Tag Archives: MA

Payments Winners/Losers?

Wells gets A+: New Amex Partnership

CEO View – Battle of the Cloud Part 5

Controlling Wallets – Battle of the Cloud Part 3

Least Cost Routing – Part 1

Business Implications of Payment Tokens

Battle of the Cloud – Part 2

Previous Blog – Part 1 – May 11, 2012

Let’s update the Cloud Battle story and discuss events since my last post on the subject

Square, Visa, Google, PayPal, Apple, Banks, … have recognized the absurdity of storing your payment instruments in multiple locations. All of us understand the online implications, Amazon’s One Click makes everything so easy for us when you don’t have to enter your payment and ship to information. (V.me is centered around this online experience). Paypal does the same thing on eBay, Apple on iTunes, Rakutan , …etc. But what few understand is the implication for the physical payment world. This is what I was attempting to highlight with PayPal’s new plastic rolled out last week (see PayPal blog, and Target RedCard). If all of your payment information is stored in the cloud, then all that is needed at the POS is authentication of identity (see blog).

The implications for cloud based payment at the POS are significant because the entity which leads THE DIRECTORY will have a significant consumer advantage, and will therefore also lead the breakdown of existing networks and subsequent growth of new “specialized” entities. For example, I firmly believe new entities will develop that shift “payment” revenue from merchant borne interchange to incentives

Since May, the following “significant” events “in the battle” have occurred:

- Retailers have launched MCX with Wal-Mart’s Mike Cook as the lead. I want to emphasize, this is not “mobile payments” but rather a low cost payment network (Cook talks about $0.05/payment). Some retailers will seek to integrate their loyalty card, others will create plastic (see Target RedCard), others will certainly couple with mobile. WMT will likely integrate with a virtual wallet that manages digital coupons (Coupons.com likely leading)

- Apple has rolled out Passbook in June.. See my Blog, and hardware analysis from Anandtech of why there is no NFC.

- PayPal had a marketing announcement with Discover. Why would you announce something like this with no customers? Paypal is expanding its network… but merchants are just laughing.. MCX wants a $0.05 payment, Durbin gave them a $0.21 payment and Paypal wants to get 180-250bps. As you can tell, I don’t think much of this, as the Merchants are still in control of their payment terminal. This is also not an exclusive deal with Discover. I expect 2 other major players to partner with Discover in next few months. Paypal just wanted to run with this announcement before the other products come out. I also want to emphasize that DFS is a BUY. They will be a partner of choice as they run a subscale 3 party network that can adapt much more quickly than V/MA. As a side note, Paypal will likely expand distribution of their own plastic. See related blog.

- Google rolled out Wallet 1.5 on August 1 (see blog). This is one of the biggest moves in payments and provides an enormous retailer value proposition (aligned to MCX). Google didn’t follow PayPal, Passbook, or Microsoft.. they rolled out product that was 1.5 yrs in progress. Google’s new cloud wallet allows the consumer to select any payment method, and provides the merchant with a debit rate (Bancorp non-Durbin 1.05% + $0.15 (note Google/Issuer can lower this for merchants, as any issuer could, this is a MAX rate). Google is CURRENTLY loosing money on the payment side of the business in hopes of making it up on the advertising side. This is no marketing announcement like Apple, Microsoft and Paypal.. this is a product announcement.. it is working today in my new Galaxy phone. This is also the first PRODUCTION cloud wallet for the POS. Apple, Amazon and Paypal dominate cloud wallets in eCommmerce and mCommerce. Google and Amex’s Revolution money are the only one’s doing it at the POS.

- Square acquired all 30M Starbucks mobile payment customers (see Blog). Square has done a great job acquiring merchants.. but was hurting on the consumer side. Square wants to build network and needed a pop on the consumer side. Square’s business is pivoting toward marketing and consumer experience. Within the next year, the little Square doggle will be a thing of the past. Starbucks is committing to the Square register experience, and Square is relabeling “card case” to “Pay with Square”.

- LevelUp is making payments “free” for merchants as part of a loyalty value proposition. This is an example deal.. expect more to follow. Issue is that different merchants have different priorities. LevelUp is focused in QSR/Casual Dining and is operating as part of a loyalty play. I’ve outline their revenue in this blog, don’t think it is sustainable unless they can move into acquisition.

- ISIS has lost key executives in its product area, AT&T is rumored to have a NFC/Wallet RFP of its own out and even Verizon is planning to let Google go ahead and put its wallet on the Samsung Galaxy III phones.. after all what choice does it have?

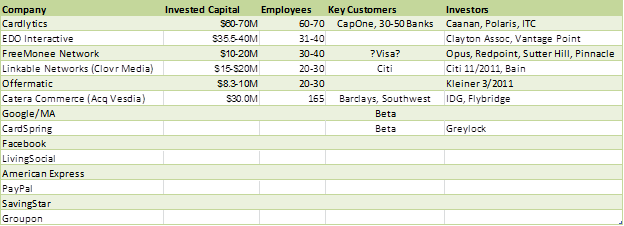

- Card linked offers and incentives in the cloud. No one is making money in this space, large retailers are not participating, hyper local merchants (who are interested) are very hard to sell to, and consumers don’t see relevant content (thus redemption rates under 2%).

Where are the cloud battle lines? Well most significantly the battle lines are forming away from NFC (as I stated in January). Even my old friends at Gartner have caught up and placed NFC in the trough of disillusionment. To restate, NFC is not bad technology.. but it delivers no “value” in itself beyond control. Mobile operators have consistently failed to build a business around a “control” strategy (see my Walled Garden Blog). In the ISIS example they mandated use of credit cards only, as this higher credit interchange was the only way to make revenue. Well guess who pays the freight here? Yep the merchants… Wal-Mart and its peers were not thrilled at giving issuers and MNOs 3.5% of sales for the privilege of accepting a mobile payment.

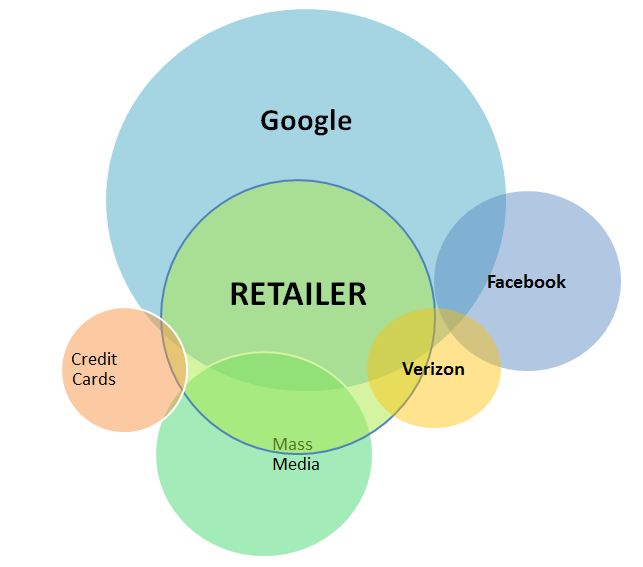

The Cloud battle is complex, as the strategies are about MUCH MORE THAN PAYMENT. Payment is the ubiquitous service that is the last phase of a successful marketing, engagement, shopping, selection, deliver, retention, loyalty process. Leaders from my vantage point:

Payment Networks:

- Mastercard focused on acting in supporting role globally.

- Discover similar to MA, but with much greater flexibility as it operates in a 3 party network and is both issuer and acquirer.

- MCX – Not a leader yet, but has CEO mindshare of every top US retailer. They seem overly focused on the cost side. There is a very big whole in their customer acquisition strategy. MCX is bidding out its infrastructure now, my guess is that Discover or Target will win it.. and the the RFPs are just a way of keeping Banks “in the tent” to keep them from changing ACH rules to kill it like they did to Scott Grimes at Cap One (decoupled Debit).

- Google – has more consumer “accounts” than any company on the planet. Can it convert them to accounts with a linked payment instrument? Google also “touches” more customers, more times per day than any other company, its heavy influence in the shopping process positions it well with retailers. Also has the best retailer sales force of anyone on this list, as they bring in customers to retailers every day. Android/Google Wallet….

- Square – Best customer experience hands down (register). It also has the most traction among small retailers

eCommerce/mCommerce:

- Apple – expect Passbook to dominate mCommerce. It will be the killer app.

- PayPal – Challenged in market adoption beyond eBay/GSI customer base. Top ecommerce sites like Amazon and Rakuten have their own integrated payment, also 50% of eCommerce/mCommerce goes through Cybersource which Visa acquired. Paypal’s future growth driven by international

- Amazon – leading eCommerce/mCommerce player. When will it take one-click beyond Amazon? Amazon’s experience is best from end-end…. PayPal/Apple will operate around the periphery of non-Amazon purchases.

- Rakuten – “Amazon of Japan” who now also owns buy.com. Fantastic experience and leading eCommerce loyalty program.

How many places do you want to store your payment credentials? Who do you trust to keep them? What data do you want providers to know about you?

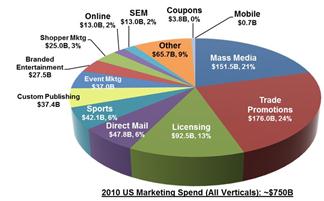

From a macro economic perspective, total payment revenue for all major participants is just under $200B in the US. Total marketing spend in the US is over $750B. Total retail sales in the US is $2.37T (not including oil/gas, Fin services, T&E). Marketing is fundamentally broken… payments is not. Retail sales gross margin has been compressed from 4.2% in 2006 to 2.4% in 2010. Who is best able to execute on the combined retail and marketing pain points? Who can be retailer friendly? Consumer friendly? Marketing friendly?

I start my analysis with #1 the consumer value proposition, and #2 the merchant value proposition. Entities like Google, Paypal, Apple already have tremendous consumer relationships and traction. They thus have very few “acquisition” costs. However, these entities do bear the costs of changing customer behavior. There are many approaches for changing customer behavior:

- Incent behavior – direct/indirect/merchant

- Customer Experience (ex Square)

- Service integration (reduce effort or # of parties)

- Reduce risk – financial (security/anonymity…)

- Reduce risk – purchasing (social, community reviews, …)

- Value proposition in commerce process (indirect incentives)

- Marketing

- ..etc

Other groups like MCX and ISIS bear the cost of both customer “acquisition” AND behavior change for: Consumer, Merchant or Both. As I state previously. one of my favorite arcane books I’ve ever read was “Weak Links” I’m almost reluctant to recommend it because it is so good you may jump ahead of me on some of my investment hypothesis. One my favorite quotes from the book

Scale-free distribution (completely open networks) is not always the optimal solution to the requirement of cost efficiency. .. in small world networks, building and maintaining links between network elements requires energy…. [in a world with limited resources] a transition will occur toward a star network [pg 75] where one of a very few mega hubs will dominate the whole system. The star network resembles dictatorships in social networks.

Networks like V, MA, PayPal, Amex and DFS are working to participate in this new Macro economic opportunity. But established networks are hard to change

“The network forms around a function and other entities are attracted to this network (affinity) because of the function of both the central orchestrator and the other participants. Of course we all know this as the definition of Network Effects. Obviously every network must deliver value to at least 2 participants. Networks resist change because of this value exchange within the current network structure, in proportion to their size and activity.”

The implications for cloud based payment at the POS are significant because the entity which leads THE DIRECTORY will have a significant consumer advantage, and will therefore also lead the breakdown of existing networks and subsequent growth of new “specialized” entities. For example, I firmly believe new entities will develop that shift “payment” revenue from merchant borne interchange to incentives (new digital coupons).

The current chaos will abate when an entity delivers a substantial value proposition that attracts a critical mass of participants. Today most mobile solutions are just replacing a card form factor… this is NOT VALUE. I am currently placing my bets on solutions that merchants support (Square, Google, MCX, LevelUp, …) as this is a key “fault” of almost every other initiative.

Comments Appreciated (as always sorry for the typos…)

NFC and Consumer Choice

7 May 2012

Thinking about consumer choice today. As the MNOs think about how to lock up the SE and SE Management.. when does a consumer get to choose what is on their phone?

As most of you are aware, ISIS is charging each and every issuer for the “right” to put their cards on the phone. In a tweet 2 weeks ago I mentioned that all of the phones in market have a major problem: they can only support one card emulation application at a time. Although I’m not completely sure if this is a firmware issue or “silicone/memory” issue it relates to the storage on the NXP’s chip. Apparently the latest version’s of NXP’s chips don’t conform to Amendment C of Global Platform’s 2.2 Specification (supporting multiple card emulation apps).

http://www.globalplatform.org/mediapressview.asp?id=777

What this means is that your new NFC phone could have hundreds of Visa cards loaded.. or hundreds of MasterCards.. but the phone can’t support the signed java applets (card emulation apps) from Visa (paywave), Mastercard (paypass), Discover (zip), Amex (expressPay), Transit (…).. you get the picture.

Doesn’t everyone want a wallet where all of your cards can get stored? Visa, MA, Amex, .. plus loyalty, gift, … ?

My hope is that the market (and regulators) will push to keep consumer choice at the center of mobile phone wallets. If the carriers can’t lock down the SE, consumers will be able to choose the most effective option. Retailers know that the only cards willing to “PAY” to get in the ISIS wallet are credit cards.. which obviously impact their interest in accepting a 350bp payment product.

The mobile wallet that “wins” will be the one that offers consumers the most control. Letting consumers load any card they want.. without that card issuer first having to pay some sort of toll to the mobile operator. Also letting the consumer decide who gets access to what data. This last area is something that needs improvement beyond data that is stored in the SE. Right now apps are taking the approach of “take it or leave it” agreeements:.. we get your location, e-mail, contacts, usage, … This terrible approach is leading to an unbelievable dissemination of data that is completely out of control. This is why HTML 5 will win.. Apps are becoming the paradigm by which companies obtain almost unlimited customer information.. and consumers will wake up soon.

As a side note, isn’t it amazing that this topic hasn’t been covered more broadly? Of course it speaks to the true uptake of mobile payments (at POS) in general..

My funny story: I went to the Duane Reade directly across from Penn Station last month. DR was a Google wallet launch retailer in NYC, with all of the beautiful marketing logos. I waved my phone to check out.. and the store manager was there behind the 8 cashiers.. he said “is that Google Wallet”.. I said no it was a Citi Sticker glued to the back of my iPhone.. I asked him how many purchases he has seen from people using their phones.. Answer “none in the last 2 months”… Across from Penn Station… wow..

Card Linked Offers Update

27 March 2012

We see in the press that Google/MA have gone beta with Card Linked Offers, and Bank of America is about to go live with “BankAmeriDeals”. I last gave an overview of this space back in November in my Card Linked Offers post. For those that haven’t seen it, there is also a must read blog by Reed Hoffman in Forbes on the subject: The Card is the new App Platform.

Here is my blog from 3+ yrs ago – Googlization of Financial Services – outlining data flow. My purpose is mentioning this blog is not to show how smart I am (as an alternate view is already firmly established), but rather to highlight how much my view on the opportunity has changed over the last 3.5 years. As I tell all of the 12 start ups in the CLO space.. if Visa couldn’t get this to work what makes you think that it will be easy for anyone else.

There is a CORE business problem I didn’t realize back then.. merchants don’t like cards and are VERY reluctant to create ANY unique content (offers) where card redemption is REQUIRED. Further constraining the “capabilities” of CLO is lack of item detail information within the purchase transaction. IBM is the POS for 80% of the worlds to 30 retailers. Take a look at the 4690 overview here, notice what incentive solution is integrated? This was a 5 yr project for Zavers…

A story to illustrate my point on retailer reluctance. As most of you know POS manufactures like IBM, Micros, NCR, Aloha are implementing POS integration solutions similar to what Zavers has done. Most of the CLO companies above are paying the POS manufactures to write an “adapter” that will work within their POS and communicate basket detail information. (ISIS is rumored to have a 200 page Spec for this POS integration as well). There is a very big difference between having integration capability, and a RETAILERS agreeing to use it (ie share data). There must be a business value proposition for retailers to move… and I can tell you with a great deal of certainty.. Retailers don’t like the BANK card platform.

I emphasize BANK for a reason.. I was with the CMOs of 3 large retailers a few months ago. When asked what their payment preferences where, they answered without hesitation: Store Card. This is their most profitable product used by their most loyal customers (think private label). Do you think for a moment that a Retailer would deliver “incentives” to customers that are not in this group.. Remember, these PVL loyal customers also hold a number of other bank cards, and there is not much in the way of customer matching between data sets. I think you get my point.

As I stated previously, all offers businesses are highly dependent on targeting. Targeting is dependent on customer data, relevant content, effective distribution (SMS, e-mail, an App), campaign management (A/B testing, offer type, target audience, …). Campaign management is very dependent on feedback. There are very few companies that can effectively TARGET and DISTRIBUTE. The current group of CLOs is partnering with the banks to solve the targeting problem (example Catera/Citi, Cardlytics/BAC, …). This is further EXASERBATING the poor Retail adoption. Why? Here is what a CMO told me:

“Tom, lets say a consumer just shops at Nordstrom.. the card network and bank see that I just completed the transaction and now market to them … the advert is “go to Macy’s and save 20% on your next purchase”… Given that they can only offer basket level incentives this is how it must work… Tom do you know what will happen? The customer will return what they just bought and go to Macy’s and get it. How is this good for Retail?”

From an Ad Targeting/Distribution perspective, Mobile Operators certainly have an eye on this ball (mobile phone). But only a few companies like Placecast can actually deliver it for them. MNOs are truly messed up in this marketing space (within the US). If you had the CEOs of Verizon, ATT and ISIS in a room and asked “who owns mobile advertising”?.. ISIS would say nothing if both of the other CEOs were in the room.. They want it.. but no one will give it to them as they can’t execute with what they have in this space. Verizon would say “many partners”… Their preference would be to sell the platform akin to their $550M search sale to Microsoft in 2009. So VZ wants a $1B+ Ad platform sale… who would compete for that business? I digress.. but what is in place today looks much more like a rev share… Internationally there are carriers with their act together: Telefonica and SingTel (just bought Admobi).

Let me end this CLO diatribe with a customer experience view. Let’s assume I have 12 CLO players.. each partnered with a different bank/network. Also assume that all are heavily dependent on e-mail distribution. I have 6 different cards.. and will be getting at least 6 e-mails per week with basket level discounts. Now assuming that I can keep track of which offer was tied to which card.. and use the card. I’m still left at the POS with a receipt that shows none of these basket level discounts (as they are “credited” to my account after purchase).

Without POS integration AND Retail data sharing this will not work.. the customer experience is terrible, as is the campaign’s restriction on basket level discounts. The ubiquity of cards is attractive.. as is bank data on Consumer “Store preferences”…. But both work to the detriment of retailers. What consumers will see in CLO for some time is the generic 10-20% off your next purchase that will also be available in direct mail campaigns… Let’s just hope that someone can work the double redemption problem…

My read on this for Google is a little different. Google is positioning itself as a neutral platform.. it can do Retailer Friendly.. Bank Friendly… MNO Friendly.. Manufacturer Friendly… Each will have different adoption dynamics. Google’s objectives are likely: gain insight, be the central platform for marketing spend, be the most effective distributor of content, … . This offer beta would certainly seem to be a “bone” thrown to banks.. hey… here it is … good luck trying to make it work.