31 May 2012

As reported in today’s WSJ, and 6 days ago by Bloomberg, Groupon is working on a Square competitor… So the list of companies that now enable any mobile phone/tablet to be converted into a POS to 7?

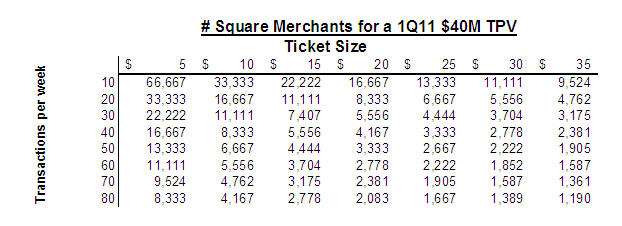

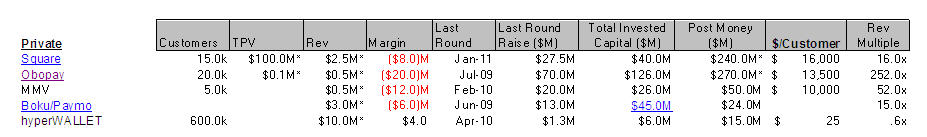

- Square, $4B GDV Run Rate

- Intuit/VZ, goPayment

- FirstData mobile pay

- PayPal + Roam?

- Groupon?

- Google?

- +10 other small start ups leveraging hardware from Verifone, RoamPay, MagTek

I joked in a tweet that perhaps this is why IBM sold its RSS division to Toshiba for $850M (a $1.15B revenue business).

What is value here? It is card acquiring? POS systems? Advertising? or something else?

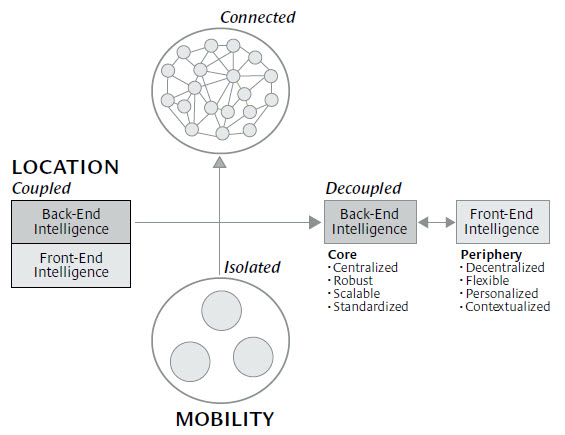

Most of us would agree that it makes little intuitive sense for a small business to have multiple pieces of specialized hardware. A specialized, locked down, PC acting as a cash register connected to a specialized locked down payment terminal.

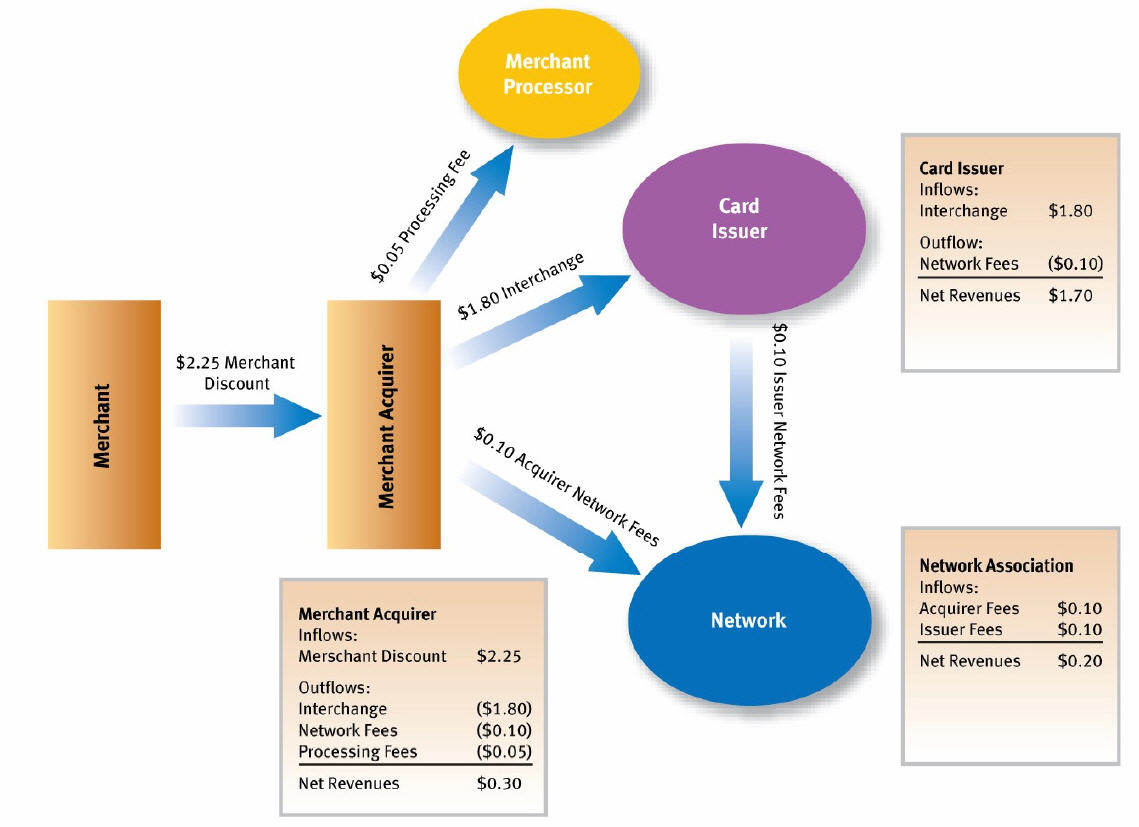

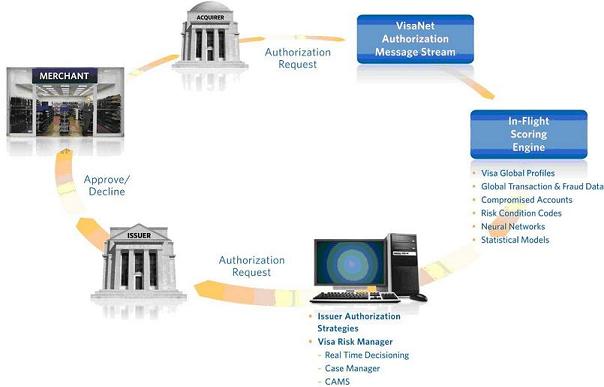

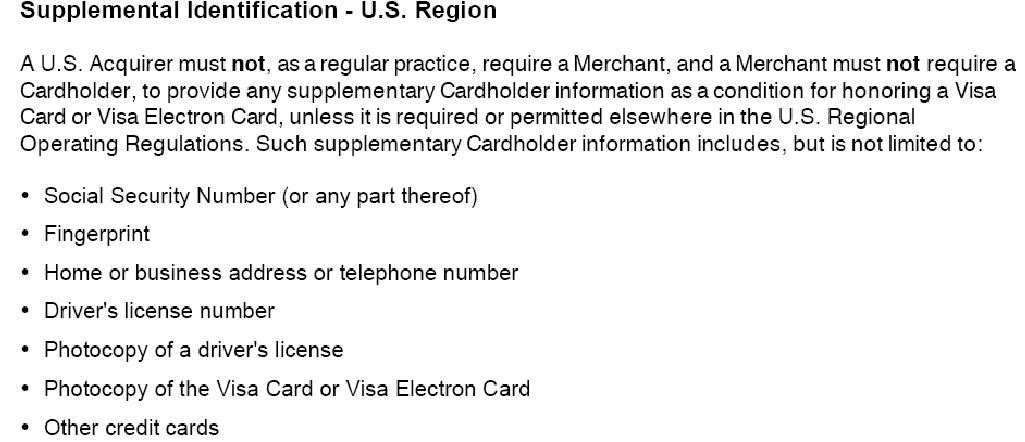

Did you know that retailers like WMT and Safeway have teams of over 500 customizing IBM’s 4690 ECRs? What on earth could these people be doing? A: Multiple tax jurisdictions, discounting rules, loyalty programs, regulations, hardware upgrades, software upgrades, new products, coupons, … a rather messy business. Similarly few people realize that the payment terminal which we swipe our card is actually owned and delivered by the retailers acquirer.. the retailer just plugs it in. This helps them solve PCI compliance issues by keeping the store completely removed from unencrypted card info.

As my 8+ square blogs have indicated, the real “macro” opportunity many of these companies are chasing is in orchestrating commerce. Commerce is a process that includes marketing, incentives, shopping/selection, purchase, and after sales support. Square has evolved from a payment acceptance doggle to a retailer commerce solution. Groupon has come about their POS from a different direction.. they need to improve the retailer and customer experience at time of use. Both will be heavily into advertising (offers, incentives, …) by end of year.

What retailers want are tools to drive customers into their store (acquisition), fill empty seats (yield management), get existing customers to buy more (basket size) and improve margin (price different customers differently).

Mainline POS manufacturers like Micros, NCR, Aloha, … have a list of companies requesting that they pre-integrate incentive solutions into their software.. By integrating incentive solutions into the POS, advertisers (and intermediaries) are hoping to close the loop in advertising. Closing the loop means allowing the advertiser to determine if a given advertisement resulted in a purchase. This would in turn allow for “performance based” advertising as opposed to cost per million, or cost per click. Today, there are very few performance based advertising solutions, as most advertising is completely untargeted.

But software availability does not equate to usage… as each retailer has their own marketing objectives. Believe it or not, retailers want to spread their campaigns across multiple advertisers, with many different programs to reach different audiences. The incentive for a new acquisition to my coffee shop will look much different than the program to retain customers (Starbucks being #1 here). Also customers are spread across multiple channels, and retailers sometimes operate as franchises that each market separately.

Case Study: Fishbowl

Fishbowl is a 10 yr old Washington DC based company 100% focused in Restaurants. Fishbowl gets its name from the fact that we drop our business cards in a fishbowl.. and the store wants to do something with them. CEO Scott Shaw is both a restaurateur, and serial entrepreneur. He and his team have done an unbelievable job constructing a campaign management tool that allows local franchisee’s to launch specific campaigns to specific customer segments (with a response rate ABOVE 10%) together with an integrated redemption package. Beyond the campaign management function at the hands of the local stores, there is an integrated “offer manager” that resides within the store’s POS systems (example Micros). If you guys saw this in action your jaws would drop.. but it was no 12 month project.. Retailers want to test it… see what it does.

Most readers can see the obvious problem here with card linked offers (previous blog ). Retailers do not want to give 15% off to every customer weekly. They want specific incentives.. to specific customers that are not necessarily in a single issuers card portfolio. Add to the complexity the fact that 80% of advertising $$ flow from manufactures and the dynamics further cloud as retailers use trade spend $$ to incent specific product purchases. GM pulled it’s Facebook spend because of this dynamic.

Every network begins with a closed loop system delivering value between at least 2 parties. The solutions in this POS space are not “pure play” electronic cash registers.. but BRIDGE devices hoping to switch transactions within existing networks, while adding new features. This seems complex for all but the smallest merchants. I like Fishbowl’s approach better.. starting with a campaign tool that would allow the retailer to touch any customer in any “ad network”. In the Groupon model, they can only reach their registered customers.. in offer models that they support. If Groupon had a killer value proposition (for both retailer and consumer) this could work well, if not they suffer from the problem of distribution and targeting (relevant offers).