Tag Archives: visa

FedNow

Very short Blog – Recapping a few tweet streams.

I think FedNow is a great effort to provide an open alternative to TCH’s RTP. I’ve spoken with, and consulted for, the KC fed on a number of occasions and provided my input to the FedNow service back in 2013. Per my blog last week the survey result from the Fed’s efforts found “emergency bill payment” as the top consumer use. Paying someone faster brings on risk. The Fed depends on banks to manage risk and price that risk. As a former banker running payments at 2 of the largest banks I have a view here.

A2A, Fed Now and Real Time – Threat to V/MA? Nope.

Sorry for typos

My good friend Dave Birch wrote a piece in Forbes today on Account to Account transfer threat to V/MA. I wanted to provide an alternate view. This will likely be a multi part blog.. today I’m starting with the consumer and the merchant (from a US perspective).

Incentives – How will Visa Amazon Play Out?

I outlined the Visa Amazon dispute in my blog 4 weeks ago. Today, Visa is confidently projecting it can bring the issue to a close. For the exec team to communicate confidence, my presumption is that they have both a primary strategy and a fall back strategy. Given that the big players influence payments so heavily, let me lay out a few scenarios on how this could wrap up.

Amazon – Affirm

Key Reading

- Affirm 3Q Earnings (last night)

- Earning Transcript

- Affirm Investor Forum (28 Sept)

- Amazon take Venmo (my blog)

- Affirm Debit+ (my blog)

- Amazon/Visa Battle (my blog)

- Amazon Co-Brand is In Play

November is turning out to be a very big week in payments! The top investor question seems to be how will V/MA be impacted? My response.. In next 2 yrs.. Less than 1-2% of US GDV however Affirm is turning out to be the leading company to watch in creating a V/MA alternative.

Affirm Debit+ is Revolutionary

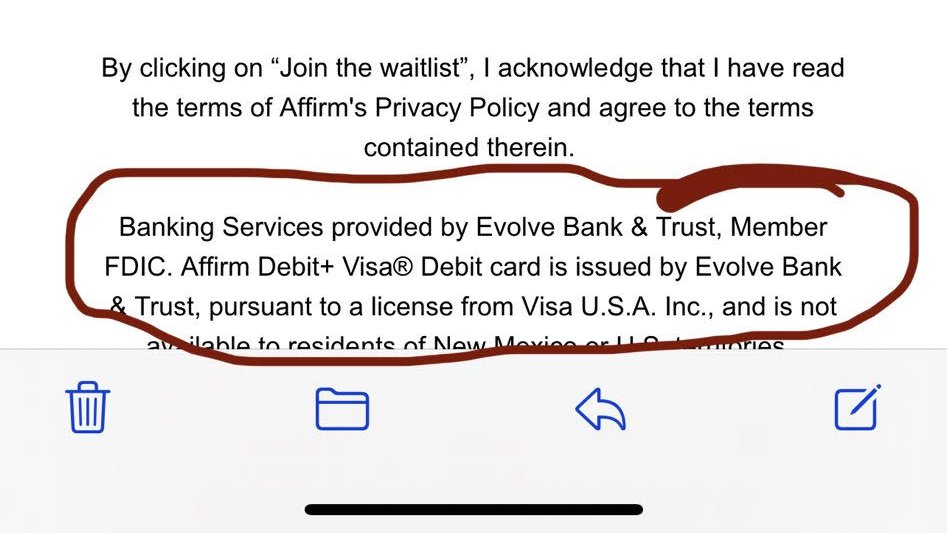

Update 8 November – Original post is below the image.. I had doubted Visa’s support here. But clearly this is a real product.

Affirm Debit+ is a decoupled debit on the Visa network with Evolve Bank as ODFI/Issuer. I doubt if Visa fully vetted this product.. it MUST have “slipped through”. For more info see Affirm’s investor day presentation.

Per my blog last week, my hypothesis is that the new Affirm Debit+ will be revolutionary.. which is why it is currently causing a massive firestorm amongst Banks. Today I want to drill into what I believe the value proposition will be (my hypothesis) and why Visa had to support this.

Today Affirm is “limited” in growth to the merchants it can directly integrate to. How can they solve this problem? Create a consumer “pay anyone” product that lets the consumer pick and choose what items they want to finance after they purchase them. Connect any of your bank accounts or all of them.. Finance anything you buy on improved terms. Affirm will also work with Stripe and others to create an improved checkout process, which will improve both conversion AND consumers ability to purchase (ie underwriting). The first mover advantage will be tremendous and step on much of the Neo Banks (already slim value prop).

New Decoupled Debit – Affirm/Plaid/Marqeta

Riding on my blog Plaid and Decoupled Debit.. It looks like Plaid and Marqeta just created a new product with Affirm as the first customer.

Affirm Debit Card – https://www.affirm.com/debit

Visa vs Amazon – When Merchants Get Leverage

Updated 17 Nov

At Money2020 this week and I have to say I’m having a blast. Seeing friends face to face and getting back to “normal” was well worth taking my first plane flight in 20 months.

Visa Announces earnings today at 5pm, the big question institutional investors are asking me is about the Amazon – Visa discussions. It is a big game of chicken right now, with earnings ramifications. To understand whats going on here, let me attempt to give some abbreviated history.

Apple Pay Fees (Short Blog)

Thought I would give more detail on whats going on with V/MA, Issuers and Apple (from WSJ article yesterday Apple Pay Fees Vex Issuers). Perhaps I’ll collect a fee from the WSJ.. odd that I mention Apple Pay fees on Monday to have it come up in the WSJ on Tuesday. Oh well..

Case for CBDC – Market Efficiency

Sorry for typos here.

As most of you know I love to read the arcane (ex favorite book is Weak Links – related blog) and I love economists. Today I’m reading some of Thomas Phillippon’s research (NYU’s economist and author of The Great Reversal: How America Gave Up on Free Markets). Many of you will recall I covered Dr. Phillppon’s work in my 2015 blog Changing Economics of Payments. My summary of Phillippon’s work: