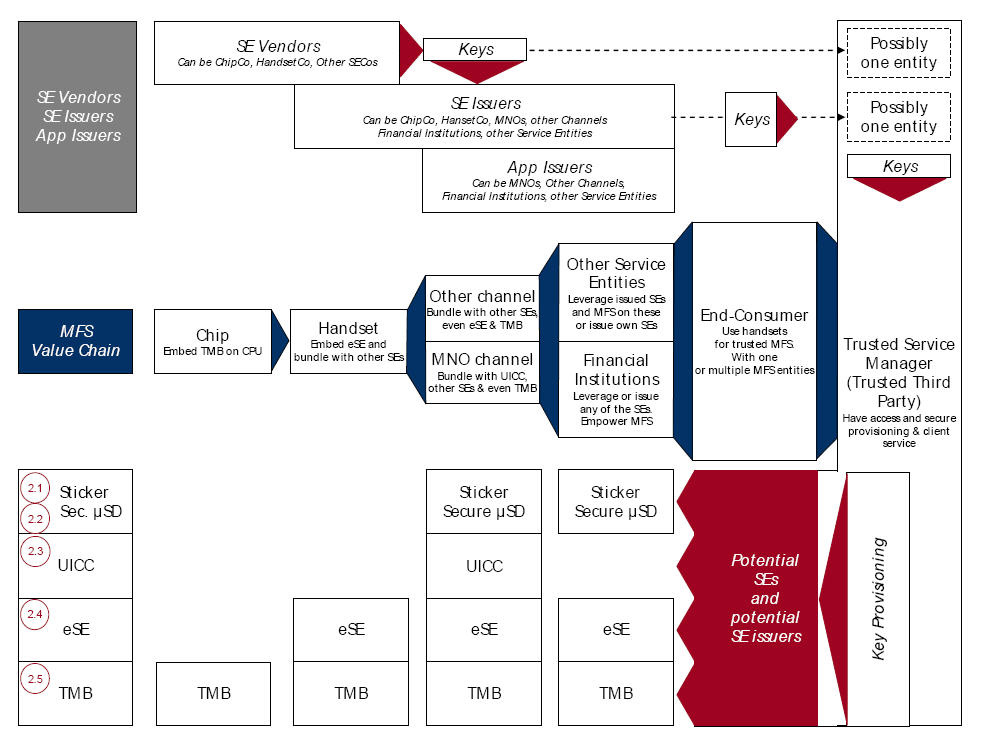

Mobile Operators and the GSMA created an industry forum to define a broad set of standards surrounding Near Field Communications (see http://www.nfc-forum.org/aboutus/). This is a new “platform” where multiple applications can leverage an ISO 14443/18092 compliant radio/controller (Ex NXP’s PN544 which is in the Nexus S). In business speak, this means that the phone can run software applications which assume the roles of the any of the multiple card “tokens” above. In the NFC world,  PayPass is just a software application which can be installed on an NFC enabled phone. The NFC architecture could also facilitate applications to act as a PayPass Reader (POS machine), Oyster Card, or on to take the place of your office badge to open secure doors (Previous Blog on NFC Ecosystem).

PayPass is just a software application which can be installed on an NFC enabled phone. The NFC architecture could also facilitate applications to act as a PayPass Reader (POS machine), Oyster Card, or on to take the place of your office badge to open secure doors (Previous Blog on NFC Ecosystem).

The 140 members of the NFC forum have done a superb job of creating a the specifications of a “platform”. Unfortunately, it takes strong business leadership to create a business model (and team) that can execute against it. Generically, key measures of platform success are “ecosystem revenue” and number of entities investing in it (see ISIS Blog). By these measures the ISIS consortium’s plans are severely challenged. Today, Apple seems better positioned to execute in a “closed” NFC model (see Apple and NFC).

NFC as Payment Platform – Disruption

NFC thus enables a new “software” nature for both existing cards and payment at the point of sale. Disruption occurs in: cost of customer acquisition, cost of delivering “new” payment services, cost of developing a payment network, cost of POS infrastructure, …etc.. As a side note, there is a separate case to be made that this same disruption exists in emerging markets separate from NFC (See MNOs rule in Emerging Markets).

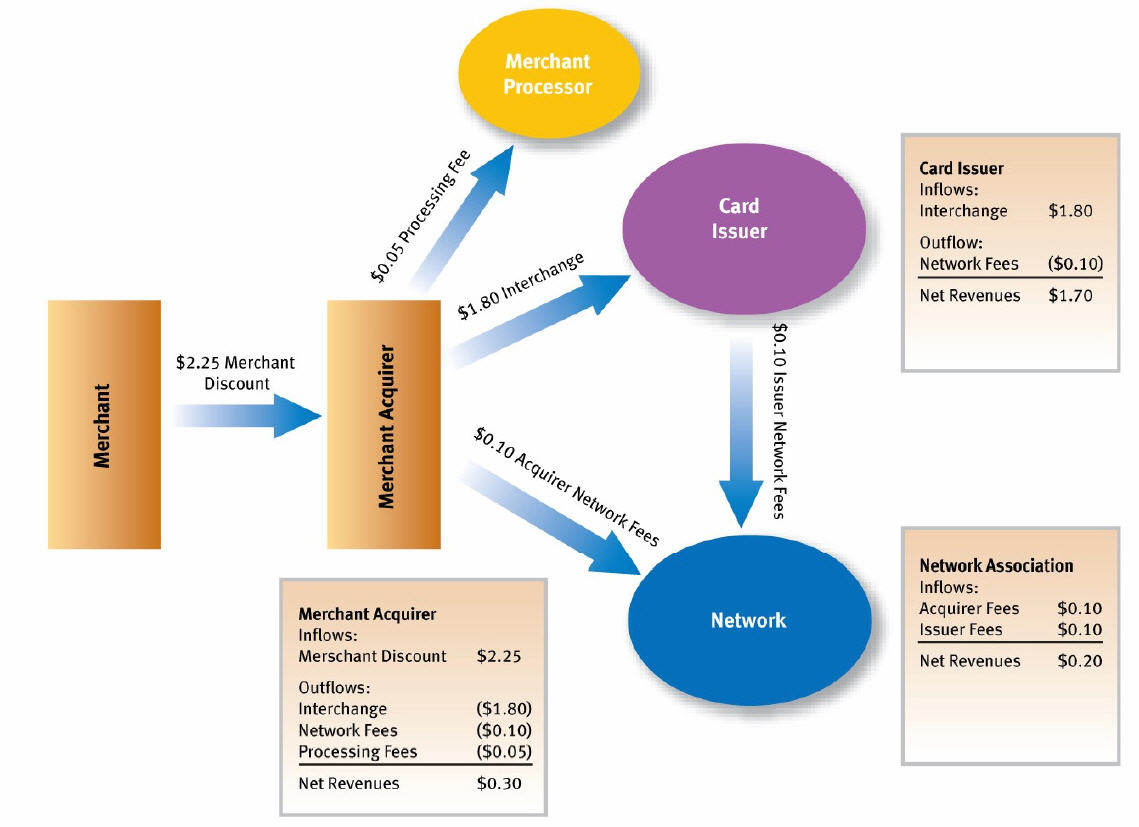

Card Costs – Industry 101

Anyone in the credit card business knows that acquiring a new customer has 3 primary cost components: marketing, application, activation/use. Marketing is straightforward enough with card cost per acquisition (CPA) driven by marketing effectiveness (direct mail, online, referral, co-brand partner, …) to a specific demographic. CPAs in card can range from $10 to $200+. Application encompasses collection of consumer data, credit scoring, pricing, acceptance of terms, approval and shipment of physical card. Activation and use is rather self explanatory.. with example costs relating to incentive programs driven on first use.. and continued use.

Future Scenario – PayPal/Bling

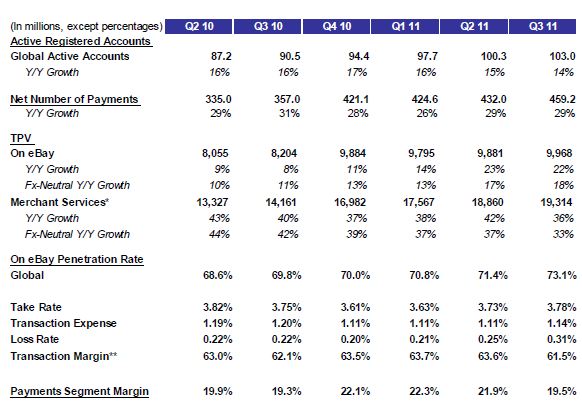

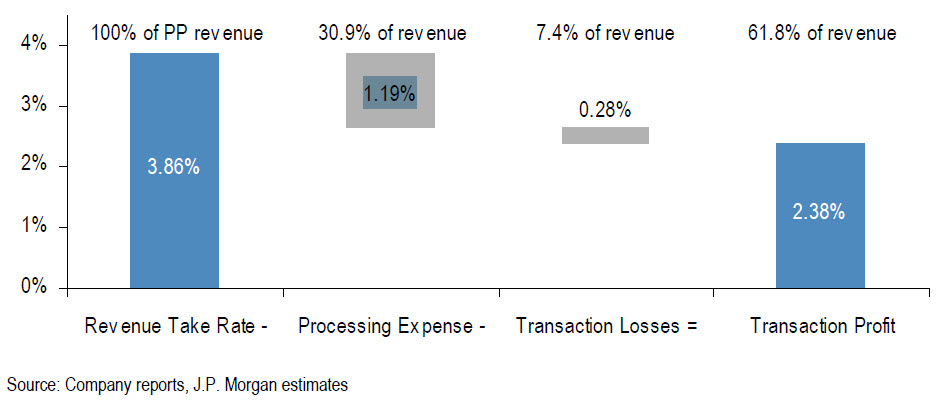

Let’s discuss a scenario involving a new payment instrument. Given that Paypal’s analyst day is Wed perhaps: PayPal and Bling at the POS. Today, Bling’s RFID based tags attach to your personal items and enable you to pay at a Bling enabled POS device (including Verifone’s new terminals). This model has a few problems, one is that tags must be mailed and activated. In a future scenario, PayPal has hired Zenius solutions to build a PayPal/Bling POS application within an NFC enabled phone. Now you just download the PayPal app to your iPhone 5 (complete with NFC). Merchant’s POS systems currently allow them to receive updates for each supported payment instrument. In this “future” case, PayPal has decided to eliminate the need for normal merchant agreements.. all that is needed for a merchant to accept a PayPal/Bling NFC payment is a paypal merchant account (with PaymenTech). What are PayPal’s costs in this model? Marketing (and paying the MNO for NFC access).

If PayPal could extend leverage their consumer footprint into the POS, with little cost, what does this mean for banks? It means that the banks could also build a new payment instrument that leverages their customer footprint. Why do you need a Visa or Mastercard brand at all if there is no cost to reissue? For consumers, what payment instrument do you choose? Is there a threat to the entire concept of a credit card? Apple, Google and Amazon scenarios may also logically follow this example. Retailers like Target could also extend use of their payment instrument outside of their stores (see Target RedCard).

Bank Strategy in this model? See Banks Will Win in Payments

MNO Billing

Carriers in the US, EMEA and Asia are expanding into mobile billing services (provided by Bango, Boku, billtomobile, payforit, …etc). In this model, carriers are taking on some additional credit risk (for post paid accounts) and expanding use of pre-paid. Given that the carriers will be controlling the NFC platform (see related blog), they could also extend this payment capability to the POS with the appropriate processor relationships (ie. First Data, FIS, PaymenTech, …etc).

Disruptive Innovation – Mobile as Advertising Platform

This blog has gone on a little too long.. so will have to make this part 2. The basis for this section is my previous Blog: Mobile Advertising Battle. Disruption is cost to influence a customer prior to purchase. Influence includes targeting that is relevant to customer’s geography, preferences, demographic, transaction context, behavior, …etc

Summary

What does all this mean? What will 2014 look like? Unfortunately I don’t have a crystal ball.. what I would really like to do is charter some smart college team to create a “virtual option market” where we could all participate in pricing/evaluating various options (as laid out in the HBR article Strategy as a Portfolio of Options).

From an investor perspective, the prospect for these disruptive innovations altering the market is real, but with many dependencies and tremendous stakes. Clayton Christensen presented IBM/Intel/Windows as key example in dynamic of disruptive innovation. IBM chose to ignore the PC market.. as the margins were poor. Today, payment incumbents clearly see the threat and are reacting to it. Additionally, incumbents hold many of the “keys” necessary to execute and are well placed to construct new competitive barriers as well as ferment chaos and confusion. Small companies embarking on investments in this space must be versed in dancing with 800 lb gorillas… so ensure you have execs that can fill out the dance card and move swiftly while wearing iron shoes.

The litmus test for disruption involves delivering service in a substantially different cost structure. A key example is delivering simplified “good enough” product to a demographic that is “over served” by existing providers. From my (very limited) purview, there seems to be 2 core

The litmus test for disruption involves delivering service in a substantially different cost structure. A key example is delivering simplified “good enough” product to a demographic that is “over served” by existing providers. From my (very limited) purview, there seems to be 2 core