2 January 2013 (updated typos and added content on kyc, cloud, and push payments)

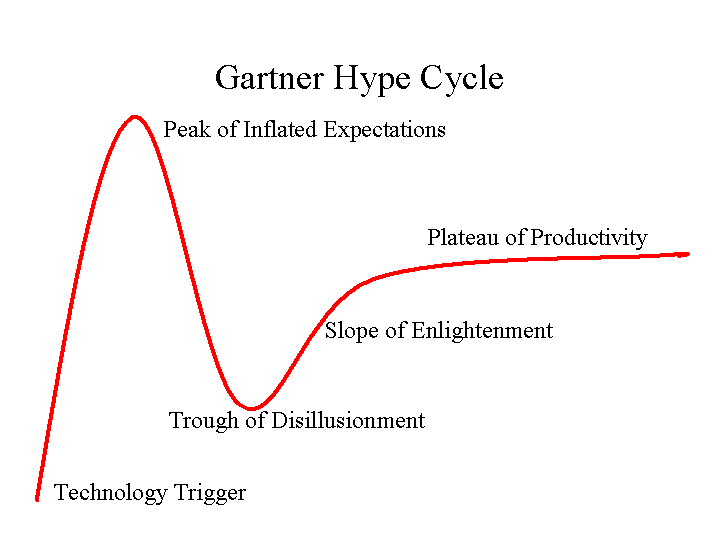

Looking back to my first “prediction” installment 2 years ago, 2011: Rough Start for Mobile Payments, not much has changed. Although I am personally approaching the “trough of disillusionment”. Lessons below are not exclusively payment (ie mobile, commerce, advertising) but seem relevant .. so I mashed them together. Key lessons learned for the industry this year:

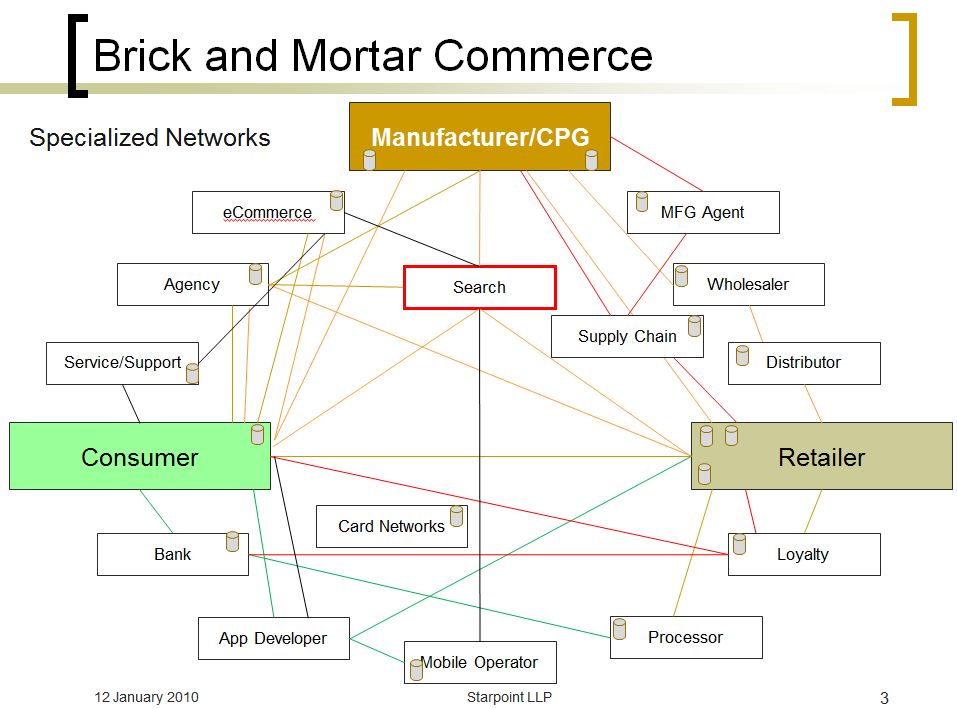

- Payment is NOT the key component of commerce, but rather just the easiest part of a very long marketing, targeting, shopping, incentive, selection, checkout, loyalty … process. Payments are thus evolving to “dumb pipes”.

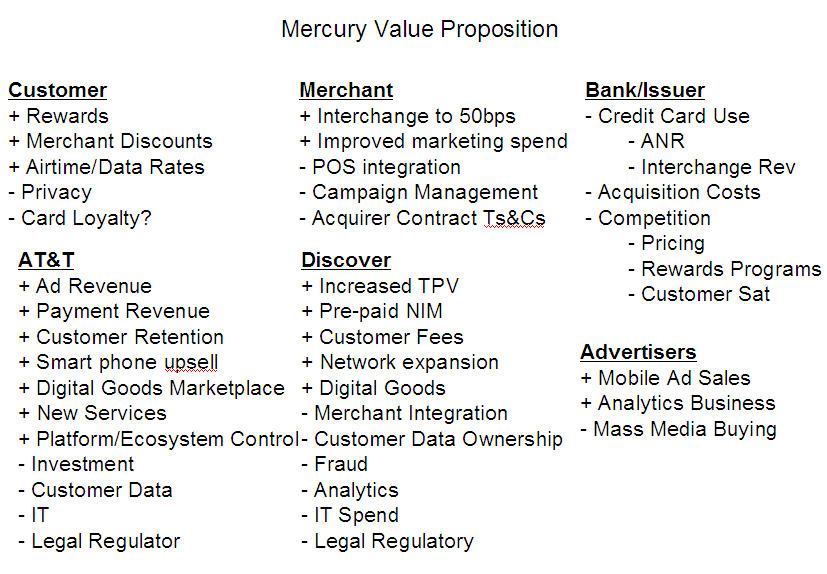

- Value proposition is key to any success for mobile at the POS. There are no payment “problems” today. None of us ever leave the store without our goods because the merchant did not accept our payment. There are however many, many problems in advertising, loyalty, shopping, selection, …

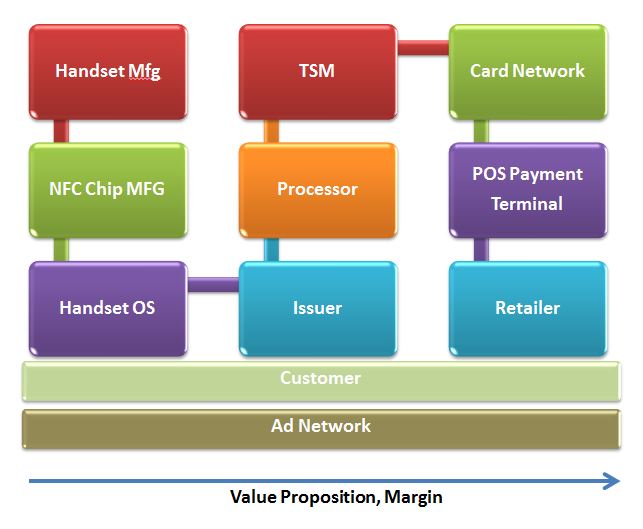

- There is no value proposition for the merchant or the consumer in NFC. NFC as a payment mechanism is completely dead in the US, with some hope in emerging markets (ie transit).

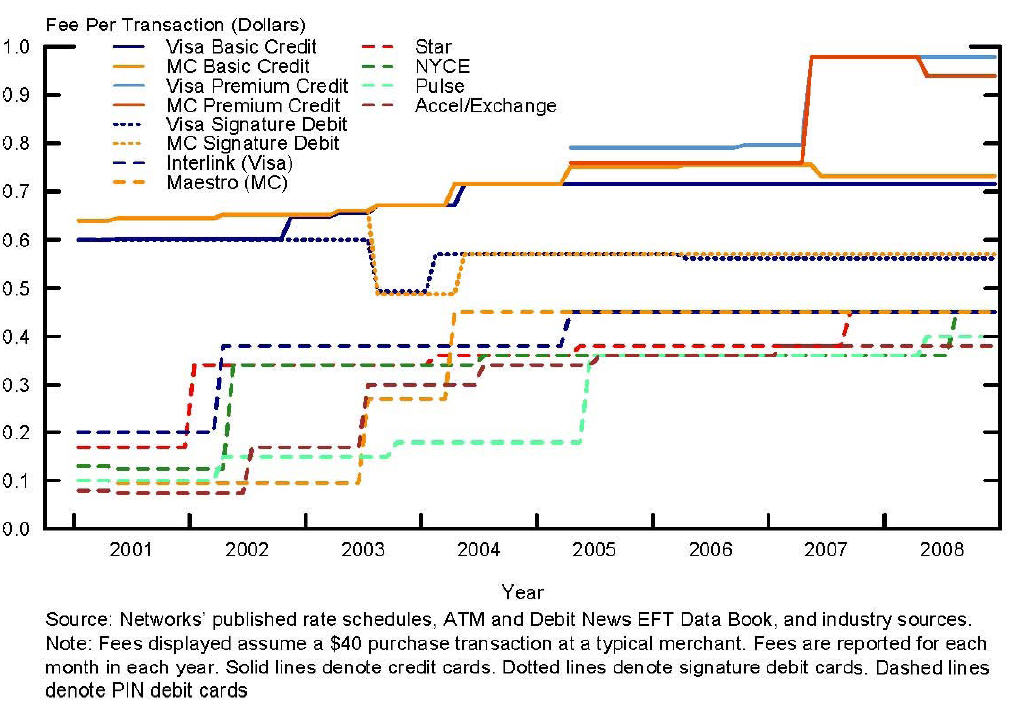

- 4 Party Networks (Visa/MA) can’t innovate at pace of 3 party networks (Amex/Discover). See Yesterday’s blog.

- Visa is in a virtual war with key issuers, their relationship is fundamentally broken. This is driving large US banks to form “new structures” for control of payments and ACH. Control is not a value proposition.

- US Retailers have organized themselves in MCX. They will protect their data and ensure consumer behavior evolves in a way which benefits them. Key issues they are looking to address include bank loyalty programs, consumer data use, consumer behavior in payment (they like chip and PIN but refuse to support contactless).

- Card Linked Offers (CLO) are a house of cards and the wind is blowing. Retailers don’t want banks in control of acquisition, in fact retailers don’t spend much of their own money on marketing in the first place. Basket level statement credits don’t allow retailers to target specific products and it also dilutes their brand without delivering loyalty. Businesses want loyalty… Companies like Fishbowl and LevelUp are delivering.

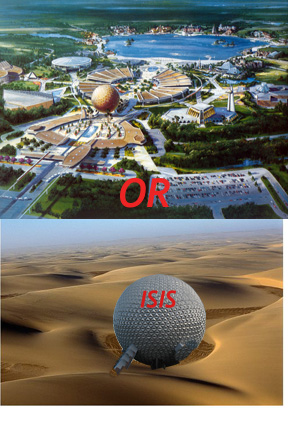

- Execution. This may be subject of a future blog… Fortune 50 organizations, Consortiums, Networks, Regulated Companies all share a common trait: they are challenged to execute. Put all of these groups together (

without a compelling value proposition…) and we have our current state (see my Disney in a desert pic). Take a look at who is executing today and you will see product focus around a defined value proposition. My leaders: Square, Amex, Amazon, Sofort, Samsung, Apple, SKT, Docomo and Google. Organizations can’t continue to stick with leaders that are focused solely on strategy, or technology, or corporate development… You should be able to lock any 3 people in a room for a week and see a prototype product. The lack of depth in most organizations is just astounding. Executives need to bring focus.

without a compelling value proposition…) and we have our current state (see my Disney in a desert pic). Take a look at who is executing today and you will see product focus around a defined value proposition. My leaders: Square, Amex, Amazon, Sofort, Samsung, Apple, SKT, Docomo and Google. Organizations can’t continue to stick with leaders that are focused solely on strategy, or technology, or corporate development… You should be able to lock any 3 people in a room for a week and see a prototype product. The lack of depth in most organizations is just astounding. Executives need to bring focus. - In a NETWORKED BUSINESS, it’s not enough to get the product right. You must also get retailers, consumers, advertisers, platform providers, …etc. incented to operate together. Today we see broken products and established players throwing sand in the gears of everyone else in order to protect yesterday’s network. Fortune 50 companies have shown poor partnership capabilities. Their strategies are myopic and self interested. For example Banks DO NOT DRIVE commerce, but support it. Their “innovation” today is self serving and built around their “ownership” of the customer. Commerce acts like a river and will flow through the path of least resistance. There can only be so many damns… and they will be regulated.

- The Valley and “enterprise” startups. There are billions of dollars to be unlocked at the intersection of mobile, retail, advertising, social. Most of the value requires enterprise relationships. Most investment dollars have flowed to direct to consumer services. I expect this to change.

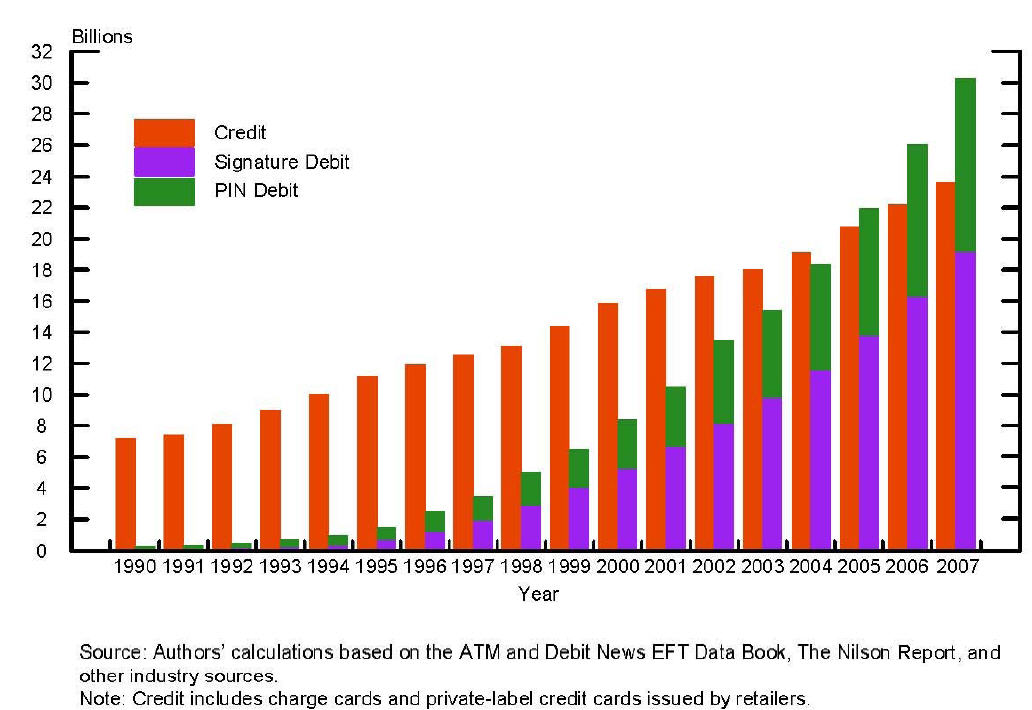

- Consumer Behavior is hard to change, particularly in payments, it normally follows a 20 yr path to adoption. For example, in every NFC pilots through 7 countries we saw a “novelty” adoption cycle where consumer uses for first 2 months then never uses again. My guess is that there are fewer than 1-2 thousand phone based NFC transactions a week in the entire US. (So much for that Javelin market estimate of $60B in payments).

- Consumer Attention. Who can get it? They don’t read e-mails, watch TV adverts, click on banner ads. My view is that the lack of attention is due to a vicious cycle relating to relevant content and relevant incentives.

- Hyperlocal is hard. The Groupon model is broken, CLO is broken.. Large retailers have a targeting problem AND a loyalty problem. Small retailers have a larger problem as the have no dedicated marketing staff. Their pain is thus bigger, but selling into this space requires either a tremendous sales team or a tremendous brand (self service).

- My favorite quote of the year, from Ross Anderson and KC Federal Reserve. [With respect to payment systems].. if you solve the authentication problem everything else is just accounting.

Predictions

Here are mine, would greatly appreciate any comments or additions.

- Retailer friendly value propositions will get traction (MCX, Square, Levelup, Fishbowl, Google, Facebook, …)

- MCX will not deliver any service for 2 years, but individual retailers will create services that “align” with principals outlined by MCX (Target Redcard, Safeway Fastforward, …etc). The service which MCX should build is a Least Cost Routing Switch to enable the most efficient transaction across payment “dumb pipes”. This will enable merchants who want to take risk on any given customer the ability to do so..

- Banks will build yet another consortium in an attempt to control payments. They will work to “protect consumers” by hiding their account information and issue “payment tokens”. I agree with all of this, yet this is a very poorly formed value proposition and Banks will find it hard to influence consumer behavior.

- We will see more than one bank start a pilot around Push Payments (see blog).

- Facebook and Google will gain significant traction in mobile ad targeting…. following on to targeted incentives… which will lead to mobile success. Bankers, please read this again.. success in mobile will begin with ad targeting and incentives. Payments are an afterthought…

- Retailers at the leading edge will begin to see that their consumer data asset is of greater value than their core business.

- Banks will follow Amex’s lead in creating dedicated data businesses. What is CLO today will morph into retailer analytics, offers and loyalty.

- Apple will put NFC in their iPhone.. but usage is focused on device-device communication… not payment. NFC will be just another radio in the handset, there will be multiple SEs with the carriers owning a SWP/SIM based one.. and the platform provider managing the other. Which will succeed? A: the group that can best ORCHESTRATE value across 1000s of companies.

- Visa will lose a top 5 issuer to MA, and they will see a future where their debit revenue is gone (in the US) as MCX and bank consortiums take ownership of ACH and PIN debit.

- We will see 100s of new companies work to create new physical commerce experiences that include marketing, incentives, shopping, selection. Amazon is the driving force for many, as retailers work to create a better consumer experience at competitive price.

- Chaos in executive ranks. Amex, Citi, MCX, PayPal, Visa all have new CEOs.. all will be shaking up their payment teams.

- Retail banking is going through fundamental change. Bank brands, fee income and NRFF are declining, big dedicated branches will be replaced by more self service. Mass market retail will see significant leakage into products like pre-paid. Retailers and Mobile Operators are better able to profitably deliver basic financial services, to the mass market, than banks…. see my Blog Future of Retail: Prepaid.

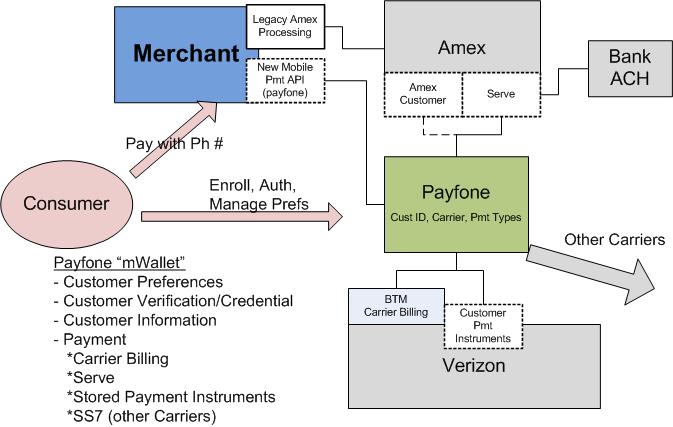

- Unlocking the Cloud… and Authentication. KYC is a $5B business. Look for mobile operators to build consumer registration services that will tie biometrics with phone. Digital Signatures on contracts, payment through biometrics, .. all will be possible in a world without plastic. Forget NFC… See previous Blog on KYC and Cloud Wallets.

Does anyone remember

Does anyone remember  My primary digital wallet is Amazon, with Paypal as a close #2. The buying experiences are just superb, unfortunately neither extend well into the POS. I have a PayPal debit card I use here.. but I have a hard time justifying why I would use a paypal debit card that pulls money from a pre-funded account which is tied to my Bank of America Checking.. why not just use my BAC Debit Card? I don’t think I’m alone here.. The thought that comes to mind: why do I use PayPal at all? Convenience is certainly a key element, but I also really don’t like giving out all of my personal information to every vendor I do business with. Why does any vendor need to know my name? Is there a business case for anonymity? For Readers in Germany I know your answer… of course there is.

My primary digital wallet is Amazon, with Paypal as a close #2. The buying experiences are just superb, unfortunately neither extend well into the POS. I have a PayPal debit card I use here.. but I have a hard time justifying why I would use a paypal debit card that pulls money from a pre-funded account which is tied to my Bank of America Checking.. why not just use my BAC Debit Card? I don’t think I’m alone here.. The thought that comes to mind: why do I use PayPal at all? Convenience is certainly a key element, but I also really don’t like giving out all of my personal information to every vendor I do business with. Why does any vendor need to know my name? Is there a business case for anonymity? For Readers in Germany I know your answer… of course there is.