4 Aug

- http://www.businessinsider.com/levelup-reward-payments-2012-8

- https://www.thelevelup.com/how-it-works

- http://venturebeat.com/2012/08/02/levelup-t-ventures-funding/

Levelup just completed a $21M round and announced last month that payments would be “free” for merchants.

Take a look at this youtube video to review high level customer experience.

[youtube=http://www.youtube.com/watch?v=AltHtxsaLJQ]

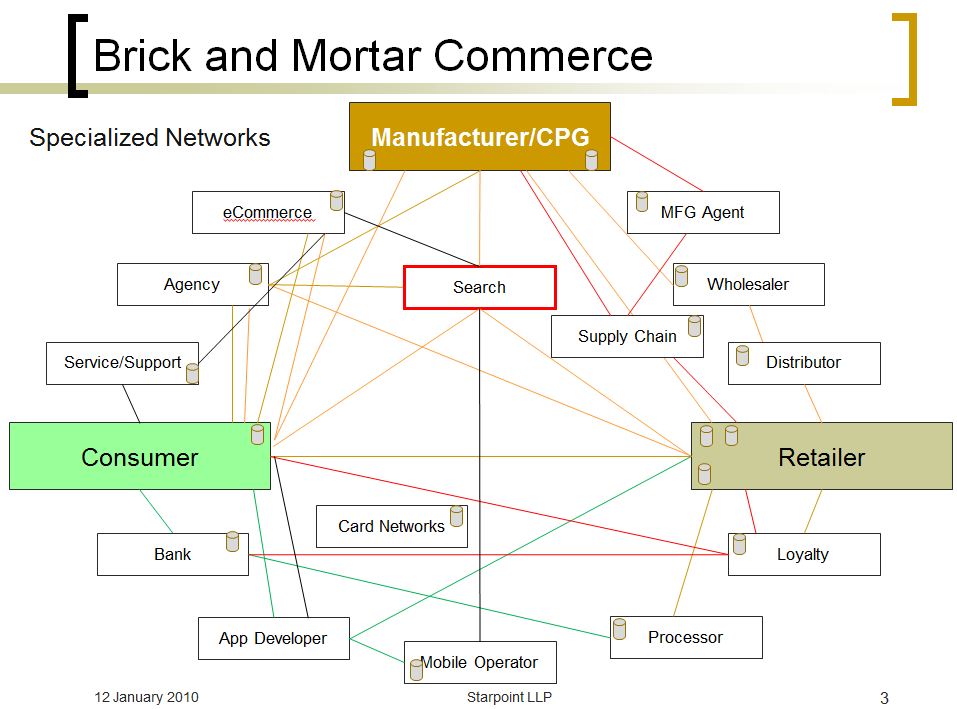

In order for Level up to successfully complete a transaction:

- Merchant must set up account

- Teach servers how to “read a barcode”

- Consumers create an account

- Consumers set up payment instrument

- Data connectivity in the store for consumer to generate barcode

- Data connectivity in the store for merchant to read barcode (less of an issue as servers may be on internal private wi-fi).

- Restaurant reconciles payments from levelup with cash register, payments from card processor, groupon, living social, …

- Restaurant determines “value” of loyalty program vs other marketing forms.

My first question on seeing this is “why”!? why would restaurants want to do this? Why would consumers want an account? Why would Google Ventures and TMobile put money in this? (see rough start for mobile payments, Digital wallet strategies). What is the value proposition?

First, let me admit 2 very big biases I have (associated with this model).. they were formed by some very hard lessons learned

1) Building both sides of a network is very hard to do

2) Commercial buildings are a black hole for connectivity. My estimate is that 3G service is avail in less than 40% of all commercial buildings.

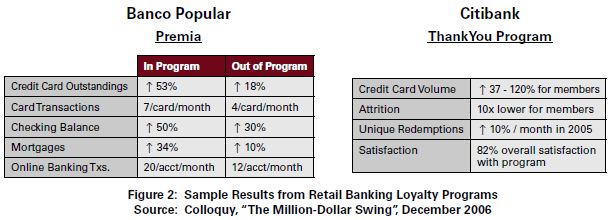

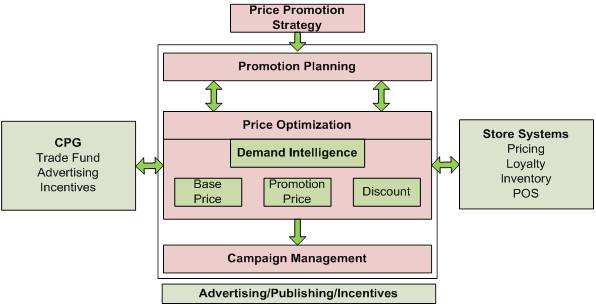

The primary value proposition is a loyalty, allowing a Starbucks like checkout experience and loyalty program. As I stated in this blog, loyalty is a $48B business.. so can theLevelUp act as an effective loyalty program manager? What is their market?

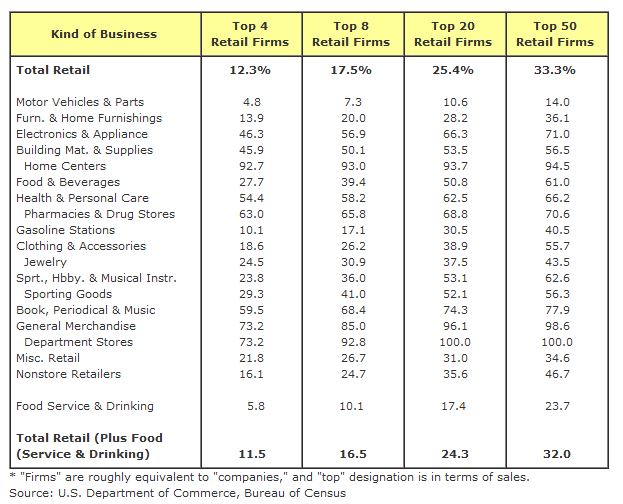

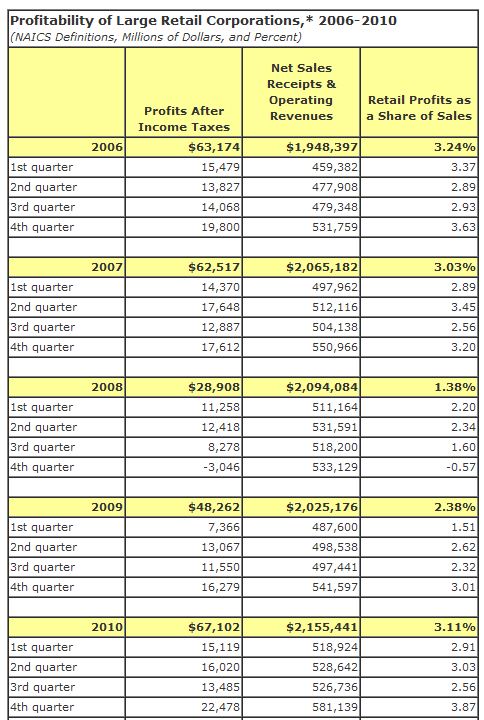

Total Sales in US restaurants was $632B in 2011, of that $216B is for full service restaurants with the majority of restaurants (472,000 out of 474,000) operating with under 500 employees (independents and small chains). In the restaurant vertical, small businesses dominate.. compared to mainline retail (where the top 20 retailers capture about 60% of sales …ex gas, auto, restaurants).

LevelUp is currently focused on small restaurants. Top 20 retailers have already established very successful loyalty programs (CVS is #1 with over 60M members). Big chains are far less willing to let another company deliver value outside of their brand.

Loyalty program costs vary greatly, however program fees are typically below 5% of sales for participating customers. Given a 5% participation rate and a 20% usage rate the total addressable market for loyalty program management (for small restaurants in the US) is $100M… a pretty small number

Can small chains benefit from a centralized loyalty program? Who is best positioned to execute on this? Loyalty programs are an important part of any acquisition plan: how do you keep customers coming back? Is it the product? They price? Experience? Every company has a strategy, and every customer is different.

Selling to 400,000 small businesses takes time. This would also seem to be something that either open table, paypal, Square, Google could do easily.

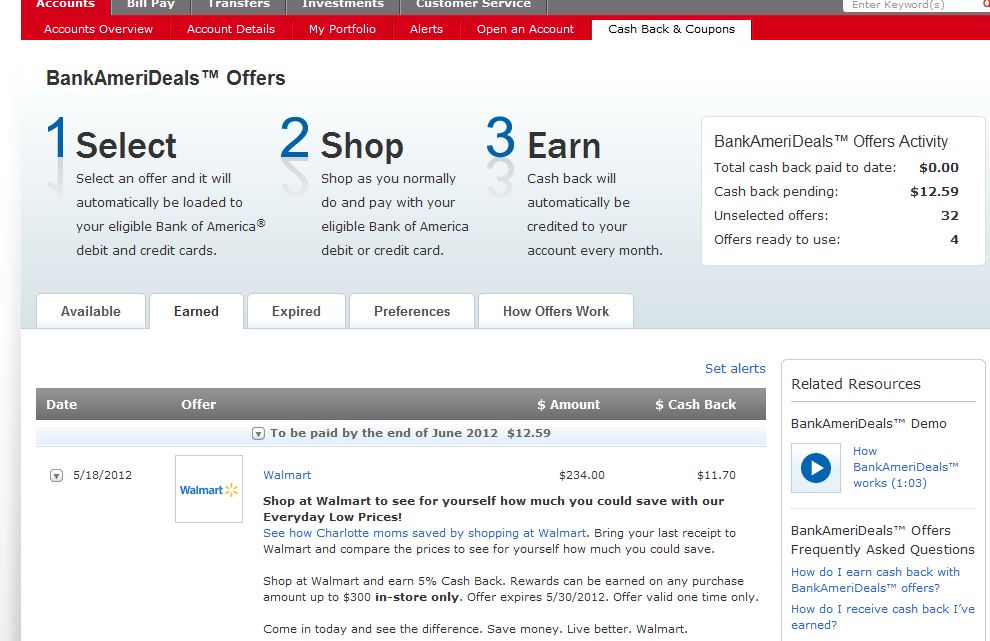

Free Payments may help LU find traction with small restaurants, but from what I hear restaurants have already been struggling to reconcile Groupon offers, LivingSocial Offers with their books.. taking payment through an alternate network (ie different processor) is likely to further challenge the book keeping of these small establishments.

Strong recommendation to restaurants:

1) See what kind of cell data coverage you have in your store before you roll this out. (Update. From notes below it seems that LevelUp does not generate a unique code at each use. Static QR code improves usability inside the restaurant, at the expense of fraud. LevelUp will be acting as a TPPA, so retailers will not bear fraud costs… My guess is that LU has the ability to generate unique QR codes, but has chosen not to roll them out while they build scale. Its a race to build scale before fraud develops, and they are required to generate unique QR codes. In this “future” scenario there will be a connectivity requirement. )

2) Get customer information yourself and use it…

3) Try the #1 restaurant marketing solution in the market: FishBowl.. unbelievable results.

Thought appreciated.

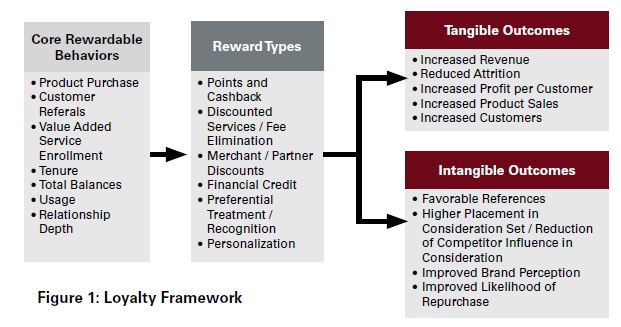

economy in 2 billion U.S. household loyalty program memberships. Edgar Dunn provide a great graphical view on the purpose of loyalty programs

economy in 2 billion U.S. household loyalty program memberships. Edgar Dunn provide a great graphical view on the purpose of loyalty programs