Short Blog

I’ve had quite a few inbound calls on Durbin and Debit in eCom so I thought it was time for a short blog. Note this is my 90% confidence view talking to 3 of the top retailers and 2 of the top processors.

Short Blog

I’ve had quite a few inbound calls on Durbin and Debit in eCom so I thought it was time for a short blog. Note this is my 90% confidence view talking to 3 of the top retailers and 2 of the top processors.

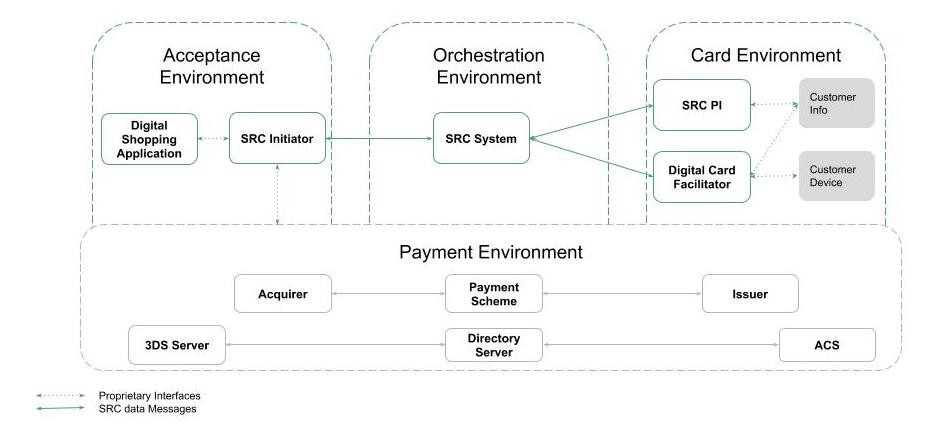

UPDATE – Nov 29 2022 – Note that I have conflated the relationship between SRC and 3DS 2.0. 3DS 2.0 is the authentication protocol used by SRC. 3DS 2.0 has been widely adopted as a mandatory replacement to 3DS 1.0. Part of the driver for adoption was the EU SCA mandate. SRC has NOT been widely adopted as it is a fairly broken consumer experience at the moment.

I’m at M2020 today and it has been a “back to normal” fantastic event. Let me put my “merchant hat” on for a story from their perspective.

Short blog – 80% confidence

© Starpoint LLP, 2022. No part of this site, blog.starpointllp.com, may be reproduced in whole or in part in any manner without the permission of the copyright owner.

Phase 1 of TCH’s token efforts will be in SRC model. A bank branded “wallet” acting in the DCF role for TCH PIs . Just as VAC has enabled the elimination of physical hardware for acceptance, issuers see a plastic-less future for cards. They want to own the issuance of cards and want much more than a token, they want the entire “wallet”.

Go to market is either as:

© Starpoint LLP, 2022. No part of this site, blog.starpointllp.com, may be reproduced in whole or in part in any manner without the permission of the copyright owner.

Friday I was a tad “let down” in the Sionic/TCH/MX release of Pay-by-Bank. Per my blog on Google/TCH launch and Google P2P I was anticipating something much bigger. To be clear I firmly believe that TCH is working on an “ApplePay Competitor”, which will entail TCH tokens inside of Google’s phone, but this will be 3-6 months out. Per the blogs above, I see neither pay-by-bank nor TCH Tokens in Google Pay as a threat to V/MA.

Today I thought I would drill down into “pay by bank”, the dynamics of why it works in some markets, and why I see little threat to V/MA in replacing core cards in eCom or at POS.

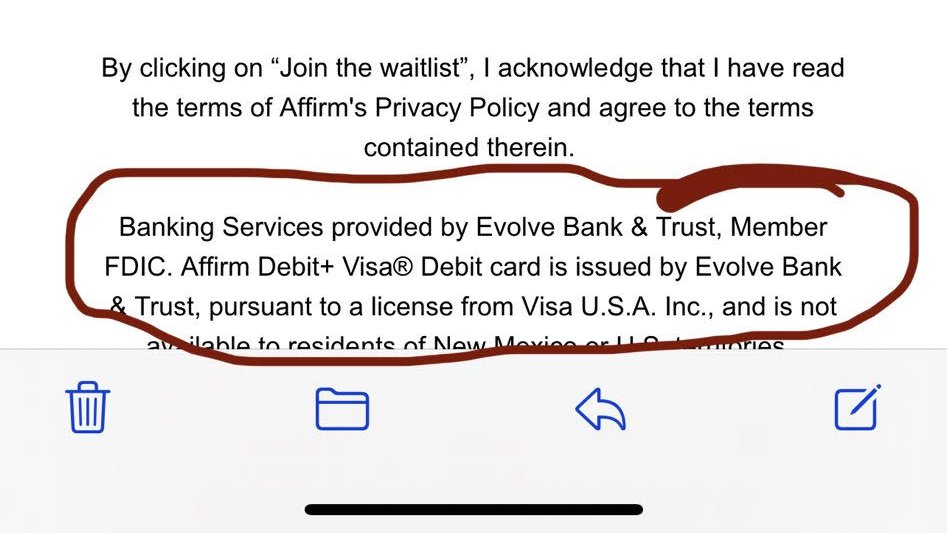

Update 8 November – Original post is below the image.. I had doubted Visa’s support here. But clearly this is a real product.

Affirm Debit+ is a decoupled debit on the Visa network with Evolve Bank as ODFI/Issuer. I doubt if Visa fully vetted this product.. it MUST have “slipped through”. For more info see Affirm’s investor day presentation.

Per my blog last week, my hypothesis is that the new Affirm Debit+ will be revolutionary.. which is why it is currently causing a massive firestorm amongst Banks. Today I want to drill into what I believe the value proposition will be (my hypothesis) and why Visa had to support this.

Today Affirm is “limited” in growth to the merchants it can directly integrate to. How can they solve this problem? Create a consumer “pay anyone” product that lets the consumer pick and choose what items they want to finance after they purchase them. Connect any of your bank accounts or all of them.. Finance anything you buy on improved terms. Affirm will also work with Stripe and others to create an improved checkout process, which will improve both conversion AND consumers ability to purchase (ie underwriting). The first mover advantage will be tremendous and step on much of the Neo Banks (already slim value prop).

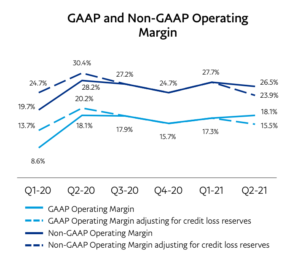

PayPal has been my #1 holding for last 5 yrs, and it has been on a fantastic ride… especially so over the last 18 months! (see MVP – Continued Domination for more).

Paypal announced 2Q21 earnings 2 weeks ago (7.28). TPV growth was 40% with eBay, 48% without out, while sales grew at a 32% clip without  eBay versus 19% with. Earnings? Not so much as margin erosion has hit the business. One core driver of margin has investors particularly concerned: “Take rate” (net merchant revenue less cost to clear payments) fell from 2.21% in the fourth quarter of 2020 to 2.11% in the first quarter and 2.01% in the second quarter.

eBay versus 19% with. Earnings? Not so much as margin erosion has hit the business. One core driver of margin has investors particularly concerned: “Take rate” (net merchant revenue less cost to clear payments) fell from 2.21% in the fourth quarter of 2020 to 2.11% in the first quarter and 2.01% in the second quarter.

Two HUGE payment events this week

Amazon 2%

Per Bloomberg, consumers that don’t want to go for the 5% back Amazon store card (SYF) can now link their DDA and earn 2% back. This may be the biggest payment innovation of the year!

Notifications