I outlined the Visa Amazon dispute in my blog 4 weeks ago. Today, Visa is confidently projecting it can bring the issue to a close. For the exec team to communicate confidence, my presumption is that they have both a primary strategy and a fall back strategy. Given that the big players influence payments so heavily, let me lay out a few scenarios on how this could wrap up.

Category Archives: payments

Affirm Debit+ is Revolutionary

Update 8 November – Original post is below the image.. I had doubted Visa’s support here. But clearly this is a real product.

Affirm Debit+ is a decoupled debit on the Visa network with Evolve Bank as ODFI/Issuer. I doubt if Visa fully vetted this product.. it MUST have “slipped through”. For more info see Affirm’s investor day presentation.

Per my blog last week, my hypothesis is that the new Affirm Debit+ will be revolutionary.. which is why it is currently causing a massive firestorm amongst Banks. Today I want to drill into what I believe the value proposition will be (my hypothesis) and why Visa had to support this.

Today Affirm is “limited” in growth to the merchants it can directly integrate to. How can they solve this problem? Create a consumer “pay anyone” product that lets the consumer pick and choose what items they want to finance after they purchase them. Connect any of your bank accounts or all of them.. Finance anything you buy on improved terms. Affirm will also work with Stripe and others to create an improved checkout process, which will improve both conversion AND consumers ability to purchase (ie underwriting). The first mover advantage will be tremendous and step on much of the Neo Banks (already slim value prop).

Apple Pay Fees (Short Blog)

Thought I would give more detail on whats going on with V/MA, Issuers and Apple (from WSJ article yesterday Apple Pay Fees Vex Issuers). Perhaps I’ll collect a fee from the WSJ.. odd that I mention Apple Pay fees on Monday to have it come up in the WSJ on Tuesday. Oh well..

PayPal – ?Super App?

PayPal has been my #1 holding for last 5 yrs, and it has been on a fantastic ride… especially so over the last 18 months! (see MVP – Continued Domination for more).

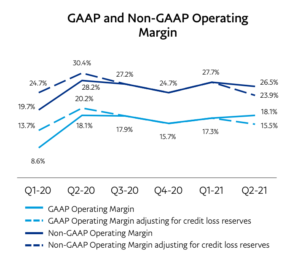

Paypal announced 2Q21 earnings 2 weeks ago (7.28). TPV growth was 40% with eBay, 48% without out, while sales grew at a 32% clip without  eBay versus 19% with. Earnings? Not so much as margin erosion has hit the business. One core driver of margin has investors particularly concerned: “Take rate” (net merchant revenue less cost to clear payments) fell from 2.21% in the fourth quarter of 2020 to 2.11% in the first quarter and 2.01% in the second quarter.

eBay versus 19% with. Earnings? Not so much as margin erosion has hit the business. One core driver of margin has investors particularly concerned: “Take rate” (net merchant revenue less cost to clear payments) fell from 2.21% in the fourth quarter of 2020 to 2.11% in the first quarter and 2.01% in the second quarter.

Case for CBDC – Market Efficiency

Sorry for typos here.

As most of you know I love to read the arcane (ex favorite book is Weak Links – related blog) and I love economists. Today I’m reading some of Thomas Phillippon’s research (NYU’s economist and author of The Great Reversal: How America Gave Up on Free Markets). Many of you will recall I covered Dr. Phillppon’s work in my 2015 blog Changing Economics of Payments. My summary of Phillippon’s work:

ApplePay Accept (Mobeewave) in October

Note comment June 2022 – This blog did not anticipate the creation of Visa Acceptance Cloud which completely eliminated the device certification requirements.

My track record on Apple is pretty good.. having broken the Apple Pay news in 2014 and Last August I announced the Apple/Mobeewave acquisition. Apple is great at keeping secrets… perhaps the best tech company in the world in this regard. My latest forecast? Apple will enable payment acceptance in the US this October with Elavon as a payment processing partner.

Growth Vector #1 – Embedding Payments

Pardon Typos.. still in proof mode

Previous Blogs on Topic

- Payments in the OS – Browser Tokens – May 2016

- Payment in the OS – mCom/eCom Converge – Dec 2014

- Apple Pay in Browser – Mar 2016

- eCom Thoughts – Sept 2015

TCH – Real Time Payments

NOTE – Aug 2022 – this blog is a tad wrong about the Zelle settlement process. Zelle uses its own organic settlement system from the Pariter acquisition and provides TCH with a net settlement file some of which may be processed on RTP.

——————

Its been 18 mo since my last TCH update. As a quick refresh, the reason everyone cares about the TCH project, is that TCH is the ONLY place that the top 6 bank CEOs get together to collaborate on payments. TCH operates CHIPS (the largest private ACH network in the world), settling around $1.5T of payments PER DAY (think stock market, B2B, V, MA… everything). Within the ACH scheme every member bank has a settlement account and a nightly Net Settlement process is run.

Payments 2020 – MVP Continued Domination?

I’m back to blogging after a 5 year hiatus… The CEO thing is rather all consuming. Glad to have an exit so I can get back to my fellow payment geeks.

What to blog about first? Given we are in new decade I thought about writing some grand predictions. But rather than look forward, we must spend a little time in the past, as the past 10 years have been JUST AMAZING in payments. I’m calling this blog series “payment growth vectors” where I hope to recap what has transpired in payments (history) to provide a trajectory for evaluation of the future course.