I outlined the Visa Amazon dispute in my blog 4 weeks ago. Today, Visa is confidently projecting it can bring the issue to a close. For the exec team to communicate confidence, my presumption is that they have both a primary strategy and a fall back strategy. Given that the big players influence payments so heavily, let me lay out a few scenarios on how this could wrap up.

ACH, A2A and Marketing Incentives

(sorry for typos). I’m up at 5am this Saturday and have all kinds of things I’d like to write about: DeFi, PayFacs, Opportunities in B2B payments, Platform strategies of Shopify/Stripe/Adyen.. I’ve settled on a short blog surrounding ACH, A2A and Marketing incentives. The key question I will be answering today: will an ACH based A2A or ACH checkout option develop threatening V/MA?

Amazon – Affirm

Key Reading

- Affirm 3Q Earnings (last night)

- Earning Transcript

- Affirm Investor Forum (28 Sept)

- Amazon take Venmo (my blog)

- Affirm Debit+ (my blog)

- Amazon/Visa Battle (my blog)

- Amazon Co-Brand is In Play

November is turning out to be a very big week in payments! The top investor question seems to be how will V/MA be impacted? My response.. In next 2 yrs.. Less than 1-2% of US GDV however Affirm is turning out to be the leading company to watch in creating a V/MA alternative.

Amazon Takes Venmo…

Big news from PayPal’s earnings yesterday was Amazon taking Venmo. I wanted to summarize the 15 tweets on the topic and provide a little more background into the dynamics.

Amazon is an amazing company from a people perspective, perhaps the best TEAM I’ve had as a customer. They always proceed within a plan and purpose. So why Venmo? As I related 2 weeks ago, Amazon is working to reduce the costs of payments. They have managed fraud down to 3bps.. So why can’t their processing costs look a lot more like Walmart? They have been successful in achieving this in EU (Sepa DD) and India (see blog), but the US remains (by far) the highest cost geography.

Affirm Debit+ is Revolutionary

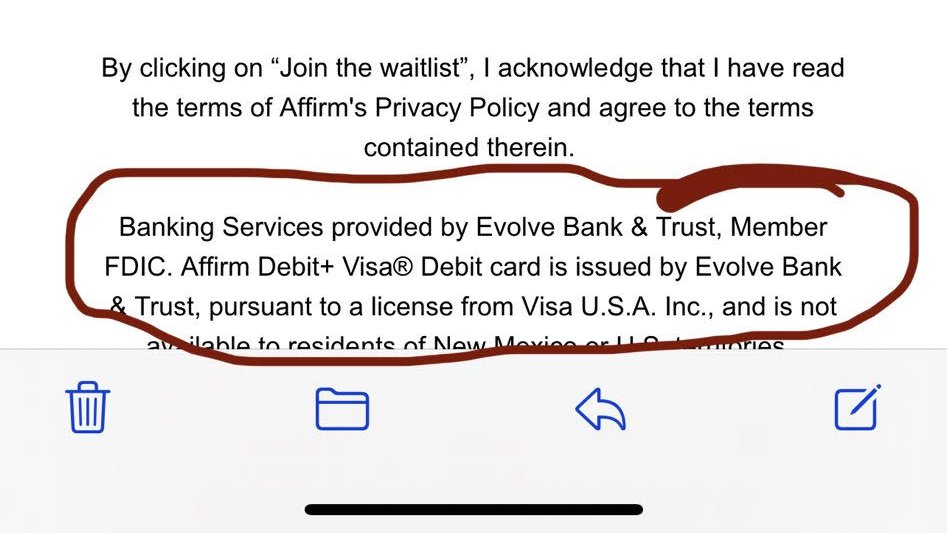

Update 8 November – Original post is below the image.. I had doubted Visa’s support here. But clearly this is a real product.

Affirm Debit+ is a decoupled debit on the Visa network with Evolve Bank as ODFI/Issuer. I doubt if Visa fully vetted this product.. it MUST have “slipped through”. For more info see Affirm’s investor day presentation.

Per my blog last week, my hypothesis is that the new Affirm Debit+ will be revolutionary.. which is why it is currently causing a massive firestorm amongst Banks. Today I want to drill into what I believe the value proposition will be (my hypothesis) and why Visa had to support this.

Today Affirm is “limited” in growth to the merchants it can directly integrate to. How can they solve this problem? Create a consumer “pay anyone” product that lets the consumer pick and choose what items they want to finance after they purchase them. Connect any of your bank accounts or all of them.. Finance anything you buy on improved terms. Affirm will also work with Stripe and others to create an improved checkout process, which will improve both conversion AND consumers ability to purchase (ie underwriting). The first mover advantage will be tremendous and step on much of the Neo Banks (already slim value prop).

New Decoupled Debit – Affirm/Plaid/Marqeta

Riding on my blog Plaid and Decoupled Debit.. It looks like Plaid and Marqeta just created a new product with Affirm as the first customer.

Affirm Debit Card – https://www.affirm.com/debit

Visa vs Amazon – When Merchants Get Leverage

Updated 17 Nov

At Money2020 this week and I have to say I’m having a blast. Seeing friends face to face and getting back to “normal” was well worth taking my first plane flight in 20 months.

Visa Announces earnings today at 5pm, the big question institutional investors are asking me is about the Amazon – Visa discussions. It is a big game of chicken right now, with earnings ramifications. To understand whats going on here, let me attempt to give some abbreviated history.

Plaid and Pay By Bank

As I sit down with my coffee this morning I’m asking myself what are the key questions to answer:

- What is the Plaid service? What innovation have they created?

- Is it a threat to V/MA?

- What merchants/Consumers will use it?

- What do banks think of this? Can they stop it?

Short Blog – PayPal and Pinterest

PayPal and Pinterest – Super Distraction?

What’s behind this deal?

PayPal needs

-

- Increase users and platform engagement (MAU)

- Grow the merchant value proposition

- Get into the START of a consumer shopping experience

- Enable a new mobile first shopping experience – focused on small merchants – from beginning to end (like Alipay)

-

- “Inspiration to Action” – They are missing the action beyond a ad click.

- Stalled user growth

- 50%+ Revenue growth with consistent operating loss.

- 454M Users with ARPU of $5.08/User vs PayPal’s $21/User

- Ad Growth to Action. Advertising business with solid advertising relationships with CPGs and large retailers. However you don’t click to buy from a CPG.

- Needs platform to complete consumer journey.

Apple Pay Fees (Short Blog)

Thought I would give more detail on whats going on with V/MA, Issuers and Apple (from WSJ article yesterday Apple Pay Fees Vex Issuers). Perhaps I’ll collect a fee from the WSJ.. odd that I mention Apple Pay fees on Monday to have it come up in the WSJ on Tuesday. Oh well..