Thought I would give more detail on whats going on with V/MA, Issuers and Apple (from WSJ article yesterday Apple Pay Fees Vex Issuers). Perhaps I’ll collect a fee from the WSJ.. odd that I mention Apple Pay fees on Monday to have it come up in the WSJ on Tuesday. Oh well..

Google Plex – On Track Pivot

I was quite surprised to see the front page of my Saturday WSJ emblazoned with “Google Is Scrapping Its Plan to Offer Bank Accounts to Users”. As the former guy responsible for Citi’s online banks globally, and also a guy working in creation of the original Google Pay (as consultant), I thought I would provide some much needed clarity here (consistent w/ blog Google’s Bank Plans and the 20 others I’ve written on Google Pay over the last decade).

Payments and the Observer Effect

Most of you techie’s out there had a physics class at some point and can recall the Observer Effect in Quantum Physics: the act of observation can change the measured results. Observation in payments has become the second largest driver of margin and has enabled many new specialists…. so I thought I’d outline some broad thoughts and tell a few stories.

Why is observation important? Payment behavior is truth marked data of what a consumer actually did (offline). While I may search for Ferrari’s, or visit dealership (mobile location) what I actually bought is much more important in predicting behavior and evaluating risk. Purchase data is the most valuable data for that reason (and issuing banks had a lock on it.. Until about 5 yrs ago). The lock has been broken and payment data has become the “missing link” to unite heterogeneous data sets.

PayPal’s New Mobile Bank

Quick thoughts on today’s announcement

This is a solid product.. Not a “super app” but perhaps the best mobile first bank in the US (and beyond). What is NEW?

-

- Mobile UI to integrate all those heterogeneous apps (and acquisitions)

- High yield savings account (0.4% APR) powered by synchrony

- Integration of Honey offers/rebates/loyalty programs

- Better Direct Deposit/Bill Pay integration (ex faster clearing/availability of direct deposits)

PayPal – ?Super App?

PayPal has been my #1 holding for last 5 yrs, and it has been on a fantastic ride… especially so over the last 18 months! (see MVP – Continued Domination for more).

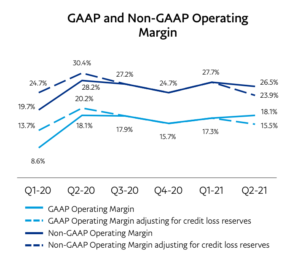

Paypal announced 2Q21 earnings 2 weeks ago (7.28). TPV growth was 40% with eBay, 48% without out, while sales grew at a 32% clip without  eBay versus 19% with. Earnings? Not so much as margin erosion has hit the business. One core driver of margin has investors particularly concerned: “Take rate” (net merchant revenue less cost to clear payments) fell from 2.21% in the fourth quarter of 2020 to 2.11% in the first quarter and 2.01% in the second quarter.

eBay versus 19% with. Earnings? Not so much as margin erosion has hit the business. One core driver of margin has investors particularly concerned: “Take rate” (net merchant revenue less cost to clear payments) fell from 2.21% in the fourth quarter of 2020 to 2.11% in the first quarter and 2.01% in the second quarter.

Square in Crypto/DeFi

From Bloomberg yesterday 16 July

Why is this a great thing for Square and DeFi?

#1 Today DeFi and Crypto in Commerce (POS and eCom) are in need of a “core” that can manage either compliance and connections to existing financial services, or operate in critical mass with minimal interaction to banks (ex – custody, exchange, platform, consortium-diem).

Case for CBDC – Market Efficiency

Sorry for typos here.

As most of you know I love to read the arcane (ex favorite book is Weak Links – related blog) and I love economists. Today I’m reading some of Thomas Phillippon’s research (NYU’s economist and author of The Great Reversal: How America Gave Up on Free Markets). Many of you will recall I covered Dr. Phillppon’s work in my 2015 blog Changing Economics of Payments. My summary of Phillippon’s work:

ApplePay Accept (Mobeewave) in October

Note comment June 2022 – This blog did not anticipate the creation of Visa Acceptance Cloud which completely eliminated the device certification requirements.

My track record on Apple is pretty good.. having broken the Apple Pay news in 2014 and Last August I announced the Apple/Mobeewave acquisition. Apple is great at keeping secrets… perhaps the best tech company in the world in this regard. My latest forecast? Apple will enable payment acceptance in the US this October with Elavon as a payment processing partner.

Retail Banking’s “Blockbuster” Moment?

Last week, in his annual shareholder letter (page 28), Jamie Dimon stated “Banks have enormous competitive threats — from virtually every angle,” he said. “Fintech and Big Tech are here… big time!”

Short Blog – BNPL Recap

101 Blog… probably not for the BNPL experts. Recap at bottom.

While CDBC may impact debit networks in a 5 yr view, I thought I would write a short blog on BNPL’s impact to credit networks in near term (See Insider’s BNPL market Analysis and MRC’s overview of solution providers)