I hope to finish part 2 – Power of Bank Networks tomorrow (12-15 pages). In the meantime I have to recap a few key developments this week.

Continue readingPart 1 – US Payments Environment

Assessing the Environment and Setting the Focus (part 2 – Power of Bank Networks)

© Starpoint LLP, 2022. No part of this site, blog.starpointllp.com, may be reproduced in whole or in part in any manner without the permission of the copyright owner. Please do not share unless you hold an enterprise license.

Must read FT article “How JPMC’s plan to kill credit cards split the bank”. The article discusses Jamie Dimon’s internal mandate to drive a new payment network. I was shocked with the level of internal org quotes here. In my view, Jamie is the best bank CEOs in history (based on performance and talent coming out of JPMC). As a former banker, I know how hard it is to move the ship. However, FT is wrong. Chase’s efforts ARE NOT about killing credit cards, but rather creating something much bigger.

This is a long blog..

Continue readingTCH Phase 1 – eCom Wallet

Short blog – 80% confidence

© Starpoint LLP, 2022. No part of this site, blog.starpointllp.com, may be reproduced in whole or in part in any manner without the permission of the copyright owner.

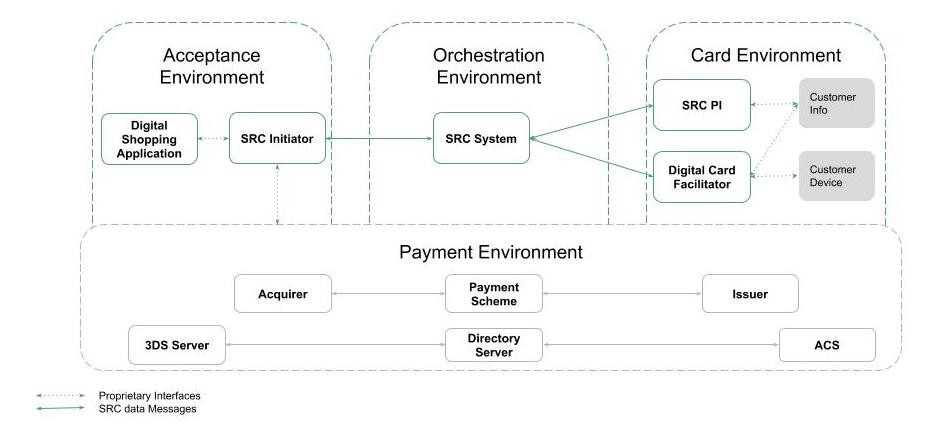

Phase 1 of TCH’s token efforts will be in SRC model. A bank branded “wallet” acting in the DCF role for TCH PIs . Just as VAC has enabled the elimination of physical hardware for acceptance, issuers see a plastic-less future for cards. They want to own the issuance of cards and want much more than a token, they want the entire “wallet”.

Go to market is either as:

- TCH as SRC System, or

- Visa as the SRC System for all TCH banks (V and MA) with TCH is a “unique role” managing all consumer data, registration, payment tokenization, …

Apple – #1 Payment Innovator

As Apple is set to launch the iPhone 14 today, I was thinking about the significance of ApplePay’s innovations to V/MA and how these innovations benefit the entire network of merchants and consumers. Making payments easy is hard… Apple is the lead “innovator” within the V/MA networks at the consumer touchpoint (with Google, Samsung, PayPal and others in the mix). Their “wallet” and branded integration into both POS AND mCom is unrivaled and represents 93% of all mobile wallet payments in the US (2021).

This 2021 Pulse Network Debit Whitepaper provides the best public view on performance (US Only), with TPV CAGR over 50%. Quite frankly, when it comes to mobile payments, it’s silly to talk about anything else by ApplePay in the US

Near Term Impacts of Distributed Ledger Technology to Financial Services – Chain of Trust

© Starpoint LLP, 2022. No part of this site, blog.starpointllp.com, may be reproduced in whole or in part in any manner without the permission of the copyright owner.

Continuation of last week’s blog on “binding” and minting of tokens.

I’m currently immersed in DeFi, DAOs, Blockchain, …etc. Selected readings are at the end of this blog. Keeping Current in DeFi/DLT is almost impossible. I certainly invite comments and corrections to anything I’ve written below. While I have teams building services in this area, my perspective is biased. My purpose in writing is to stimulate discussion so don’t be shy in the comments, I welcome disagreement and discussion.

Topic today: What impacts will the $50B invested in FinTech/DLT/Crypto have on existing financial services in next 5-10 yrs? What is the summary CEO/Investor View?

Notifications

Pay By Bank – Where does it work and why?

© Starpoint LLP, 2022. No part of this site, blog.starpointllp.com, may be reproduced in whole or in part in any manner without the permission of the copyright owner.

Friday I was a tad “let down” in the Sionic/TCH/MX release of Pay-by-Bank. Per my blog on Google/TCH launch and Google P2P I was anticipating something much bigger. To be clear I firmly believe that TCH is working on an “ApplePay Competitor”, which will entail TCH tokens inside of Google’s phone, but this will be 3-6 months out. Per the blogs above, I see neither pay-by-bank nor TCH Tokens in Google Pay as a threat to V/MA.

Today I thought I would drill down into “pay by bank”, the dynamics of why it works in some markets, and why I see little threat to V/MA in replacing core cards in eCom or at POS.

Bank Opportunity – Binding

Big picture thoughts on a key service where banks will lead in the future

© Starpoint LLP, 2022. No part of this site, blog.starpointllp.com, may be reproduced in whole or in part in any manner without the permission of the copyright owner.

Existing businesses spend significant energy on remaking things that work. Moore’s law has justified this investment in chipmaking, as has Tesla’s investments in batteries and manufacturing processes. These area of focus are where products performance is critical to the customer and incremental capability provides differentiation. But what about banking and payments? What provides differentiation? Which investments are driving performance critical to the customer? or operational efficiencies? (see Changing Economics of Payments)

Google/FedNow + Banks Hire New Network CEO

© Starpoint LLP, 2022. No part of this site, blog.starpointllp.com, may be reproduced in whole or in part in any manner without the permission of the copyright owner.

September 7

This blog is dated so I removed most of the content. Key Updates – 21 Jan 2023

- Banks gave up on their own AUthentify Wallet launch and jumped on board a “white label” SRC wallet led by Visa (See 23Jan2023 WSJ)

- Banks have been working on mobile payments for 13 years through TCH (see blog).

- Inital pitch was at Money 2020, big retailers didn’t bite (see blog)

- The wallet is not owned by EWS, but a new payment network led by James Anderson. The ownership of this new network is the same at EWS (see blog below).

- Competitor is Apple.. the banks want to own the mobile payment experience. Google is working with the TCH banks and is also working with FedNow (long blog coming on this one)

- TCH RTP effort focus has move to commercial flows and bill payment.. Forbes Article on Launch of Pay by Bank using TCH. Google’s role seems to be limited to hosting servers in the Google Cloud. This was NOT the big announcement I thought was coming. It looks like the TCH tokens in Google Wallet are actually “network tokens” with token vault as TCH

- Apple is not involved in any of these activities, yet Google is working to pilot both FedNow and TCH RTP to leverage their India UPI success.

- The banks have just hired James Anderson as CEO of a new banking consortium where the assets of TCH, Akoya and Early Warning line up. This CEO will be tasked with creating a new network to “compete with ApplePay” as the premier mobile payment platform.

Durbin 2 – Short Update

Note: existing subscribers have all notifications turned off by default. To update notifications, please visit Member Login –> Notification Preference above.

© Starpoint LLP, 2022. No part of this site, blog.starpointllp.com, may be reproduced in whole or in part in any manner without the permission of the copyright owner.

What are the new Durbin’s legislative prospects? A: Not at all likely (<10% probability)

Top retailers spent this week meeting with Bank CEOs trying to convince them to support the new Durbin legislation. Their pitch was to enable bi-lateral deals, “new products” and avoid network rules (see blog). Banks did not seem to bite, as they remembered the lessons of Durbin 1:

- Only largest merchants benefited from dual routing

- Consumers lost in debit rewards (ie keep the change), increased bank account fees, and no merchant pass-through of savings

- Acquirers/processors did not pass through fee reductions to most merchants

- Networks recovered lost revenue through merchant fees

- Large banks lost competitive advantage as smaller “exempt” banks under $10B operated under different rules

- See WSJ article