Visa,wallet,CYBS,PlaySpan

18 July (Updated from 17 June 2011

). Corrected significant error on scope of Visa Wallet. It is much more than an autofill (point 4 below)

Previous Blog: Visa’s mobile portfolio

I’ve been thinking about Visa’s wallet strategy this week. From my last blog (Visa Digital Wallet)

… a non-announcement, a rebranding of what CYBS and PlaySpan already have. Too many teams are angling to create the wallet (mobile, online, …), and not enough focusing on the value of what is in it. Google, Apple, and RIM will win the mobile wallet wars. I guess I can’t blame Visa for trying.. however it would have been nice if they could have been successful at eCommerce to start with.

Here are the questions I’m trying to answer:

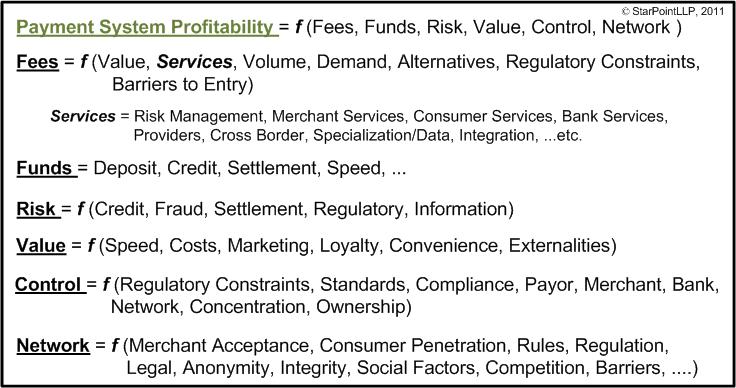

- What is their investment thesis?

- What assets are they trying to leverage and what opportunity do they plan to attack?

- What is their strategy in attacking the opportunity?

- How will the banks react/support this strategy?

For those that haven’t read my blogs for 2 years.. let me restate a few points that I’ve made previously:

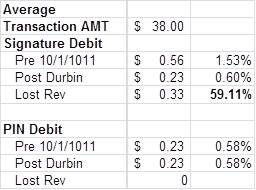

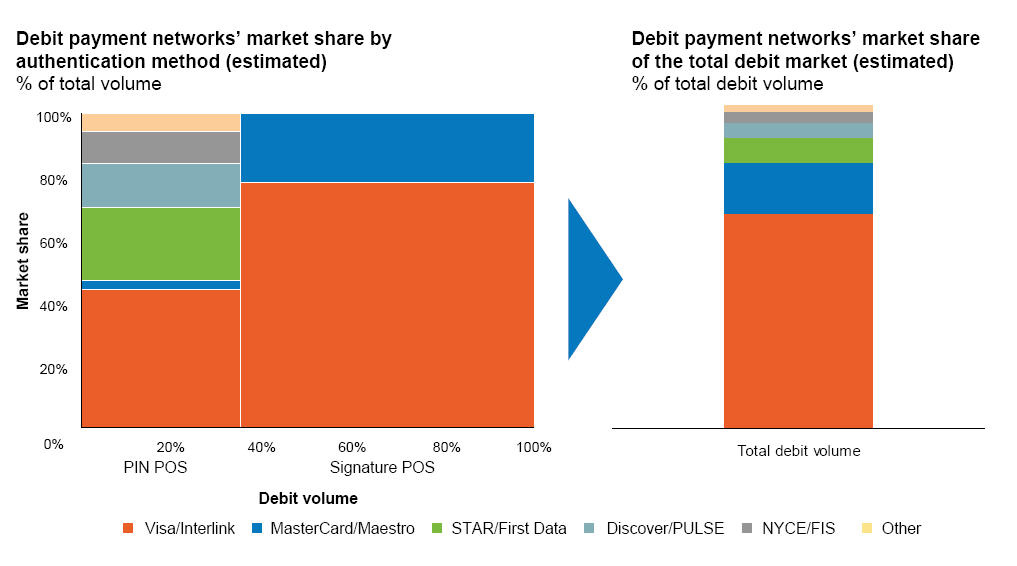

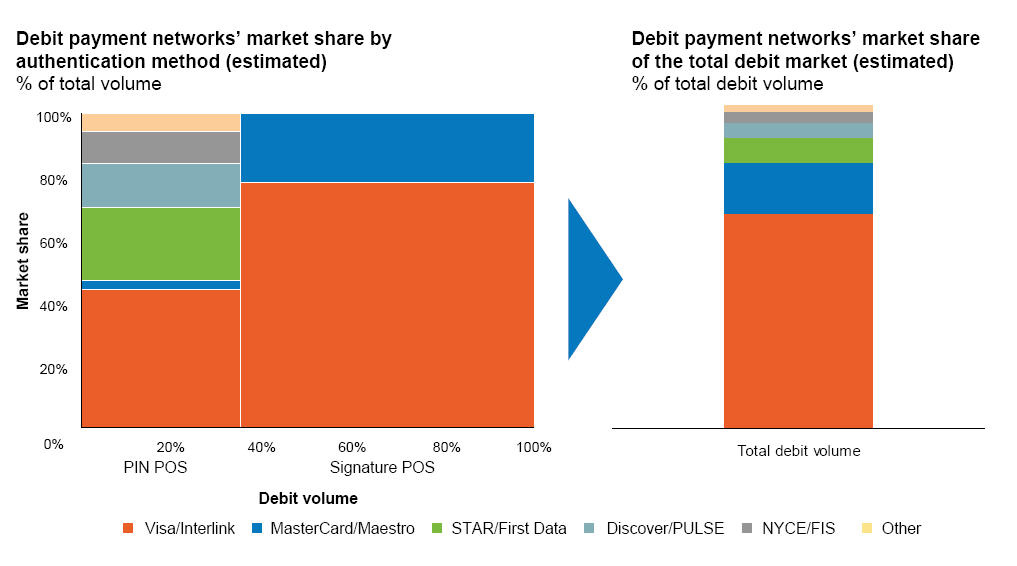

- Visa has a very big hole in their earnings with Durbin.. not only will they loose substantial debit revenue.. they could be loosing debit forever… as member banks assess whether signature debit makes sense to continue… and create a centralized bank switch for PIN debit (ala SVPCo or TCH). Merchants and consumers both prefer PIN today. I don’t believe Visa has adequately described this debit driven financial risk to the investment community.

- Visa is attempting to fill the debit void with new transaction types, services and “cash replacement”. The top 2 prospects are G2P payments (payments by a government to people.. from pensions to welfare) and “mobile payments”.

- There are 5 classes of mobile payments: 1) mobile initiated bank payments (ex. Monitise, , Cashedge, send your bank a message to transfer funds as in bill pay). 2) mobile commerce payments – digital (ex iTunes, PayPal, BilltoMobile, Boku, Bango, …), 3) mobile commerce payments – physical goods (ex Square, Amazon, Visa Wallet, PayPal, Bango, ..) 4) Mobile phone as a wallet – Physical device at point of sale (ex, NFC Google Wallet, 5) Mobile Money for Unbanked (MMU) (ex MPesa, GCash).

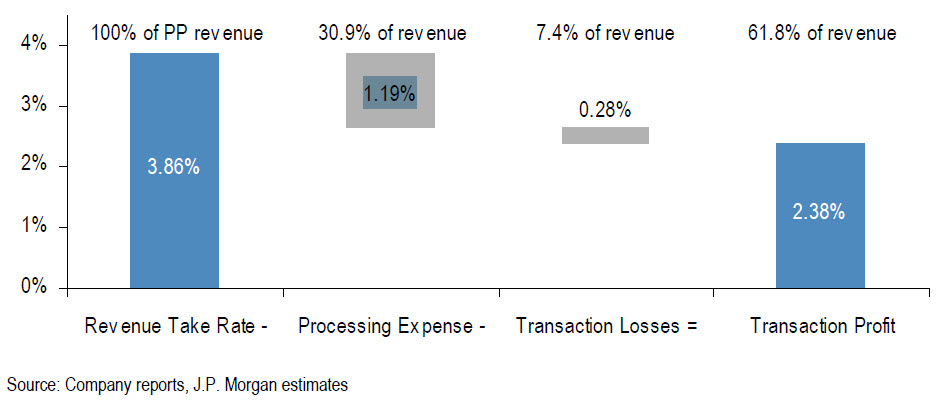

- Any initiative above is profitable for Visa only if: it replaces cash/other electronic (ex G2P), drives a transaction into higher margin product (Debit to Credit), increases number of transactions (customer use), or increases use of processing services (ex CYBS). Monitise obviously did none of these.

- The big issuers are not fans of Visa’s moves in mobile and innovation. Visa is beginning to walk on toes and create “universal services”, many of which overlap with the large issuers have competing plans (alerts, offers, mobile, P2P).

- Visa’s wallet value proposition (and solution) go something like this: Here is an API for your online banking.. consumer clicks on Visa Wallet and their card(s) get automatically stored in our digital wallet for use at any merchant site.. and a new Visa wallet account is created. Bank, you benefit by increased card transaction fees (use) and enable your customers to pay for digital goods with their Visa card in a one click service that delivers better consumer experience. Issues are that Visa has not signed up any of the top issuers and are also very dependent on PlaySpan’s existing consumer base. Most merchants don’t like the idea of helping out banks.. or Visa.. In order to change consumer behavior, and drive usage, a value proposition is needed. Are consumers doing digital goods payments today? Yes.. what does Visa do for merchants that BTM, Zynga, PayPal.. and others don’t? Options: 1) Use our CYBS processing, 2) use API only and “form fill” to leverage your existing processor, 3) Liability shift and reduced interchange for attempted VBV use. This last one has not be covered significantly .. may delve into with future blog.

- Visa is attempting to evolve its debit network from “debit” to bi-directional (see my VMT blog) with the OCT transaction set. This would enable it to compete with ACH and deliver services like P2P with little bank involvement.

What is Visa’s investment Thesis?

My guess is this “ replace the debit hole by leveraging our existing customer footprint into new transaction types, expand card acceptance and create customer stickiness with new products and services that work in every channel”

Assets to Leverage?

- Consumer account holders. I don’t call them Visa customers because they are not.. they are customers of the issuing bank. If a bank wants to rebrand their portfolio (to Mastercard, Amex, or a new white label) they are no longer Visa card holders.. Visa holds no consumer agreements. … BUT they want to..

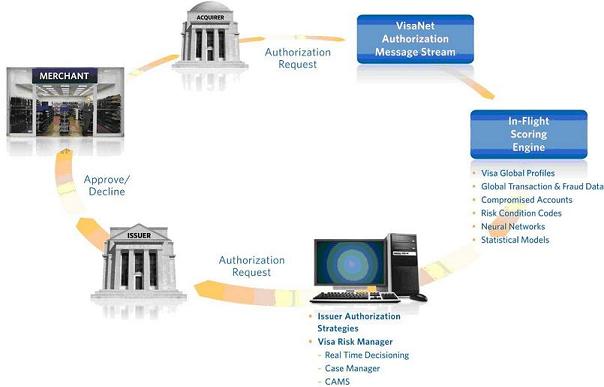

- Payment Network: Acceptance and services (Bank, merchant, consumer).

- VBV Agreement where liability shift and interchange reduction possible (for ecomm/mcom CNP transactions)

A rather short list. Note that prior to CYBS, Visa held very few merchant agreements… it was the acquiring bank and processor that held the merchant agreement.

Strategy to attack the G2P and Mobile Opportunities?

Visa probably sees the lack of NFC handsets and POS terminals as a deciding factor in delaying any push here. The $600M-$800M in NFC GDV is too small to impact more than 5% of the Durbin hole. I believe they have initiatives lined up against the following business drivers

1. Increase number of transactions (customer use)

- Increase merchant acceptance locations: Square, CYBS, Visa Wallet

- Increase Consumer Use: Visa Wallet, Visa Money Transfer, Marketing,

2. Replaces cash/other electronic (ex G2P)

- Fundamo, Playspan, Visa Wallet, ..

3. Drive transactions into higher margin products (Debit to Credit),

- ?NFC? It would seem this is a “stage 2” plan.. They first need to get consumer’s using the wallet in high volume/frequent transactions. After they get usage.. they can migrate.. It may even line up with another partner like Apple who isn’t quite ready for NFC anything. Visa actually doesn’t seem to like the idea of a card in the phone wallet.. a wallet they don’t control.. they want the card in a VISA Wallet.. a Visa Cloud wallet that they do control..

4. Increase use of processing services… I not going to touch on this now..

Visa’s wallet strategy is a two pronged approach. Consumers will have accounts “auto created” by their issuing bank (at least the ones that implement the wallet API) and

( Old Content 17 June) all by implementing a simple form fill API where Visa’s wallet pre-populates all of the consumer information and payment items on a merchant’s checkout page.

New Content (18 July)

Visa is looking to build a consumer footprint to compliment its CYBS online merchant footprint. To be clear, Visa is looking to grow its eCommerce processing business AND create additional lock in (stickiness) with Visa Issuing banks. Visa will first ATTEMPT to roll out this service first with all CYBS merchants… then get additional merchants to either convert to CYBS or at least Add Wallet as an additional payment type. Chase PaymentTech is expected to take a lead roll.

Value proposition to Merchant

– Merchants will be given a fairly attractive option to reduce CNP interchange with 2 Components: Attempted VBV verification (Visa can reduce merchants rates for attempted 3DS verification) and #2 reduced interchange in volume discounts with key partner banks like Chase.

– Processing Package (cost). Expect Visa/CYBS to aggressively price for non-CYBS merchants

– Single Wallet for online, mobile and perhaps even physical goods

Value Proposition for Banks

– Lock in to Visa (I can’t really think of another one)

This is not a bad strategy… IF the world were standing still.. and if Visa had a positive reputation with merchants. The value proposition here is all built around convenience. It is a good plan.. but merchants have many other options and they know that accepting a new Visa product has always proved to be a Faustian Bargain (aka deal with the Devil).

As a side note, I saw Square’s COO today in a conference. His quote was something like “Square is much more than about swipe.. I wouldn’t have invested if that were the case”. None of us know what this grand plan is.. but obviously it must involve merchants.. and I would hope a better profit margin (from 20-30bps). After he spoke a CEO came up to me and said “the major processors love square (and Chase PaymentTech). Now there is a place for all of the sub prime merchants to migrate toward… Can Square monetize a base of merchants that were outside of the ISO focus and processor interest? They are not doing it today.. How could they possible morph their value proposition into something with higher margin? Keith certainly seemed to imply that Square had a merchant incentive/Groupon/foursquare model in mind. A deal of the day only redeemable at a square merchant? Hmm.. seems like a little bit of a stretch.

See related Visa Press Release here (RightCliq)